Navia Weekly Roundup (JUNE 18 – JUNE 21, 2024)

Week in the Review (JUNE 18 – JUNE 21, 2024)

Market Hits Record High Amid Volatility; Banks Lead Performance

Indian market ended higher for the third straight week with benchmarks posting fresh all-time highs with extended buying from FIIs. However, the market witnessed high volatility amid weak progress of monsoon and mixed global markets.

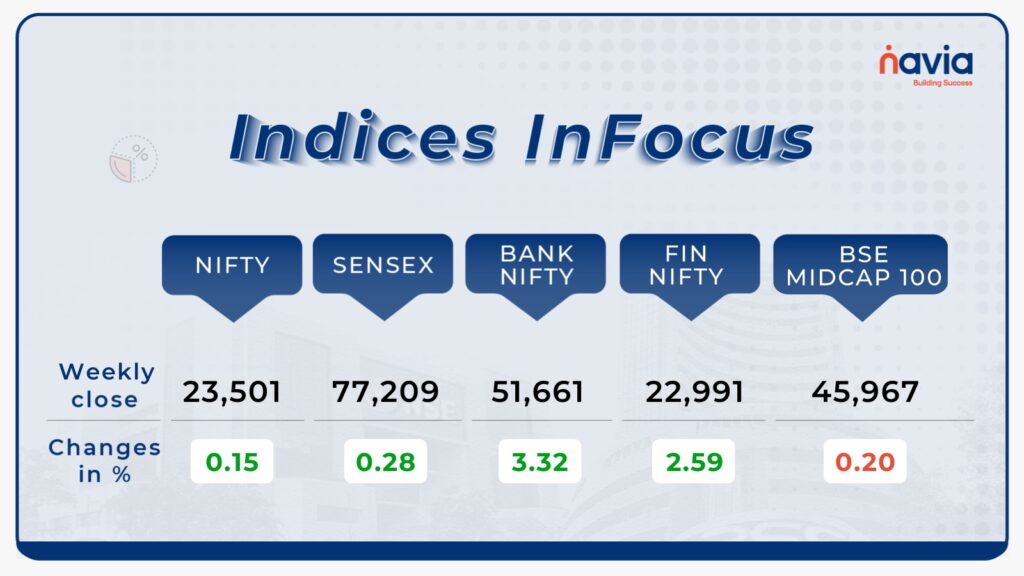

Indices Analysis

In this week, BSE Sensex added 0.28 percent to end at 77,209, while Nifty50 index rose 0.15 percent to close at 23,501. On June 19, BSE Sensex touched fresh record high of 77,851.63, while Nifty50 hits record high of 23,667.10 on June 21.

BSE Mid-cap Index ended on flat note. Gainers included Samvardhana Motherson International, Clean Science & Technology, IDFC First Bank, Bayer CropScience, JSW Energy, APL Apollo Tubes, Deepak Nitrite and Exide Industries, while losers were Linde India, Tube Investments of India, Zee Entertainment Enterprises, Torrent Power, Power Finance Corporation.

Interactive Zone!

Last week’s poll:

Q) India’s _ was the first digitized stock exchange

a) The National Stock Exchange (NSE).

b) The Bombay Stock Exchange (BSE).

c) Multi Commodity Exchange (MCX).

Last week’s poll Answer: b) The Bombay Stock Exchange (BSE).

Poll for the week: Which of these derivatives are not exchanged on the Indian stock markets?.

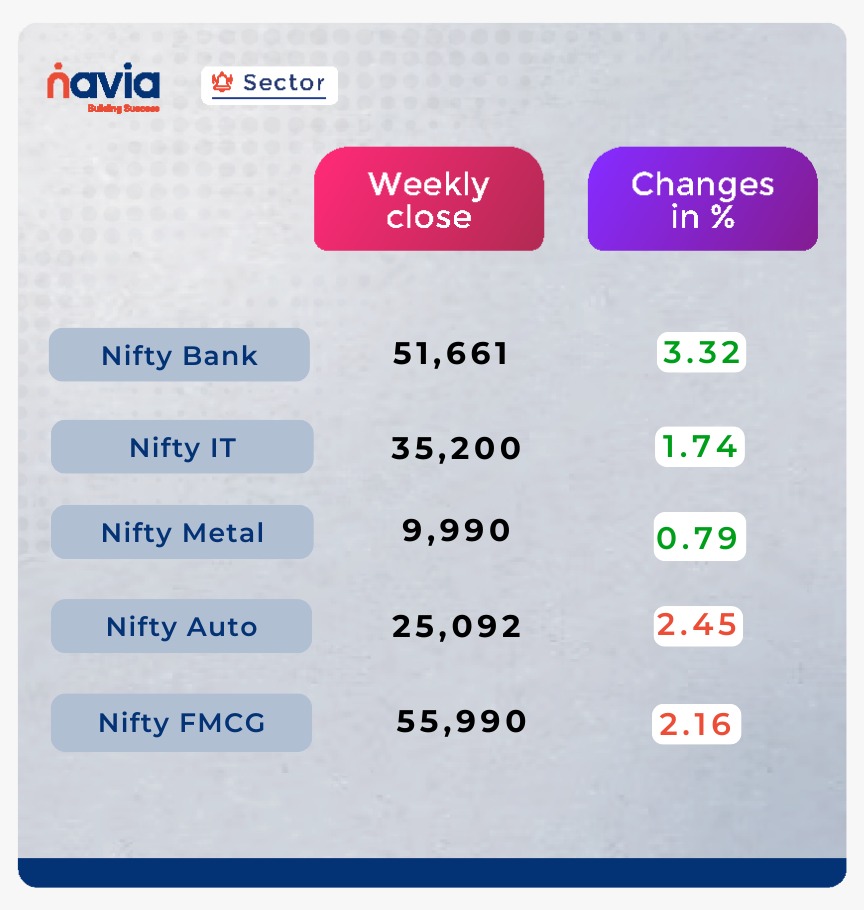

Sector Spotlight

Among sectors, Nifty Bank index gained more than 3.32 percent, Nifty Information Technology index up nearly 1.74 percent, and Nifty Metal index up 0.79 percent. However, Nifty Auto index slipped 2.45 percent, Nifty FMCG index shed 2.16 percent.

Explore Our Features!

Stay ahead with real-time updates on key market indices! Learn how to customize your Navia App for a personalized investment overview. Watch our tutorial to see how to tweak indices, change spots, and visualize spot charts to fit your needs.

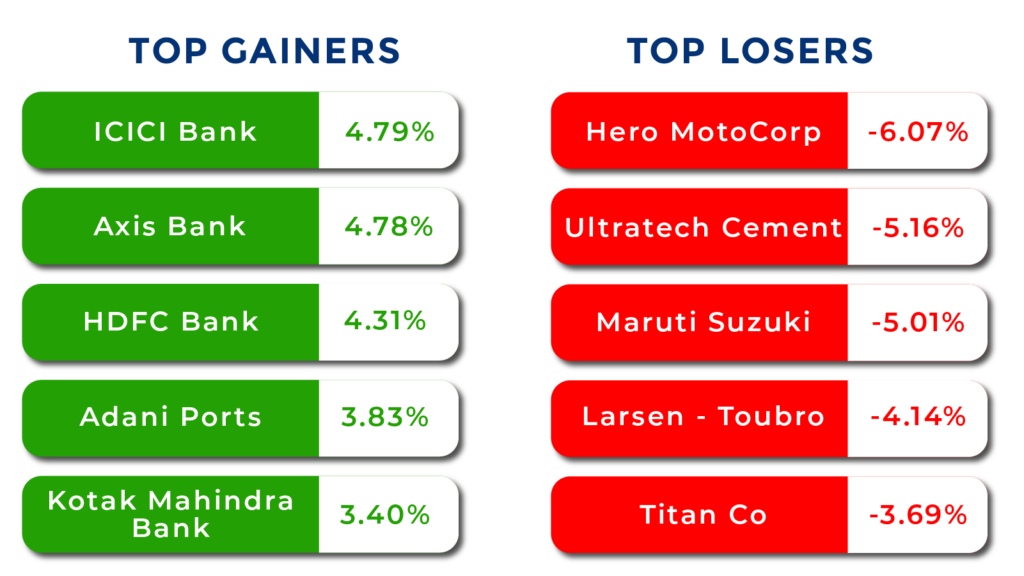

Top Gainers and Losers

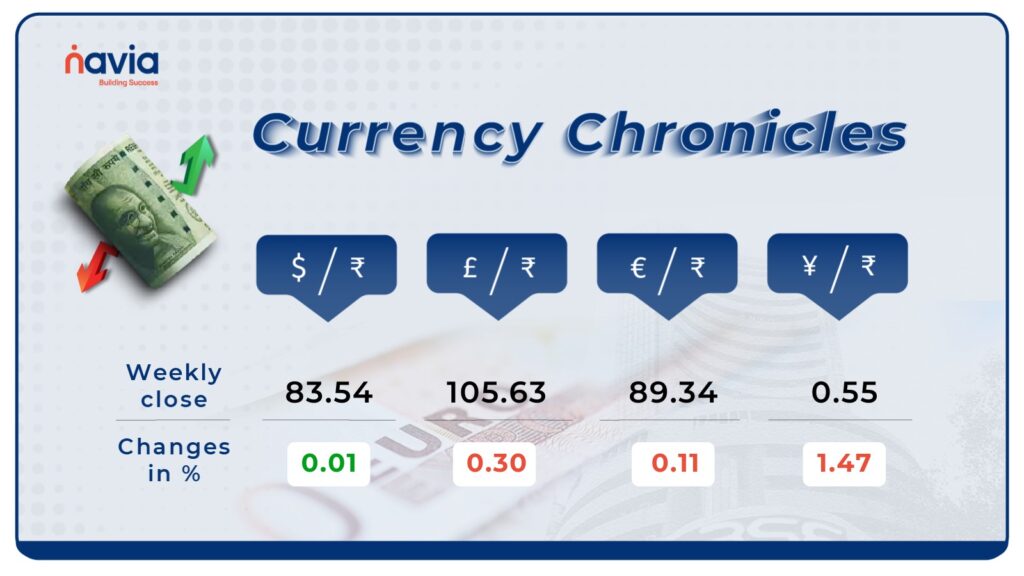

Currency Chronicles

USD/INR:

The Indian rupee ended flat this week, closing at 83.54 on June 21 compared to its June 14 closing of 83.56. This stability reflects a balanced interplay between demand and supply for the domestic currency.

EUR/INR:

The EUR to INR exchange rate decreased by 0.11% over the week. Despite this slight decline, bullish sentiment remains prevalent in the EUR/INR market, indicating positive expectations among traders and investors. By the end of the week, the EUR to INR rate reached ₹ 89.34.

JPY/INR:

The JPY to INR exchange rate saw a decrease of 1.47% for the week. However, bullish sentiment continues to dominate the JPY/INR market, suggesting ongoing confidence among market participants. At the end of the week, the JPY to INR rate stood at ₹ 0.55.

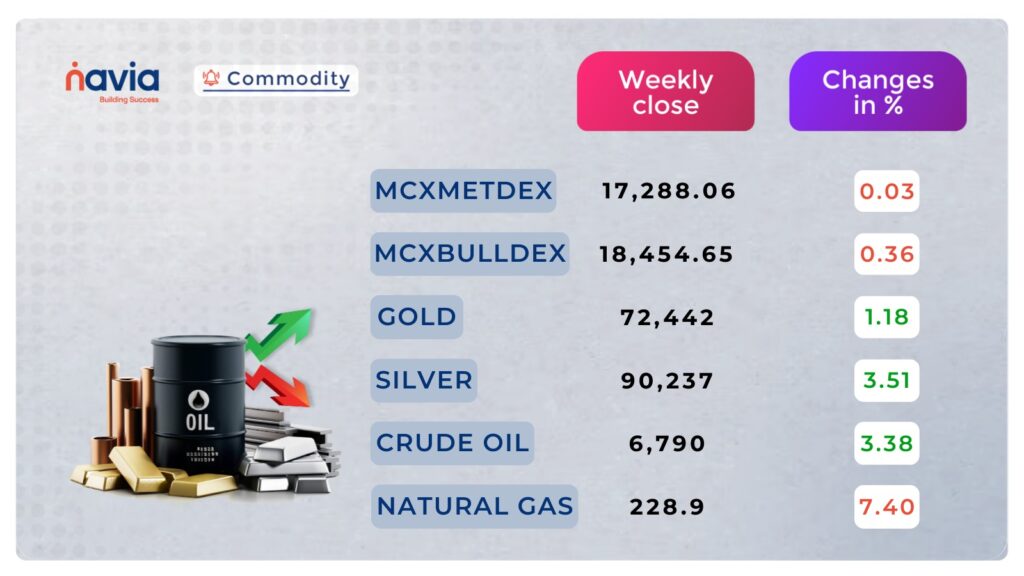

Commodity Corner

Gold is showing positive momentum driven by safe-haven demand amid tensions in the Middle East and rising bets on the U.S. Federal Reserve interest rate. The current R1 is placed at 73250 and S1 is placed at 71784.

Crude oil is showing a strong uptrend rally due to OPEC+ extending its production cuts, which has increased demand in the market. The previous session closed 0.98% positive. The current R1 is placed at 6916 and S1 is placed at 6630.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

The Cricket Match of Life: How Appa Taught Us to Win

Discover how Appa’s Saturday morning lessons on saving and financial responsibility can help you secure your family’s future. Dive into our latest blog to unlock these valuable insights!

How to Grow Your Money: 6 Essential Investing Rules for Building Wealth

Here are six essential investing rules that can help you grow your money and build wealth over time.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?