Navia Weekly Roundup (Oct 06 – Oct 10, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Market extended the winning run in the second consecutive week ended October 10 with Nifty reclaiming 25,300 amid positive global as well domestic cues including continues DII buying, ease in geopolitical risk, FII turning buyers, positive development in US-India trade talk, and positive start of the earnings season.

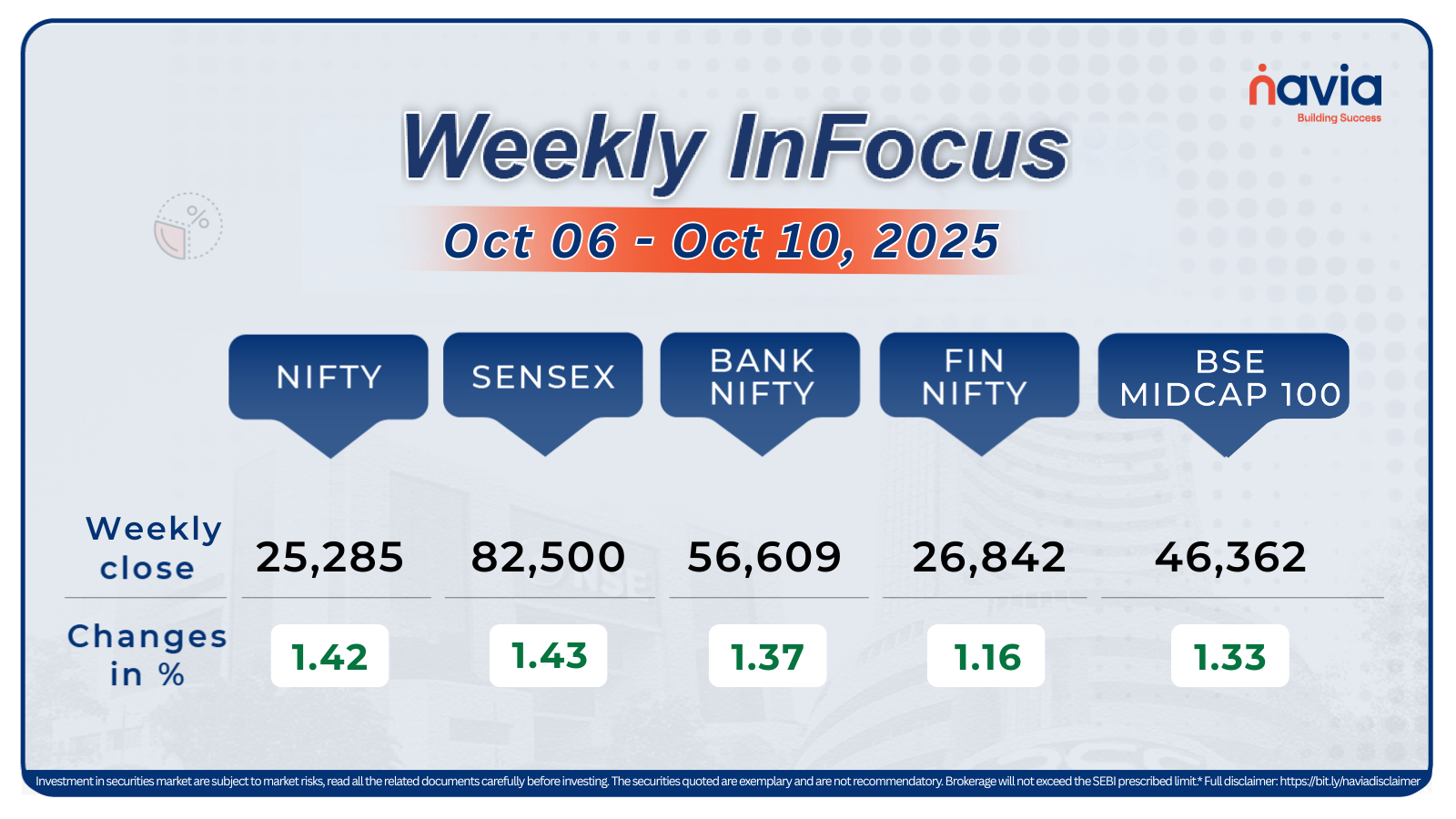

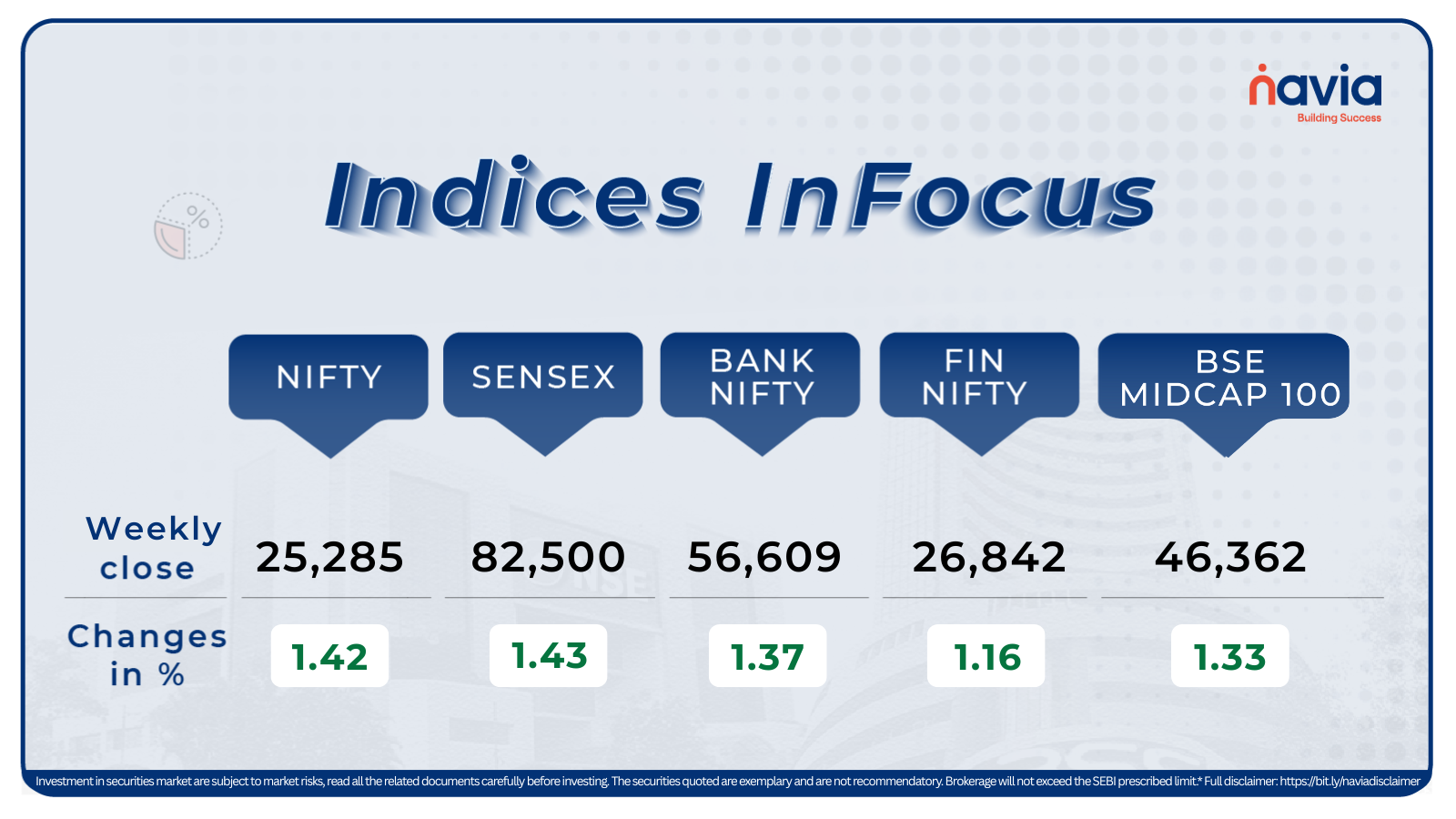

Indices Analysis

For the week, BSE Sensex index added 1.43 percent to finish at 82,500.82 and Nifty50 rose or 1.42 percent to end at 25,285.35.

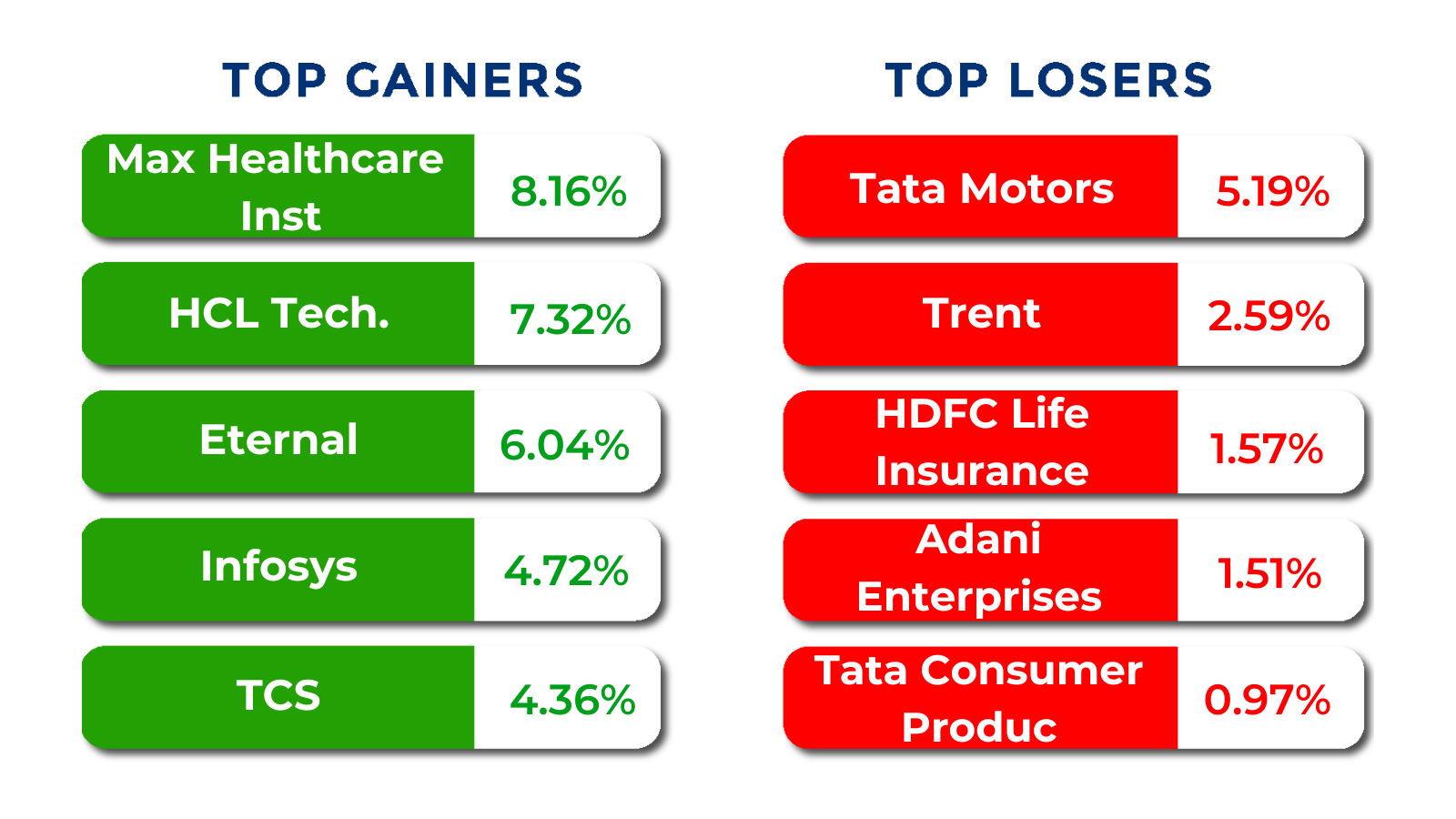

The BSE Large-cap Index added 1.4 percent supported by Divis Laboratories, Max Healthcare Institute, HCL Technologies, LTIMindtree, Eternal, Swiggy, Infosys, Polycab India, Tata Consultancy Services, Tech Mahindra. However, losers were Jindal Steel, Tata Motors, Hyundai Motor India, Siemens Energy India, Waaree Energies.

BSE Mid-cap Index rose 1.5 percent supported by Sun TV Network, L&T Finance, Aditya Birla Capital, Bank Of India, Aegis Vopak Terminals, National Aluminium Company, Fortis Healthcare. However, losers included Dixon Technologies, Hitachi Energy India, KPIT Technologies, Whirlpool of India.

The BSE Small-cap index ended flat. Jindal Photo, Indo Thai Securities, Indraprastha Medical Corporation, GM Breweries, Sky Gold and Diamonds, Dreamfolks Services, Stylam Industries, Infibeam Avenues, Salzer Electronics, SpiceJet, Avalon Technologies, Indef Manufacturing, South Indian Bank were up between 15-41 percent. However, Shankara Building Products, Paushak, Hemisphere Properties India, John Cockerill India, Nelcast, Lumax Auto Technologies, VTM, Praveg fell between 10-22 percent.

After remaining net sellers for the last 12 weeks, the Foreign Institutional Investors’ (FIIs) turned net buyers in this week as they bought equities worth Rs 2975.53 crore. On the other hand, Domestic Institutional Investors (DII) remained net buyers in 25th week, as they purchased equities worth Rs 8,391.11 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

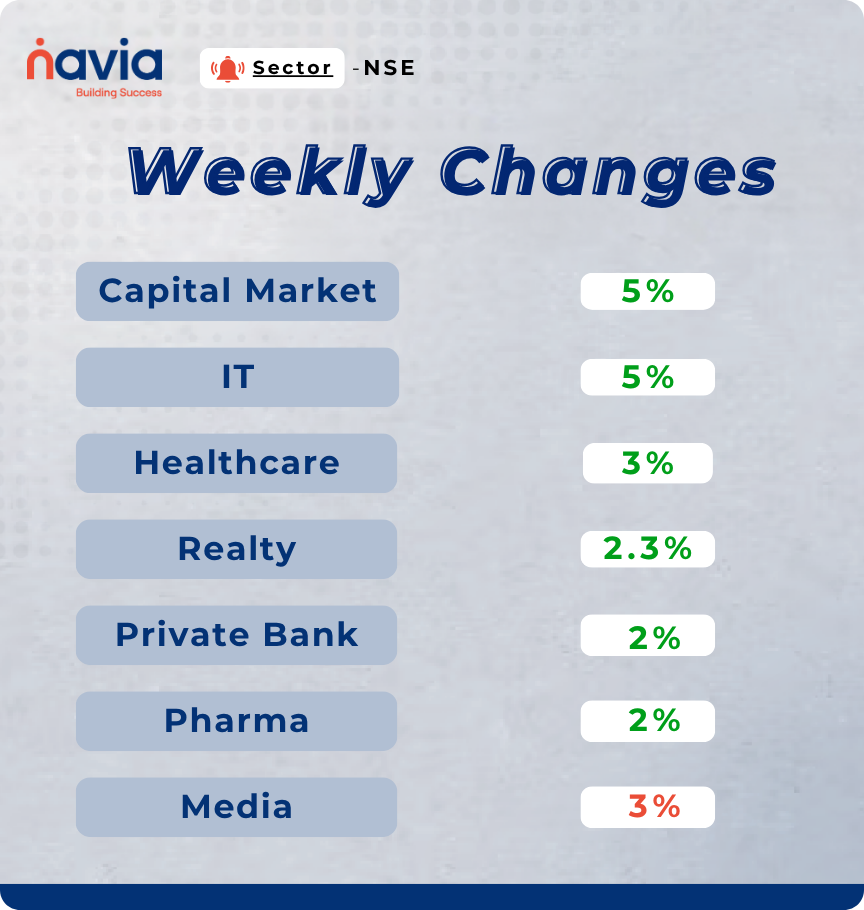

Among sectors, Nifty Capital Market and IT indices remained top performers with 5 percent gain, followed by Nifty Healthcare index (up 3 percent), Nifty Realty index (up 2.3 percent), Nifty Private Bank, Nifty Pharma up 2 percent each. However, Nifty Media index shed nearly 3 percent.

Top Gainers and Losers

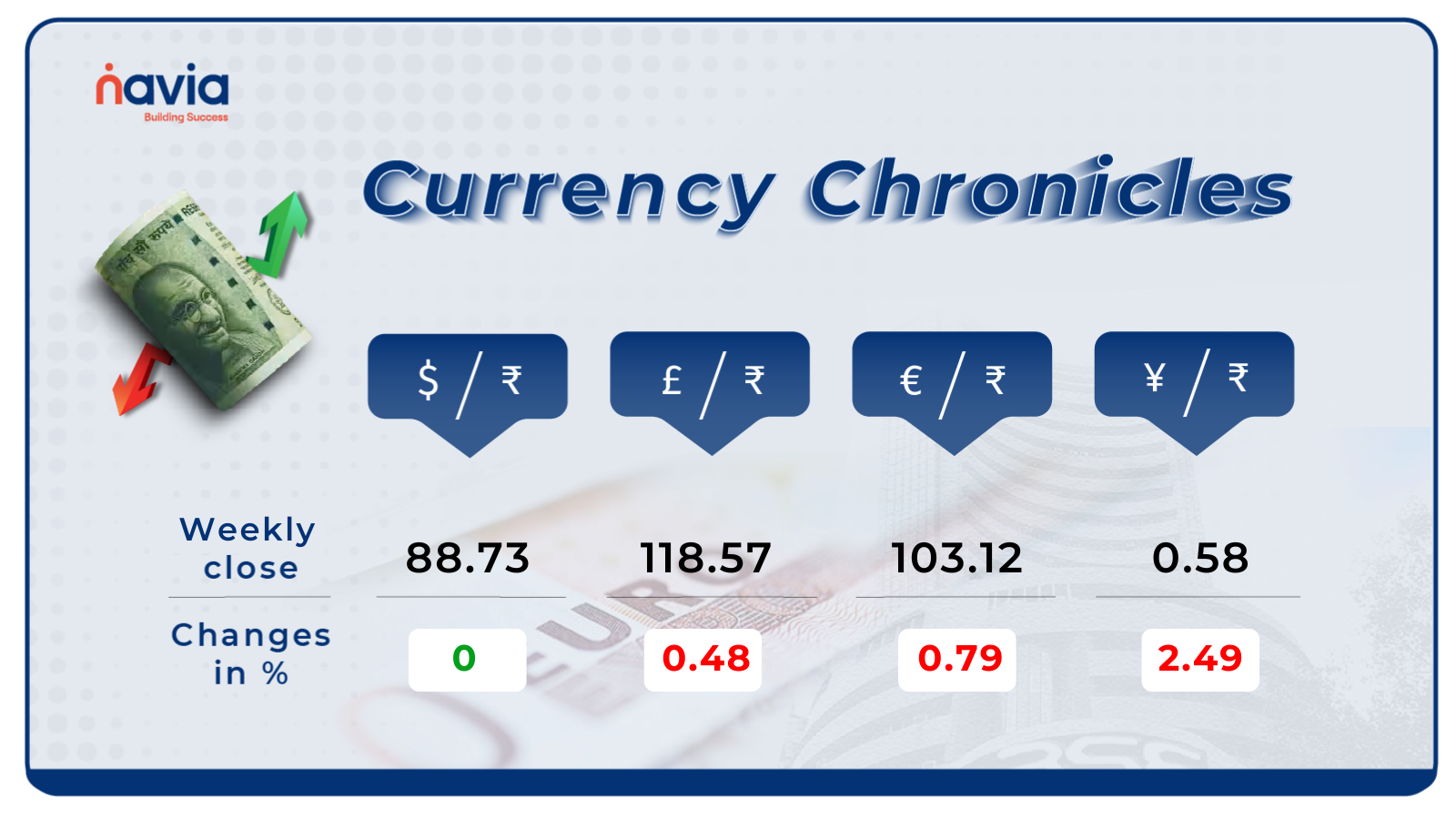

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.73 per dollar, gaining 0% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.12 per euro, losing 0.79% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, losing by 2.49% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

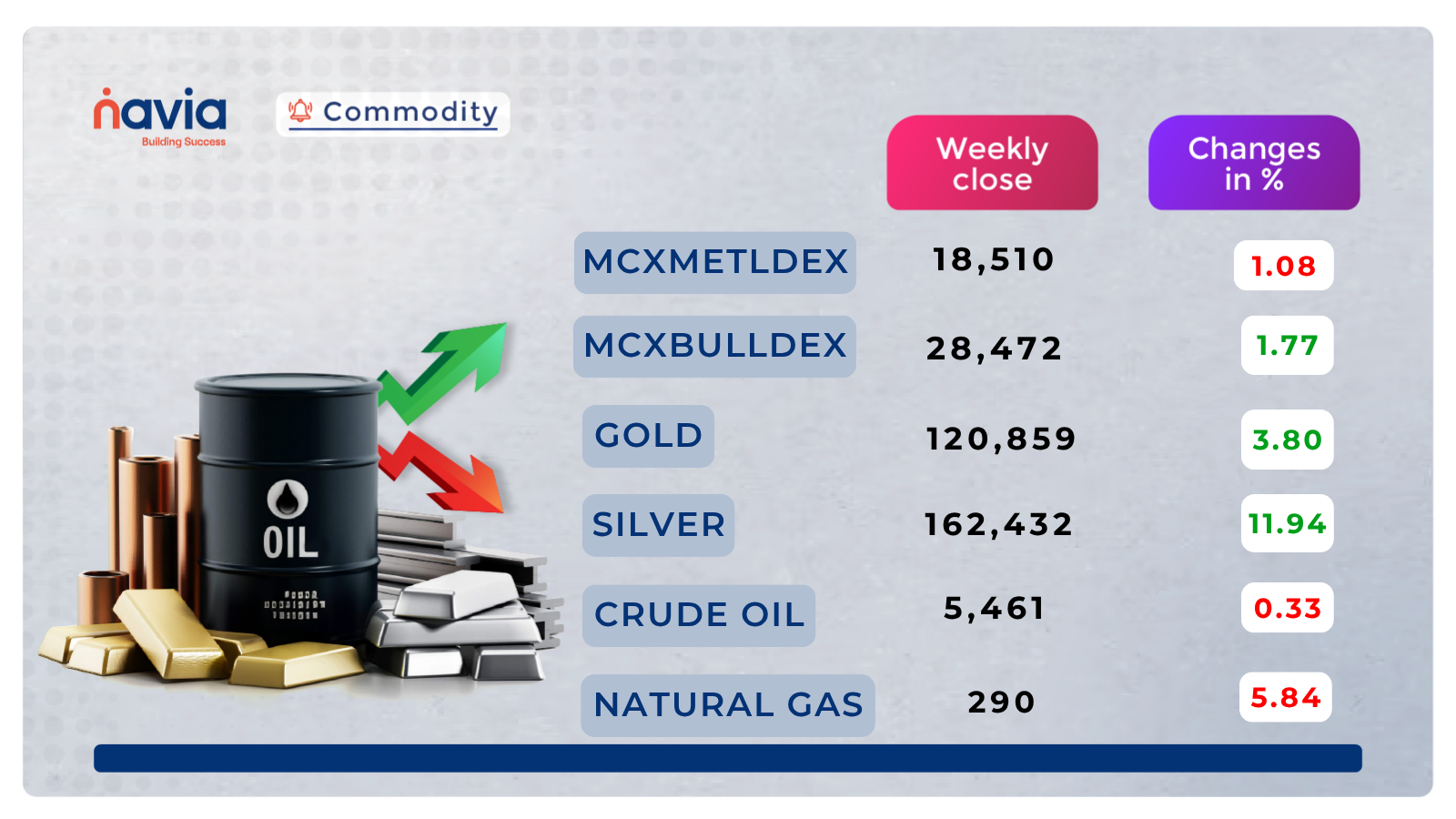

Commodity Corner

MCX Crude Oil price is currently hovering around a horizontal support zone. This level has held multiple times in the past (late August and mid-September), so it’s crucial. However, recent candles show struggles to rebound, indicating weak demand. Price previously failed to hold above 5,780, marking it as a strong resistance. Unless this level is reclaimed, any rallies may face selling pressure near this zone. Neutral to mild bullish only if price sustainably reclaims 5,550–5,600 and forms higher lows.

In the last session, Gold closed at 120,859. MCX Gold is trading within a rising parallel channel. The overall structure remains bullish, but the recent candles show a sharp correction from the upper trendline, signaling short-term profit booking. The current correction appears to be a retracement within the uptrend, not a reversal yet. If gold holds above 1,18,900–1,19,000, buyers may re-enter, pushing prices back toward the 1,22,500–1,23,000 zone. However, a decisive breakdown below 1,18,900 could trigger a deeper correction toward the lower channel line near 1,16,500–1,17,000. Momentum is cooling off, suggesting short-term consolidation or pullback. The broader trend remains bullish as long as prices stay within the channel and above 1,18,000.

Natural Gas had been consolidating in a falling wedge pattern. It has broken out strongly above the resistance trendline with high momentum. Sharp bullish candles indicate aggressive buying. Volume and momentum suggest a trend reversal from bearish to bullish. Sustaining above 282 keeps the bullish outlook intact. Natural Gas likely to test 315–320 zone. If it sustains above 320, rally can extend toward 340–345. A fall below 282 could invite profit booking toward 265–270; major trend support remains 248.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Why We Fear Losses More Than We Enjoy Gains?

Investors are like marathon runners, focusing on long-term wealth and accepting lower risk and minimal time commitment. Traders are like sprinters, aiming for quick profits from short-term price fluctuations using Technical Analysis of price charts, requiring higher risk and constant time commitment.

Breaking Promises to Our Future Self

Time Inconsistency is a behavioral bias where our present self values immediate rewards over future benefits, causing us to break planned financial commitments (e.g., delaying SIPs or overtrading).

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.