Navia Weekly Roundup ( NOV 4- NOV 08, 2024)

Week in the Review

The broader indices underperformed the main indices, with BSE Smallcap index fell more than 1 percent in the week ended November 8. During the week, the benchmark indices witnessed extreme volatility, amid weak Q2 earnings, persistent FII selling, ignoring rate cut by Bank of England and Federal Reserve in their latest meeting.

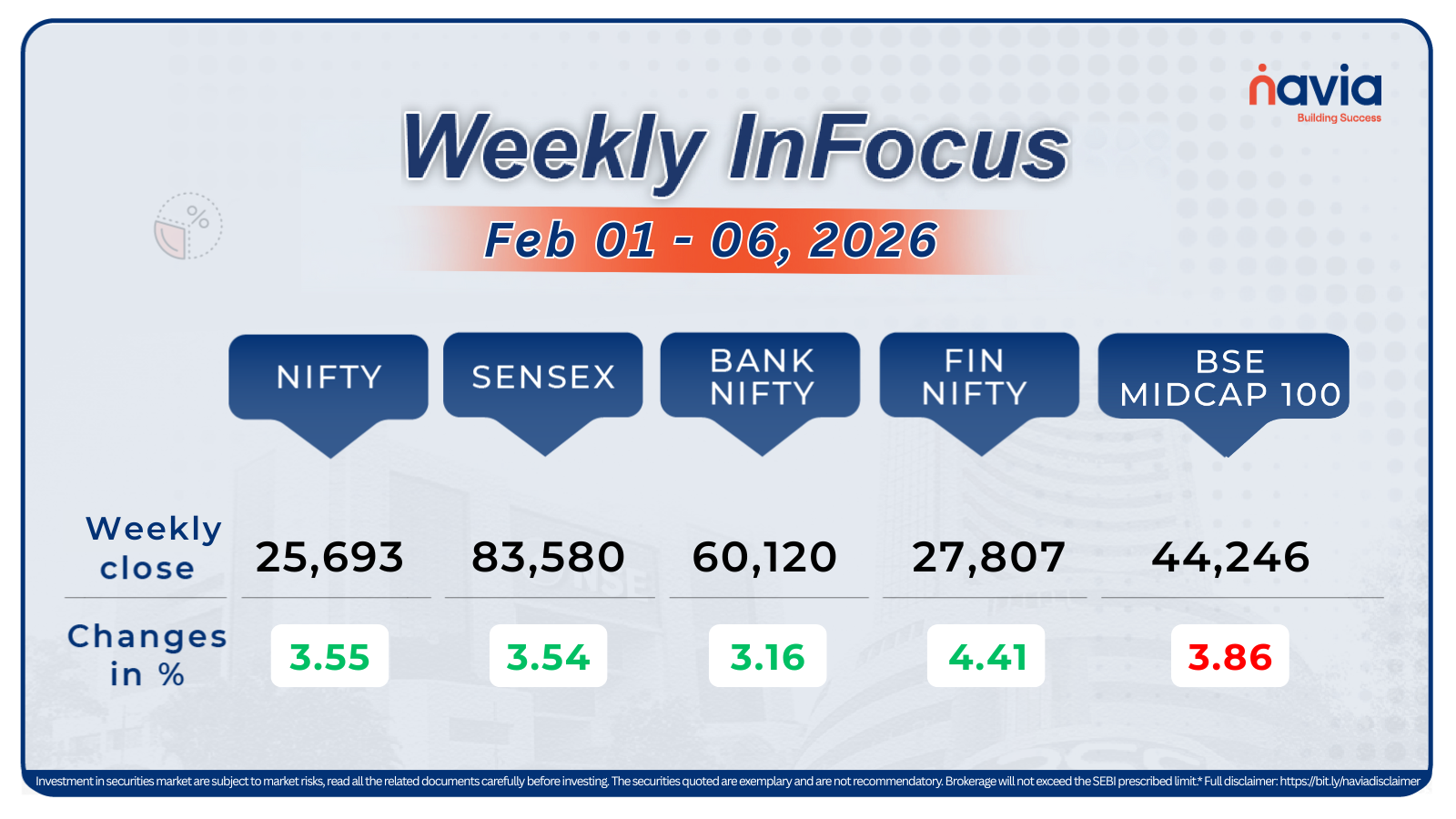

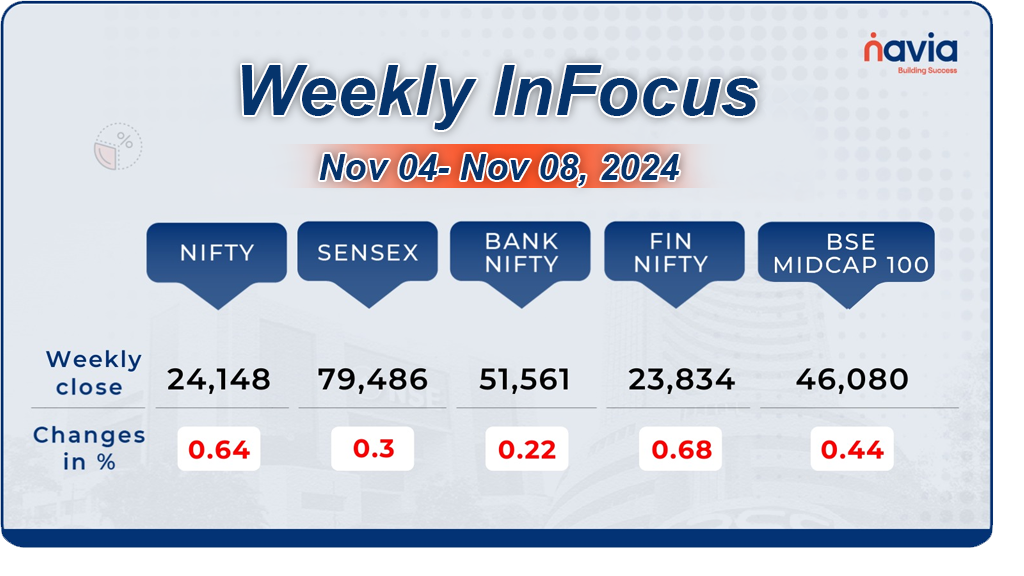

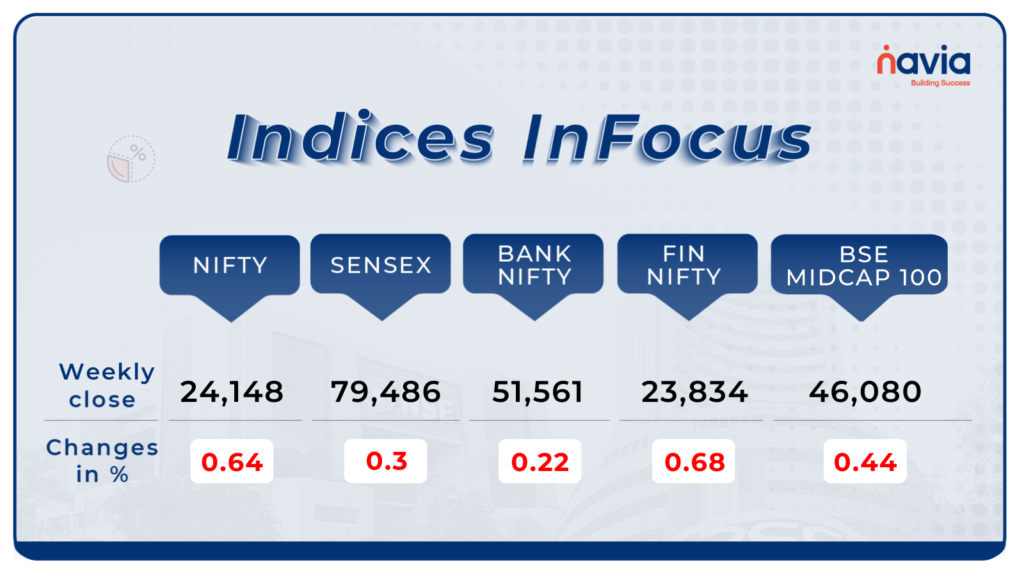

Indices Analysis

This week, BSE Sensex was down 237.8 points or 0.3 percent to end at 79,486.32, while the Nifty50 index was down 156.15 points or 0.64 percent to close at 24,148.20.

The BSE Large-cap Index, BSE Mid-cap Index and BSE Small-cap indices fell 0.7 percent, 0.4 percent and 1.3 percent, respectively. The Nifty-50 Index and Sensex were flat to marginally negative in the past week, while the mid-cap index lost around 0.45% and small-cap index lost 1.3% underperforming large-caps

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

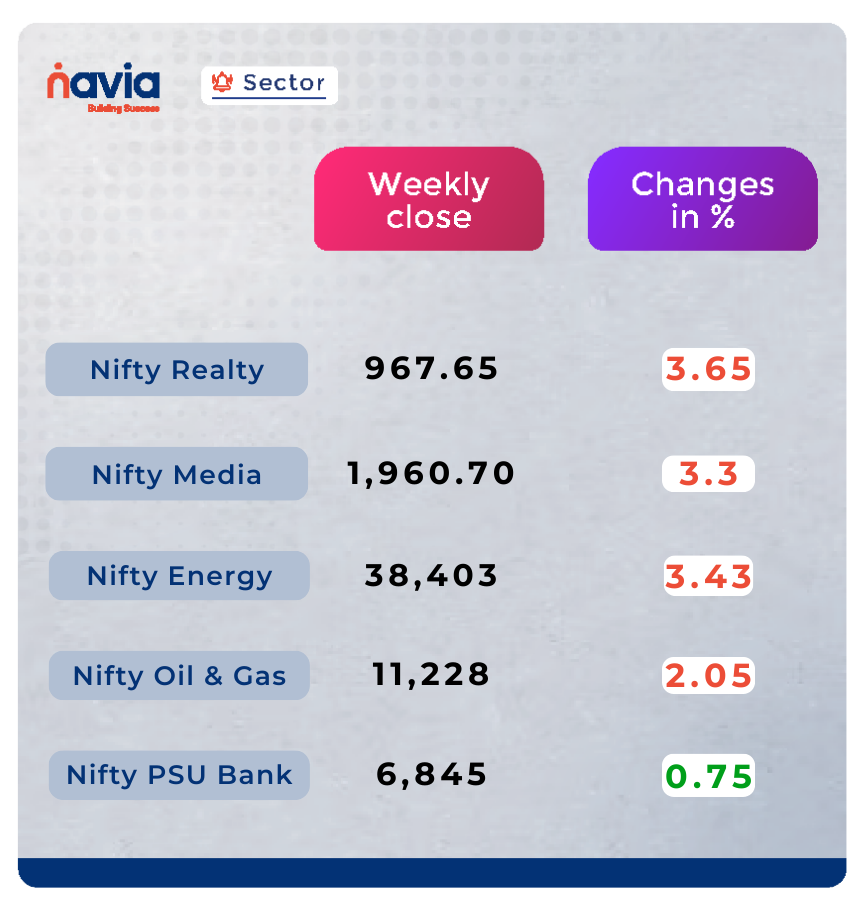

Sector Spotlight

Among sectors, Nifty Realty index shed nearly 4 percent, Nifty Media fell 3.2 percent, Nifty Energy index declined 3 percent, Nifty Oil & Gas index was down nearly 2 percent. On the other hand Nifty Information Technology index added 4 percent, and Nifty PSU Bank index rose 1 percent.

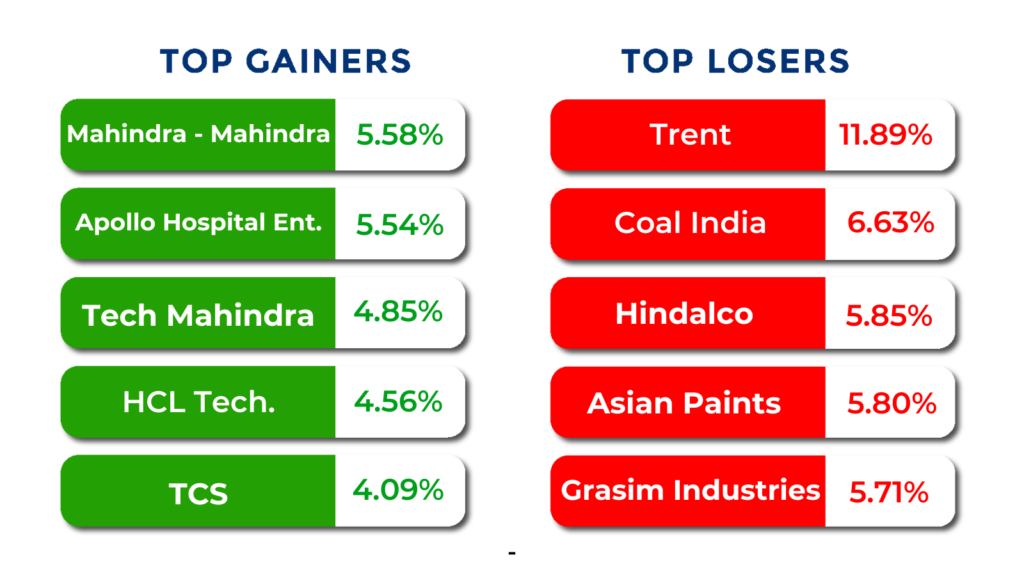

Top Gainers and Losers

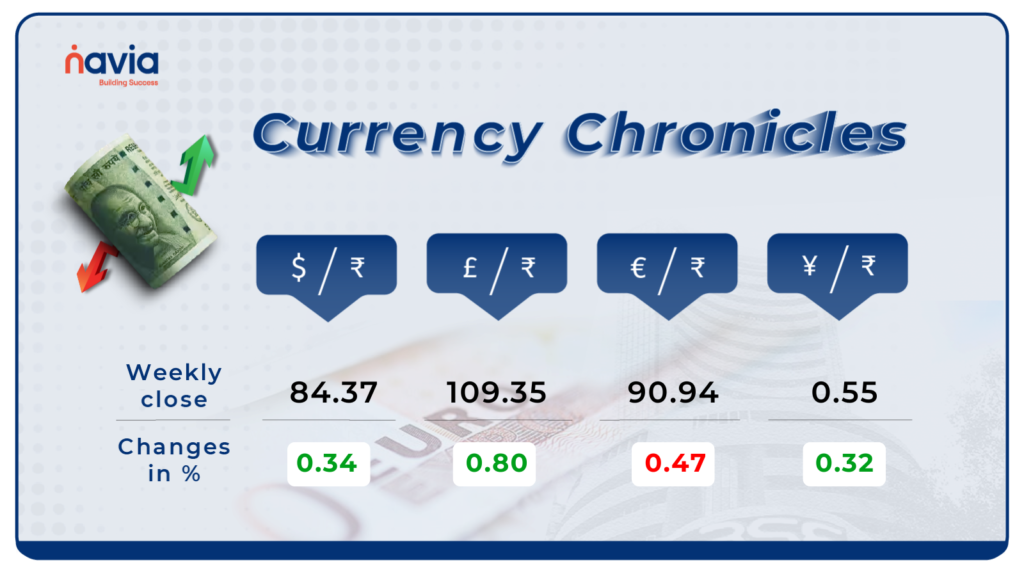

Currency Chronicles

USD/INR:

The Indian rupee faced a notable dip against the U.S. dollar, sliding 29 paise to a new low of ₹84.37, after touching a fresh record of ₹84.38 earlier in the week. Sentiment remains cautious as the rupee continues to grapple with external pressures.

EUR/INR:

The euro dipped against the rupee, decreasing by 0.47% to close at ₹90.94. Currently, market sentiment toward EUR/INR appears bearish, signaling potential softness in the euro’s demand.

JPY/INR:

The Japanese yen showed resilience, rising by 0.32% for the week to end at ₹0.554374. Although minor, this gain suggests ongoing interest in the yen amidst broader currency fluctuations.

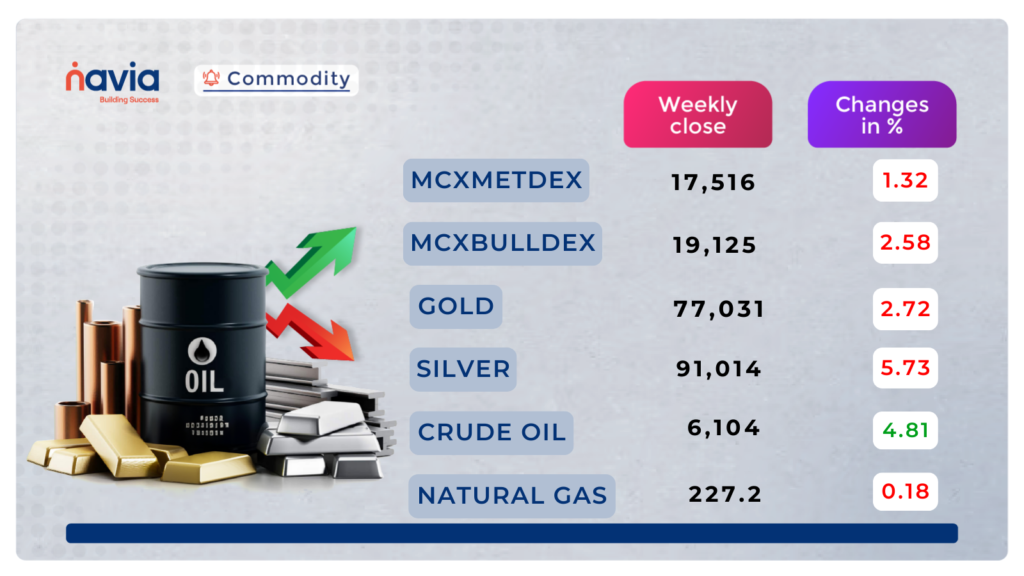

Commodity Corner

Crude oil is currently in a period of uncertainty, forming a Symmetrical Triangle pattern. While the last session ended up bullish once again. The market’s future movement will depend on whether it breaks above the resistance or below the support.

If the price can break above the resistance level of 6170, it may rise to 6240 and 6340. However, if the price falls below the support level of 6040, it could signal a downward trend, potentially leading to a fall to 5940 or even 5850.

Gold has been rising recently, forming an Ascending Broadening Wedge pattern on the daily chart. Yesterday, the market ended bullish after retesting the channel, indicating a trend turn. We can expect some more decline in the upcoming sessions.

Natural gas has been trending uncertainly, where the last sessions ended slightly bearish in the symmetrical triangle pattern on the daily interval chart. The future direction of the market is uncertain at this point and will depend on how it reacts to these key support and resistance levels.

If the market breaks below the support level of 222.50, it could further decline to 217 and 210.50 levels. However, if the price breaks above the resistance level of 236, it could revive the upward trend, potentially leading to a rise to 243 and 250.

Silver has been falling, as shown in the Ascending Broadening Wedge chart. The last session ended up bullish after retesting the channel. The market’s future movement will depend on whether it breaks above the resistance or below the support. If the market breaks above the current resistance level of 92,800, it may continue to rise to 94,800 and 96,600 levels. However, if the price manages to break below the support level of 90,400, it could start to decline once again, potentially leading to 88,300 and 86,500 levels.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Maximizing Returns Without Chasing Trends: Why a Multicap Approach Makes Sense

Constantly switching between funds based on market trends can lead to high taxes and missed compounding opportunities. A multicap strategy offers a better way to capture market growth across all segments—large, mid, and small caps—without the need for constant fund changes. Dive into this week’s blog to learn the advantages of a multicap approach, examples, and how Navia’s tools can simplify your investment journey.

Why Do Traders Succeed in Demo Accounts But Fail in Real Trading?

Many traders excel in demo accounts but face challenges in live trading, often due to emotional pressures, lack of discipline, and real market conditions. In this week’s blog, Navia dives into the reasons behind this gap and shares insights on how to make a smoother transition from demo to real trading.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?