Navia Weekly Roundup (June 23 – 27, 2025)

Week in the Review

The Indian equity indices extended the gains in the second consecutive week ended June 27 after moderation in crude oil prices amid ease in geopolitical tensions in the Middle East, persistent FII buying, favourable monsoon forecast and ease in trade tensions ahead of the deadline.

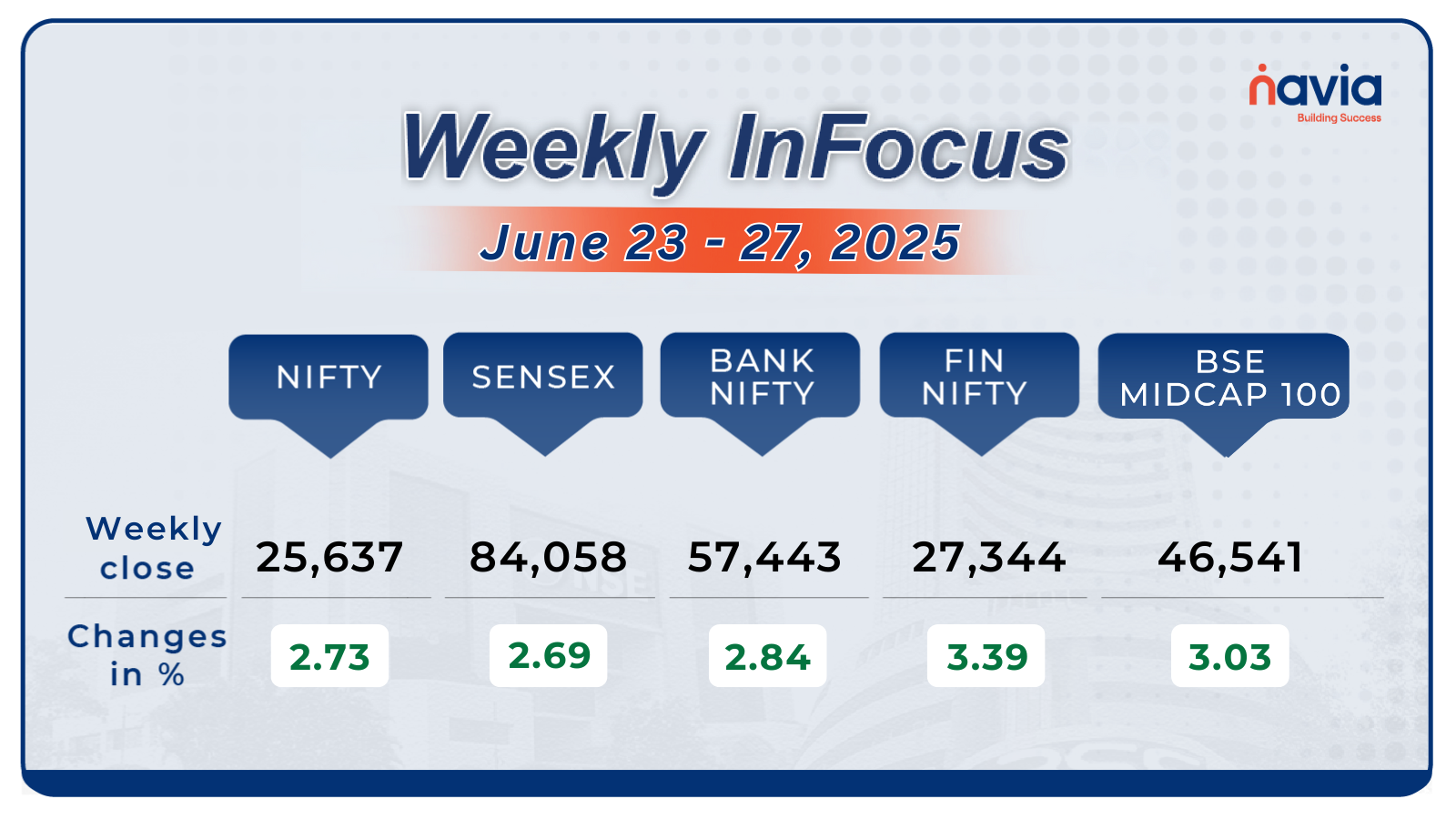

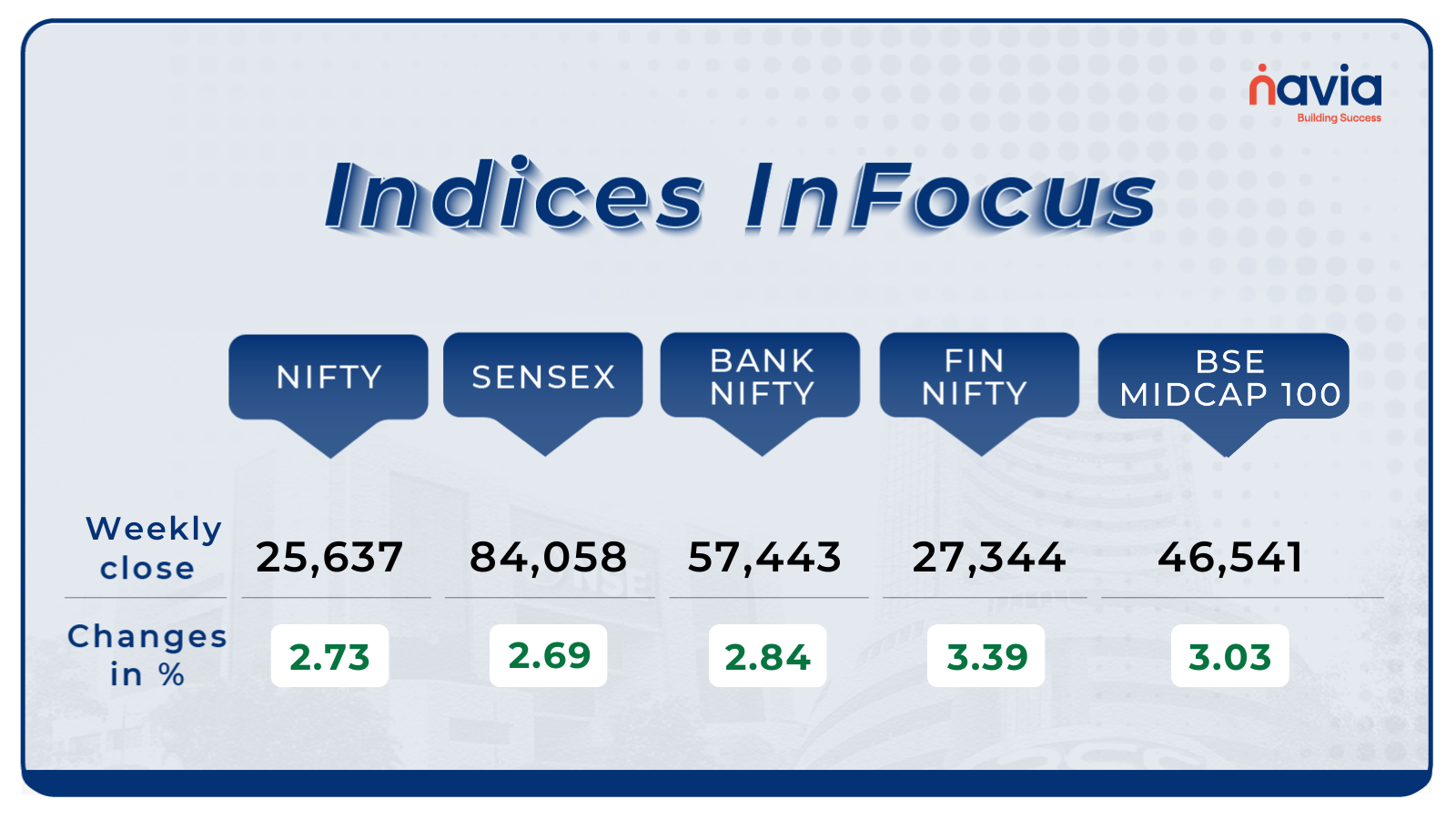

Indices Analysis

For the week, the BSE Sensex index rose 2.69 percent to end at 84,058.90, and Nifty50 added 2.73 percent to close at 25,637.80.

The BSE Large-cap Index jumped more than 2 percent led by IDBI Bank, Adani Total Gas, Jio Financial Services, Adani Power, Hyundai Motor India, Berger Paints India, Polycab India, Adani Enterprises.

BSE Mid-cap Index gained more than 2 percent supported by Brainbees Solutions, Hindustan Petroleum Corporation, Abbott India, Bayer CropScience, Page Industries, Punjab and Sind Bank. However, losers were KPIT Technologies, Godrej Industries, Oil India, Ola Electric Mobility, Oracle Financial Services Software, PB Fintech.

The BSE Small-cap index surged 3.5 percent with Kirloskar Brothers, Balaji Amines, Astec Lifesciences, Steel Exchange India, Mukand, Bajel Projects, Bajaj Consumer Care, Nuvama Wealth Management rising more than 20 percent each. However, Sadhana Nitrochem, Infibeam Avenues, Timex Group India, Confidence Petroleum fell between 10-22 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

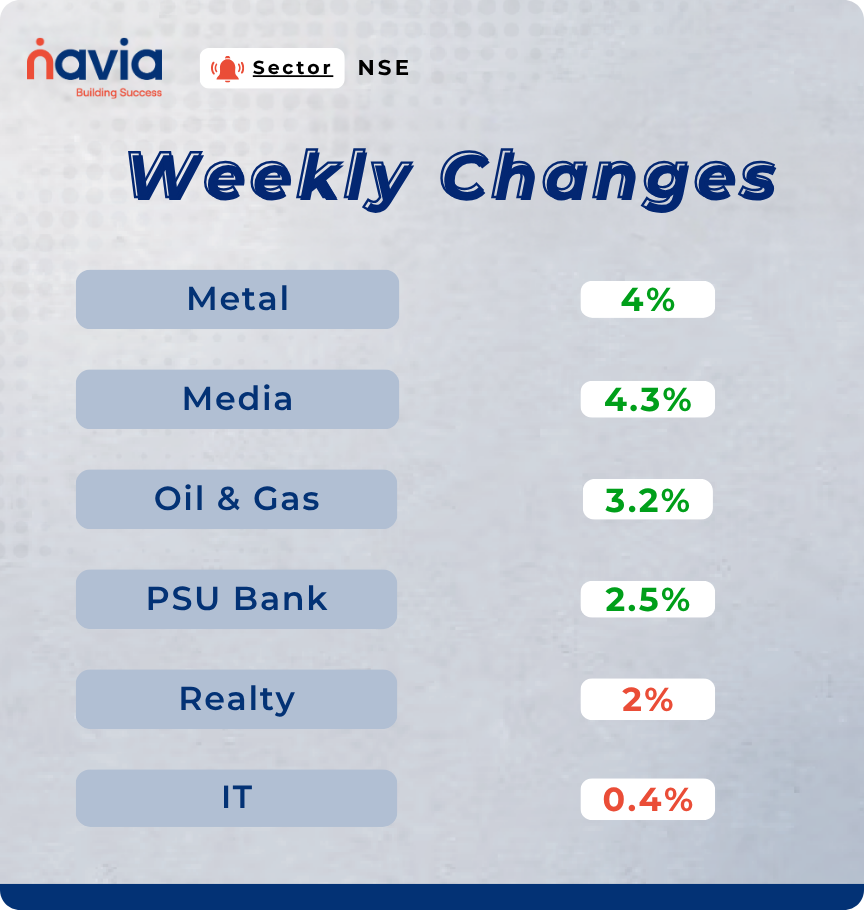

Sector Spotlight

On the sectoral, Nifty Metal index added nearly 4 percent, Nifty Media index rose 4.3 percent, Nifty Oil & Gas index gained 3.2 percent and Nifty PSU Bank index added 2.5 percent. However, Nifty Realty Index shed nearly 2 percent and Nifty Information Technology index shed 0.4 percent.

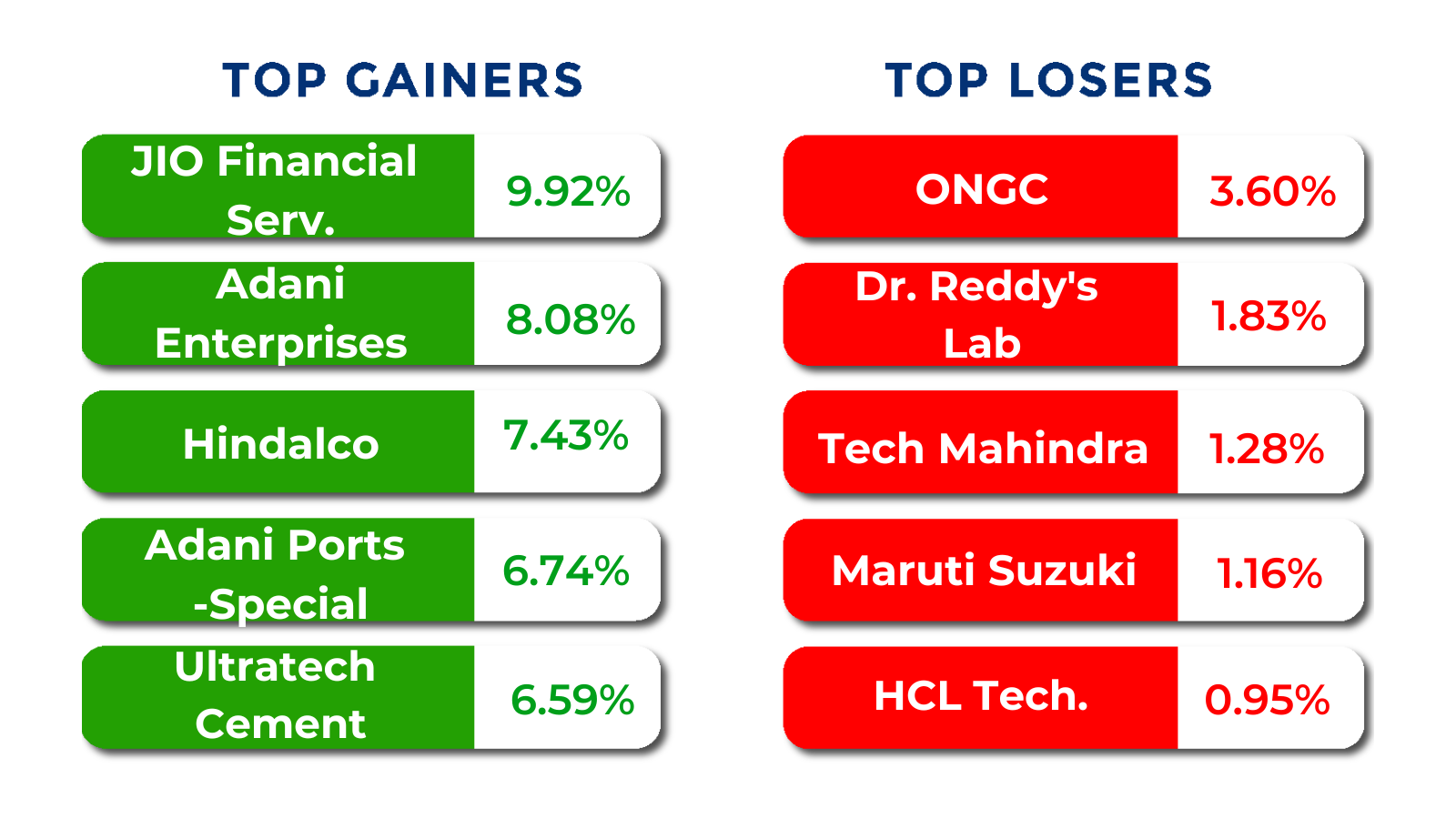

Top Gainers and Losers

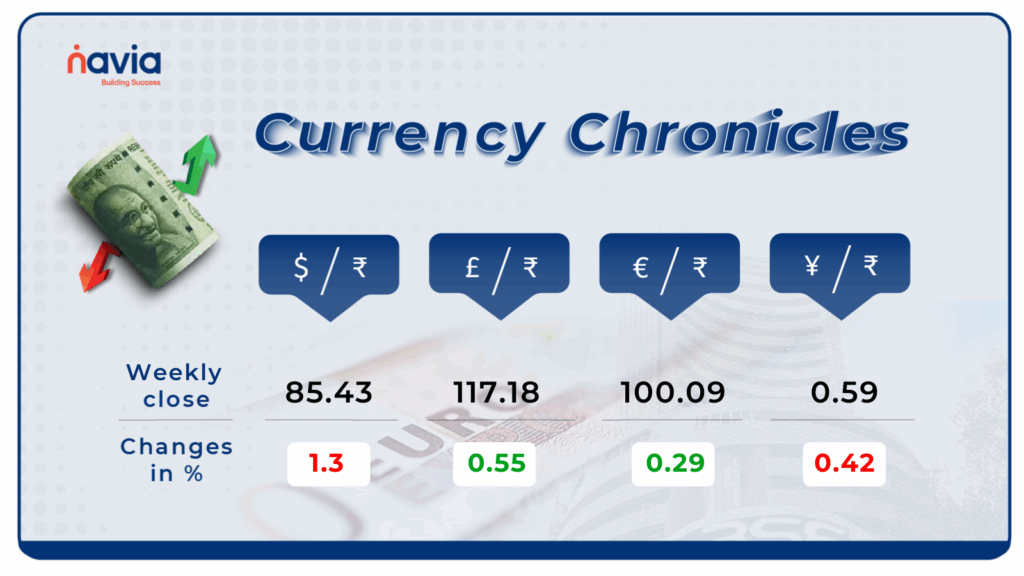

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.43 per dollar, losing 1.3% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹100.09 per euro, gaining 0.29% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, losing 0.42% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

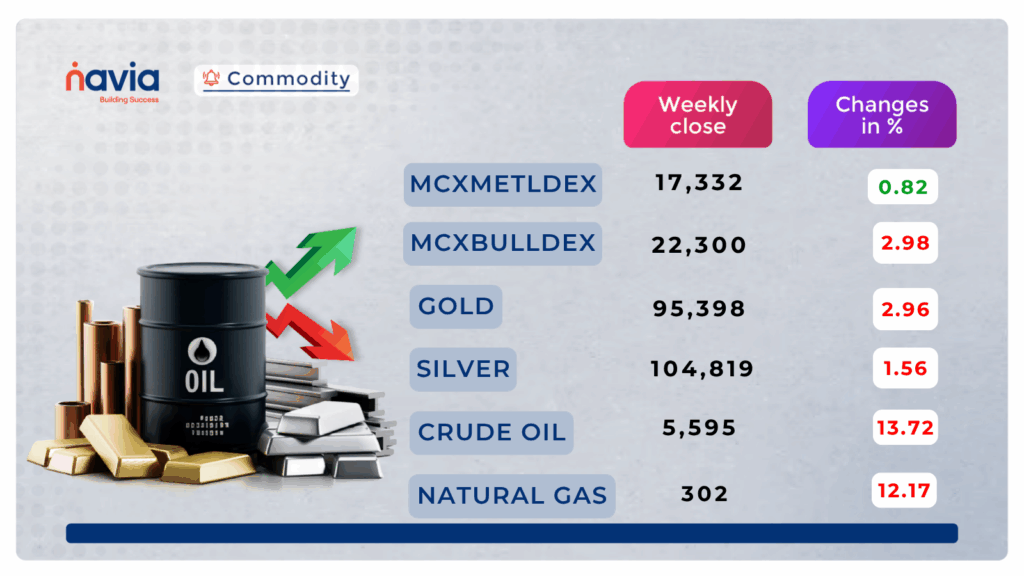

Commodity Corner

Crude Oil traded within a broken descending channel on the 5-minute chart. Last session closed at 5,595. Sustaining above 5,800 may support further upside, while immediate support lies at 5,400. Further intraday upside momentum is likely above 5655 while a breakdown below 5590 could trigger additional selling pressure.

In the last session, Gold closed at 95,398. Gold continues to move within an ascending channel. Sustaining above 98,000 may confirm further bullish momentum. A sustained move above this range could lead to further upside in Gold. For intraday traders, a move above 97550 may indicate upside potential, while a dip below 97000 could trigger further downside pressure.

Natural Gas is currently trading in a Ascending channel showing an uptrend. The last session closed at 302. Another intraday move is likely above 302. However, a close below 295 could signal further downside in prices. Sustaining above 330 on a broader timeframe could lead to short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Return is Easy, But What About Risk? A Simple Guide to Risk-Adjusted Returns (with a 7% Risk-Free Rate)

Not all high returns are created equal. This guide explains how the Sharpe Ratio helps investors compare different assets by accounting for the risk taken to earn returns — using a 7% risk-free benchmark. From stocks to mutual funds and even options, you’ll learn how to spot which investments offer better value per unit of risk, not just flashy numbers.

SEBI’s New Rules on Algo Trading for Retail Investors – What You Need to Know!

Starting August 1, 2025, SEBI is enforcing new guidelines to regulate algorithmic trading for retail investors. These rules ensure that only verified Algos, vendors, and platforms are used — while exchanges monitor activities and brokers are held accountable. Whether you build your own strategy or use a vendor’s tool, transparency, security, and regulatory oversight are now front and center.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.