Navia Weekly Roundup (Oct 13 – Oct 17, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Indian market continued the gaining streak in the third consecutive week ended October 17, posting biggest weekly gains in four months amid FII turning buyers, continued DII support, falling crude oil prices, Fed rate cut hopes, however, investors stay cautious amid US government shutdown worries, US-China trade tensions and renewed banking sector jitters.

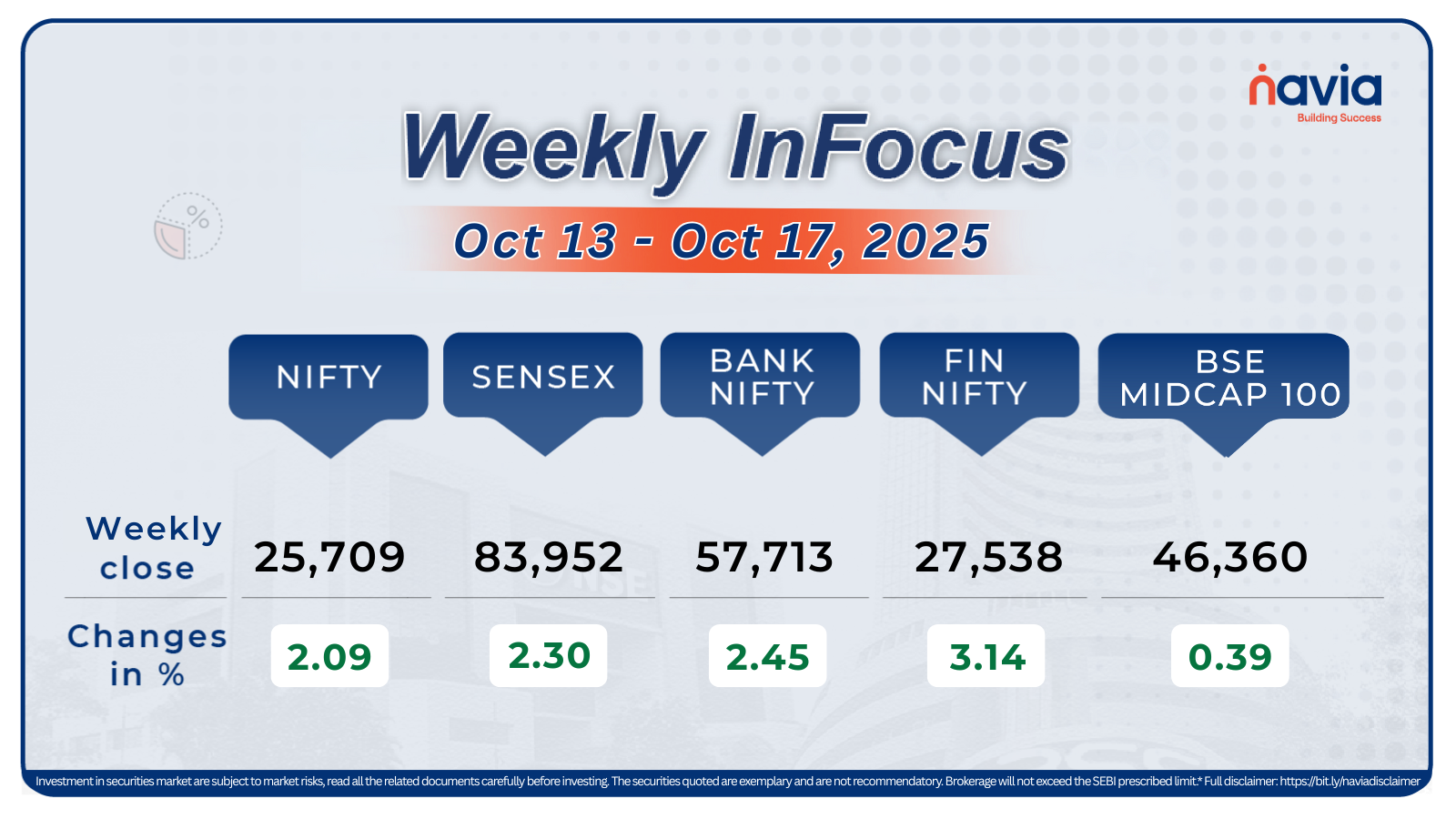

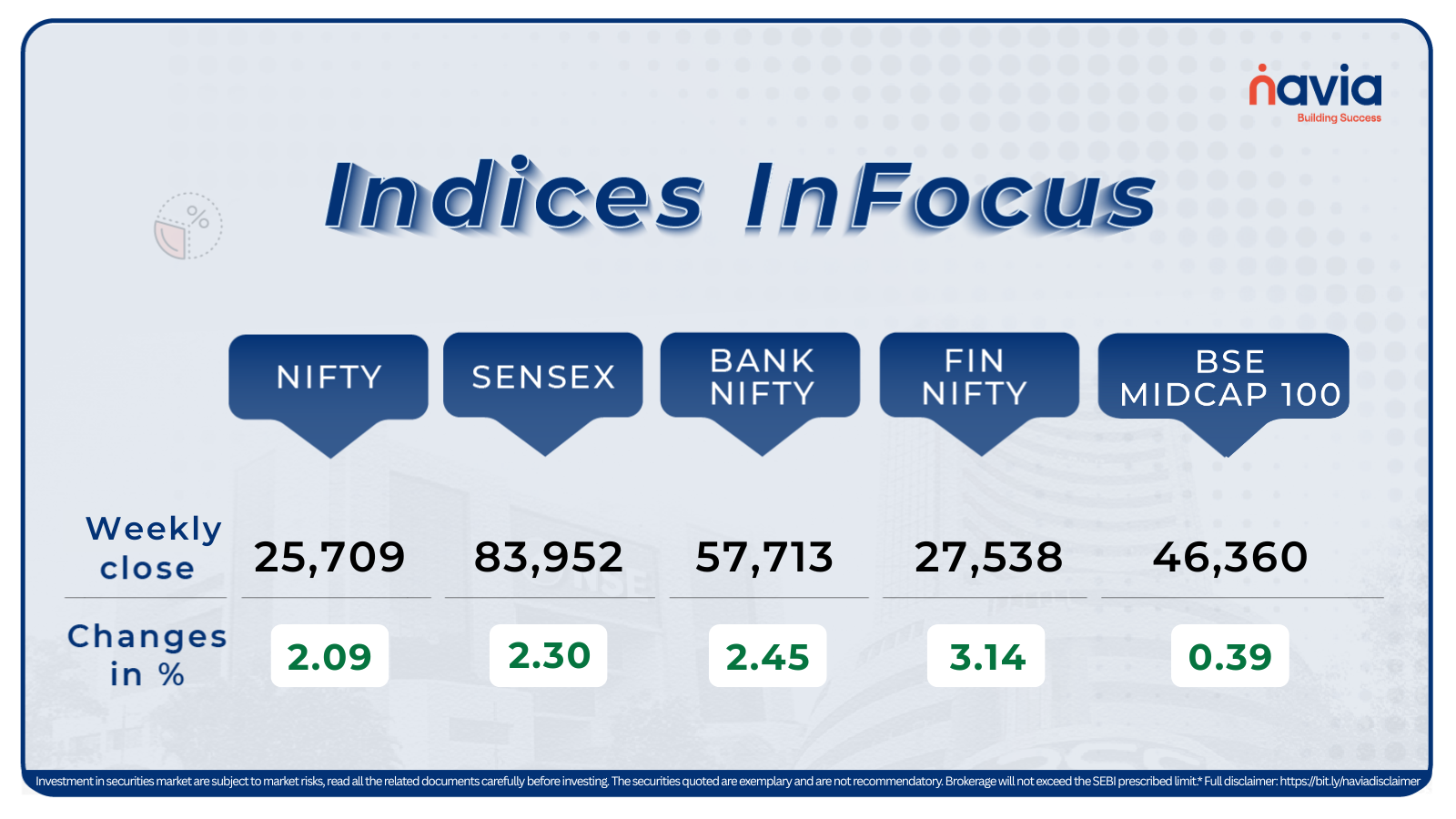

Indices Analysis

For the week, BSE Sensex index surged 2.30 percent to close at 83,952.19 and Nifty50 added 2.09 percent to finish at 25,709.85.

The BSE Large-cap Index rose 1.5 percent led by Adani Power, ICICI Lombard General Insurance Company, Nestle India, Asian Paints, Waaree Energies, Mahindra and Mahindra, while losers were Infosys, Siemens Energy India, Polycab India, Vodafone Idea, Indian Overseas Bank, Indus Towers, Wipro, Punjab National Bank.

BSE Mid-cap Index ended flat. Whirlpool of India, Ola Electric Mobility, Persistent Systems, Godrej Properties, Sona BLW Precision Forgings, Mahindra and Mahindra Financial Services, Oberoi Realty, 360 ONE WAM gained between 6-18 percent, however, Yes Bank, PB Fintech, Schaeffler India, Emcure Pharmaceuticals, Bandhan Bank, Oracle Financial Services Software, Dixon Technologies, Go Digit General Insurance, Glenmark Pharma, Tata Technologies.

The BSE Small-cap index shed 0.6 percent with Amal, Magellanic Cloud, VL E-Governance and IT Solutions, Lotus Chocolate Company, Dhunseri Ventures, Walchandnagar Industries falling between 15-25 percent, while Share India Securities, Stallion India Fluorochemicals, GM Breweries, Tatva Chintan Pharma Chem, MTAR Technologies added between 21-41 percent.

The Foreign Institutional Investors’ (FIIs) remained net buyers for the last three sessions of the week but for the week they offloaded equities worth Rs 586.76 crore. On the other hand, Domestic Institutional Investors (DII) continued their buying on 26th week, as they bought equities worth Rs 28,044.45 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

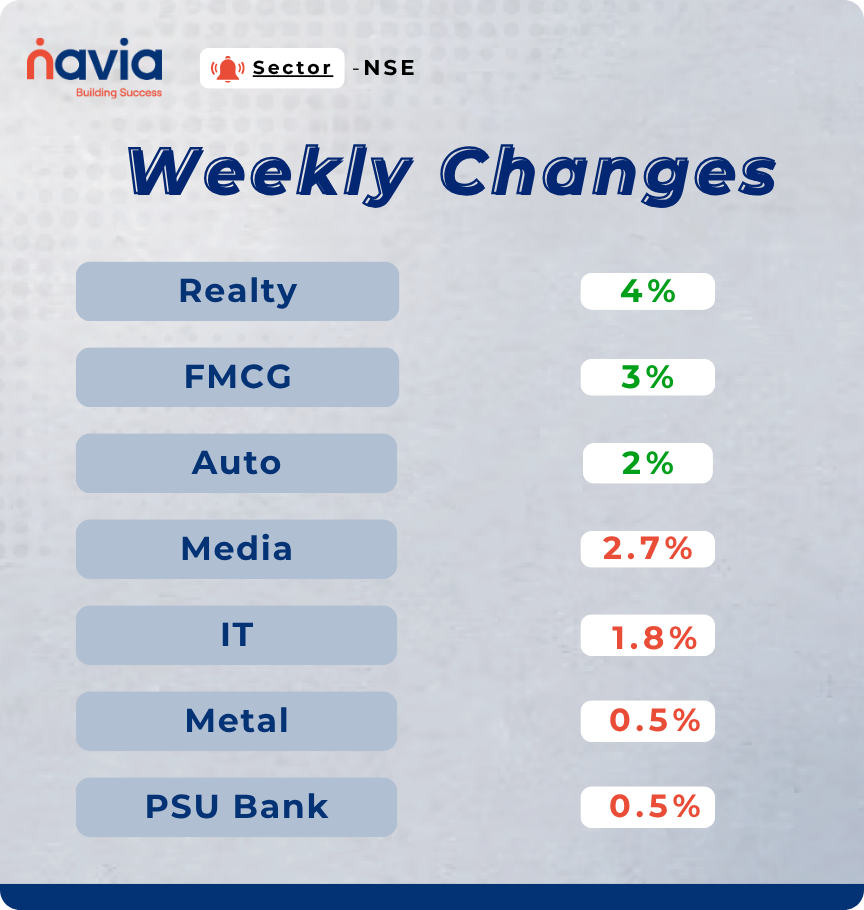

Sector Spotlight

On the sectoral front, Nifty Realty index gained 4%, Nifty FMCG index rose 3%, Nifty Auto index rose 2%, while Nifty Media index shed 2.7%, Nifty IT index fell 1.8%, Nifty Metal and PSU Bank indices declined 0.5% each.

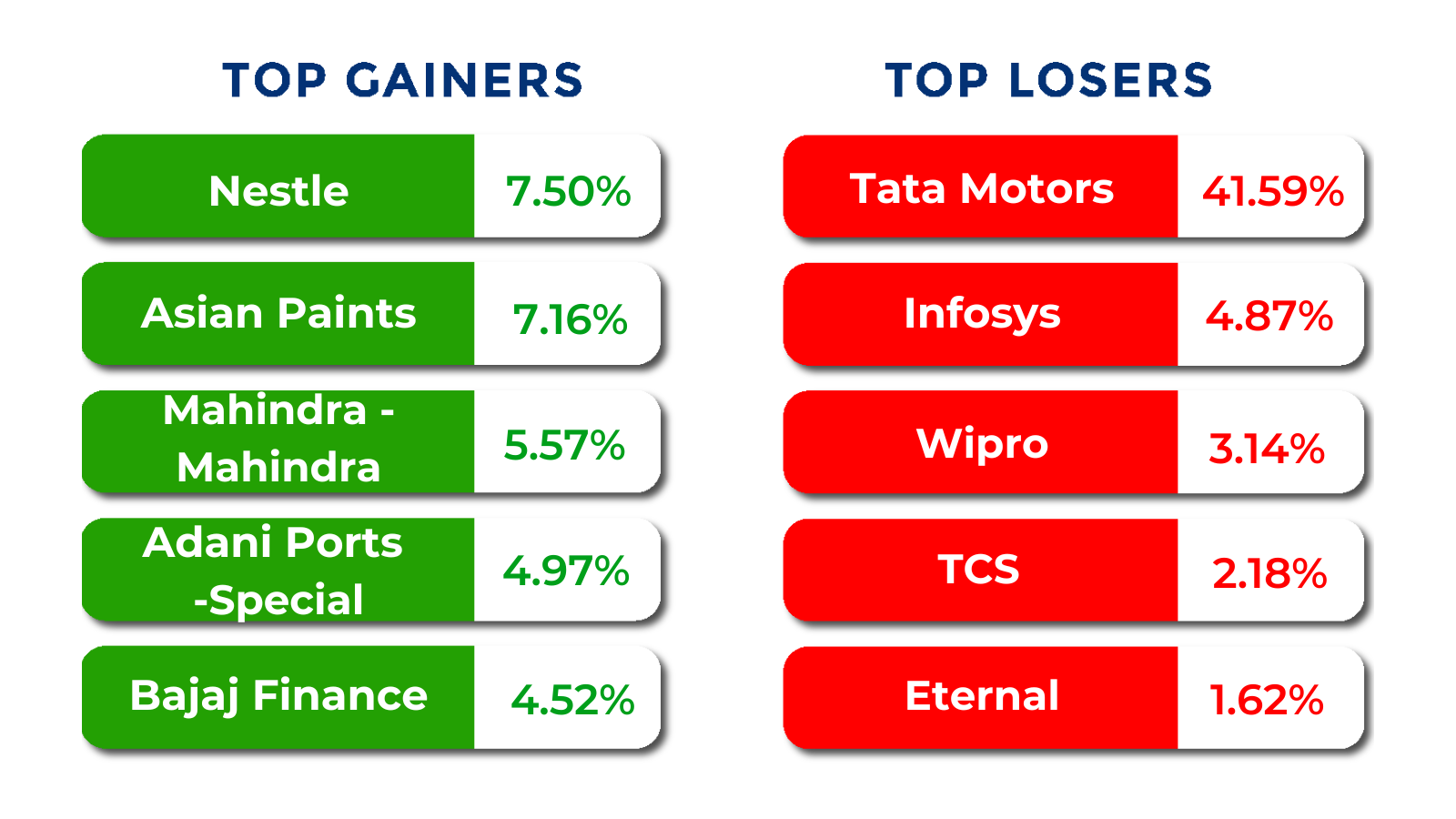

Top Gainers and Losers

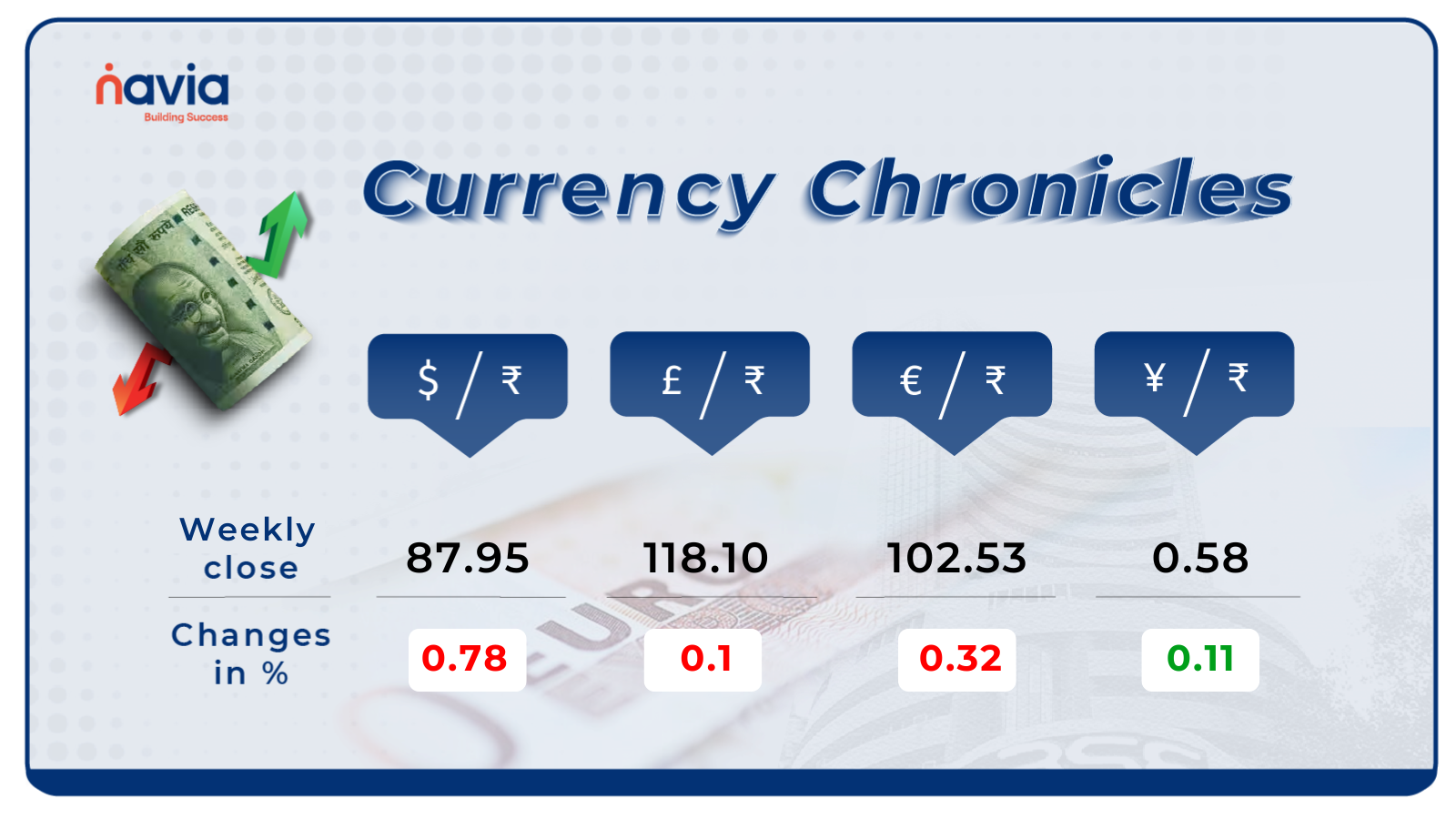

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹87.95 per dollar, losing 0.78% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹102.53 per euro, losing 0.32% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, gaining by 0.11% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

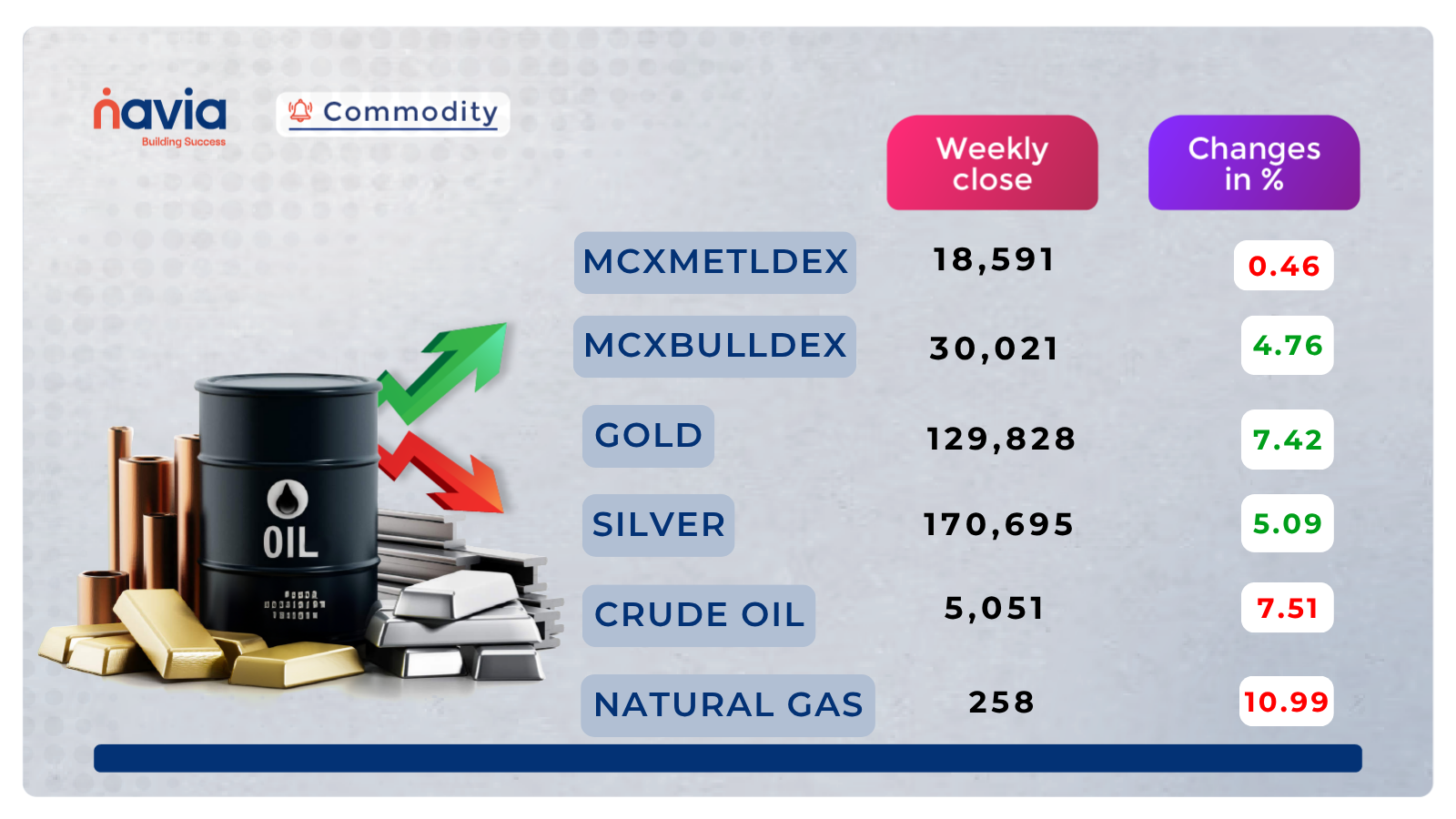

Commodity Corner

MCX Crude Oil chart shows a rising wedge pattern, which is typically bearish. The price broke down from the wedge, confirming the bearish reversal. After the breakdown, the price tried to retest the previous support zone and failed to break above it, turning it into resistance. This reinforces the bearish sentiment. The red horizontal line at 5805 was a strong resistance level; the price reversed sharply from that area. If the price breaks and closes below 4972, it could trigger further downside momentum.

In the last session, Gold closed at 129,828. Gold price is moving cleanly within an upward-sloping channel, suggesting a well-structured uptrend. The current price just touched the upper boundary of the channel (around 130,000), which may act as short-term resistance. Steady bullish candles with minimal pullbacks. However, being at the upper end of the trend channel, expect some cooling off or consolidation unless strong momentum continues. The trend remains bullish unless price breaks and sustains below 118,979.

Natural gas, a A symmetrical triangle had formed with converging trendlines. Breakout occurred to the upside, but the bullish momentum was short-lived. A sharp rally followed by an even sharper reversal suggests a bull trap. Multiple rejections at this level show supply pressure. Current price (258) is approaching the key horizontal support around 248.3. This level acted as strong demand zone previously and could be tested again. A break below 248.3 would open the door to further downside toward 230.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

The Auspicious Hour: A Complete Guide to Muhurat Trading 2025

Muhurat Trading is a special one-hour trading session held by the NSE and BSE on Diwali (Laxmi Pujan), marking the traditional start of the new financial year (Samvat 2082). It’s considered an auspicious time to make a token, long-term investment for prosperity, blending finance with culture.

The Endowment Effect: Why We Overvalue What We Own

The Endowment Effect is a cognitive bias where we irrationally assign a higher value to something simply because we own it. In investing, this is costly, leading to overvaluing owned stocks (even when fundamentals are weak), hesitating to rebalance, and avoiding the realization of losses because selling feels like a personal loss rather than a rational financial move.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.