Navia Weekly Roundup (Oct 20 – Oct 24, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian markets started the new Samvat on a positive note, with benchmarks hitting a fresh 52-week high during the week and extending the weekly gains in the fourth consecutive week for the first time in 2025 amid hopes of an India-US trade deal, FIIs turning buyers and a decent set of Q2FY26 earnings.

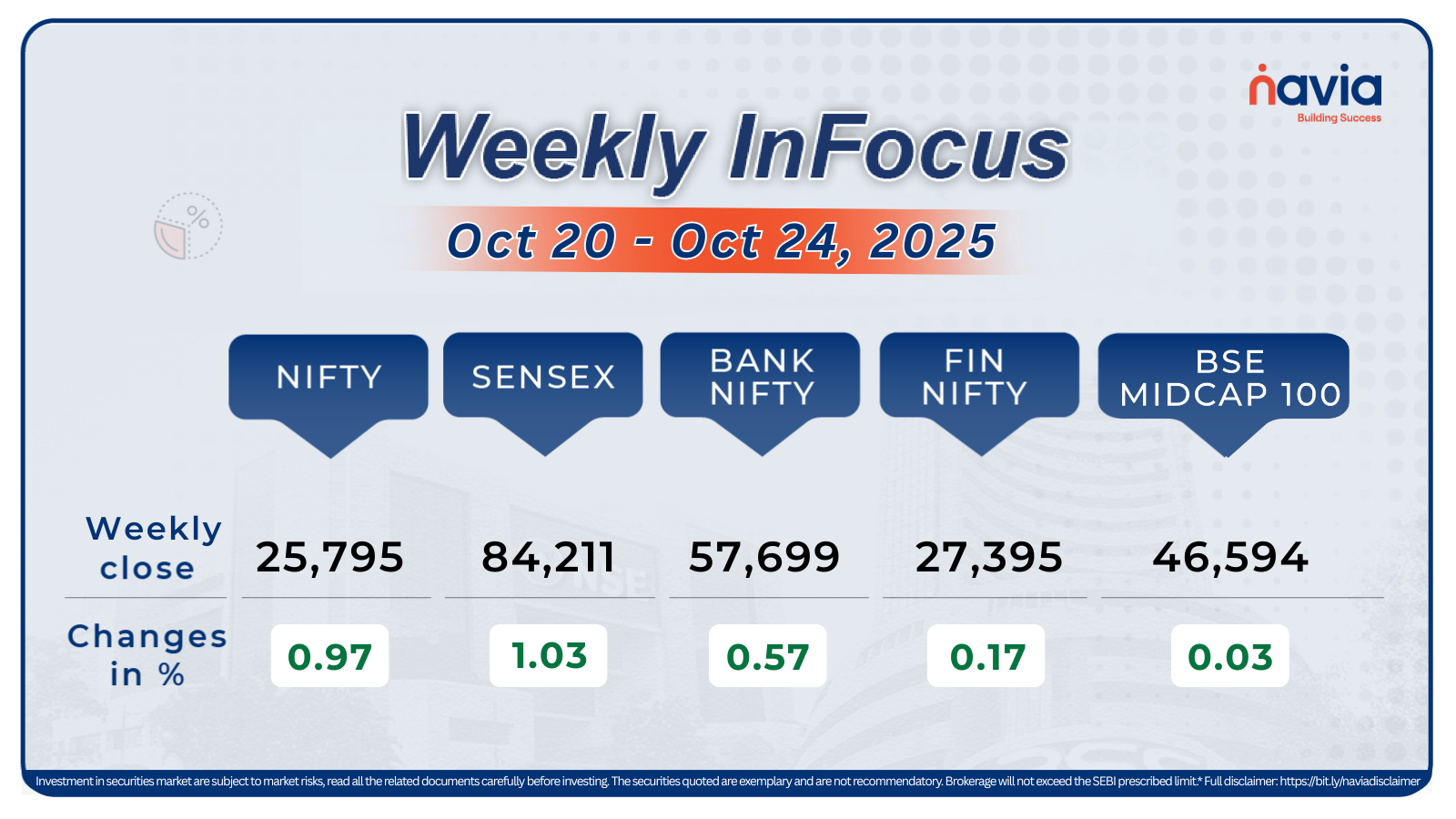

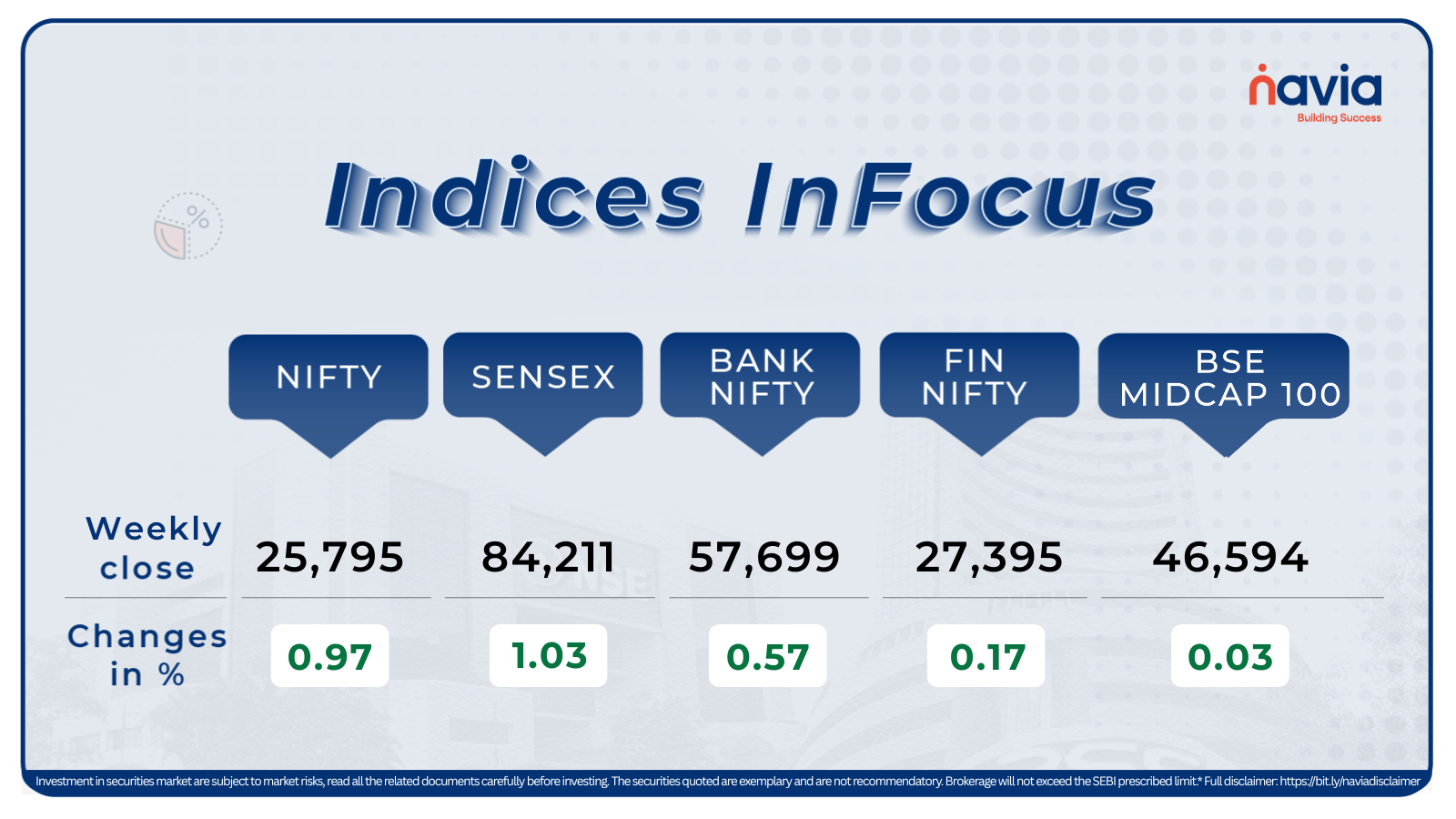

Indices Analysis

For the week, the BSE Sensex index jumped 1.03 percent to end at 84,211.88, and the Nifty50 rose 0.97 percent to end at 25,795.15.

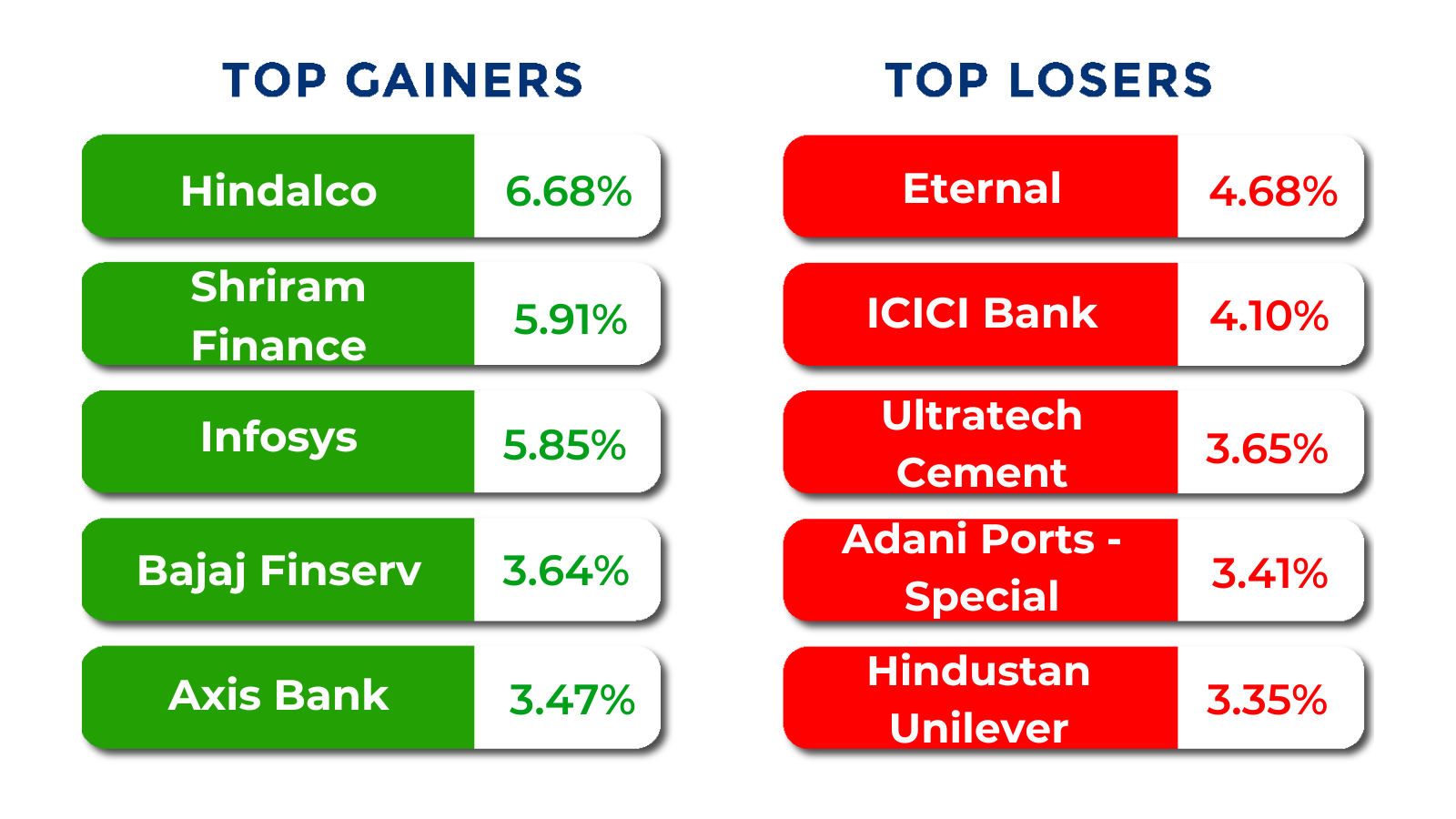

The BSE Large-cap Index ended with marginal gains. Vodafone Idea, Hindalco Industries, Shriram Finance, Infosys, Indus Towers, Cummins India gained 5-10 percent, while losers were Eternal, CG Power and Industrial Solutions, ICICI Bank, UltraTech Cement, Hyundai Motor India, Shree Cements, Adani Ports and Special Economic Zone, Hindustan Unilever.

BSE Mid-cap Index rose 0.5 percent, led by IDFC First Bank, Bank of India, AU Small Finance Bank, Federal Bank, Central Bank of India, Bandhan Bank, CRISIL, while losers were Ola Electric Mobility, Dixon Technologies, Dalmia Bharat, Muthoot Finance, Supreme Industries, Kaynes Technology India, Fortis Healthcare, and FSN E-Commerce Ventures.

The BSE Small-cap index added nearly 1 percent with Bhageria Industries, Mafatlal Industries, DCB Bank, Shipping Corporation of India, Rajratan Global Wire, Utkarsh Small Finance Bank rising between 21-36 percent, while losers were Stallion India Fluorochemicals, Gallantt Ispat, Indo Thai Securities, Uniparts India, Kellton Tech Solutions, Genesys International Corporation, Astec Lifesciences, and Tanla Platforms.

The Foreign Institutional Investors (FIIs) turned net buyers for the week as they bought equities worth Rs 342.74 crore, while Domestic Institutional Investors (DIIs) continued their buying on the 27th week, as they purchased equities worth Rs 5945.31 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

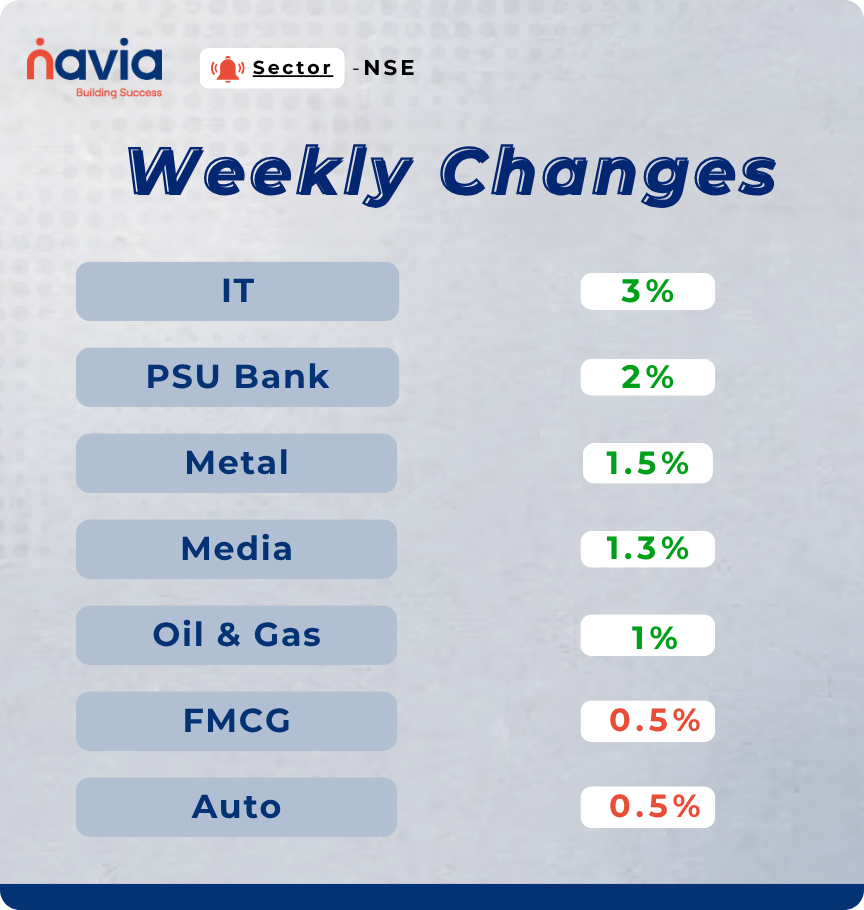

Sector Spotlight

Among sectors, the Nifty IT index gained 3%, the PSU Bank added 2%, the Nifty Metal index gained 1.5%, the Nifty Media index up 1.3%, the Nifty Oil & Gas index up 1%, while the Nifty FMCG and Auto indices were down 0.5% each.

Top Gainers and Losers

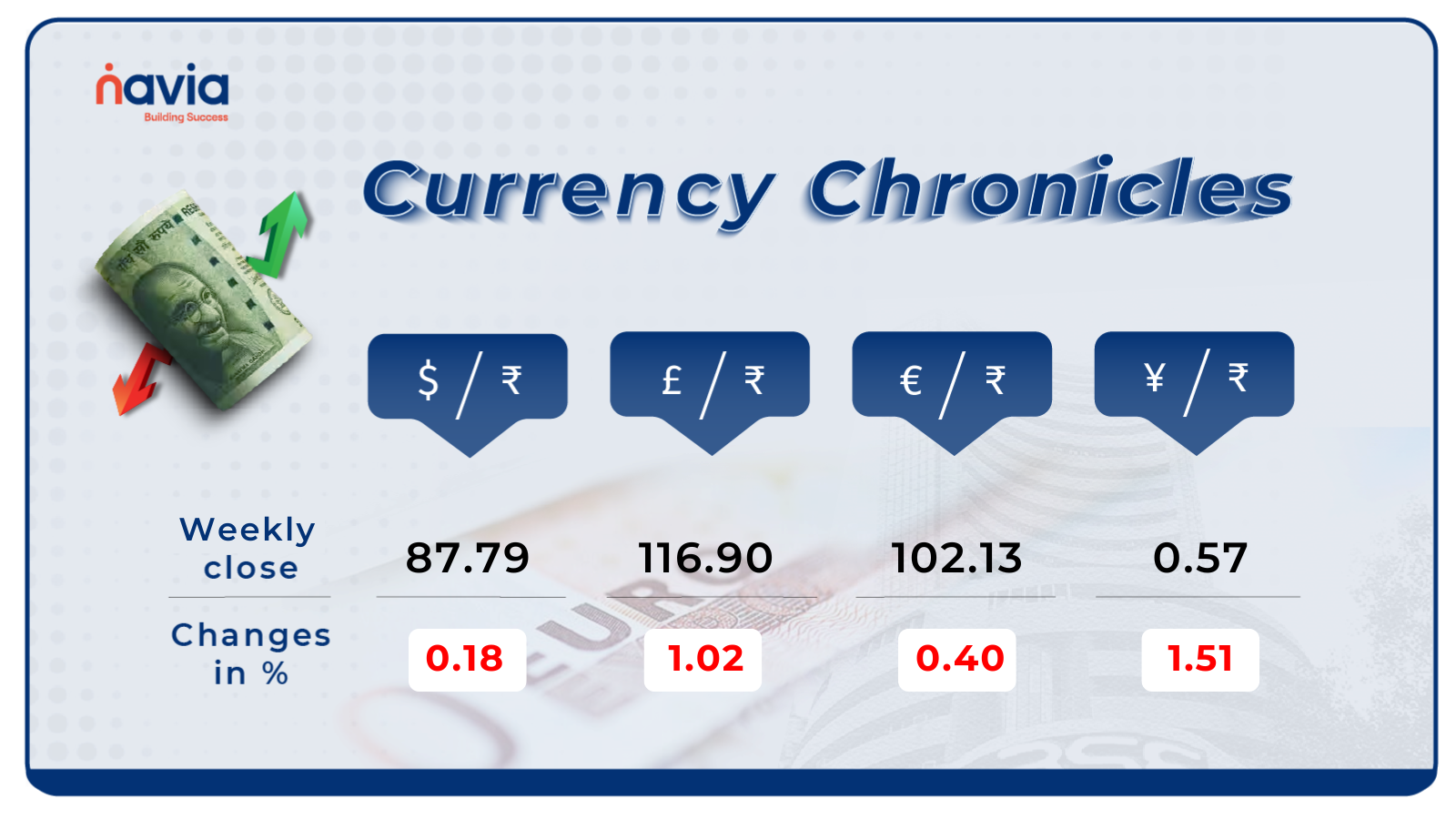

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹87.79 per dollar, losing 0.18% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹102.13 per euro, losing 0.40% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, losing by 1.51% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

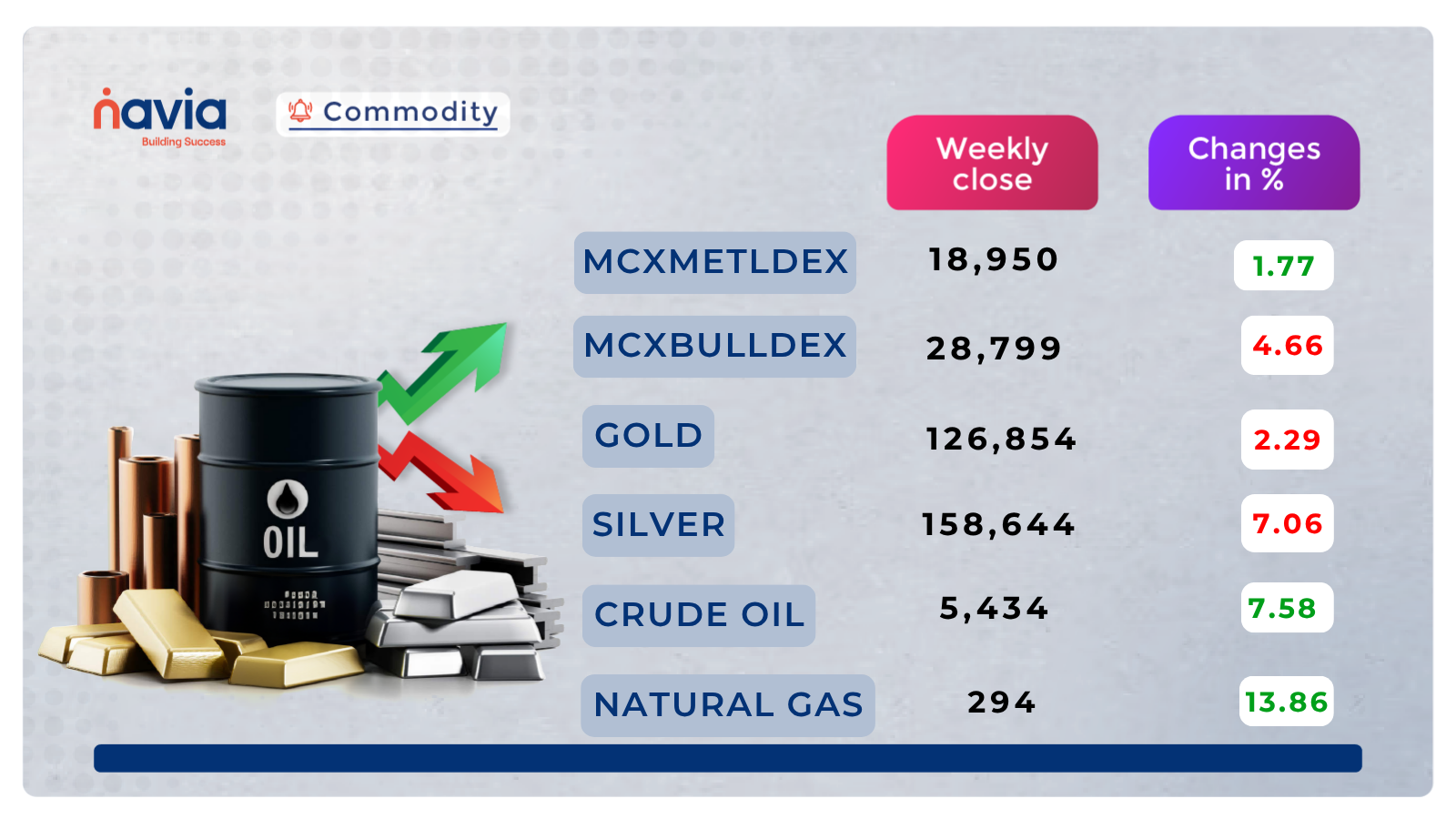

Commodity Corner

MCX Crude Oil chart shows after the breakdown, prices declined sharply and found strong support near 5,000. Recently, a sharp recovery has taken place from 5,000 toward the previous breakdown zone near 5,430–5,450. The current price (5,434) is testing the previous support, which has now turned into resistance. This area (5,420–5,450) will be crucial, if crude sustains above it, the next upside target could be 5,650–5,890. Failure to hold above this resistance could lead to a pullback toward 5,250 or 5,100.

In the last session, Gold closed at 126,854. Gold price broke below the lower trendline of the channel, a potential early warning of trend exhaustion. However, it has bounced back strongly from the support zone near 120,300. The rebound currently looks like a pullback to retest the broken channel (a common bearish retest setup). If it fails to reclaim the channel, gold may resume its short-term corrective phase. Still bullish, given the broader uptrend structure, but signs of momentum loss are emerging.

Natural Gas is consolidating between 295 and 311, showing short-term profit-taking after a strong rally. The breakout above 269 support remains valid, that level is now acting as a strong demand zone. If the price falls below 285, a deeper pullback toward 270 is possible, which would still be a healthy correction within the new uptrend. Only a close below 269.5 would invalidate the bullish setup and suggest a return to range-bound or bearish bias. Only a close below 269.5 would invalidate the bullish setup and suggest a return to range-bound or bearish bias.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

When Ego Manages Your Portfolio?

Self-attribution bias is a common psychological trap where investors credit their own skill when the portfolio performs well (“I was smart”) but blame external factors or advisors when it performs poorly (“It’s the market’s fault”).

What Returns to Expect from the Stock Market in the Long Term?

In the long term (10+ years), investors in the Indian stock market should realistically expect average annualized returns (CAGR) of 10–12%, aligning with historical averages like the Nifty 50’s performance over the past two decades.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.