Navia Weekly Roundup (May 06 – May 10, 2024)

Week in the Review

The Indian market surged with optimism due to strong Foreign Portfolio Investor (FPI) inflows and reduced Middle East tensions. This influx of investment renewed investor confidence. Also, anticipation for the upcoming Lok Sabha elections added to positive sentiment, with hopes for political stability. As the nation braces for this crucial electoral event, stakeholders vigilantly monitor and position themselves strategically in the market.

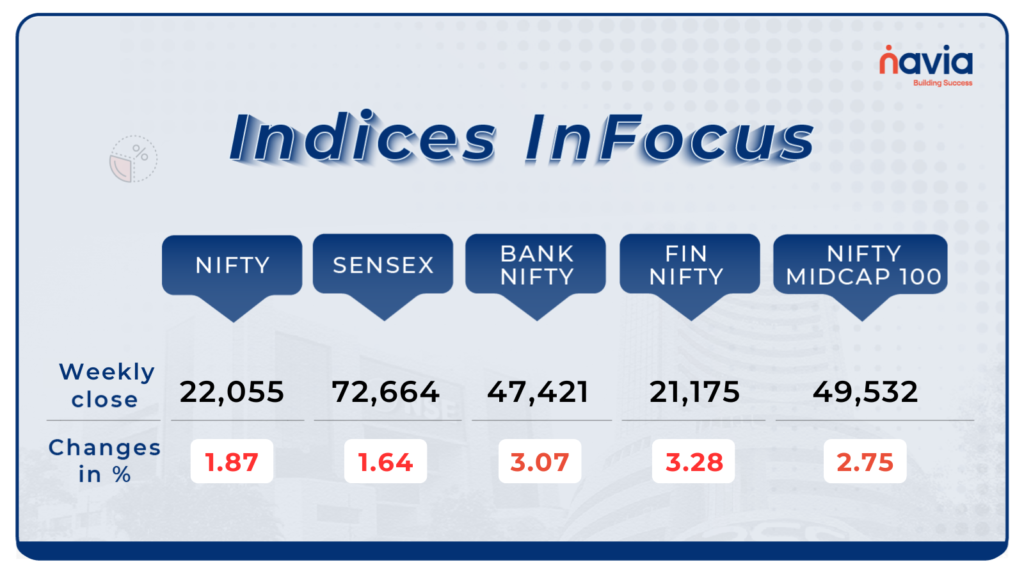

Indices Analysis

Nifty and Sensex Show Resilience Amidst Volatility!

Nifty and Sensex rebounded slightly on May 10, with Nifty settling 1.87 percent higher at 22,055 and Sensex closing 1.64 percent higher at 72,664 for the week. Despite this, Nifty formed a bearish weekly candle, indicating limited upside potential. To sustain the bounce, Nifty needs to hold above 22,000, targeting 22,222 and 22,350 zones, with support at 21,850 and 21,700 zones. As volatility persists, a cautious approach may be prudent for investors.

Interactive Zone!

Last week’s poll:

Q) What is a defensive stock?

a) A stock belonging to a defence company

b) A junk stock that we should stay away from

c) A stock that belongs to infrastructure industry

d) A stock that holds its value even when the market is falling

Last week’s poll Answer: d) A stock that holds its value even when the market is falling

Poll for the week: Which order can be executed immediately?

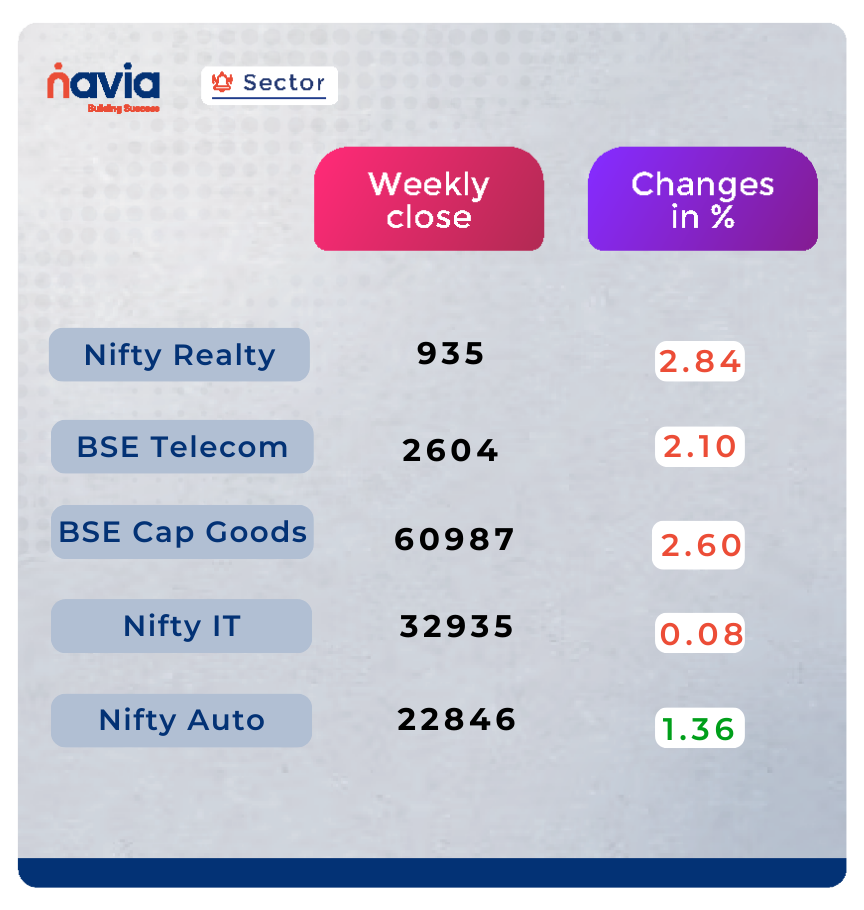

Sector Spotlight

Apart from the auto sector, all other sectoral indices ended in negative territory, with capital goods, realty, and telecom witnessing declines of 2.60%, 2.84%, and 2.10% respectively, while Information Technology experienced a marginal decrease of 0.08%.

Explore Our Features!

IPO Alert 🔔: Stay ahead of the game! Discover upcoming Initial Public Offerings with ease on the Navia App. Don’t miss out on investment opportunities – learn how with our step-by-step guide.

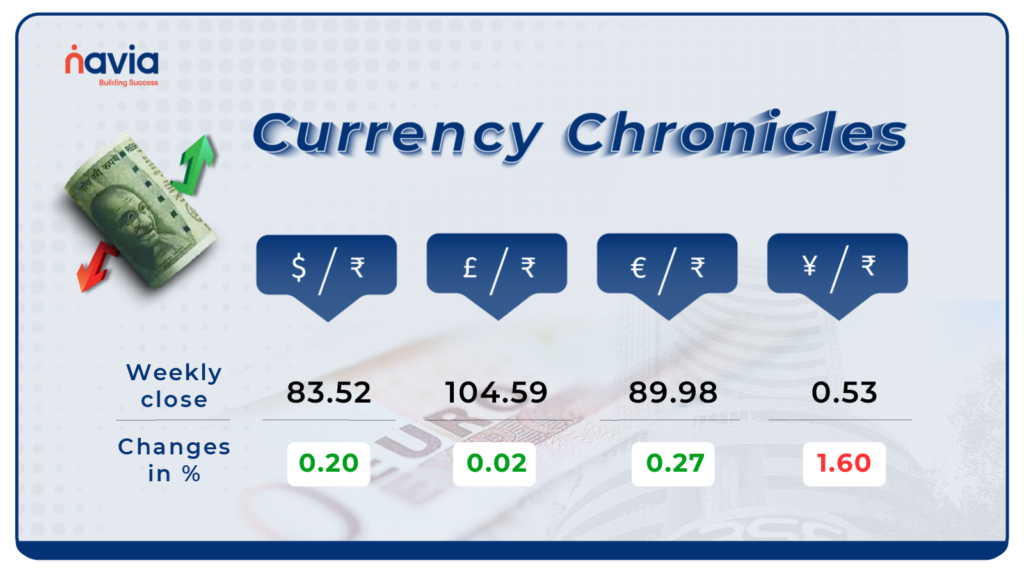

Currency Chronicles

USD/INR:

The rupee closed at 83.52 against the U.S. dollar, showing minimal change from its previous close. Despite this stability, the local currency experienced a slight decline of nearly 0.20% week-on-week, reflecting ongoing fluctuations in the forex market.

EUR/INR:

Throughout the week, the EUR to INR exchange rate saw a moderate increase of 0.27%. Bullish sentiment prevails in the EUR/INR market, indicating positive expectations among traders and investors. As of the latest analysis, the EUR to INR rate reached ₹ 89.98 by the end of the week.

JPY/INR:

In contrast, the JPY to INR exchange rate experienced a notable decrease of -1.60% for the week. Despite this decline, bullish sentiment persists in the JPY/INR market, reflecting confidence among market participants. At this moment, the JPY to INR rate reached ₹ 0.536406 by the end of the week.

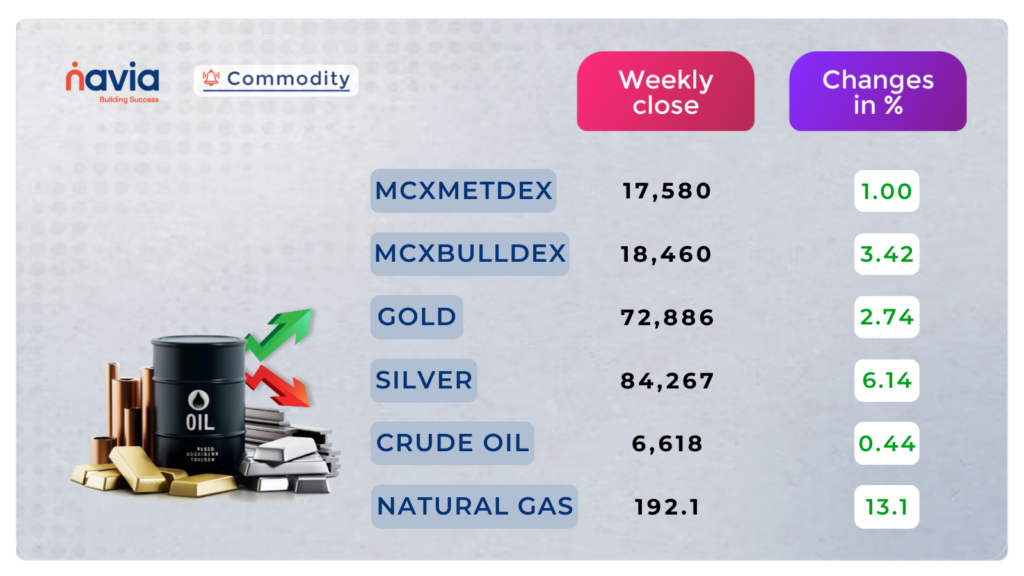

Commodity Corner

Crude oil maintained a positive stance, closing up by 0.44%. This uptick can be attributed to a prevailing risk-on sentiment across markets. Notably, robust Chinese crude oil imports signal increasing demand, further bolstering market optimism. As we navigate the current landscape, keep an eye on key support and resistance levels. The resistance level R1 stands at 6847, while the support level S1 is positioned at 6385.

Gold witnessed a notable surge in the last session, closing with a 2.74% gain. This upward momentum is expected to persist, fueled by several factors. Foremost among them is the anticipation of Federal Reserve rate cuts, prompted by a surge in initial jobless claims reaching a nine-month high. Investors are closely monitoring developments, with key support and resistance levels serving as crucial indicators. Currently, the support level S1 is at 72206, while S2 rests at 71079.

Blogs of the Week!

Gold Bars or Gold ETFs: which one to go for this Akshaya Tritiya?

Gold Bars or Gold ETFs? Discover the smartest Akshaya Tritiya investment through our latest blog packed with expert insights!

Unlocking Hidden Riches: The FCF story!

Discover how FCF reveals the true financial health of companies and empowers smart investment decisions. Don’t miss out on this insightful read!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

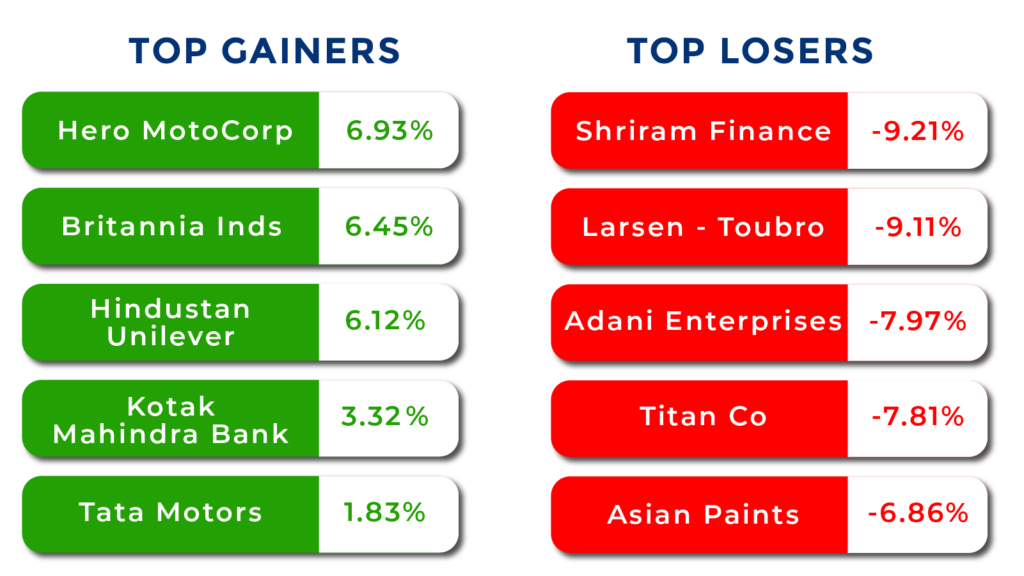

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?