Navia Weekly Roundup (June 30 – July 04, 2025)

Week in the Review

The Indian benchmark indices snapped two-week gaining streak in the volatile week ended on July 4 as investors remained cautious ahead of the impending US tariff deadline.

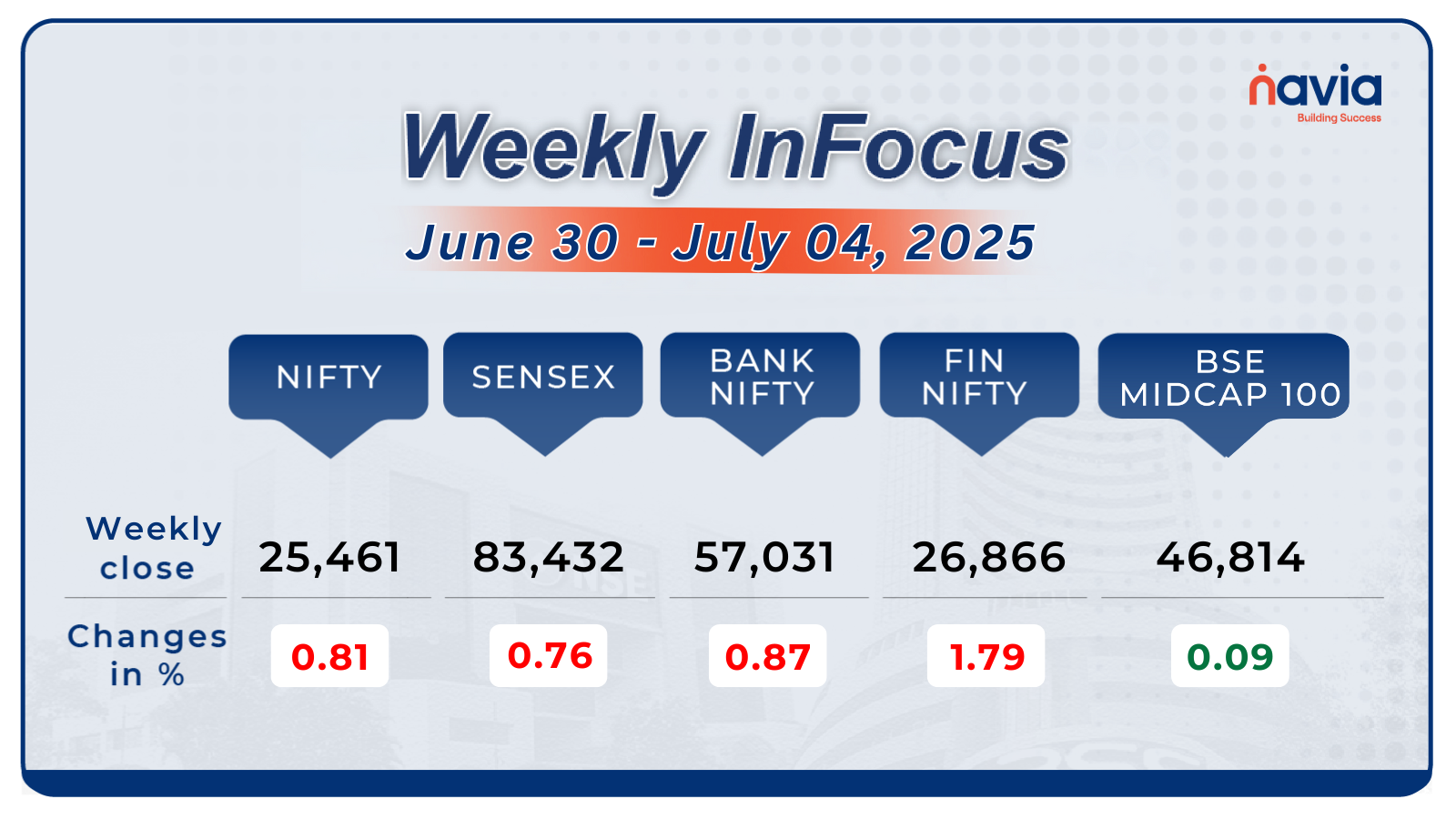

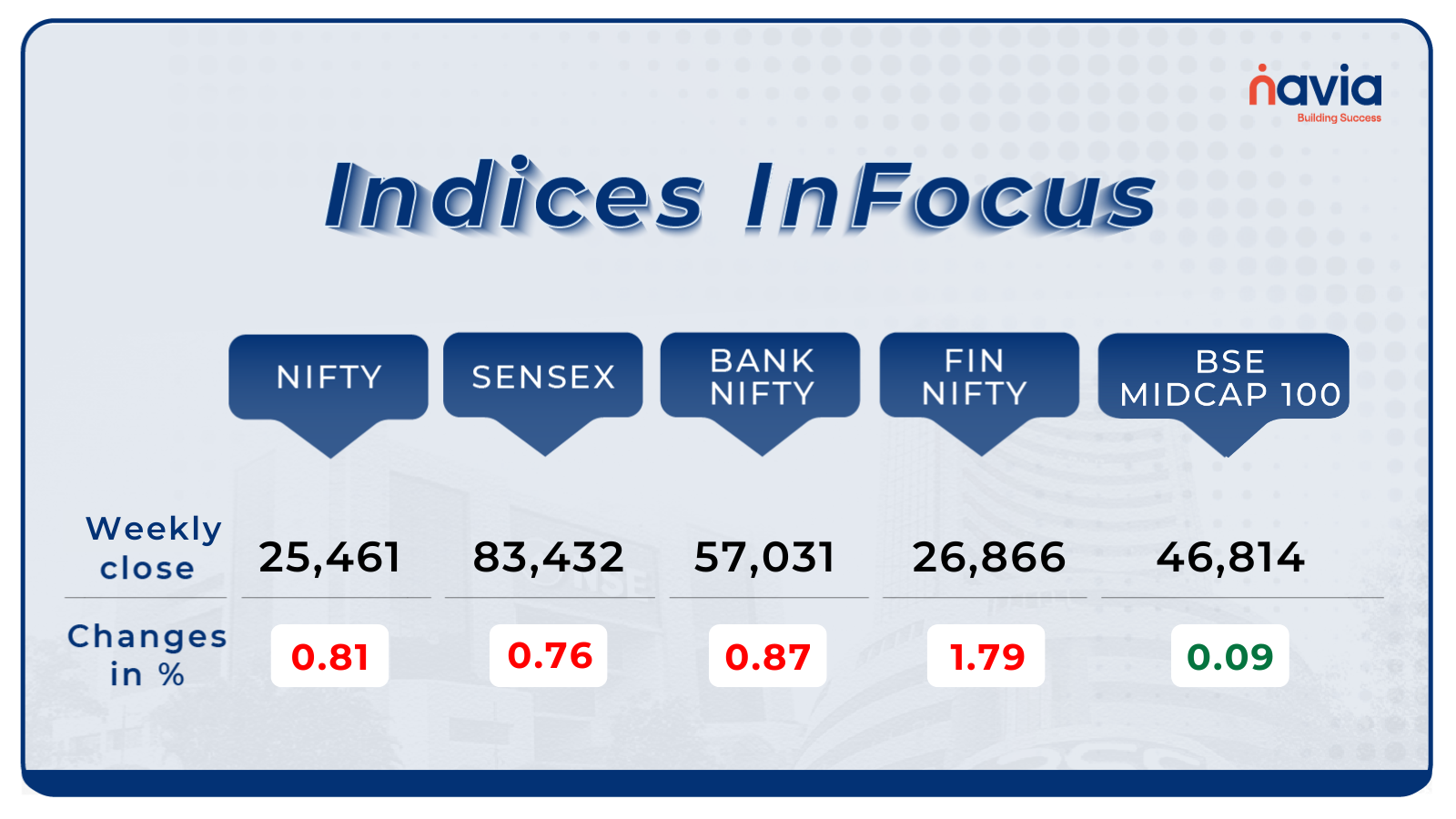

Indices Analysis

For the week, the BSE Sensex index shed 0.76 percent to close at 83,432, and Nifty50 fell 0.81 percent to end at 25,461.

The BSE Small-cap index rose 1 percent with Gabriel India, Sindhu Trade Links, PC Jeweller, SML Isuzu, Nacl Industries, Heranba Industries, Prime Focus, Signpost India rising 20-42 percent. On the other hand, Sadhana Nitrochem, Sigachi Industries, Dreamfolks Services, Nuvama Wealth Management, Sammaan Capital, Jindal Worldwide, Narayana Hrudayalaya fell between 11-22 percent.

BSE Mid-cap Index added 0.6 percent supported led by Laurus Labs, Relaxo Footwears, IDFC First Bank, Kalyan Jewellers India, Biocon, Glenmark Pharma, Ipca Laboratories, Ajanta Pharma, Endurance Technologies, GMR Airports, Aurobindo Pharma, Balkrishna Industries. However, losers included Coromandel International, Brainbees Solutions, Godrej Industries, Go Digit General Insurance, FSN E-Commerce Ventures (Nykaa).

The BSE Large-cap Index shed 0.6 percent. Losers included Trent, SBI Cards & Payment Services, Cholamandalam Investment and Finance Company, Hyundai Motor India, Swiggy, United Spirits. However, gainers were Bosch, Mankind Pharma, Punjab National Bank, Indian Overseas Bank, Bharat Petroleum Corporation, Divis Laboratories, Siemens.

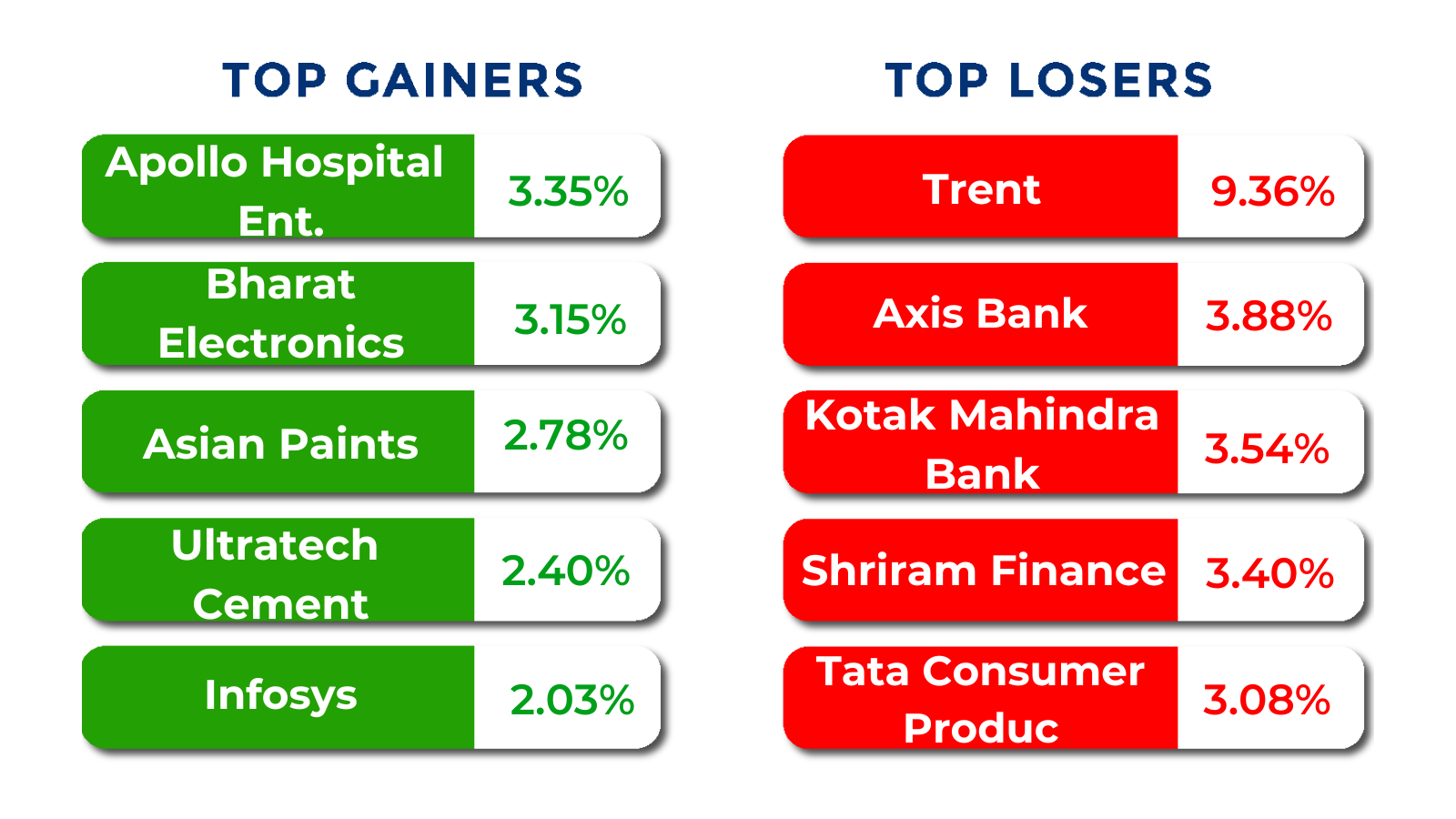

During the week, Trent lost the most in terms of market value, followed by HDFC Bank, Kotak Mahindra Bank, Axis Bank. On the other hand, Reliance Industries, Infosys, Bharat Electronics added the most of their market-cap.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

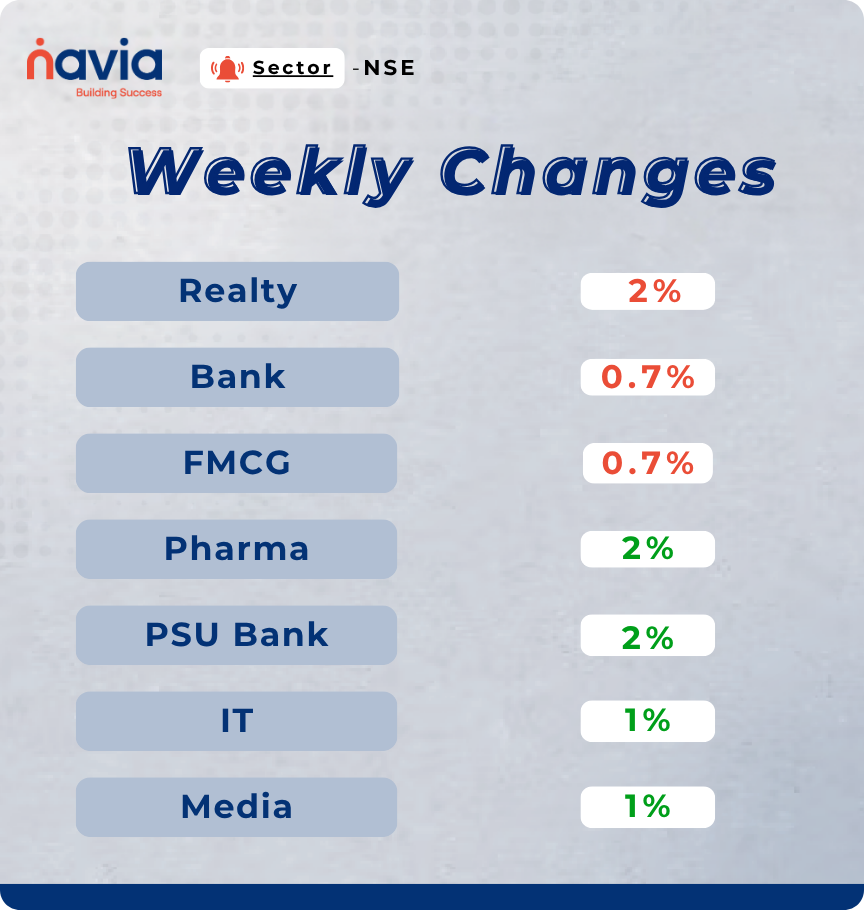

Sector Spotlight

On the sectoral, Nifty Realty index shed 2 percent, Nifty Bank index shed 0.7 percent, Nifty FMCG index fell 0.7 percent, while Nifty Pharma, Nifty PSU Bank indices added 2 percent each, Nifty IT and Media indices jumped nearly 1 percent each.

Top Gainers and Losers

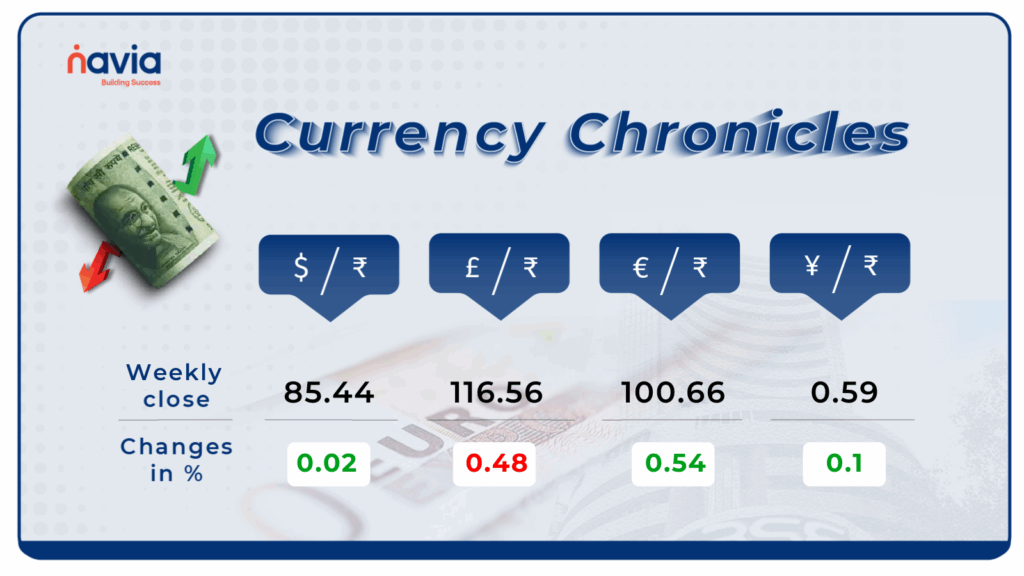

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.44 per dollar, gaining 0.02% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹100.66 per euro, gaining 0.54% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining 0.1% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

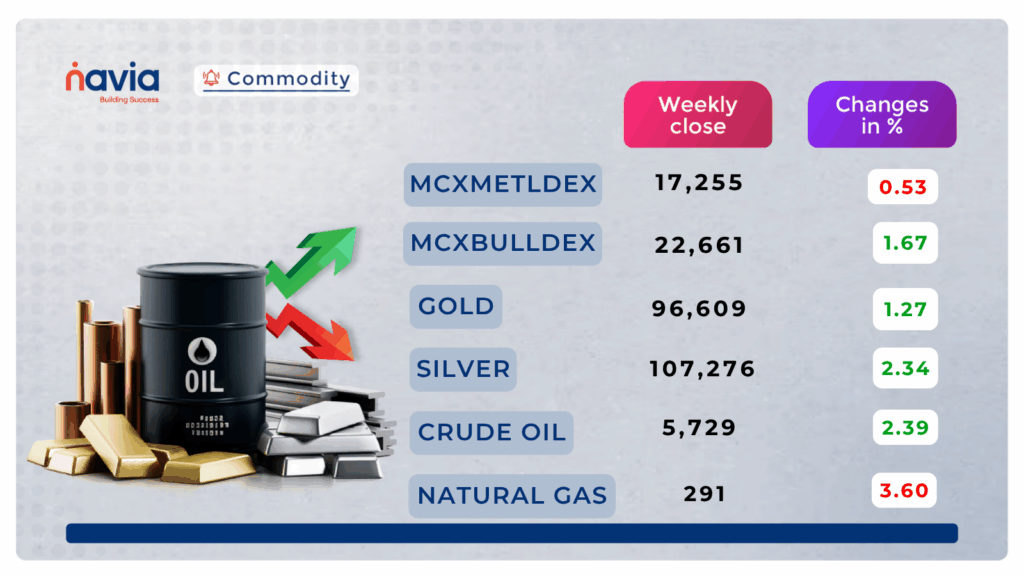

Commodity Corner

Crude Oil closed at 5729, currently trading in a broken descending channel on the 5-minute chart. Sustaining above 5800 may confirm bullish momentum, while support lies near 5700. A break below this level could trigger fresh selling pressure.

In the last session, Gold closed at 96609. Gold is trading in an Broken Descending channel in the 45 minute time frame as shown in the chart. Sustaining above 98000 could be good for Gold. A sustained move above this range could lead to further upside in Gold. For intraday traders, a move above 97000 may indicate upside potential, while a dip below 96500 could trigger further downside pressure.

Natural Gas is currently trading in a Ascending channel showing a uptrend. The last session closed at 291. Another intraday move is likely above 296. However, a close below 289 could signal further downside in prices. Sustaining above 330 on a broader timeframe could lead to short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Introducing MITRA: Helping You Find Forgotten Mutual Fund Investments!

SEBI’s new platform MITRA helps investors trace and reclaim inactive mutual fund investments over 10 years old. It’s free, secure, and easy to use. Don’t let your money sit idle — check MITRA today!

Digital Safety First: Mobile Security Tips Every Investor Must Know!

This blog offers essential mobile security tips tailored for investors who manage their finances digitally. It highlights five key practices—using trusted app stores, installing antivirus tools, avoiding public Wi-Fi, enabling device encryption, and not rooting phones—to protect sensitive investment data.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER:Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.