Navia Weekly Roundup (July 21 – 25, 2025)

Week in the Review

The Indian equity indices registered the longest weekly losing streak of 2025, as they extended the fall in the fourth consecutive week ended July 25, which is also the first time since October 2024. The market experienced high volatility during the week, amid India-UK Free Trade Agreement (FTA), mixed earnings from India Inc, sustained foreign outflow, and uncertainties over US-India trade deal.

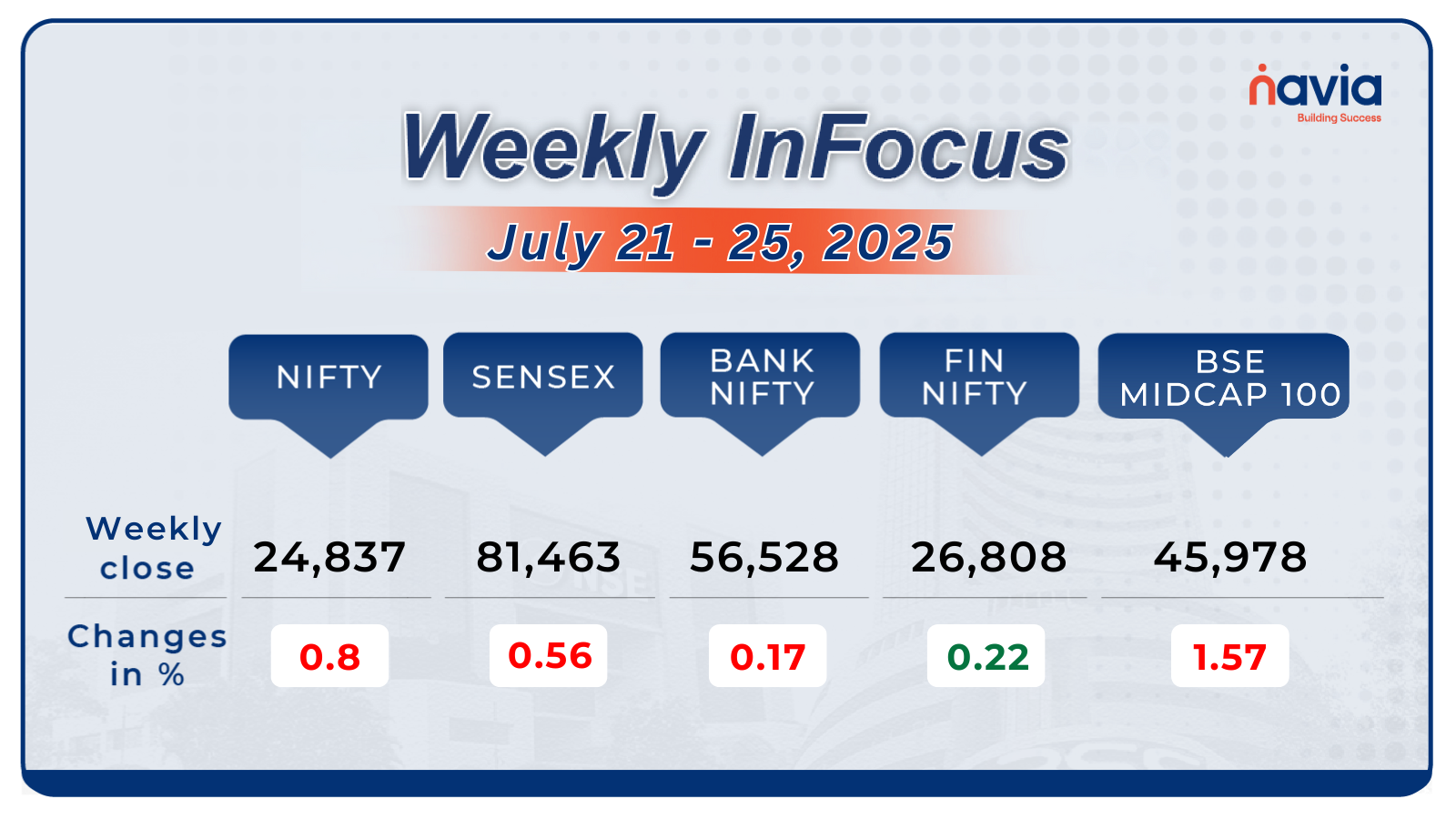

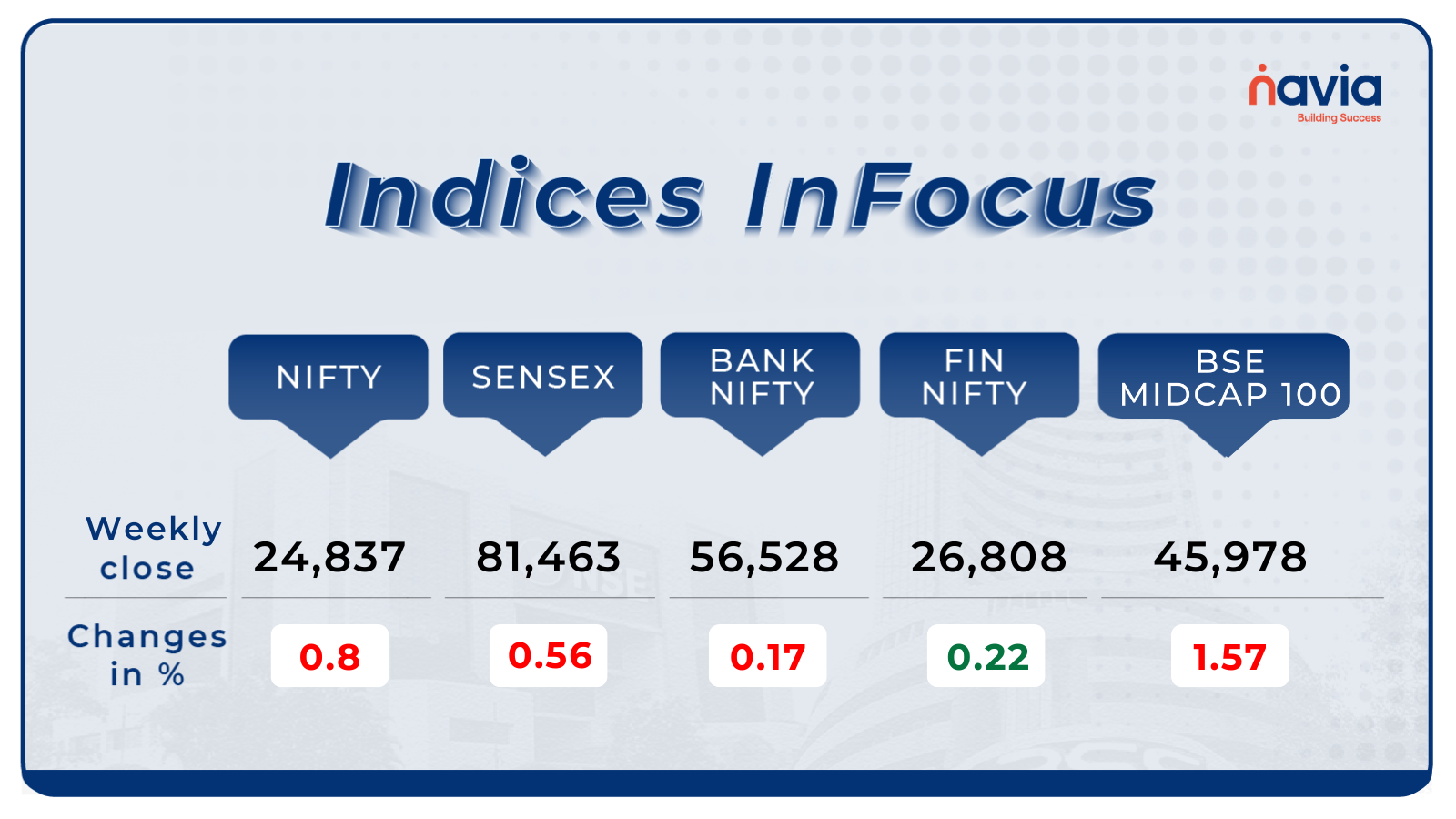

Indices Analysis

In this week, the BSE Sensex index fell 0.56 percent to finish at 81463, and Nifty50 declined 0.8 percent to close at 24837.

The BSE Small-cap index plunged 2.5 percent with Indian Energy Exchange, Blue Jet Healthcare, Control Print, Wendt (India), KSolves India, Ion Exchange (India), Ceat, Veranda Learning Solutions, Kirloskar Pneumatic Company, Quick Heal Technologies, Transrail Lighting, PC Jeweller, Ideaforge Technology, Cigniti Technologies falling between 10-34 percent. On the other hand, InfoBeans Technologies, KIOCL, Tilaknagar Industries, Master Trust, SML Isuzu added between 20-40 percent.

BSE Mid-cap Index shed 1.7 percent. Losers were Coforge, Zee Entertainment Enterprises, Persistent Systems, MphasiS, AU Small Finance Bank, Colgate Palmolive (India), while gainers were One 97 Communications (Paytm), 3M India, UPL, Coromandel International, Dixon Technologies.

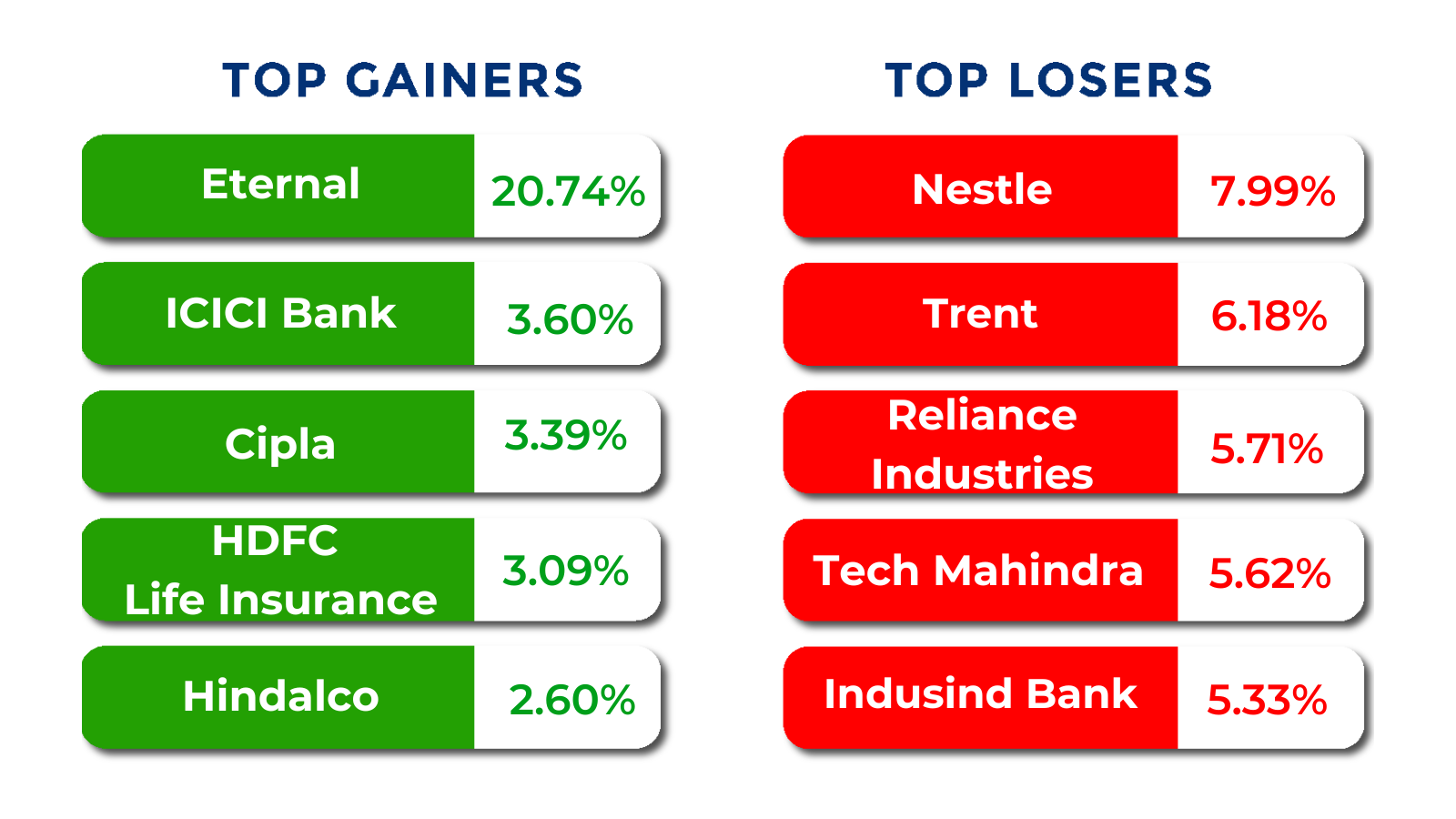

The BSE Large-cap Index fell 0.7 percent. Losers included Lodha Developers, Nestle India, Reliance Industries, Trent, NTPC Green Energy, Tech Mahindra, while gainers were Eternal, Swiggy, Info Edge India, Jindal Steel & Power, ICICI Bank, Ambuja Cements, Waaree Energies, Shree Cements, Hindalco Industries, Tata Motors.

The Foreign Institutional Investors (FIIs) remained net sellers throughout the week, while Domestic Institutional Investors (DII) compensated with buying the equities. FIIs extended their selling in fourth week, as they sold equities worth Rs 13,552.91 crore, however, DII bought equities worth Rs 17,932.45 crore, extending buying in 14th week.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

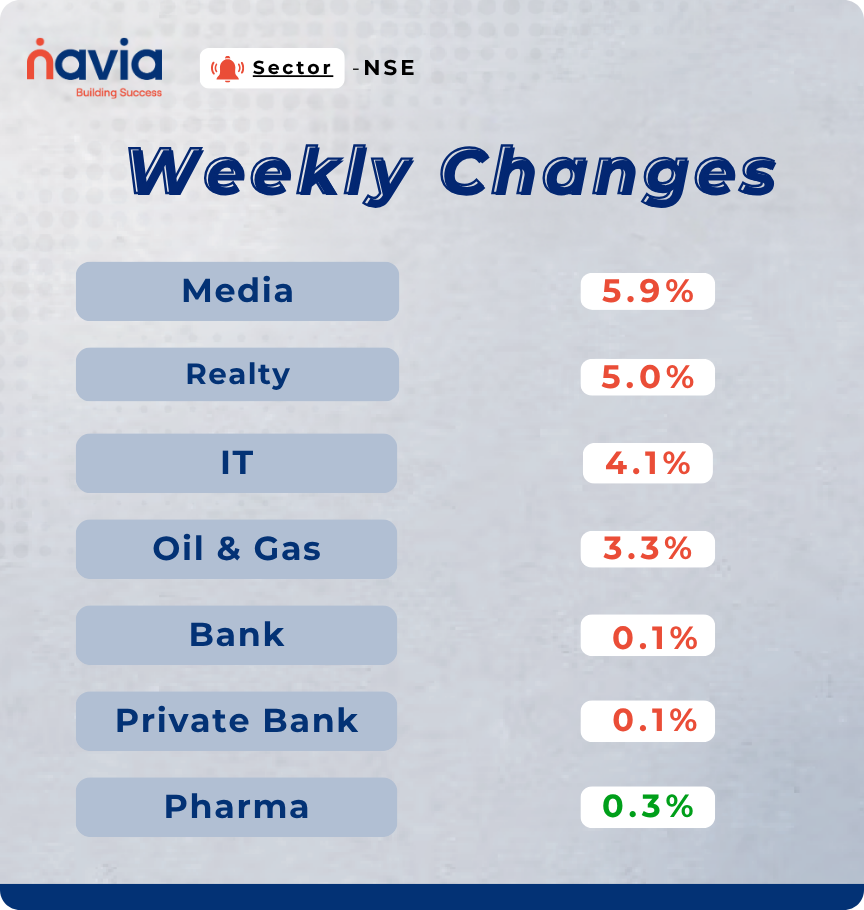

Sector Spotlight

On the sectoral, Nifty Media index shed 5.9 percent, Nifty Realty index declined 5 percent, Nifty IT index plunged 4.1 percent, Nifty oil & gas shed 3.3 percent. However, Nifty Bank, Private Bank and Pharma indices ended with marginal gains.

Top Gainers and Losers

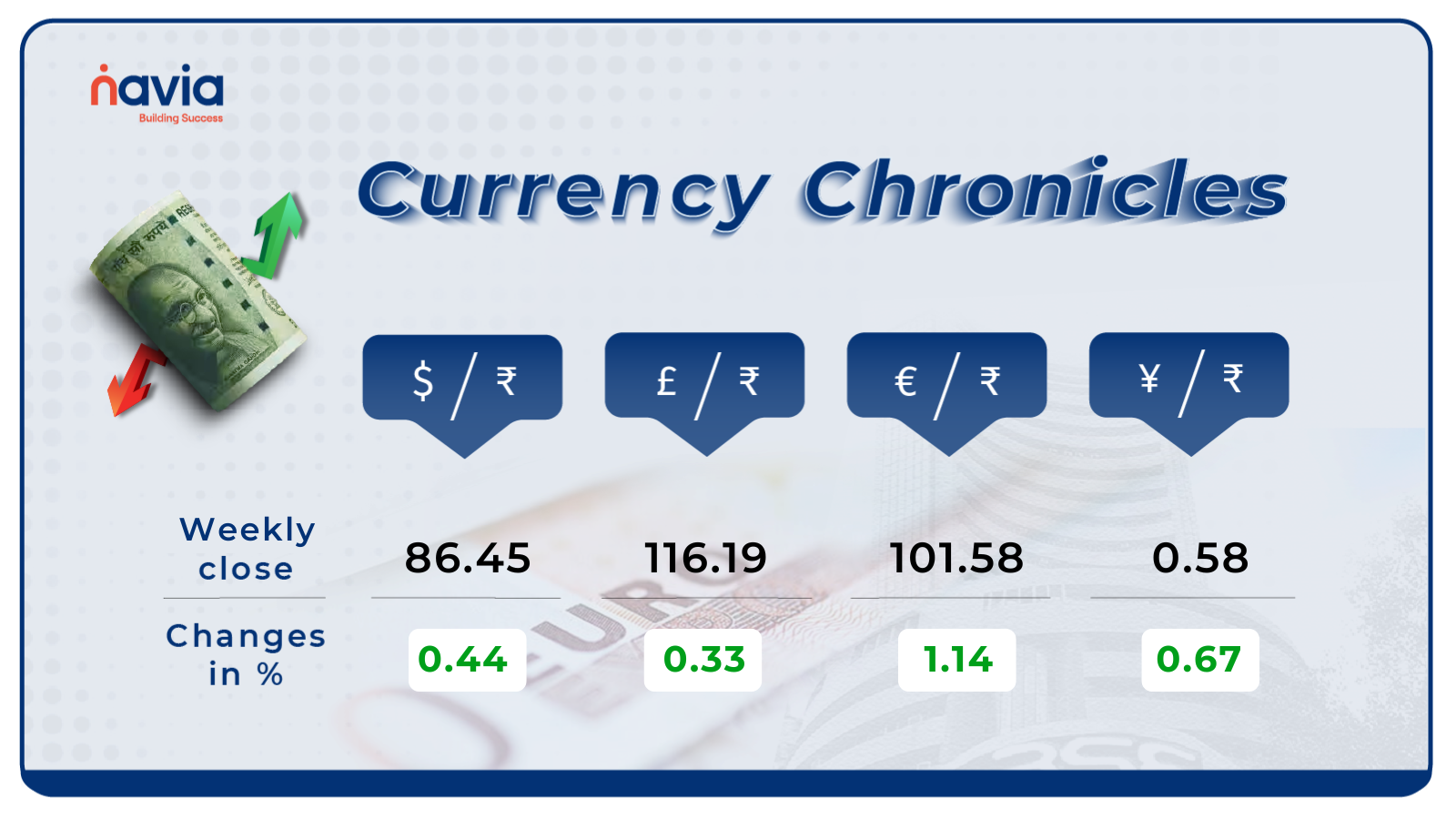

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹86.45 per dollar, gaining 0.44% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹101.58 per euro, gaining 1.14% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, gaining 0.67% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

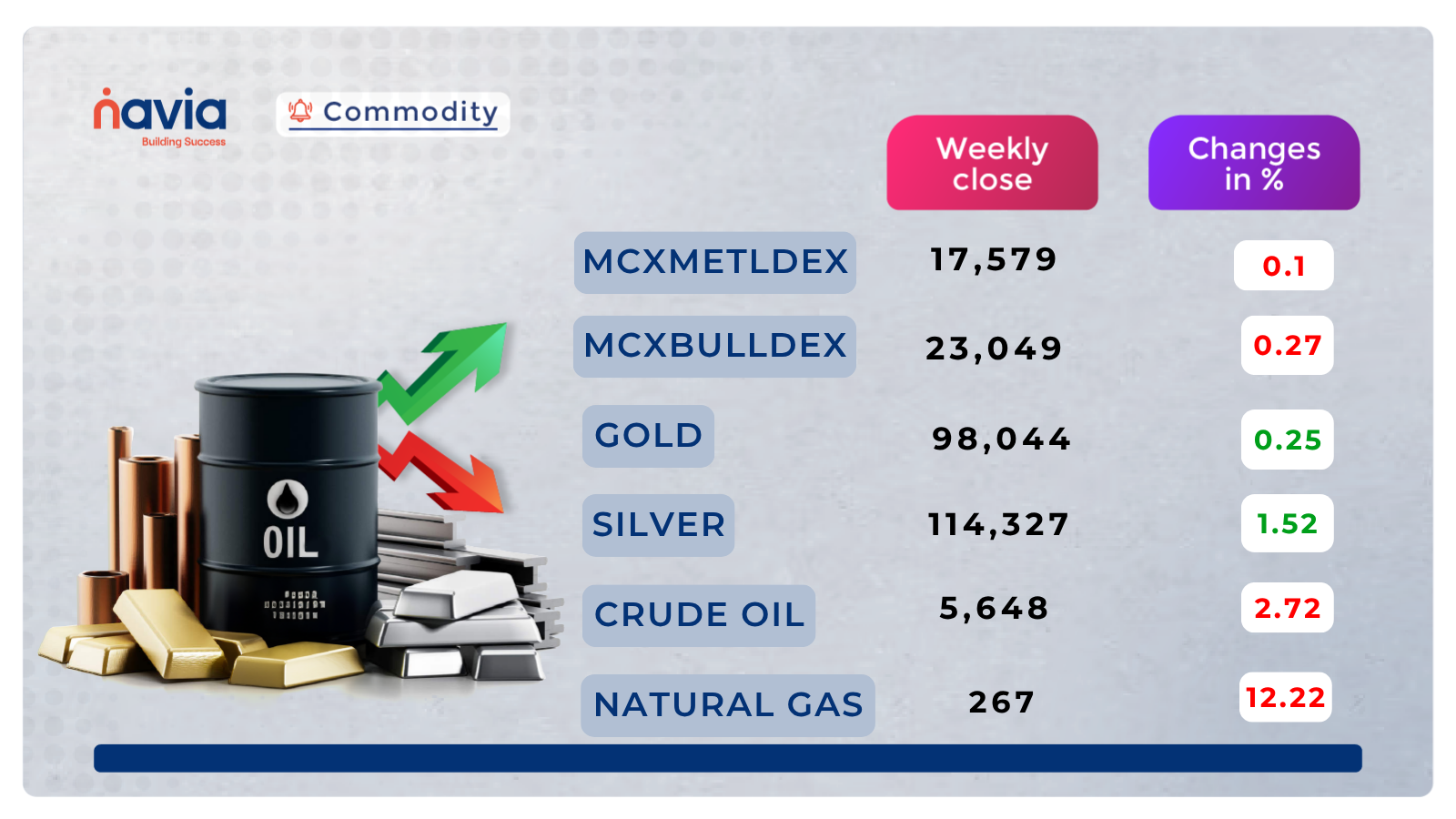

Commodity Corner

Crude Oil closed at 5,648. Price remains range-bound, trading between 5,644–5,700, showing no clear breakout. A move above 5,700 or below 5,644 is required for decisive momentum. Price is hovering just above the lower support zone, forming a potential base. However, a breakdown could extend weakness toward 5,600 and 5,550 levels, while a breakout above trendline resistance maybe open the door for bullish targets.

Gold closed at 98,044. Price has broken below the rising channel support, indicating potential weakness in momentum. It is currently testing the horizontal support zone near 98,390–98,500. A breakdown below 98,390 may open the door to further downside levels. On the upside, the immediate resistance lies around 98,851–98,872. A sustained move above this zone could reinstate bullish sentiment and resume the previous uptrend. Movement around these areas may influence short-term sentiment.

Natural Gas Futures (MCX) closed at 267. Price remains in a strong downtrend, breaking multiple support levels and forming lower highs. It is now testing the critical support zone near 266.5, which, if broken, may accelerate bearish pressure. Resistance lies at 315.4, with the immediate hurdle near 280–285 levels. A rebound from current support could trigger a short-covering bounce, but overall sentiment remains weak unless a sustained break above resistance occurs.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Investing ₹1000 in MON100 ETF: Gaining Exposure to Bitcoin via MicroStrategy

The MON100 ETF provides indirect exposure to Bitcoin through MicroStrategy’s holdings. This blog explains how the ETF works, its structure, and considerations for investors.

Understanding Candlestick Patterns: A Simple Guide for Traders

This blog introduces key candlestick patterns such as Doji and Morning Star, explaining how traders interpret them in technical analysis.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.