Navia Weekly Roundup ( Feb 17 – 21, 2025)

Week in the Review

The Indian stock markets exhibited a mixed performance during the week, reflecting broader global uncertainties. The crude oil market has experienced volatility due to mixed signals from global economic indicators and geopolitical tensions. The overall market sentiment remained cautious as foreign institutional investors continued to sell off equities, contributing to a risk-averse environment.

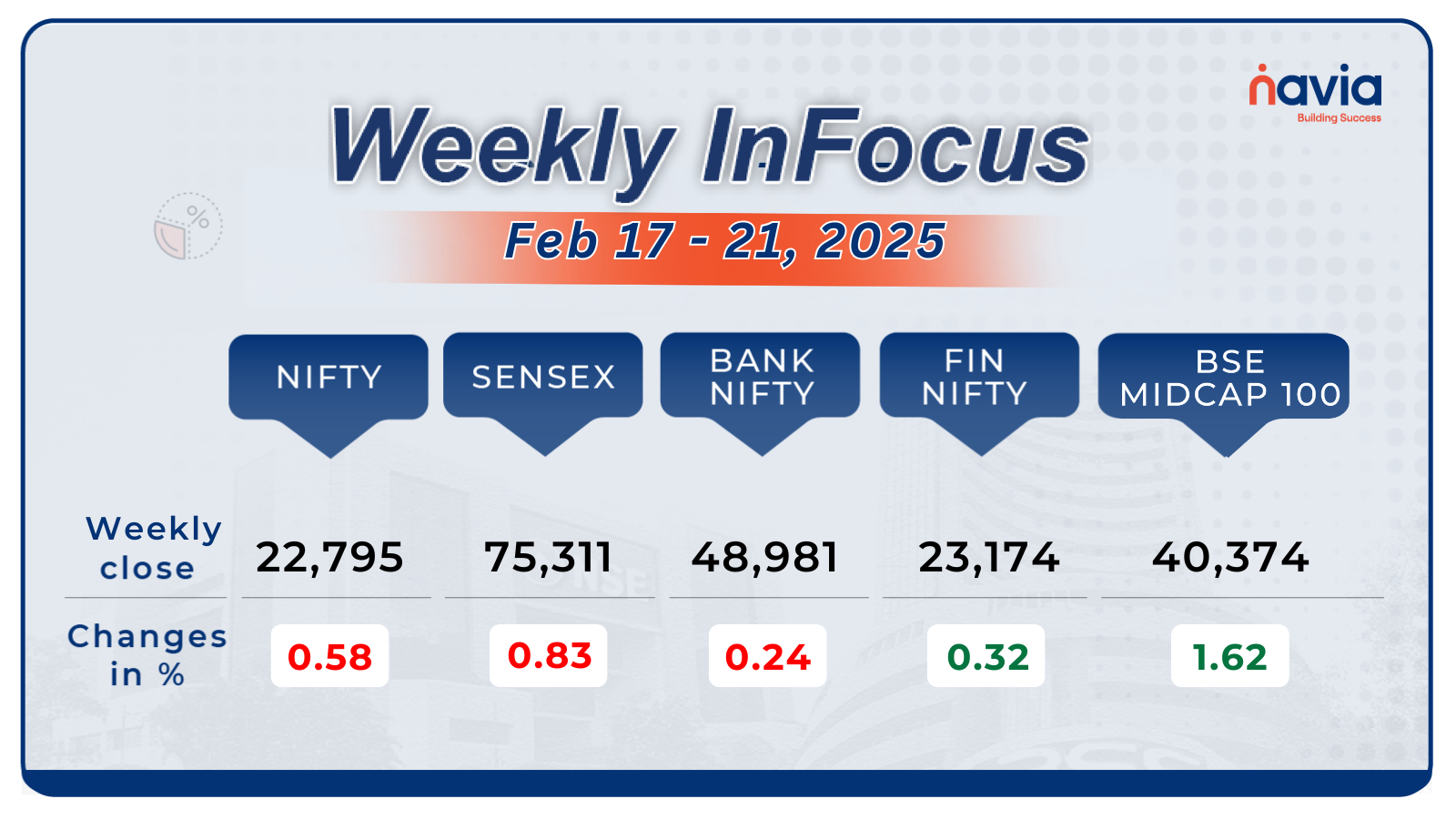

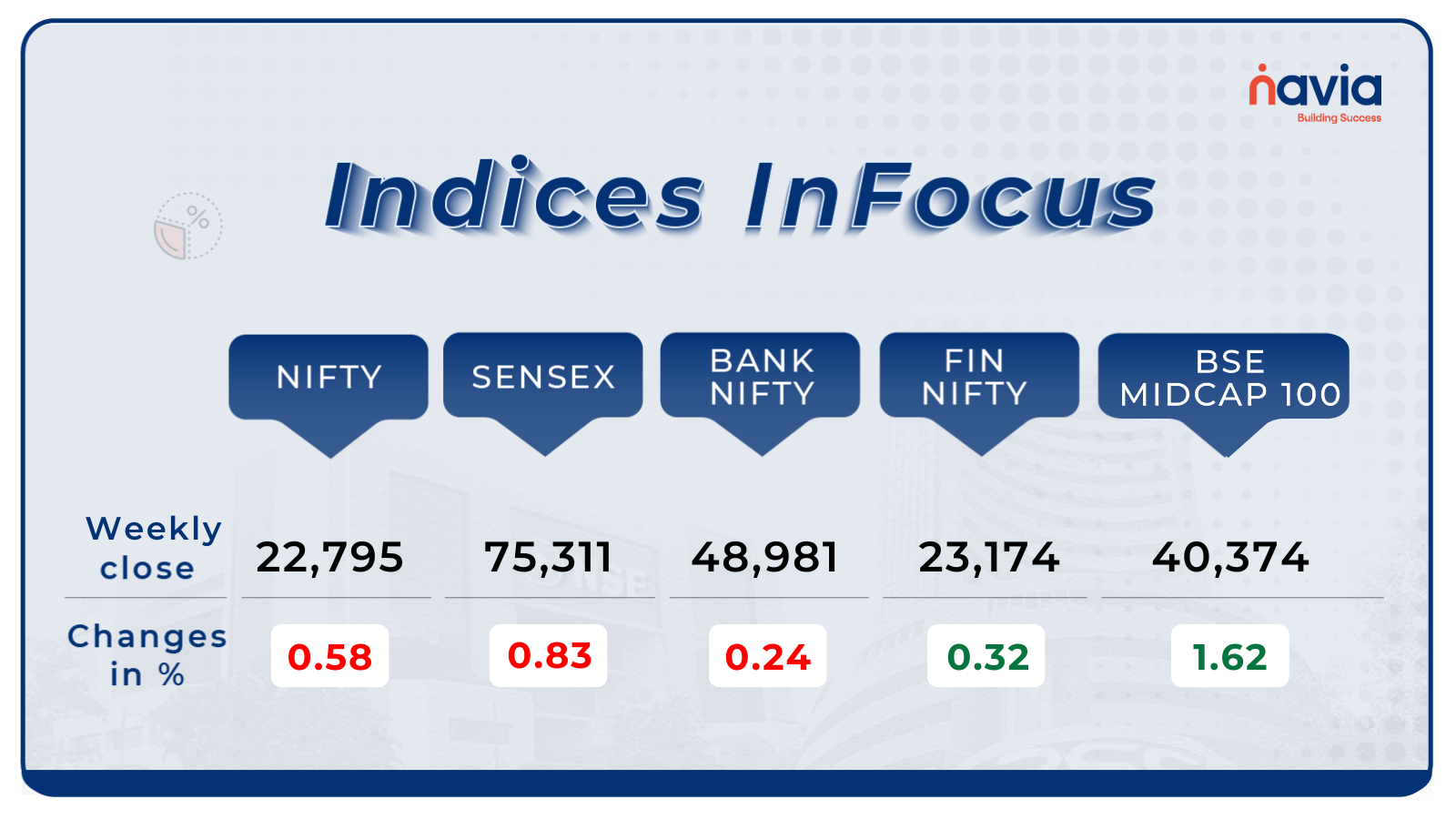

Indices Analysis

The Nifty 50 ended the week marginally lower, closing down by 0.58%, While the Nifty Midcap 150 and Nifty Small cap 250 indices saw positive performance, rising by 1.82% and 1.25%, respectively, compared to the previous week.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

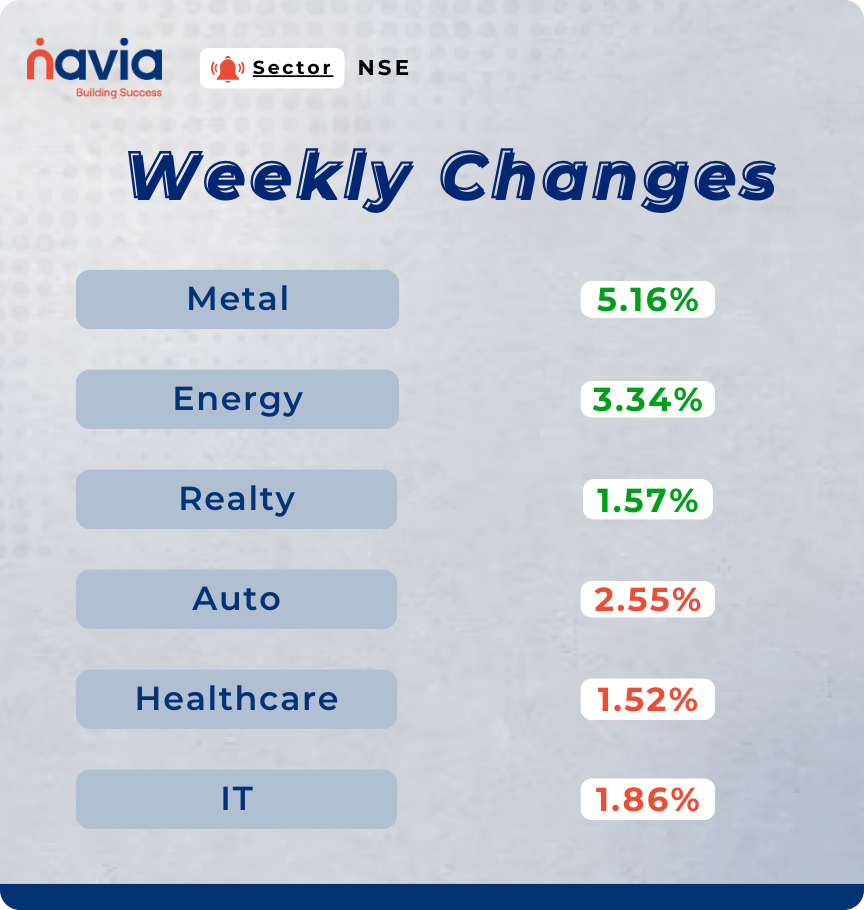

Sector Spotlight

Performance of sectoral domestic Indices exhibited mixed results. Major downturns were Nifty Auto(2.55%), healthcare(1.52%) and IT(1.86%). In contrast, Nifty Metal, Nifty Energy and Nifty Realty experienced significant gains of 5.16%, 3.34% and 1.57% respectively compared to last week.

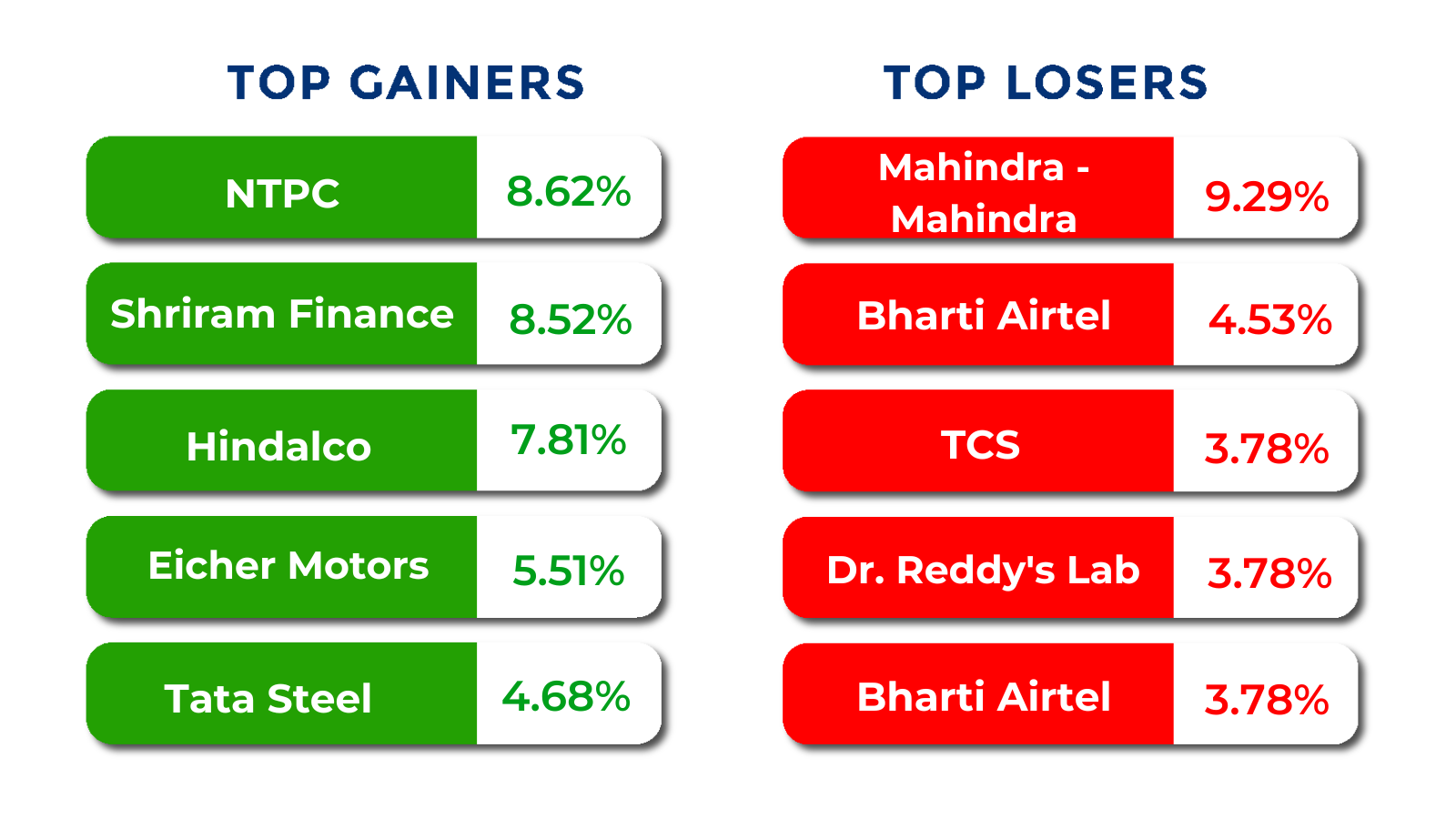

Top Gainers and Losers

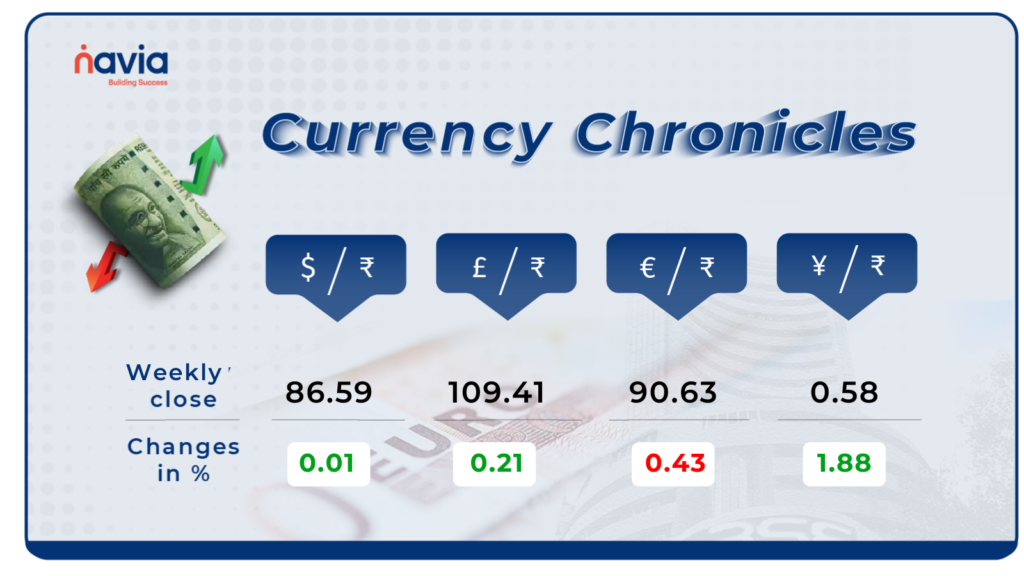

Currency Chronicles

USD/INR:

Following RBI intervention, the rupee settled at ₹86.18 against the US dollar. Sentiment in the USD/INR market remains neutral.

EUR/INR:

The euro experienced a slight decline this week, fluctuating between ₹90.60 and ₹90.70 against the Indian rupee. Sentiment in the EUR/INR market remained neutral, with the currency ending the week down by 0.43%.

JPY/INR:

Sentiment in the JPY/INR market remains bullish. By the end of the week, the JPY to INR rate is expected to rise by 1.88% to ₹0.584154.

Stay tuned for more currency insights next week!

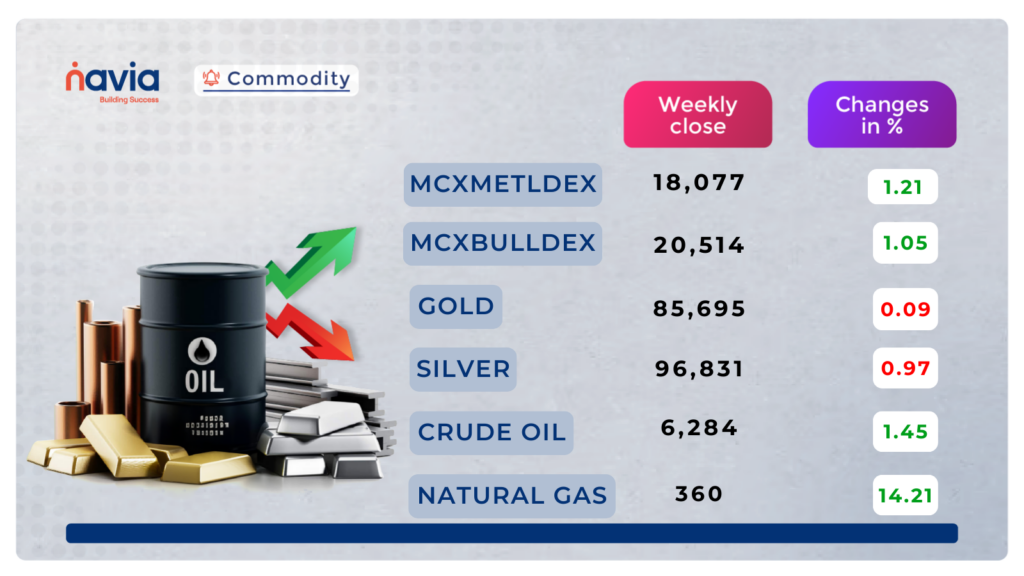

Commodity Corner

Crude oil is trading in an ascending channel on the 30-minute chart. The session closed 25 points higher at 6,284. Sustaining above 6,310 could be positive for crude oil. Technically, it may face resistance at the 6,358-6,370 range, and a strong momentum can be seen above this level. Intraday momentum is expected above 6,325 and below 6,245. The ascending channel support is placed at the 6,267-6,257 range, while resistance is at 6,400-6,410.

Oil prices remain volatile amid a weaker U.S. dollar and rising geopolitical tensions. The U.S. crude stockpile saw a larger-than-expected build of 4.6 million barrels, pressuring prices. However, expectations of supply disruptions due to Middle East tensions and potential tariffs on Canadian and Mexican crude have provided some support. Meanwhile, Russia’s expanding “shadow fleet” to bypass sanctions is adding uncertainty to the global oil trade.

Gold prices are currently trading within an ascending channel pattern. In the last session, gold closed at 85,695 up by 114 points but failed to sustain higher levels. Global uncertainties may impact investor sentiment. Another momentum move can be expected above 86,150 or below 85,680. If gold sustains above 86,350, it could lead to new highs.

Gold recently hit a record high of $2,954.69 per ounce, driven by geopolitical tensions, rising energy costs, and speculation about a potential U.S. gold reserve revaluation.

On the other hand, Goldman Sachs raised its year-end forecast to $3,100 per ounce, citing central bank demand and policy uncertainties, while UBS increased its outlook to $2,900, with peaks potentially reaching $3,200.

Natural gas prices experienced a significant surge in the last session, marking the highest momentum since 2022. However, it failed to sustain higher levels and ended in the red, down by 16 points at 360.

Technically, natural gas could face resistance in the 369-371.7 range. A close above this level could add more positivity, while increasing gas demand may further push prices higher. Intraday momentum can be expected above 361 and below 353.

Prices are influenced by rising energy costs, severe cold weather driving higher demand, and geopolitical uncertainties impacting supply chains.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Growth Vs Dividend

Growth or Dividend—what’s the smarter choice for your investments? One builds wealth quietly, while the other offers periodic payouts. But which suits your financial goals best? Explore the key differences and make an informed decision in this blog!

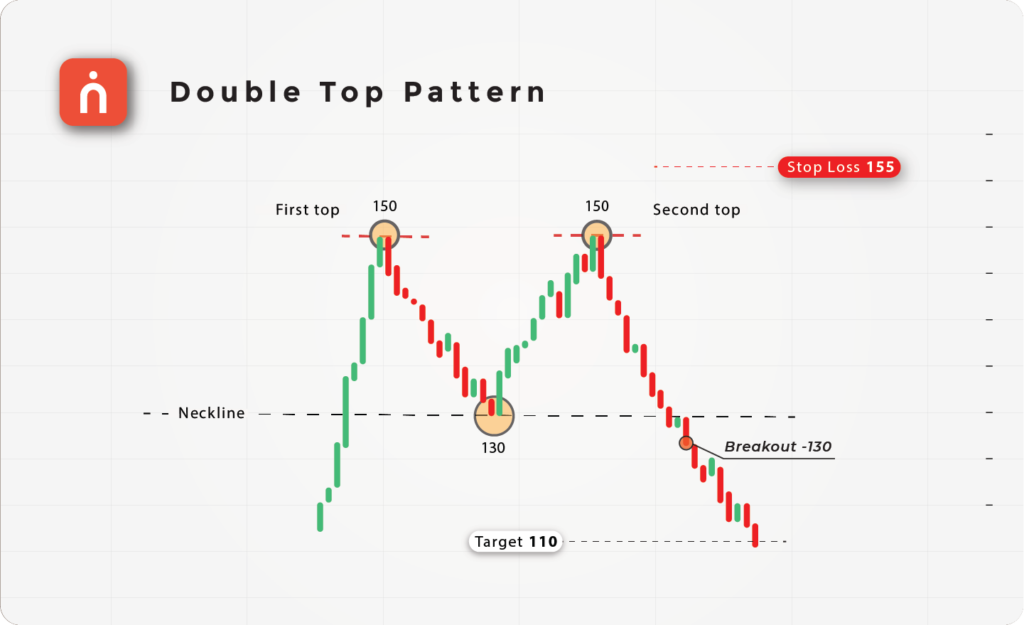

Understanding the Double Top Pattern in Technical Analysis

Is the uptrend losing steam? The Double Top Pattern might just be the signal traders are waiting for! This classic reversal pattern can help spot potential downturns before they happen. Learn how to identify, trade, and make the most of this pattern in our detailed guide!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?