Navia Weekly Roundup (Nov 10 – Nov 14, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian stock market rebounded and ended in positive territory after a volatile stretch powered by sector rotations, late-session buying, and supportive macro cues.

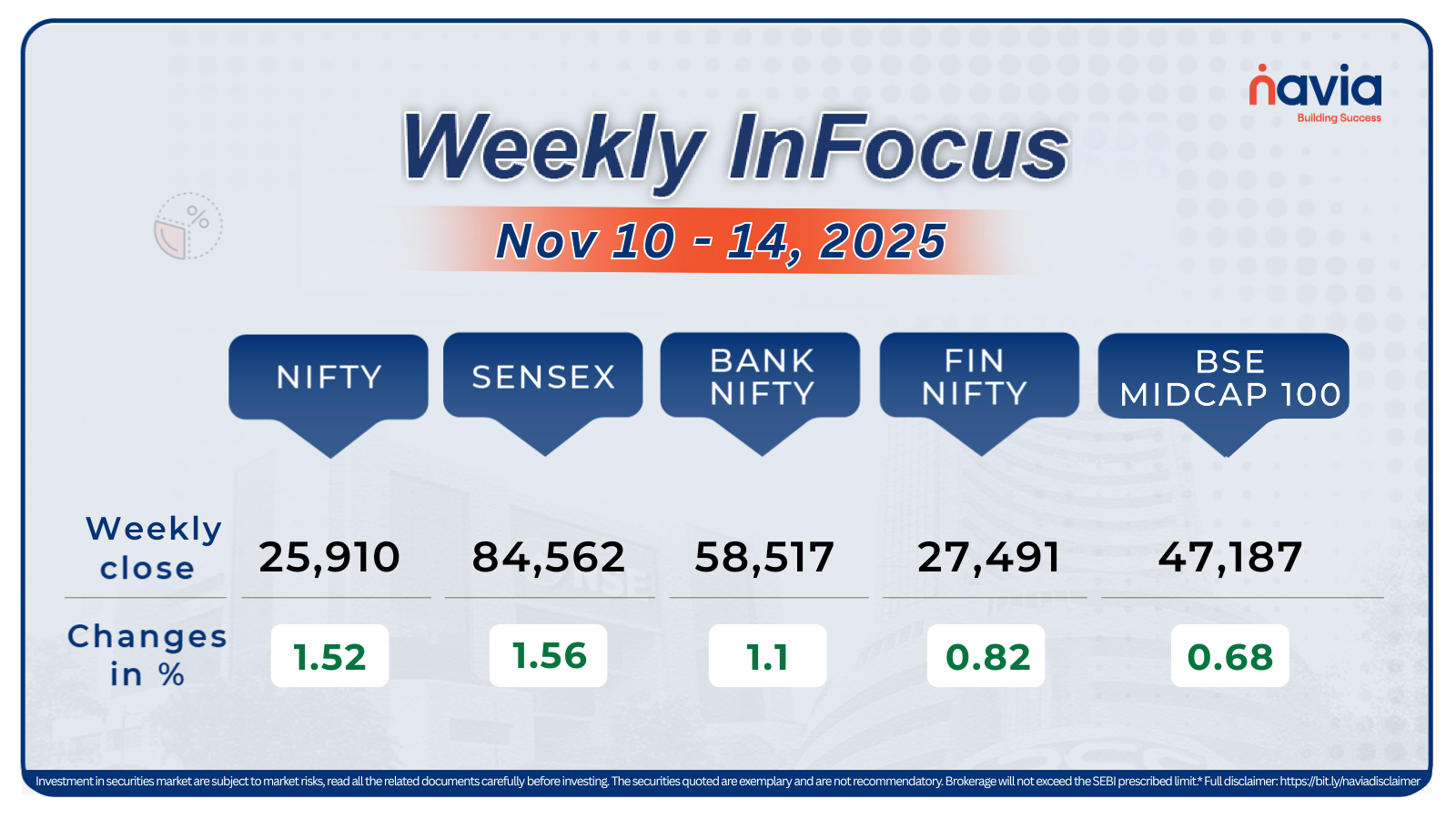

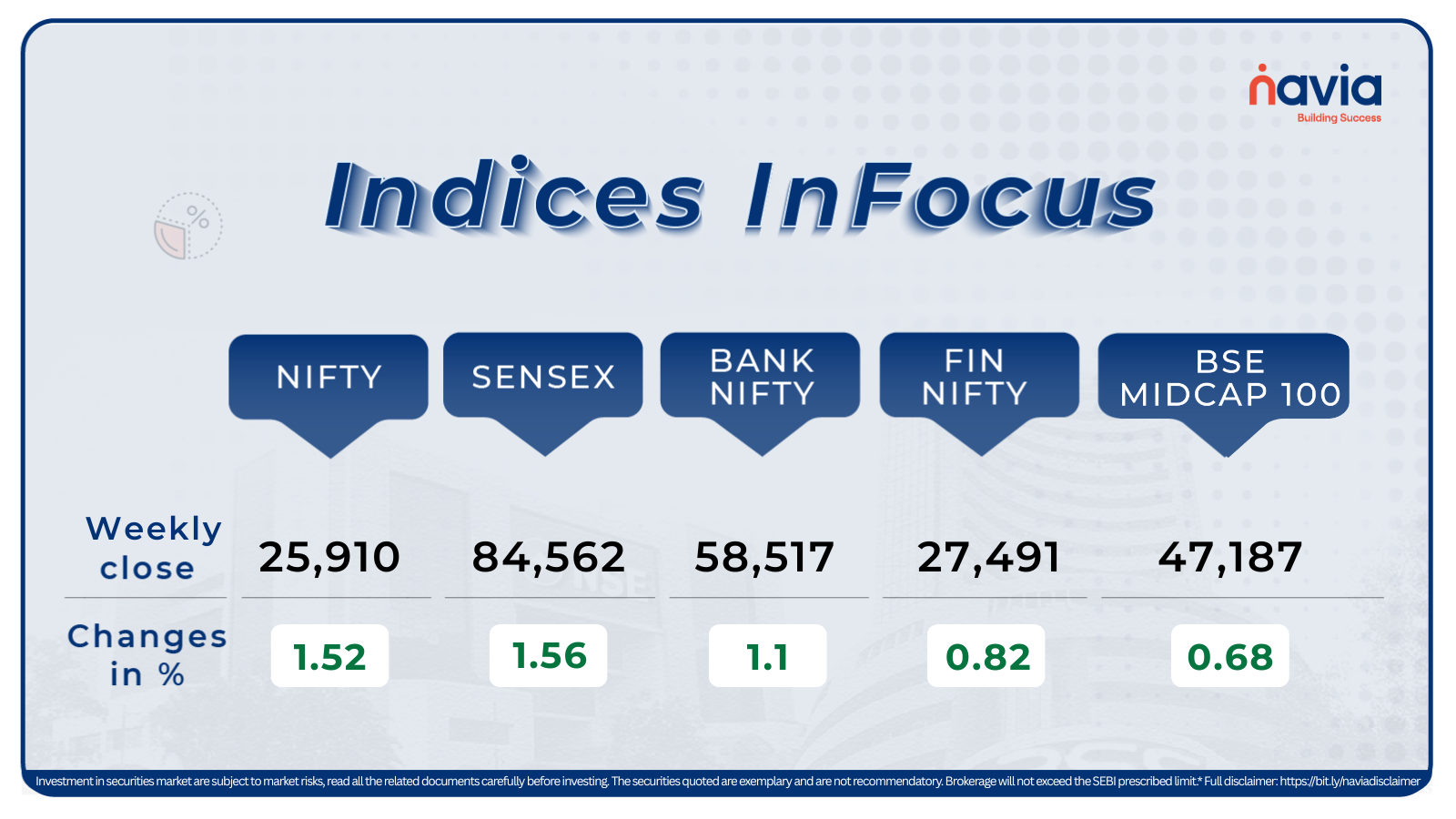

Indices Analysis

For the week, BSE Sensex index rose 1.56 percent to finish at 84,562.78 and Nifty50 gained 1.52 percent to end at 25,910.05.

The BSE Large-cap Index managed a modest advance this week, aided by strong rebounds in select PSU banks and sectoral rotation into capital goods and IT stocks. Gains were led by stocks like Axis Bank, Asian Paints, L&T, and InterGlobe Aviation that delivered positive momentum, while laggards included Tata Steel, Infosys, and TMPV, which faced downside pressure following mixed corporate results and sectoral headwinds.

For BSE Mid-cap, the action was largely stock-specific with volatility in infrastructure, commodities, and technology segments. Ipca Labs and Muthoot Finance posted notable gains of 10–11%, highlighting strong investor interest, but several mid-cap names like JK Cement and Kaynes Technology underperformed due to profit taking after results. The overall mid-cap index saw a flat to slightly negative return through the week.

The BSE Small-cap segment recorded a marginal weekly gain of 0.38%, but this masked sharp stock-wise dispersion. Expleo Solutions surged over 14%, standing out as the week’s top performer, while Allcargo Terminals and other logistics players faced steep declines near 14%. Wider breadth across small-cap counters remained subdued, showing caution despite some impressive individual gains in power, capital goods, and select tech names.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

On the sectoral front, Nifty IT index rose 2.9%, Nifty Pharma index jumped 2.5%, Nifty Auto index climbed 1.7%, Nifty Media shed 0.8%, and Nifty Realty index declined 0.7%.

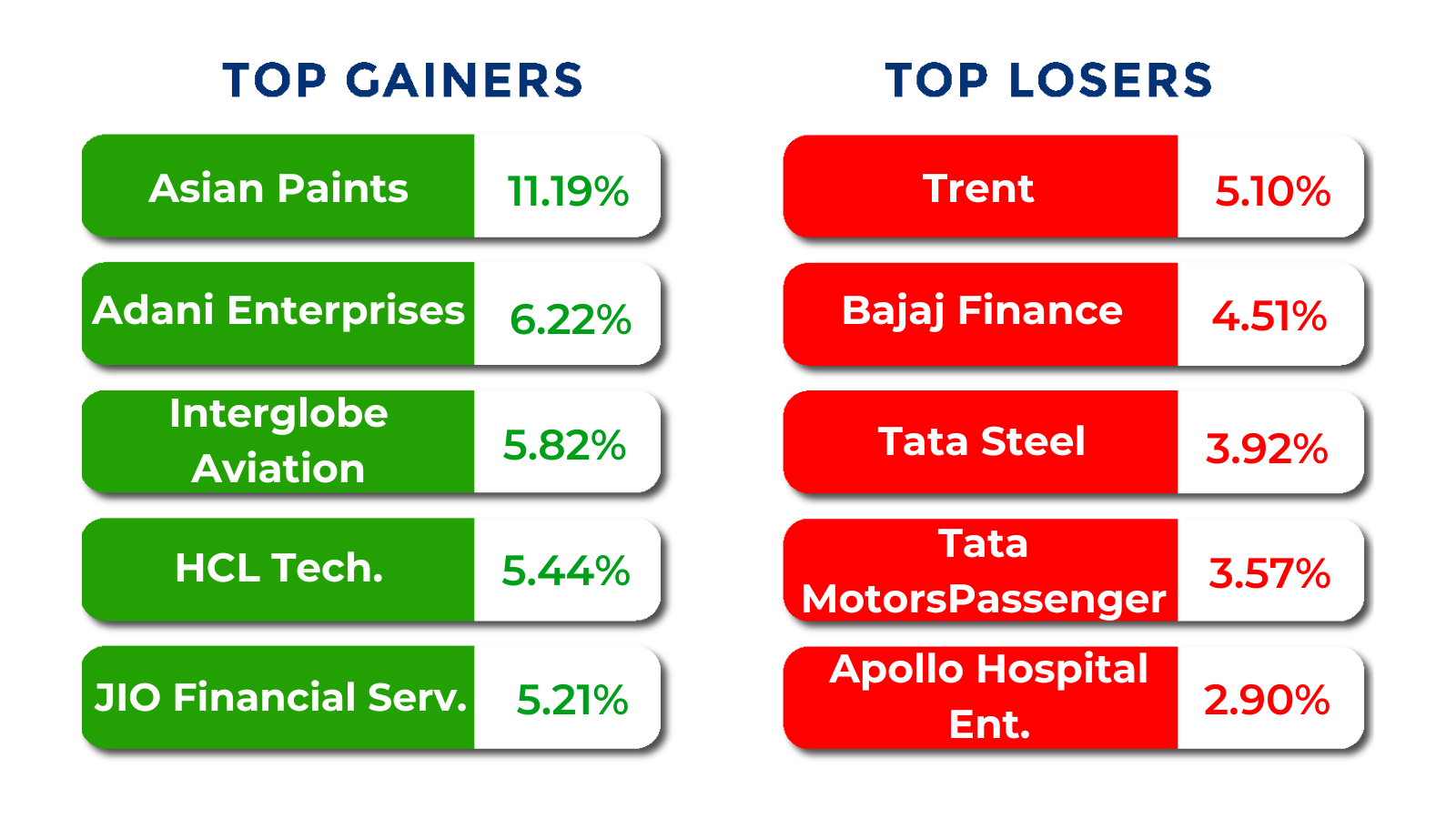

Top Gainers and Losers

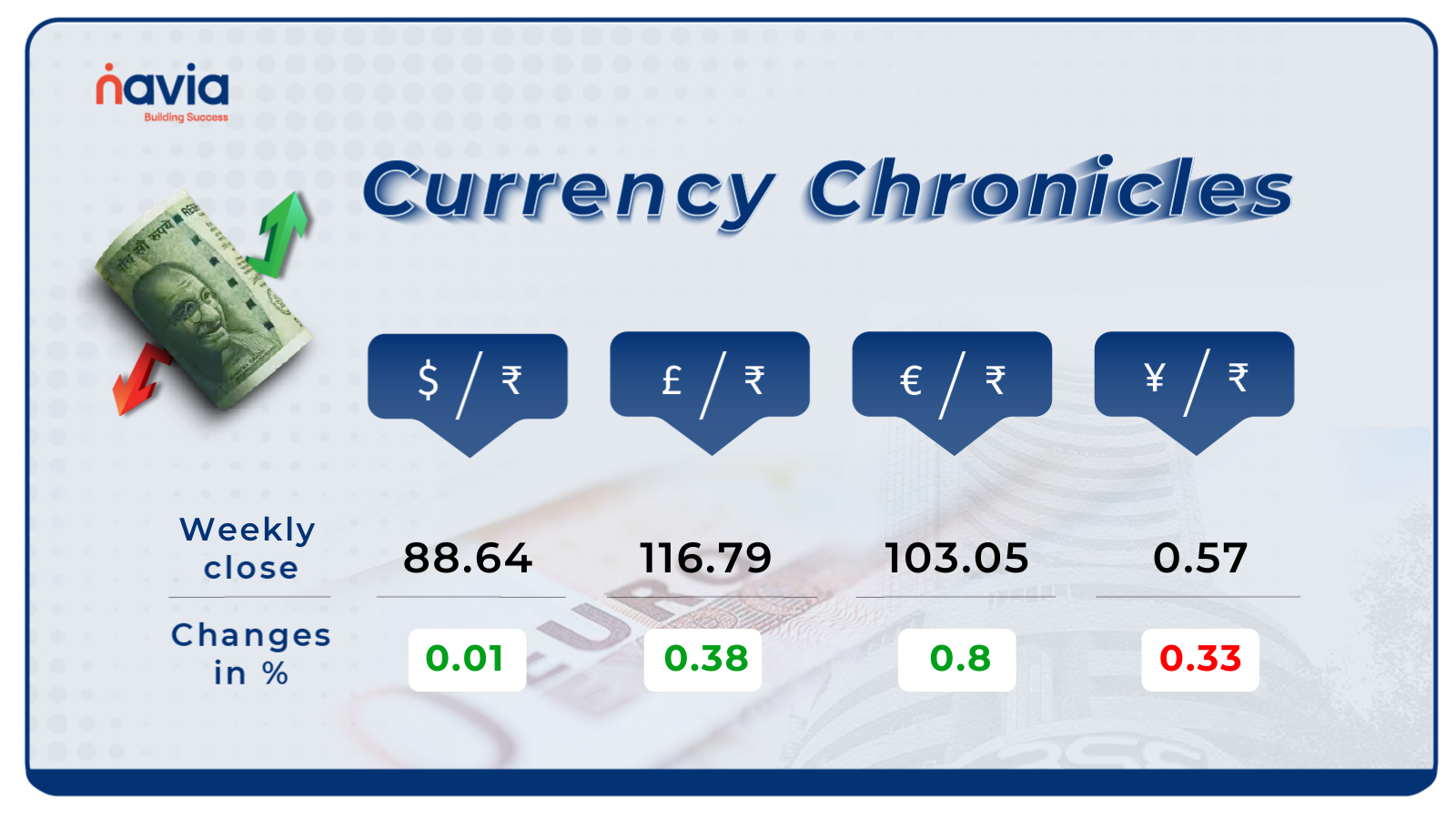

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.64 per dollar, gaining 0.01% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.05 per euro, gaining 0.8% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, losing 0.33% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

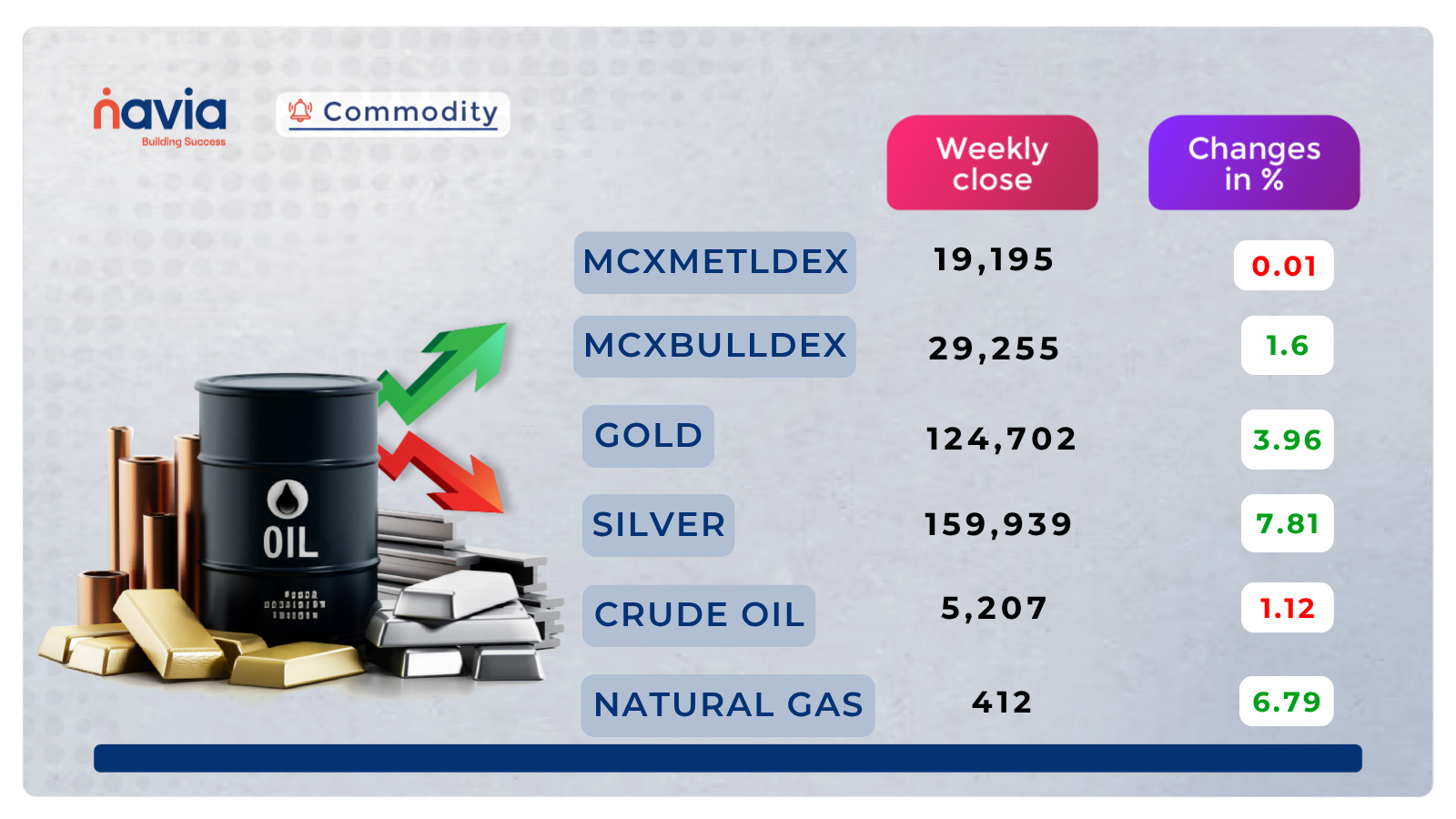

Commodity Corner

Crude Oil last session closed at 5,207, showing continued bearish pressure after failing to sustain above the 5,303 support–turned–resistance zone. The price has also rejected the descending trendline, confirming persistent selling at higher levels.As long as Crude remains below 5,303, the short-term trend stays weak, and sellers may continue to dominate. A breakdown below 5,180–5,160 could accelerate downside momentum toward the major support at 5,010. On the upside, only a strong close above 5,303 will open the door for recovery toward 5,433. A breakout above 5,433 would indicate a trend reversal, pushing prices toward 5,604.Overall, the structure is bearish with bounces facing resistance near the trendline and horizontal supply zones.

In the last session, Gold closed at 124,702, maintaining a strong bullish structure after a breakout above the 1,24,400 resistance zone. The breakout from the falling trendline and subsequent rally indicate renewed buying strength in the yellow metal. The price is now consolidating after touching the 1,27,000 mark, suggesting mild profit booking before a potential continuation move.If Gold sustains above 1,26,000, the next upside targets lie around 1,28,000–1,31,950. On the downside, immediate support is placed at 1,24,400, and a break below this could trigger a short-term correction toward 1,21,200.Momentum indicators such as RSI remain in the bullish zone, confirming ongoing strength, though short-term consolidation cannot be ruled out after the sharp upmove.

Natural Gas last session closed at 412, continuing their strong bullish momentum after a clean breakout above the major resistance zones at 363 and 394. The price has now entered an overextended rally phase, with buyers aggressively pushing through the 407 resistance area.The structure indicates a strong uptrend, supported by higher highs and higher lows visible since the breakout from the falling channel. As long as prices hold above 394, the bulls remain firmly in control. A sustained close above 414–420 could open the next bullish leg toward 435–450.However, profit booking may emerge due to the sharp run-up, and a pullback toward 394–407 cannot be ruled out. This zone now acts as a strong support demand area. Below 394, momentum may weaken, dragging prices toward 363.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

SIP, STP, and SWP—Which Systematic Plan Wins in 2025?

The core of smart investing lies in understanding the difference between SIP (Systematic Investment Plan), STP (Systematic Transfer Plan), and SWP (Systematic Withdrawal Plan).

Navigating Financial Tides: What the Current Ratio Reveals About a Company’s Health

The Current Ratio is the most crucial liquidity metric that measures a company’s ability to cover its short-term debts (Current Liabilities) using its short-term assets (Current Assets), which are expected to mature within one year.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.