Navia Weekly Roundup (JUNE 24 – JUNE 28, 2024)

Week in the Review

Indian markets continued to rise in the week ending June 30, with benchmark indices reaching new lifetime highs. This growth was primarily driven by sustained buying from Foreign Institutional Investors (FIIs), mixed global market conditions, the steady progress of the monsoon, and the Reserve Bank of India (RBI) governor’s confidence in achieving 7.2 percent growth in the current financial year.

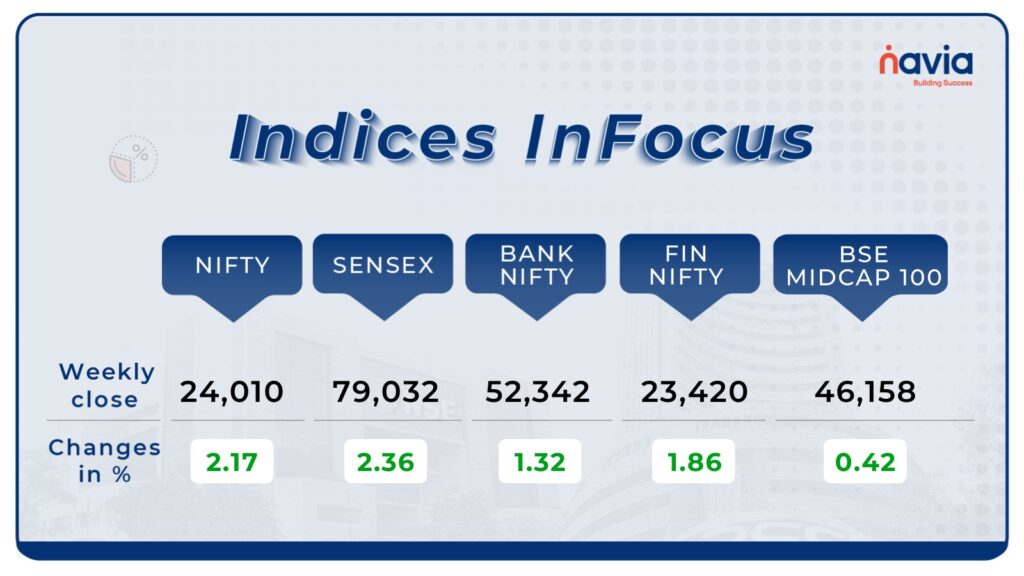

Indices Analysis

In this week, BSE Sensex gained 2.36 percent to finish at 79,032 while Nifty50 index added 2.16 percent to end at 24,010.60. On June 28, BSE Sensex and Nifty50 touched record high of 79,671.58 and 24,174, respectively.

Interactive Zone!

Last week’s poll:

Q) Which of these derivatives are not exchanged on the Indian stock markets?

a) Forward rate agreements.

b) Stock futures.

c) Futures based on indices.

d)Options for indexing

Last week’s poll Answer: a) Forward rate agreements.

Poll for the week: Which of the below statements about mutual funds in India is correct?.

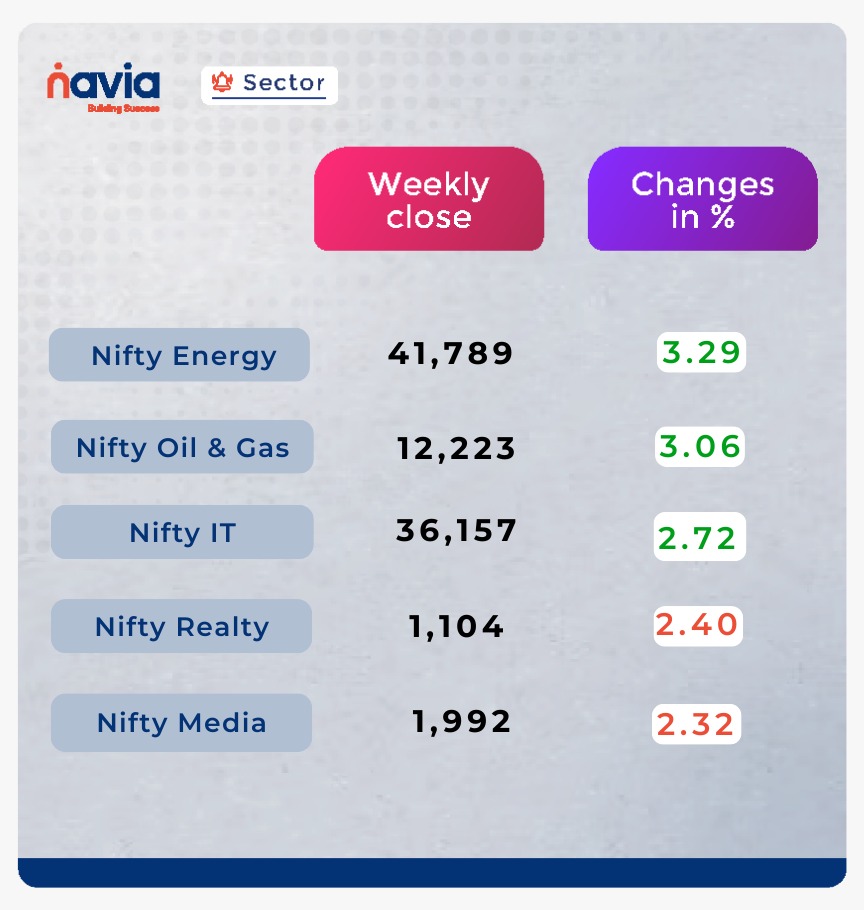

Sector Spotlight

Among sectors, Nifty Energy index rose 3.3 percent, Nifty Oil & Gas index added 3 percent, Nifty Information Technology index was up 2.7 percent. However, Nifty Realty index shed 2.4 percent, Nifty Media index slipped 2.3 percent

Explore Our Features!

Customize and monitor your favorite stocks effortlessly. Ready to take control of your stock portfolio? Watch our quick tutorial on how to seamlessly add stocks to your Navia App watchlist.

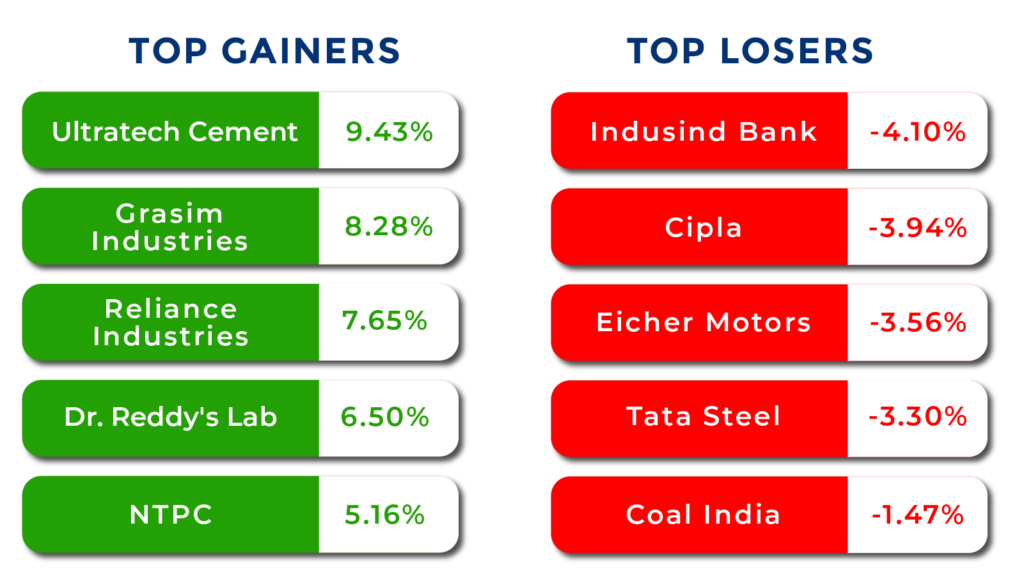

Top Gainers and Losers

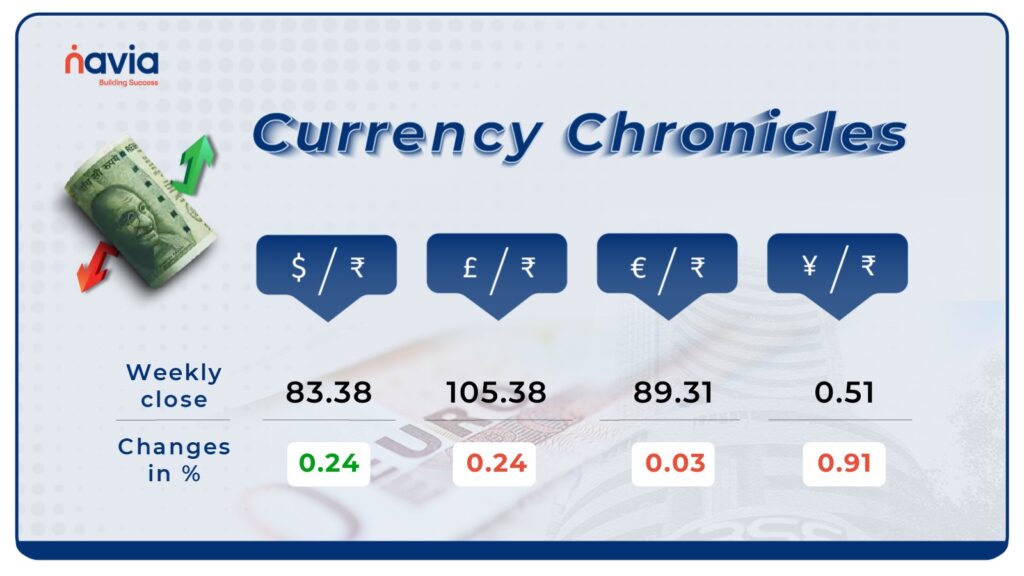

Currency Chronicles

USD/INR:

The Indian rupee strengthened against the US dollar, closing 16 paise higher at 83.38 on June 28, compared to its June 21 closing of 83.54. This gain highlights a positive week for the domestic currency.

EUR/INR:

The EUR to INR exchange rate decreased by 0.11% over the week. Despite this slight drop, bullish sentiment persists in the EUR/INR market, reflecting optimism among traders and investors. By the end of the week, the EUR to INR rate stood at ₹89.34.

JPY/INR:

The JPY to INR exchange rate fell by 1.47% for the week. Nevertheless, bullish sentiment continues to dominate the JPY/INR market, indicating ongoing confidence in the Japanese yen. By the week’s end, the JPY to INR rate reached ₹0.55.

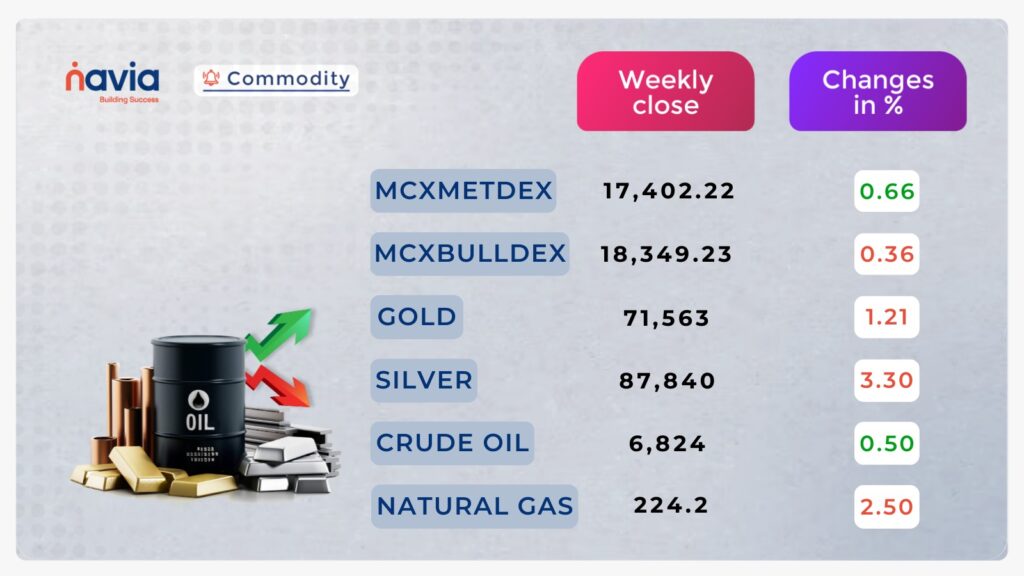

Commodity Corner

Currently, gold is experiencing strong selling pressure,currently, exprice bouce back from lower level and it closed -1.21% negative in the previous week. The current R1 is placed at 72055 and S1 is placed at 70,825

Slow demand from the world’s top oil consumer is offsetting declines, although worries about a potential expansion of the Gaza war disrupting Middle East supplies are giving negative momentum. The current R1 is placed at 6917and S1 is placed at 6777.

US weather forecasts shifted cooler, which will reduce natural gas demand from electricity providers to power air-conditioning. As a result, Natural Gas is currently experiencing negative momentum. The current R1 is placed at 236 and S1 is placed at 216.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

What are the best indicators for Intraday Trading?

Discover the top indicators for successful intraday trading. Learn how to decode market data and improve your trading skills with our latest blog.

The Psychology of Investing: Hope, Fear, and Rational Decision-Making

Explore Maya’s journey with a tech IPO and the psychological challenges of investing. Read our blog to discover how hope, fear, and rational decisions shape investment choices.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?