Navia Weekly Roundup (June 16 – 20, 2025)

Week in the Review

The Indian benchmark indices erased previous week losses on strong Friday closing amid ease in geopolitical tension after US President Trump’s statement about decision of US direct involvement in the Israel-Iran conflict in next two weeks.

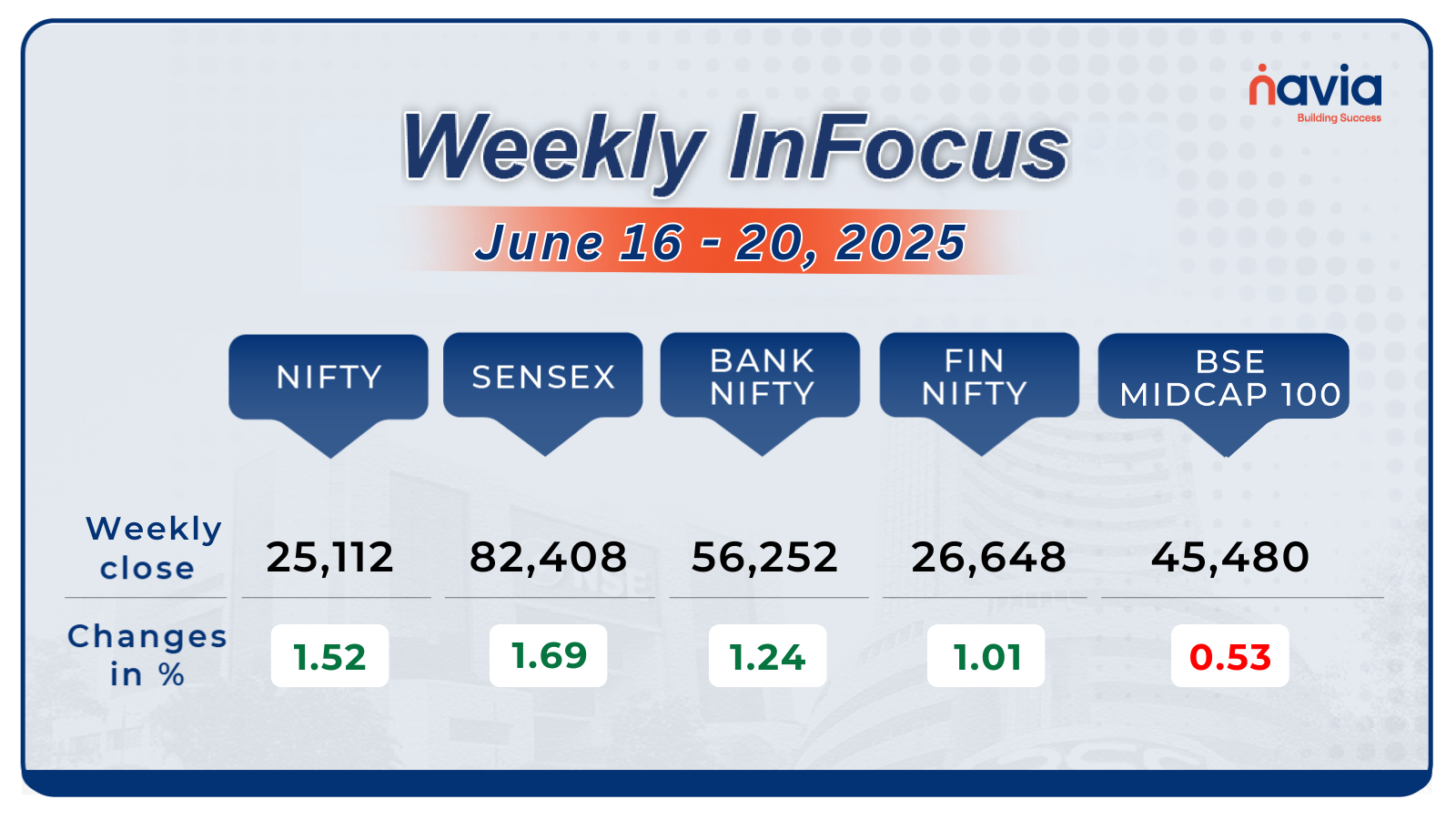

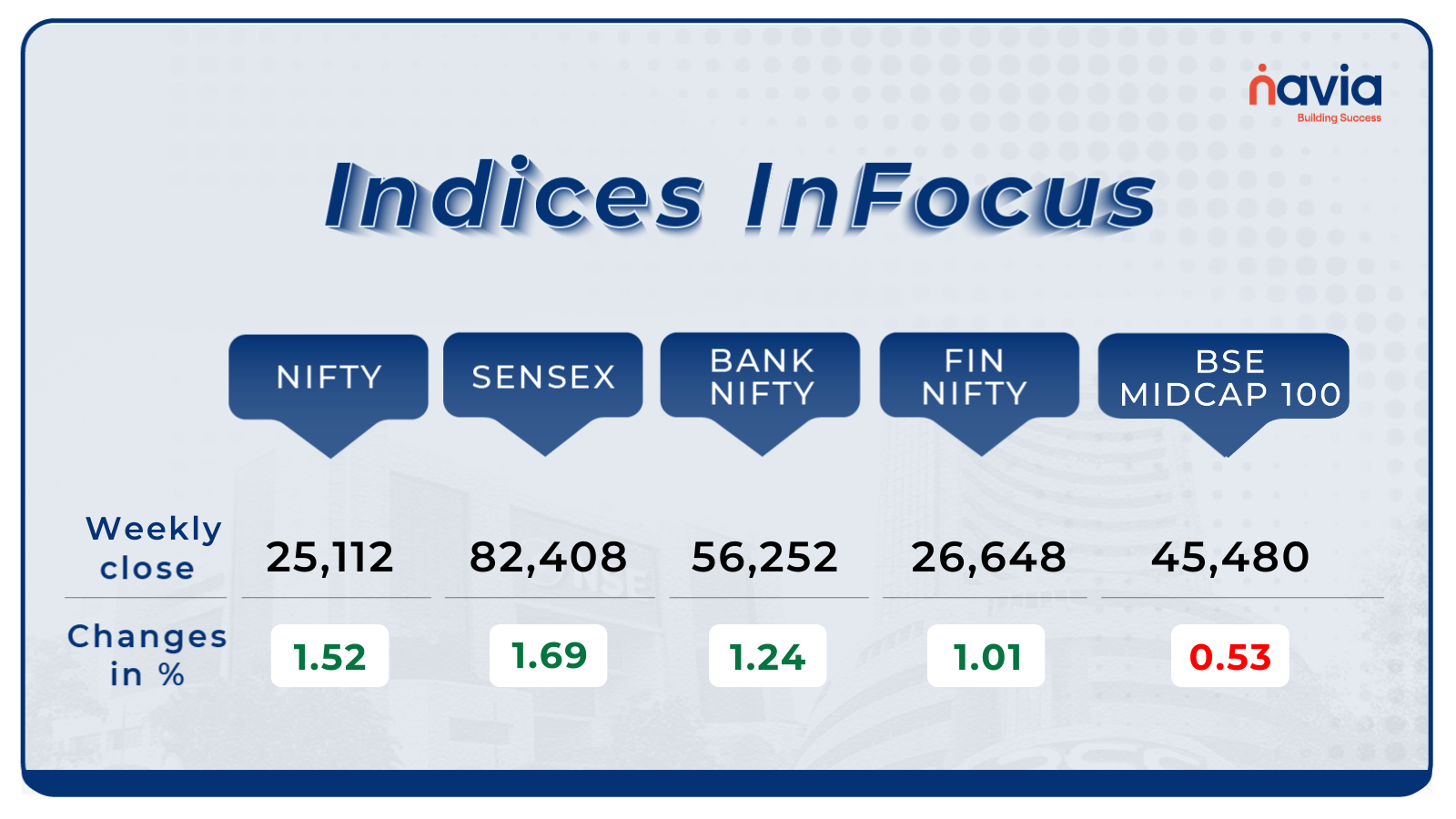

Indices Analysis

For the week, the BSE Sensex index added 1.69 percent to finish at 82,408, and Nifty50 gained 1.52 percent to end at 25,112.

The BSE Large-cap Index added 1 percent led by Swiggy, Indus Towers, Avenue Supermarts, Mahindra and Mahindra, Trent, Waaree Energies, Bharti Airtel, while losers included Hindustan Zinc, Adani Power, Adani Total Gas, SBI Cards & Payment Services, Berger Paints India, Tata Motors, GAIL India.

BSE Mid-cap Index was down 0.4 percent dragged by Brainbees Solutions, Gujarat Fluorochemicals, Linde India, Inventurus Knowledge Solutions, Bank Of India, Punjab and Sind Bank, Tata Technologies. However, gainers were Aditya Birla Capital, Endurance Technologies, CRISIL, Godrej Industries, Vishal Mega Mart, Max Financial Services, Indian Hotels Company.

The BSE Small-cap index shed nearly 2 percent with Sadhana Nitrochem, Orient Cement, Dreamfolks Services, AstraZeneca Pharma, Valor Estate, Dishman Carbogen Amcis, Concord Biotech fell between 12-22 percent, while Sterlite Technologies, Axiscades Technologies, Aeroflex Industries, Grauer and Weil (India), NRB Bearings, Electronics Mart India, KRN Heat Exchanger and Refrigeration, Kalyani Steels, Sheela Foam, Subros, Pearl Global Industries gained between 10-27 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

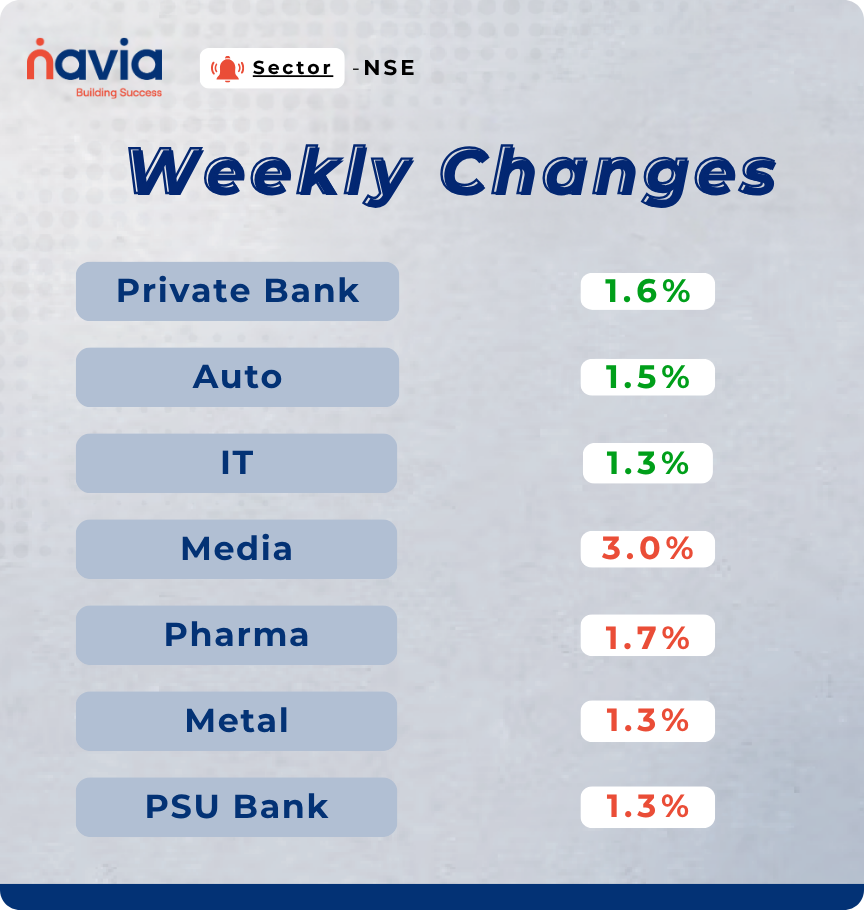

Sector Spotlight

On the sectoral, Nifty Private Bank index rose 1.6 percent, Nifty Auto index added 1.5 percent, Nifty Information Technology index rose 1.3 percent. However, Nifty Media index shed 3 percent and Nifty Pharma index fell 1.7 percent, Nifty Metal and PSU Bank indices shed 1.3 percent each.

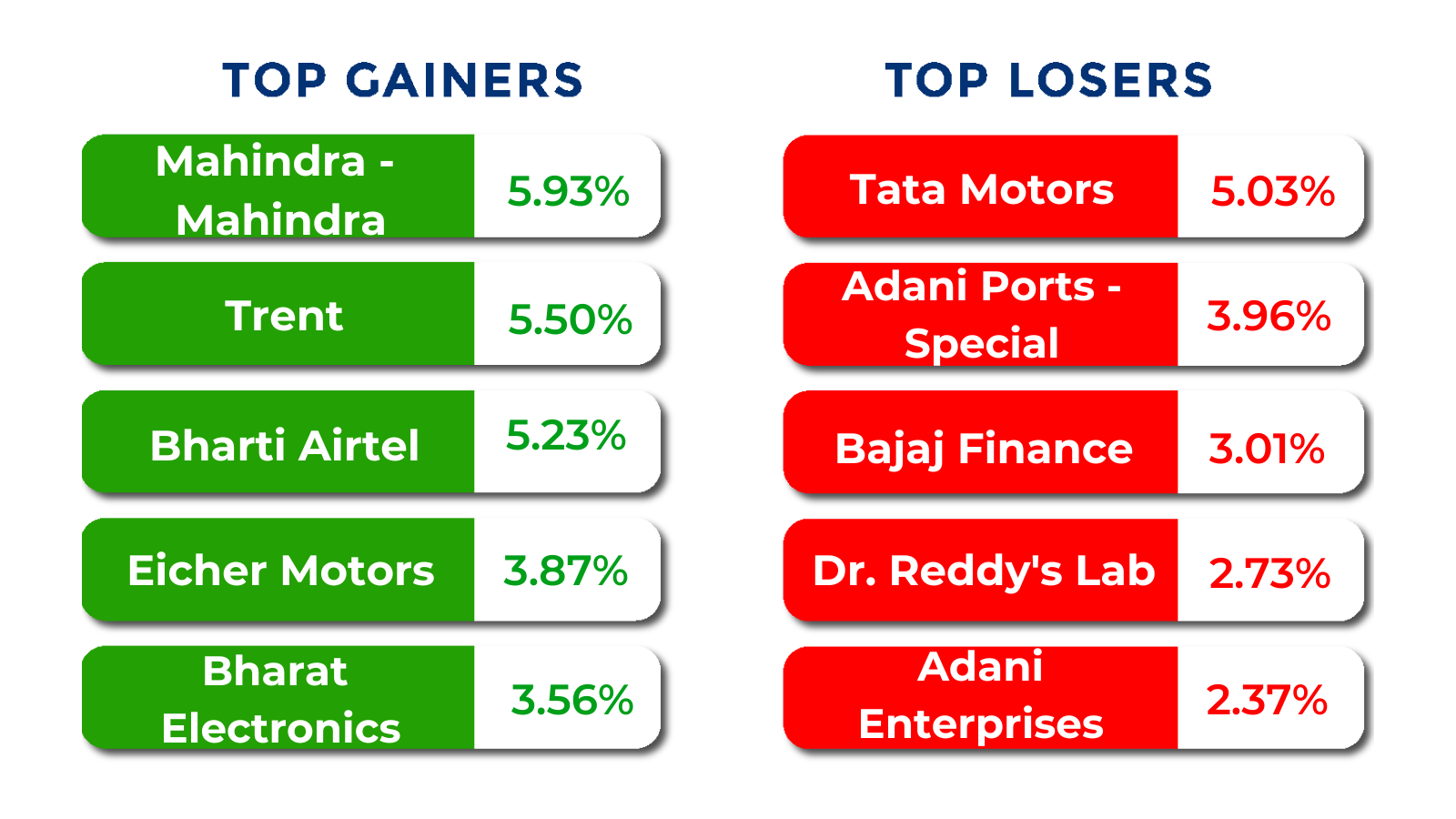

Top Gainers and Losers

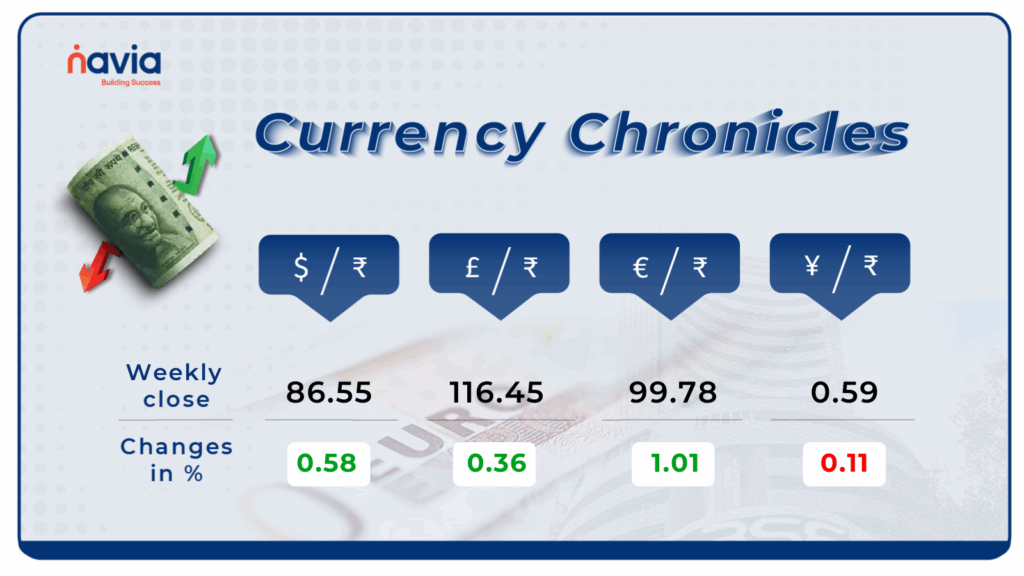

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹86.55 per dollar, gaining 0.58% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹99.78 per euro, gaining 1.01% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, losing 0.11% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

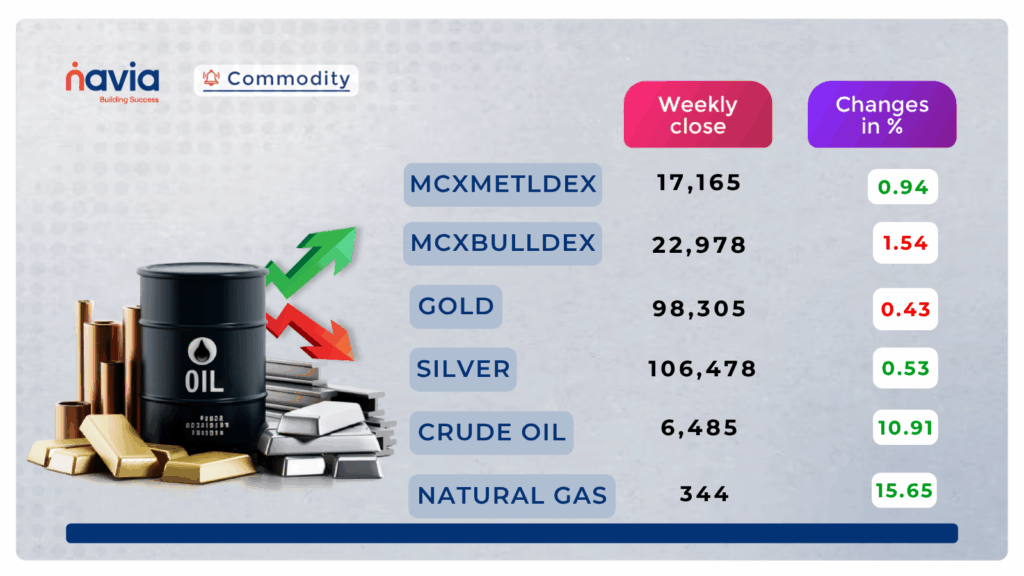

Commodity Corner

Crude Oil is currently trading in an Ascending Channel in 4 hour chart. In the last session, it closed at 6,485. Sustaining above 6400 could be good for crude oil, while immediate support is placed at 6000. Further intraday upside momentum is likely above 6470 while a breakdown below 6420 could trigger additional selling pressure.

In the last session, Gold closed at 98,305. Gold is trading in an ascending channel on the wider timeframe as shown in the chart. Sustaining above 98000 could be good for Gold. A sustained move above this range could lead to further upside in Gold. For intraday traders, a move above 99600 may indicate upside potential, while a dip below 98700 could trigger further downside pressure.

Natural Gas is currently trading in an Ascending channel showing a uptrend. The last session closed at 344. Another intraday move is likely above 360. However, a close below 346 could signal further downside in prices. Sustaining above 330 on a broader timeframe could lead to short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Jio BlackRock Gets SEBI Approval to Act as Investment Advisers

The strategic joint venture between Jio Financial Services and BlackRock, now officially approved by SEBI to operate as an investment adviser. This partnership combines Jio’s extensive digital reach with BlackRock’s global expertise, aiming to revolutionize India’s asset management landscape.

Making Your Investment Payments Safer and Simpler with Validated UPI IDs

Starting October 1, 2025, SEBI is mandating standardized and validated UPI IDs for all registered intermediaries to boost payment security for investors. These new IDs will be easily recognizable, include an intermediary type code and feature a special “thumbs-up” verification icon.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?