Navia Weekly Roundup (Oct 27 – Oct 31, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian equity indices ended the volatile (last) week of October on a negative note and snapped 4-week losing streak amid mixed corporate earnings, hawkish tone of the Fed post inline rate cut, reports of a potential hike in FDI limit in public sector banks, FII selling and ongoing US-China trade development.

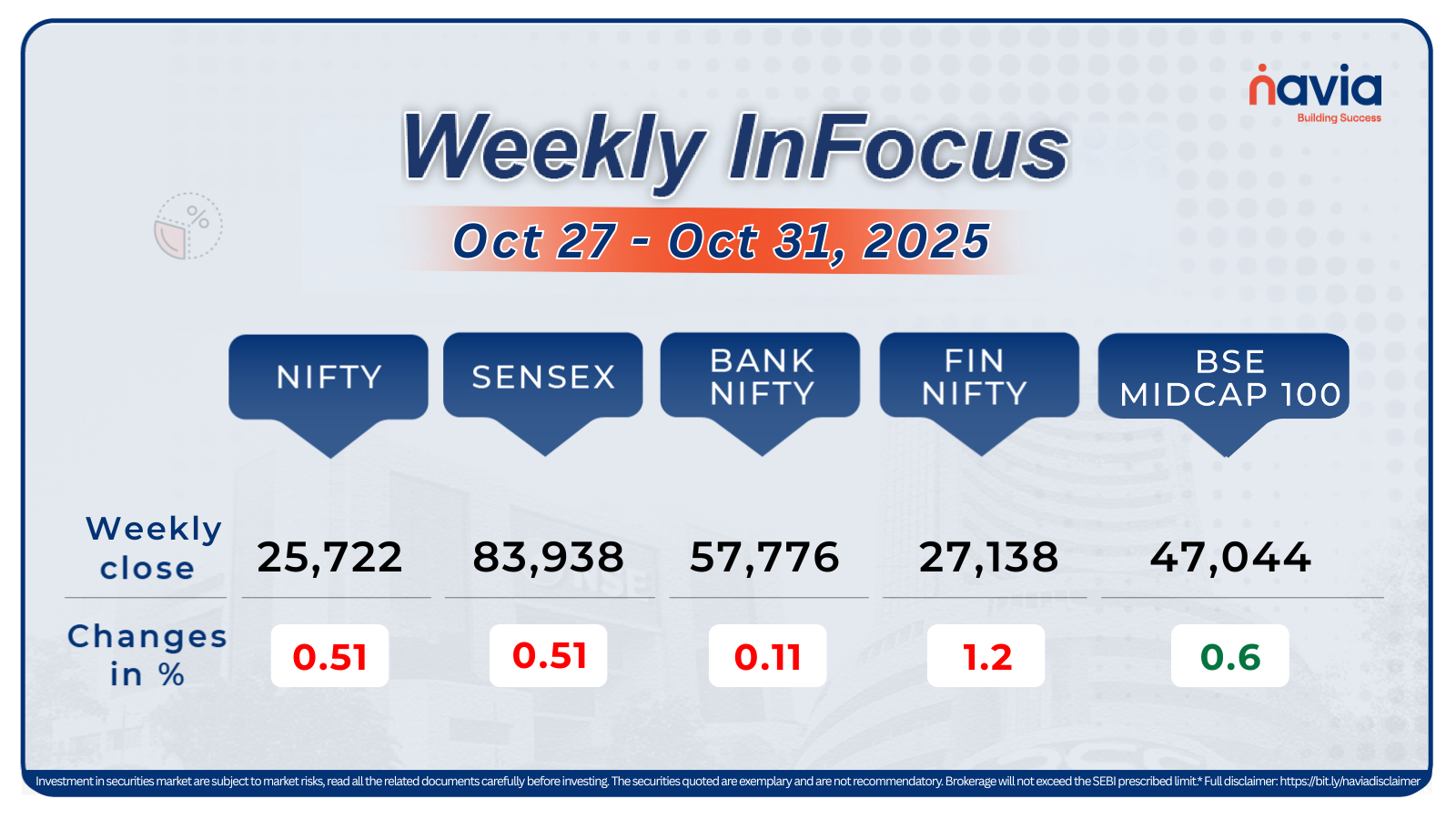

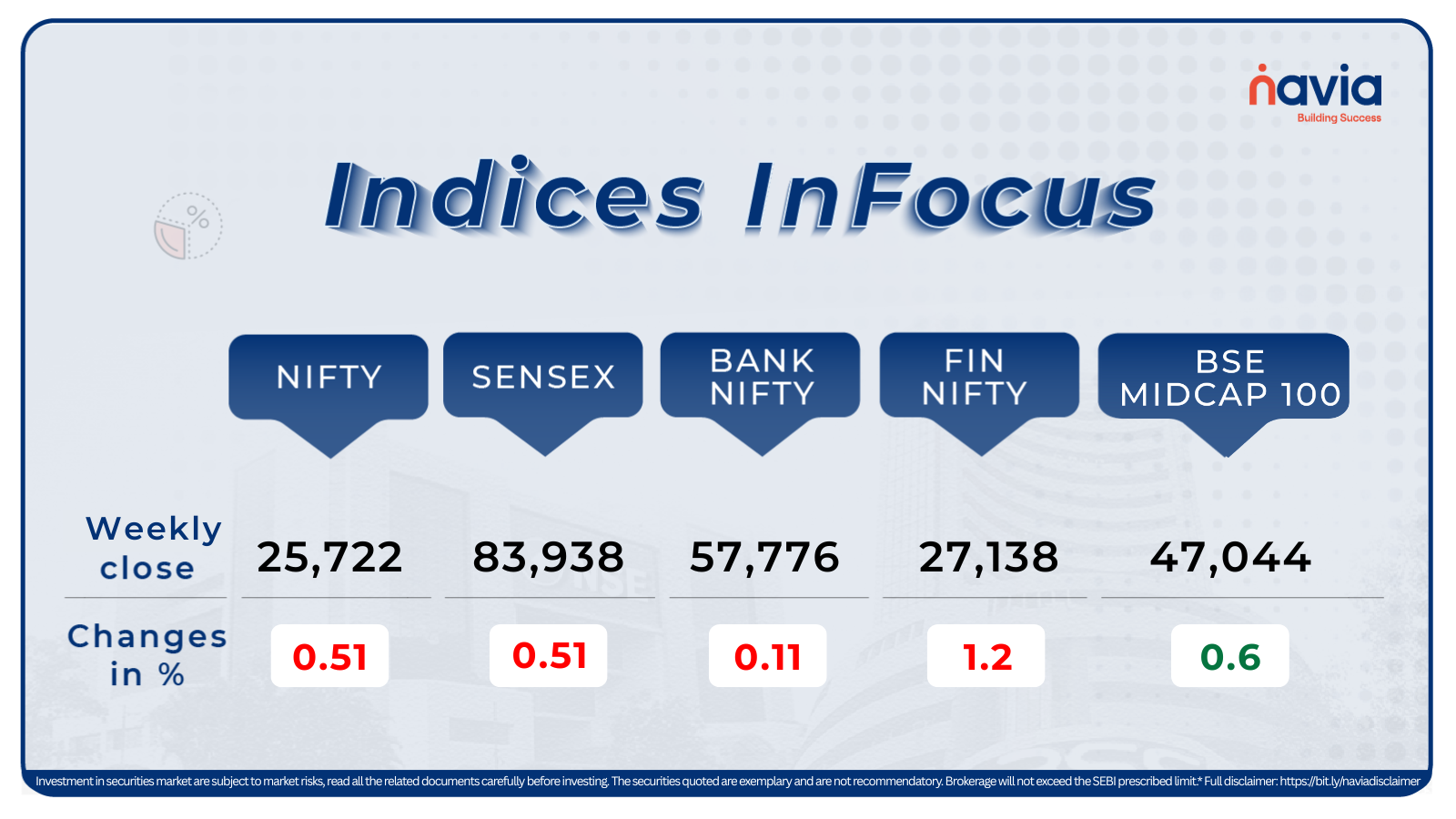

Indices Analysis

For the week, BSE Sensex index shed 0.51 percent to end at 83,938.71 and Nifty50 declined 0.51 percent to close at 25,722.10.

The BSE Large-cap Index ended on a flat note. Gainers included Adani Green Energy, Indian Oil Corporation, IDBI Bank, Canara Bank, Bharat Petroleum Corporation, Hyundai Motor India, while losers were Vodafone Idea, Dr Reddy’s Laboratories, Bajaj Holdings & Investment, Adani Power, SBI Cards & Payment Services, Cipla, SRF.

BSE Mid-cap Index added 1 percent supported by Bharat Heavy Electricals, Suzlon Energy, Hindustan Petroleum Corporation, Inventurus Knowledge Solutions, UPL, Aditya Birla Capital, PB Fintech, Steel Authority of India. However, losers were 360 ONE WAM, Bandhan Bank, Jindal Stainless, Vedant Fashions, Motilal Oswal Financial Services, Nippon Life India Asset Management, Hexaware Technologies.

The BSE Small-cap index rose 0.7 percent with Lancer Containers Lines, Chennai Petroleum Corporation, Hatsun Agro Products, Spectrum Electrical Industries, Blue Cloud, Softech Solutions, Mufin Green Finance, Five-Star Business Finance, TD Power Systems rising between 20-54 percent, while Khaitan Chemicals and Fertilizers, LE Travenues Technology (IXIGO), Stallion India Fluorochemicals, Cohance Lifesciences, Sadhana Nitrochem, JITF Infralogistics, Fino Payments Bank, Quadrant Future Tek, Dynamic Cables, Nalwa Sons Investment, GFL shed between 10-19 percent.

The Domestic Institutional Investors (DII) continued their buying on 28th week, as they bought equities worth Rs 18,804.26 crore, while the Foreign Institutional Investors’ (FIIs) sold equities worth Rs 2102 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

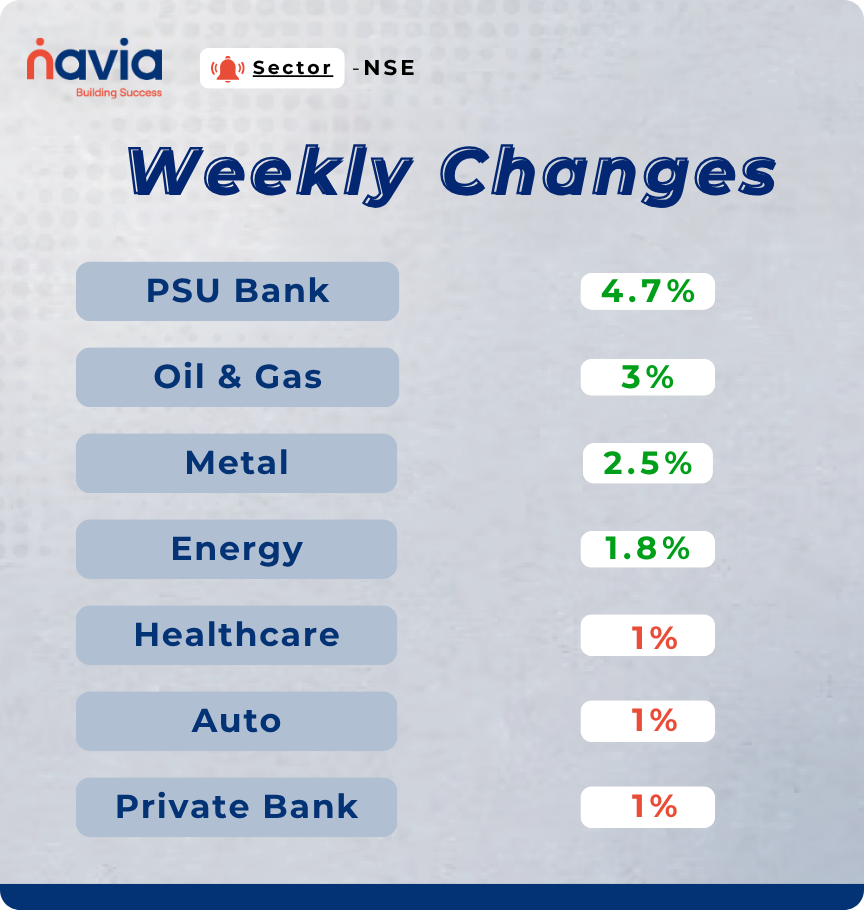

On the sectoral front, Nifty PSU Bank index rose 4.7%, Nifty Oil & Gas index gained 3%, Nifty Metal index rose 2.5%, Nifty Energy index rose 1.8%. On the other hand, Nifty Healthcare, Auto, Private Bank indices down 1% each.

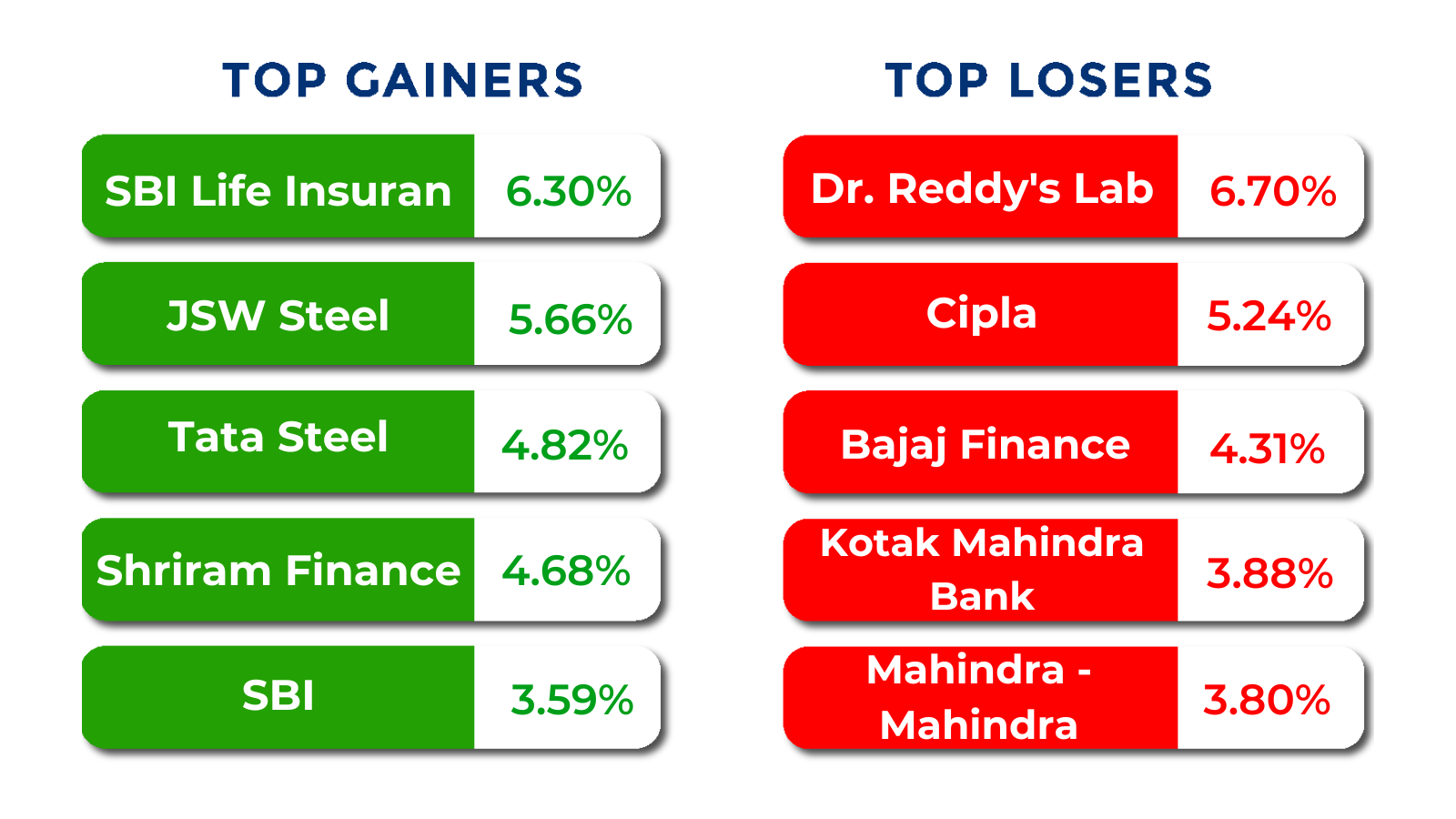

Top Gainers and Losers

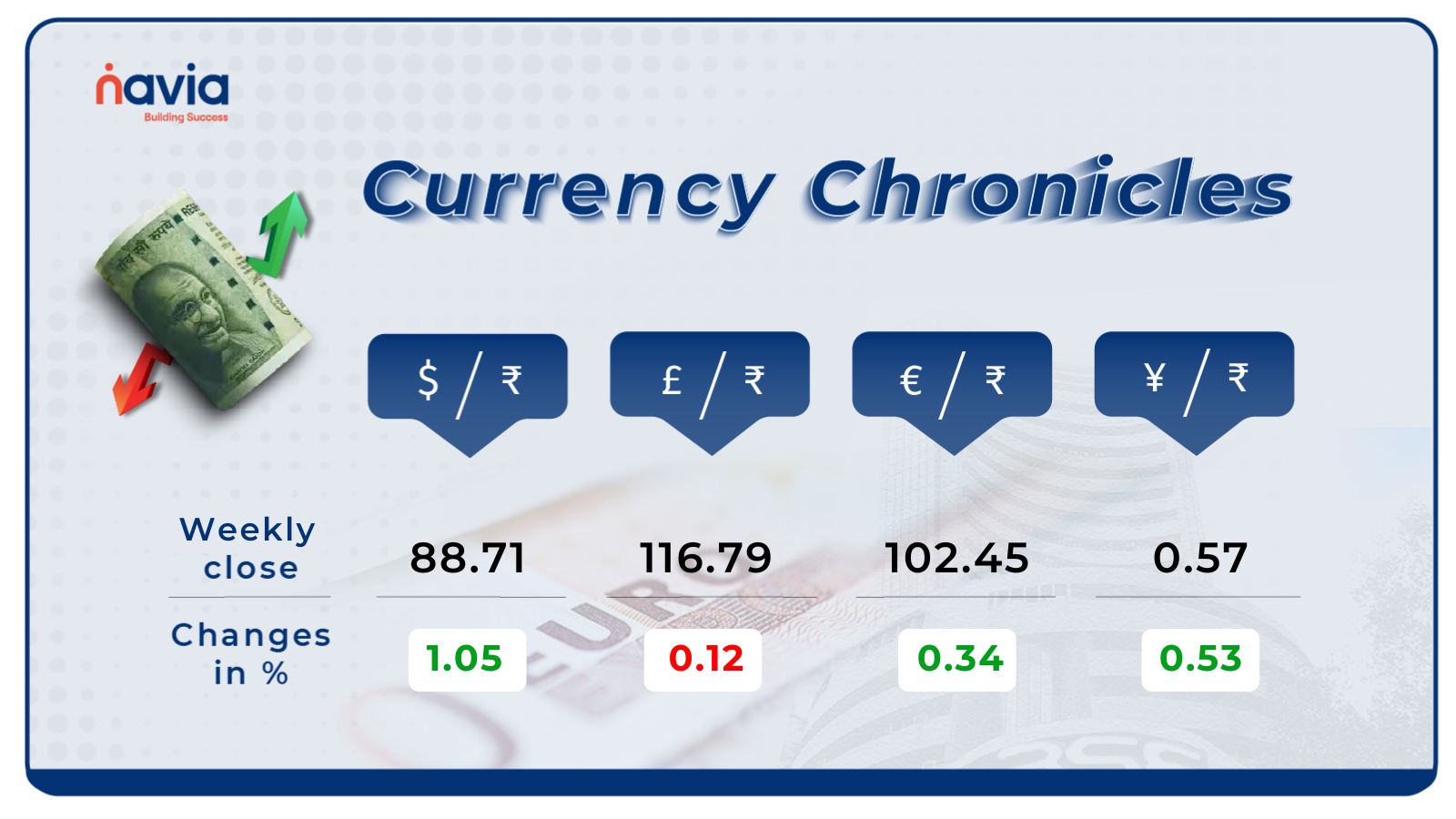

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.71 per dollar, gaining 1.05% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹102.45per euro, gaining 0.34% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, gaining by 0.53% during the week, reflecting a bulish market sentiment.

Stay tuned for more currency insights next week!

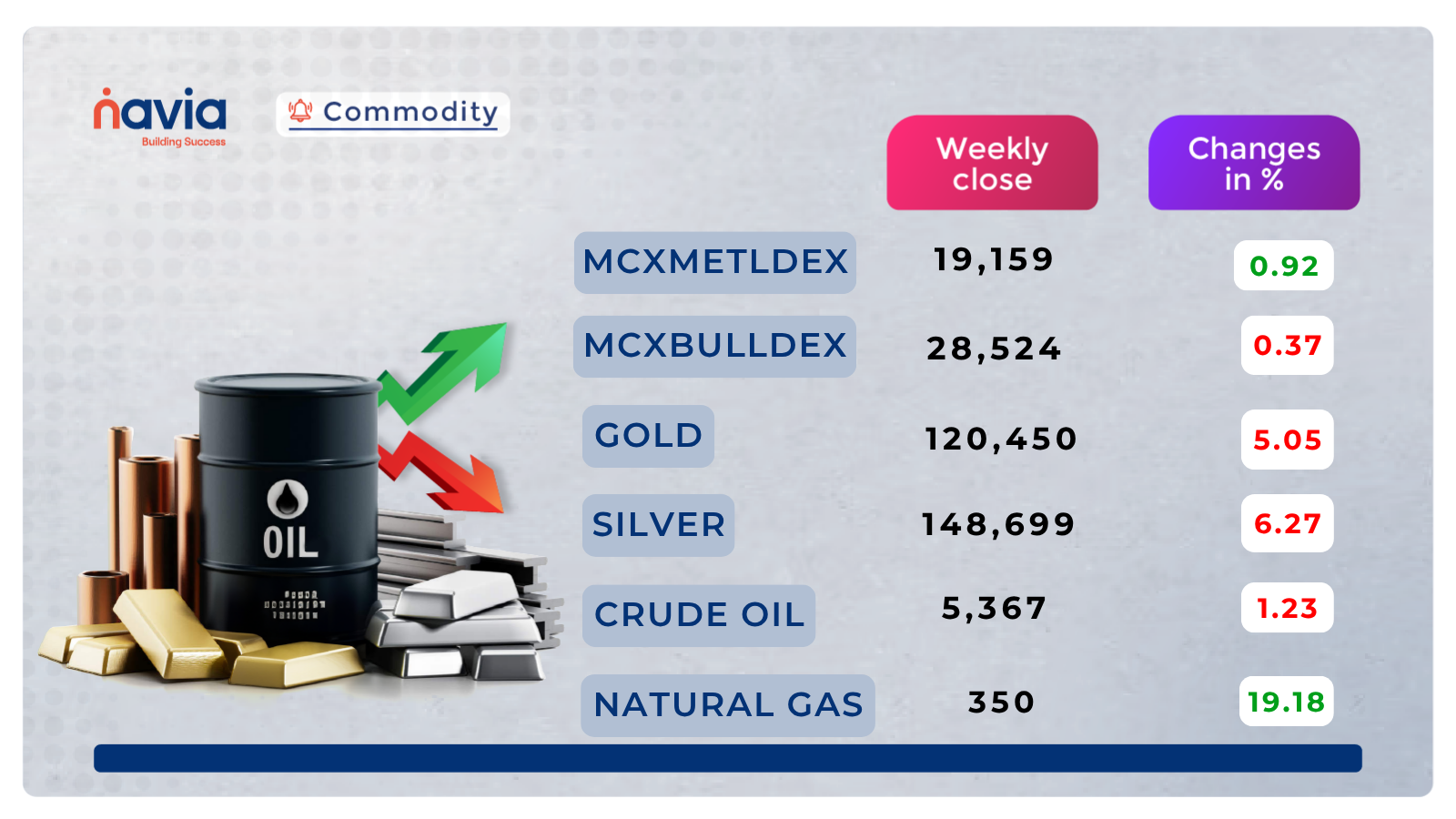

Commodity Corner

Crude Oil futures, price is currently trading near 5,390, slightly above the support zone but below key resistance. After the sharp fall, the price is now consolidating sideways, showing attempts to stabilize above 5,300. Multiple failed attempts to break above the blue resistance line suggest selling pressure at higher levels. A decisive close above 5,420–5,450 could open the door toward 5,600. If crude slips below 5,270, fresh weakness may emerge toward 5,100–5,000.

In the last session, Gold closed at 120,450. Gold futures was trading in a strong upward channel until mid-October, indicating a clear bullish trend. The price broke below the lower trendline of the channel, triggering a corrective phase. Around 1,20,300, price tested this level multiple times, showing it as a key support. Price found support near 1,18,000 and is now consolidating between 1,20,000–1,22,000. The structure suggests a pause in the downtrend, but not yet a confirmed reversal.

MCX Natural Gas consolidated in a downward sloping wedge through early October, then broke out sharply upward near 255–260. Post-breakout, price rallied strongly and cleared multiple resistances, confirming a trend reversal from bearish to bullish. After briefly consolidating near 300, it resumed momentum and now trades around 348, showing strong bullish continuation. Sustaining above 350 may open the door for a further rise toward 370–380.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Knowledge Does Not Beat Emotions!

While understanding biases like loss aversion and FOMO is valuable, knowledge alone fails because emotions and survival instincts always overpower logic during market crises.

Why Investors Sell Winners and Hold on to Losers – Understanding the Disposition Effect

The Disposition Effect is a common psychological bias where investors sell winning stocks too quickly to lock in gains (being risk-averse with gains) and hold onto losing stocks too long (being risk-seeking with losses) in the hope they’ll rebound.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.