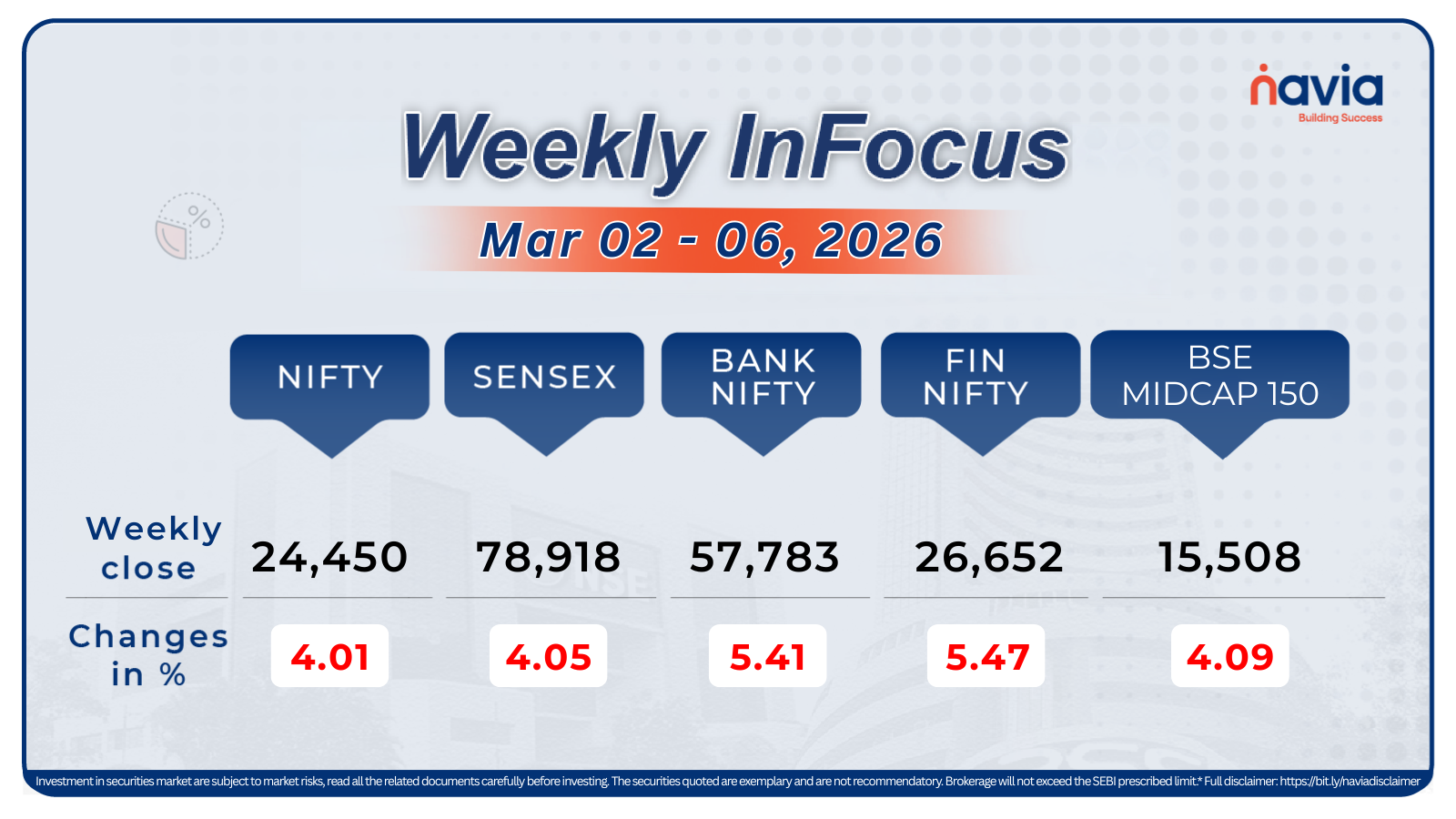

Navia Weekly Roundup ( Mar 17 – 21, 2025)

Week in the Review

Indian indices erased previous week losses and posted best weekly gain in more than 4 years, as both the main indices rise over 4 percent led by positive cues including sustained buying from domestic investors, reduced selling from foreign institutions, and appreciation in rupee.

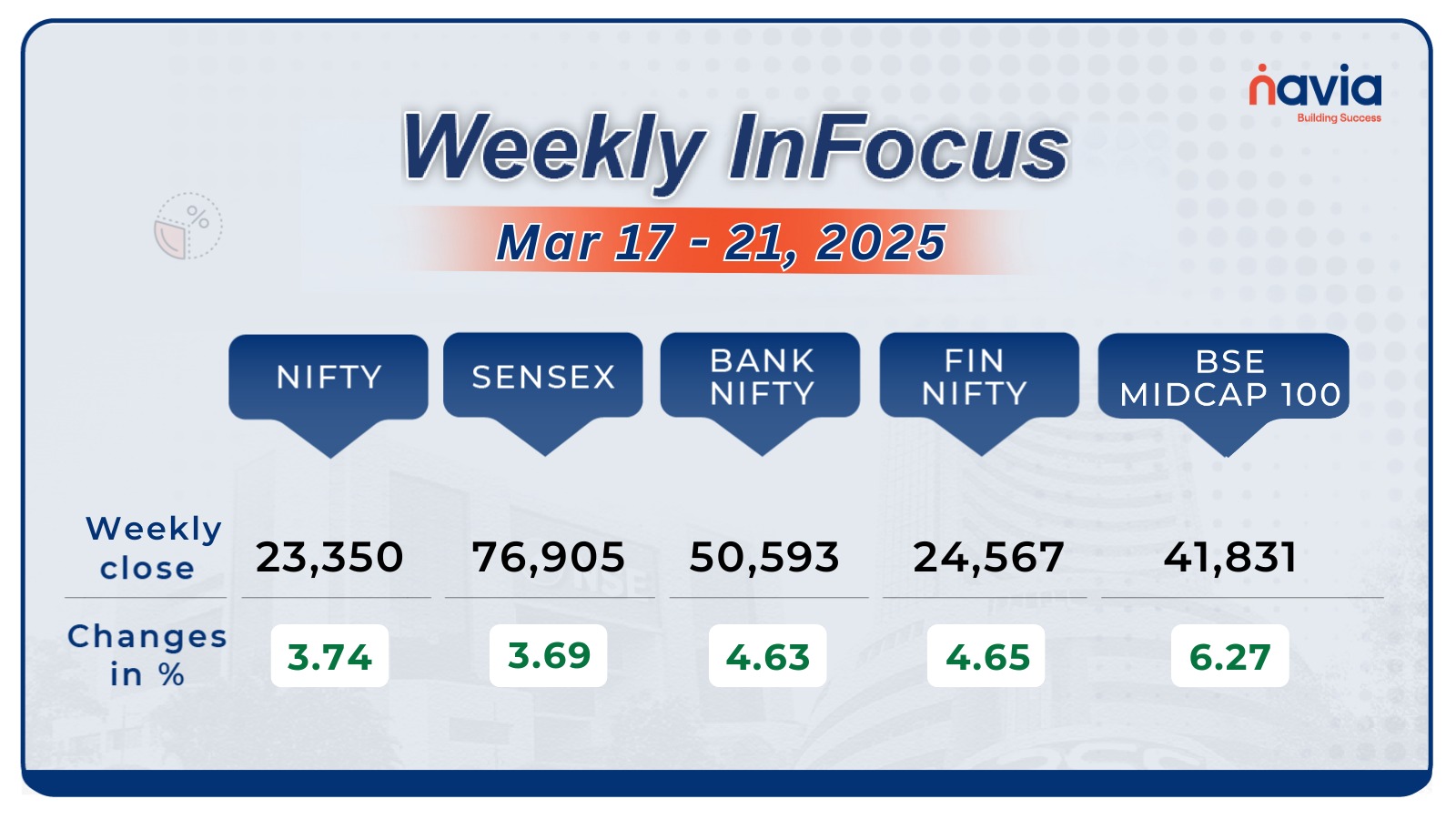

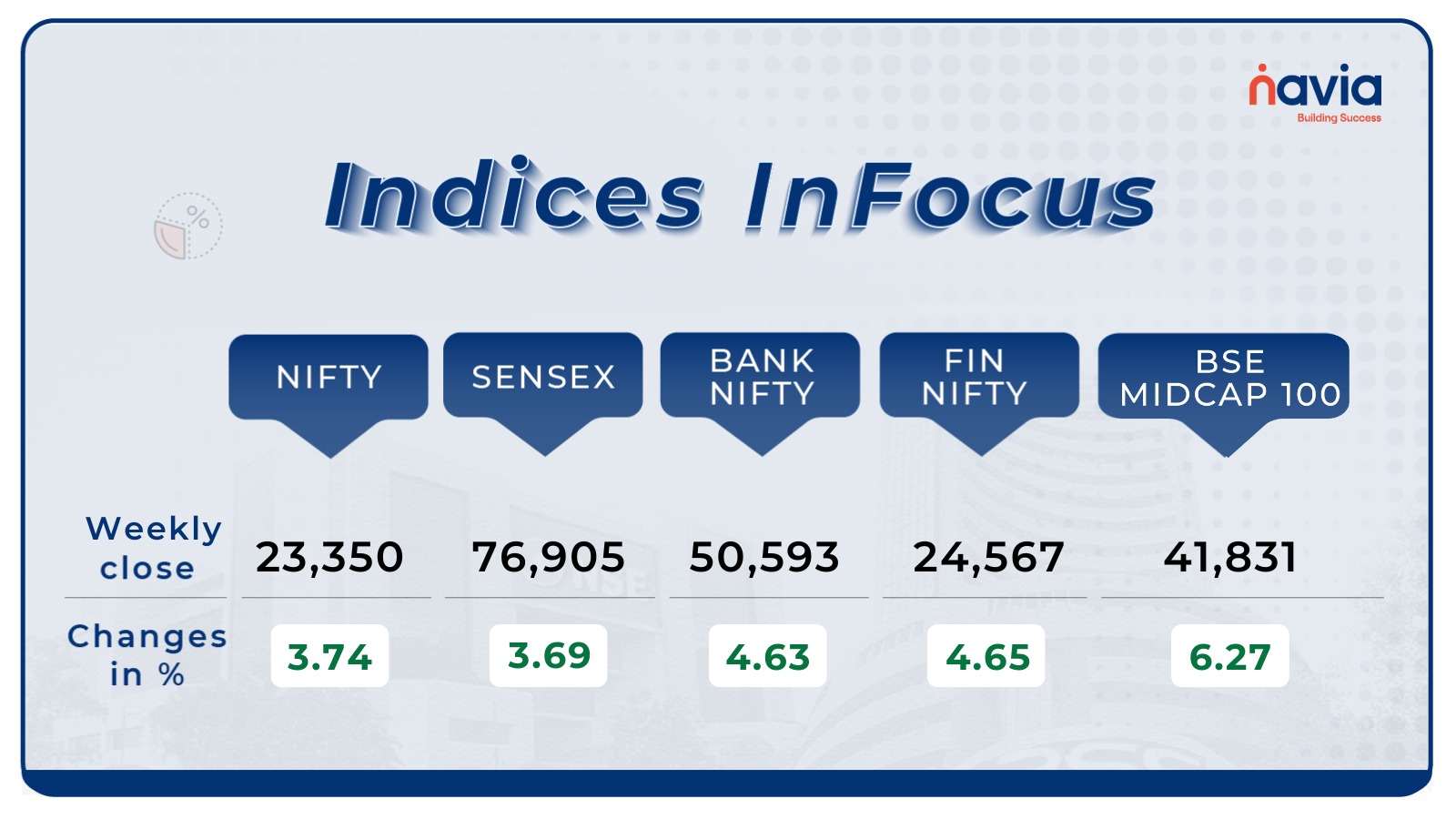

Indices Analysis

For the week, the BSE Sensex index rose 3,076.6 points or 3.69 percent to end at 76,905.51, and Nifty50 added 953.2 points or 3.74 percent to finish at 23,350.40.

The BSE Small-cap index surged nearly 8 percent with SML Isuzu, IKIO Lighting, Uttam Sugar Mills, Balu Forge Industries, Sindhu Trade Links, KSolves India, Garden Reach Shipbuilders & Engineers, Valor Estate, Indraprastha Medical Corporation, Summit Securities, Marathon Nextgen Realty, Talbros Automotive Components, Indian Hume Pipe Company, Nuvama Wealth Management adding between 25-50 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

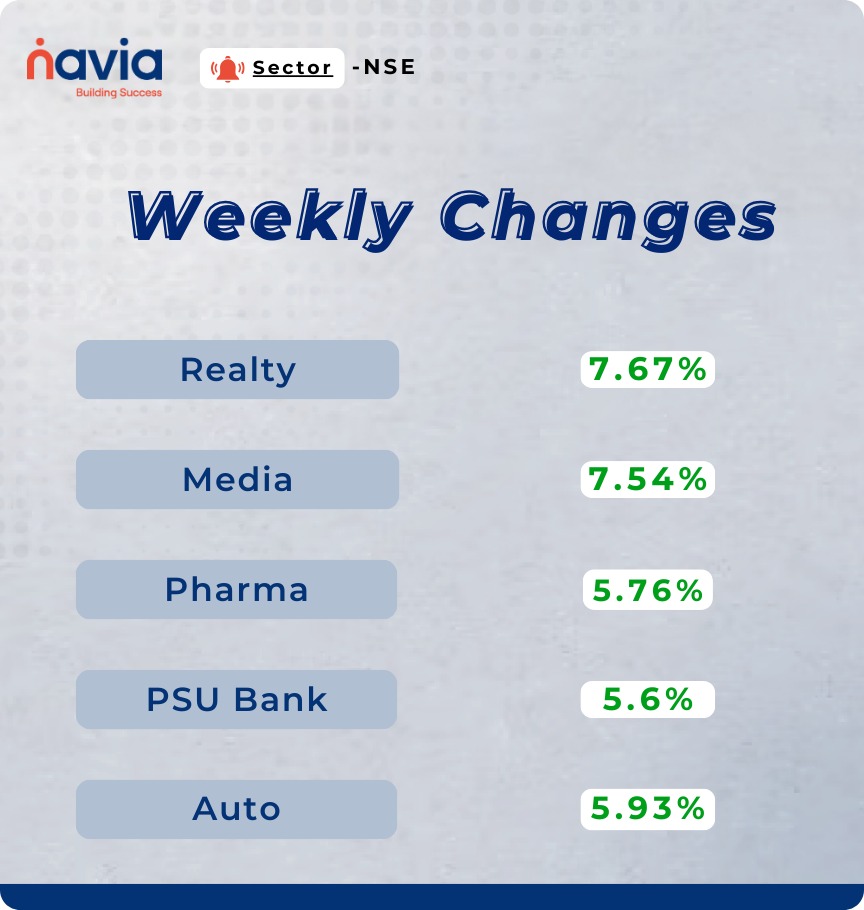

Sector Spotlight

All the sectoral indices ended higher with Nifty Realty and Media added nearly 8 percent each, Nifty Pharma and PSU Bank indices up 5.5 percent each, Nifty Auto index rose 5.9 percent.

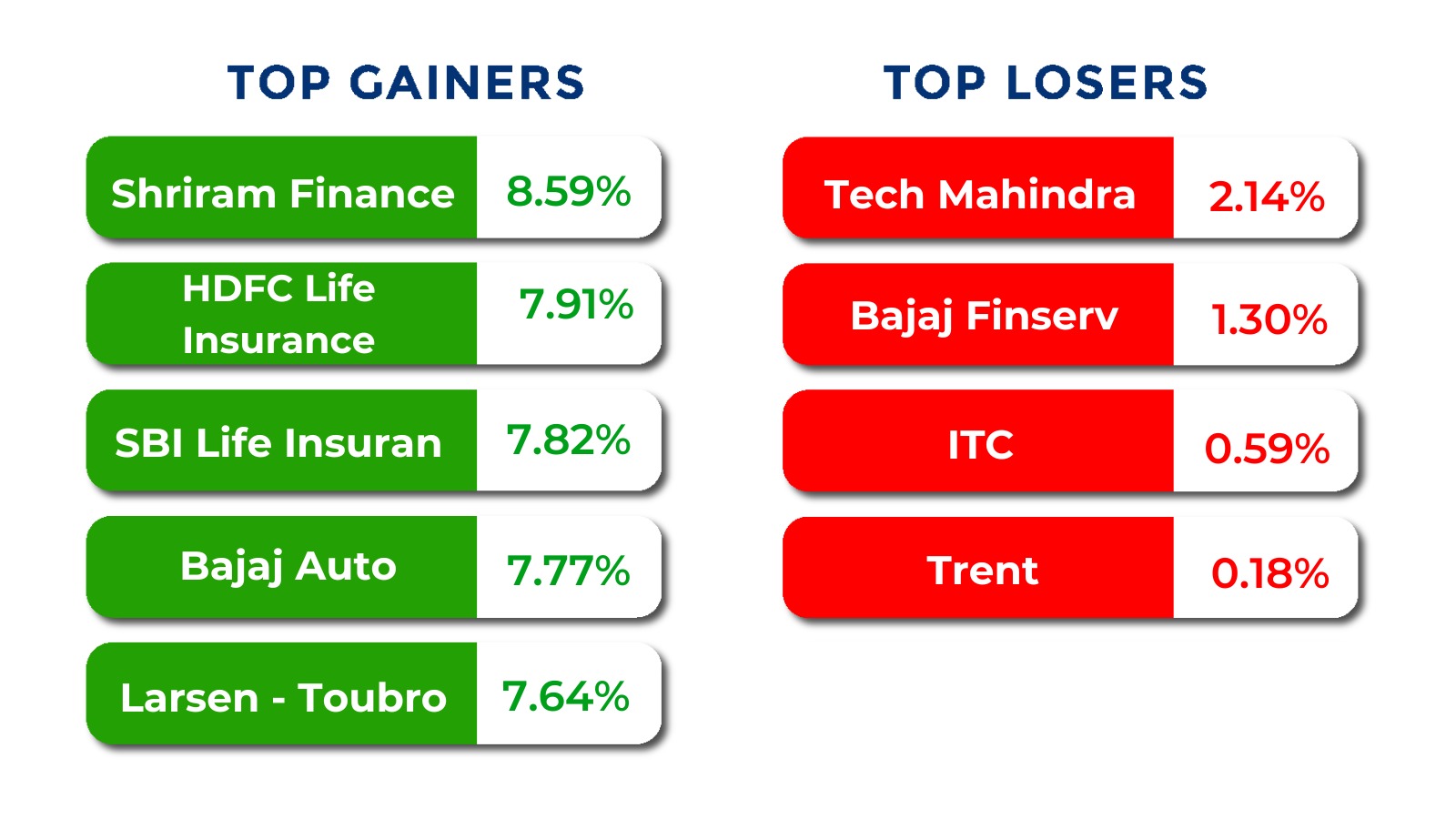

Top Gainers and Losers

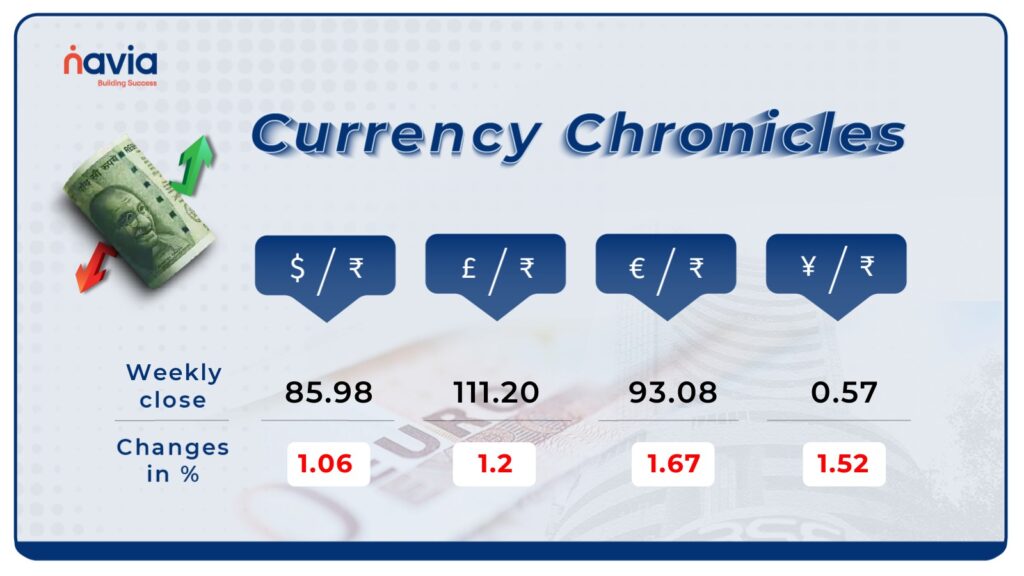

Currency Chronicles

USD/INR:

The Indian rupee recorded its best weekly performance in over two years, driven by a declining dollar index. During the week, it appreciated by 103 paise to close at ₹85.97 per dollar on March 21, compared to ₹87 on March 13.

EUR/INR:

The euro weakened against the Indian rupee, declining by 1.67% to settle at ₹93.08. Currently, the sentiment in the EUR/INR market remains neutral.

JPY/INR:

The Japanese yen declined by 1.52% to close at ₹0.57 against the Indian rupee. Currently, the sentiment in the JPY/INR market remains bearish.

Stay tuned for more currency insights next week!

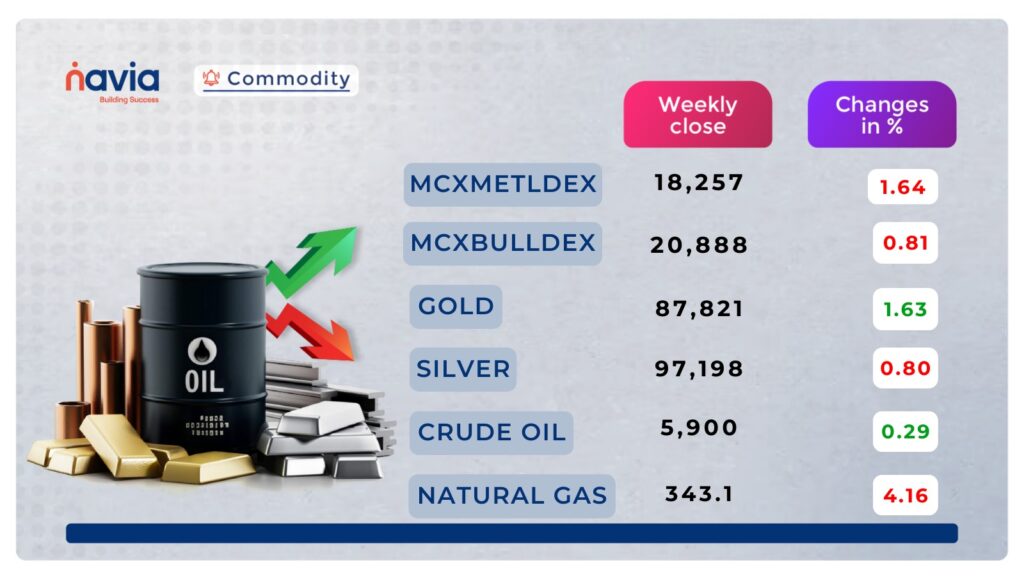

Commodity Corner

Crude oil is trading in a consolidation pattern on the 30-minute chart, moving within the range of resistance at 5,938 and support at 5,769. A descending wedge is also visible on the chart. The last session closed at 5,900, up by 76 points. Crude oil could face additional resistance from the descending trendline around the 5,900 range. Further momentum is expected above 5,900 for an upside move or below 5,871 for a downside move.

Gold has been trading in an ascending channel on the 4-hour chart. In the last session, it opened at a new all-time high and closed at 87,821, up by 104 points, trading near its record level. If gold sustains above 87,300, further positive momentum is expected. The support zone lies between 86,000–85,800, and a breakdown below this range could lead to weakness. The resistance is placed at the 90,000–90,200 range. Intraday movement is expected above 88,850 for an upside move or below 87,300 for a downside move.

Natural gas has been consolidating over the last few days, closing the previous session on a negative note, down by 17.1 points at 343.1. Further momentum can be expected above 352.2 for an upside move or below 344 for a downside move. The resistance of the consolidation pattern is placed around the 365 range, while support is positioned near 344.5.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blog of the Week!

Mastering the Stochastic RSI Crossover: A Guide for New Traders

The Stochastic RSI is a powerful tool that helps traders identify potential buying or selling opportunities by combining the Stochastic Oscillator and RSI. Key crossover signals—bullish below 20% and bearish above 80%—indicate market reversals, guiding traders in making informed decisions for entry and exit points.

Using Short-Term Capital Losses to Reduce Long-Term Capital Gains Tax

By using short-term capital losses (STCL) to offset long-term capital gains (LTCG), investors can reduce their tax liability and enhance post-tax returns. Any unadjusted losses can be carried forward for up to 8 years to offset future gains, optimizing tax savings over time.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?