Navia Weekly Roundup (May 20 – May 24, 2024)

Week in the Review

In a truncated week, Indian benchmark indices surged 2%, reaching new milestones. The Nifty surpassed 23,000 for the first time, driven by sector-wide buying, FII support, and mixed corporate earnings.

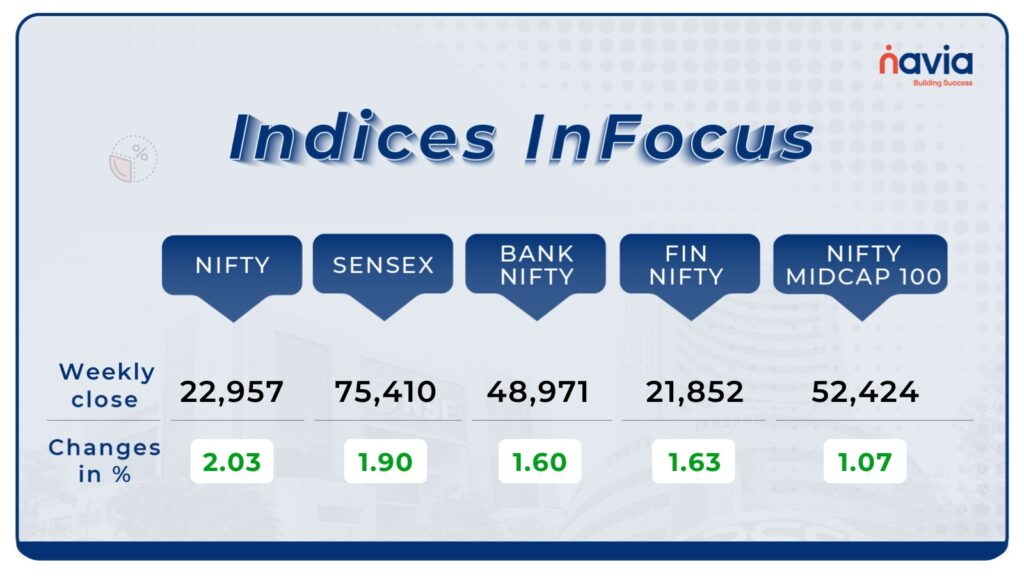

Indices Analysis

In this week, Nifty50 index rose 455.1 points or 2.03 percent to close at 22,957 after hitting new high of 23,026.40, while BSE Sensex added 1.90 percent to finish at 75,410 after touching fresh high of 75,636.5.

Interactive Zone!

Last week’s poll:

Q) In a long run, what determines the value of a stock?

a) Industry’s growth

b) Company’s revenue & profitability

c) Effective cash flow & debt management

d) All the above

Last week’s poll Answer: b) Company’s revenue & profitability

Poll for the week: The Best practice while investing is:

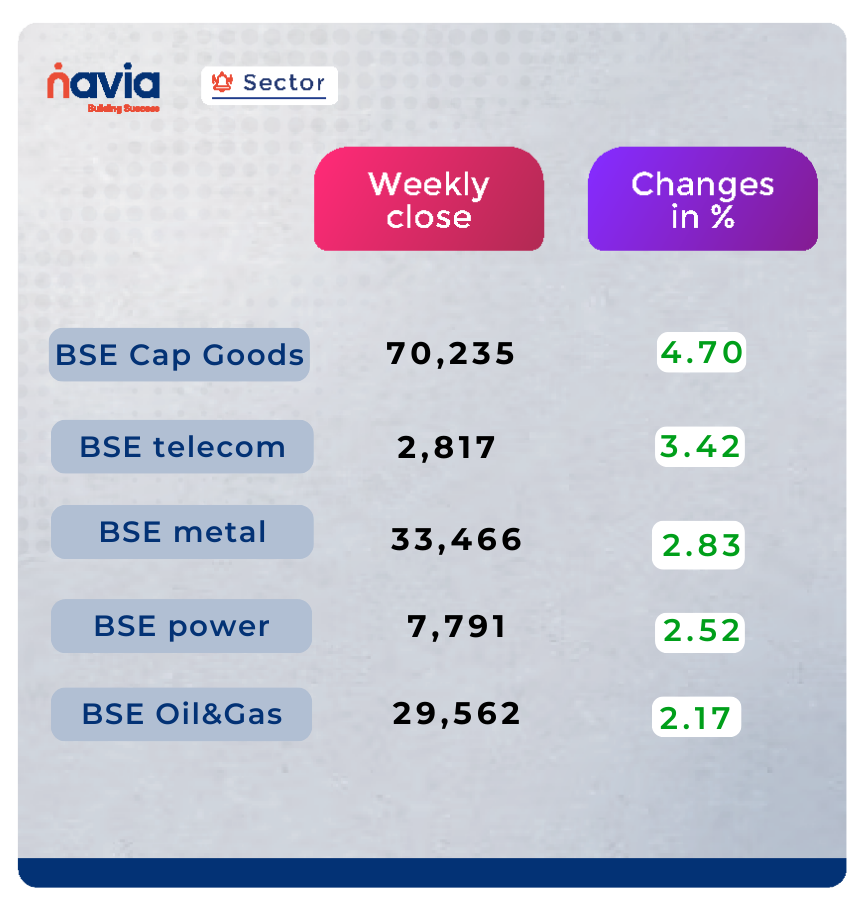

Sector Spotlight

All the sectoral indices ended on positive note with BSE Capital Goods index up 4.70 percent, BSE Telecom index rose 3.42 percent, while Metal up 2.53%, Power added 2.52% and Oil & Gas indices added 2.17 percent.

Explore Our Features!

Effortlessly add funds to your Navia App account for smooth investing and trading. Follow our step-by-step tutorial to boost your account balance and start trading hassle-free!

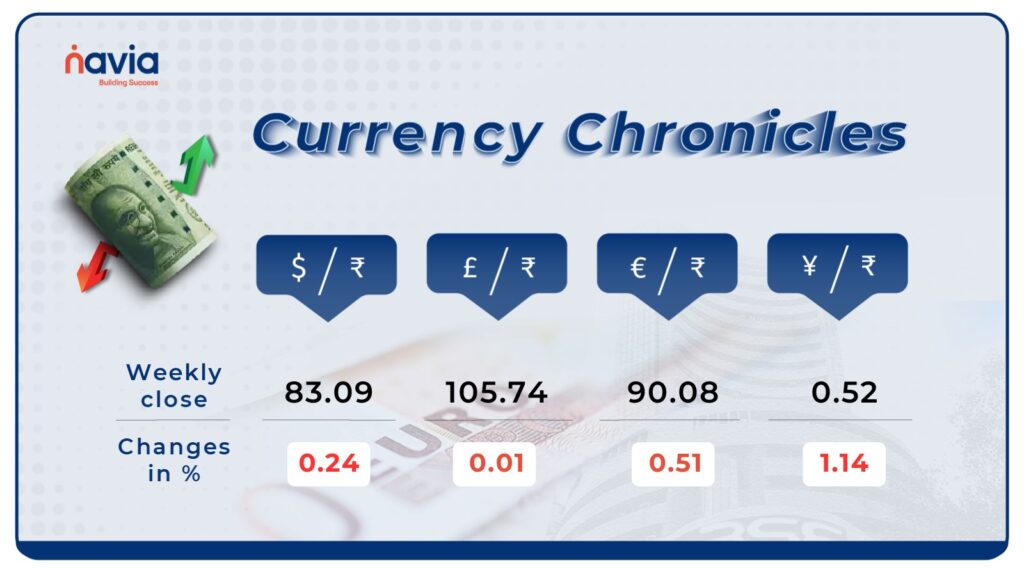

Currency Chronicles

USD/INR:

This week, the Indian rupee gained ground against the US dollar, rising 24 paise to end at 83.09 on May 24 compared to its May 17 closing of 83.33. This increase reflects a strengthening of the domestic currency amidst positive market conditions.

EUR/INR:

The EUR to INR exchange rate saw a decline of -0.51% over the week. Despite this decrease, bullish sentiment prevails in the EUR/INR market, indicating positive expectations among traders and investors. By the end of the week, the EUR to INR rate reached ₹ 90.08.

JPY/INR:

The JPY to INR exchange rate also experienced a decrease, dropping by -1.14% for the week. However, bullish sentiment remains strong in the JPY/INR market, suggesting ongoing confidence among market participants. By the week’s end, the JPY to INR rate stood at ₹ 0.527253.

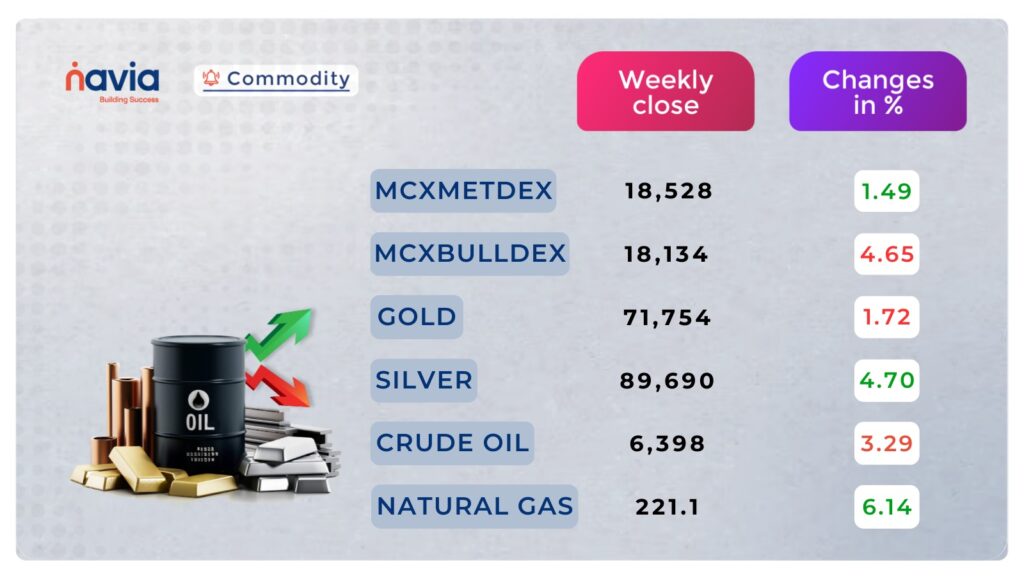

Commodity Corner

Crude oil continues its strong downtrend rally, with the week closing at 3.29% negative. The stronger-than-expected US PMI data reduced bets for Federal Reserve interest rate cuts this year, impacting the outlook for the US economy and demand for energy. The current resistance (R1) is placed at 6,515, and the current support (S1) is placed at 6,311.

In this week, gold experienced strong selling pressure and closed 1.72% negative. This trend followed investors reducing their expectations of Fed rate cuts after the recent US economic release. The current resistance (R1) is placed at 73,067, and the current support (S1) is placed at 70,316.

Blogs of the Week!

How to Grow Your Money: 6 Essential Investing Rules for Building Wealth

Explore six crucial investing rules to simplify your financial decisions and boost your wealth. Learn about doubling and tripling your money, understanding inflation, setting realistic expectations, balancing risk, and assessing your financial health. Read more to start building your wealth today!

Unlocking Hidden Riches: The FCF story!

Discover how FCF reveals the true financial health of companies and empowers smart investment decisions. Don’t miss out on this insightful read!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

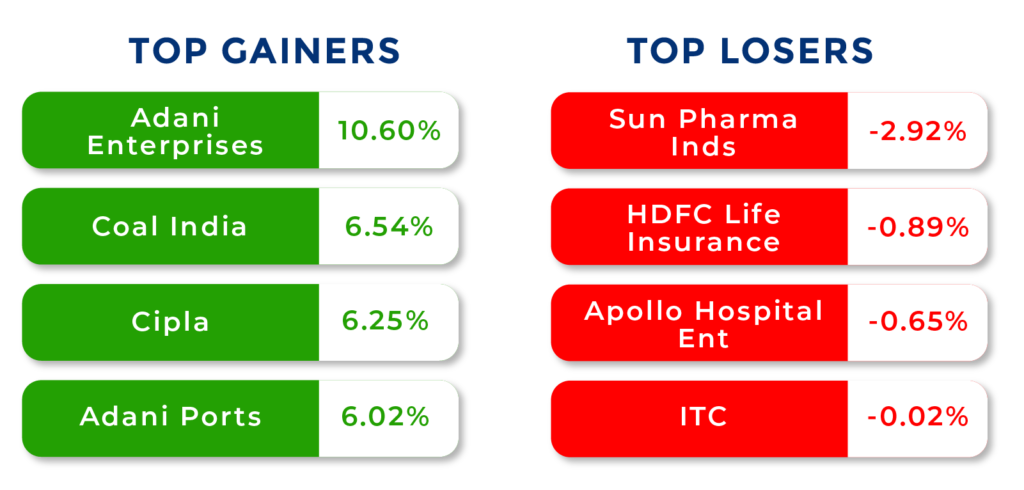

Top Gainers and Losers

Do You Find This Interesting?