Navia Weekly Roundup (Feb 16 – 20, 2026)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Despite Thursday’s sharp sell-off, the Indian benchmark indices ended the volatile week with modest gains, amid persistent selling in IT stocks and rising crude oil prices driven by escalating tensions in the Middle East.

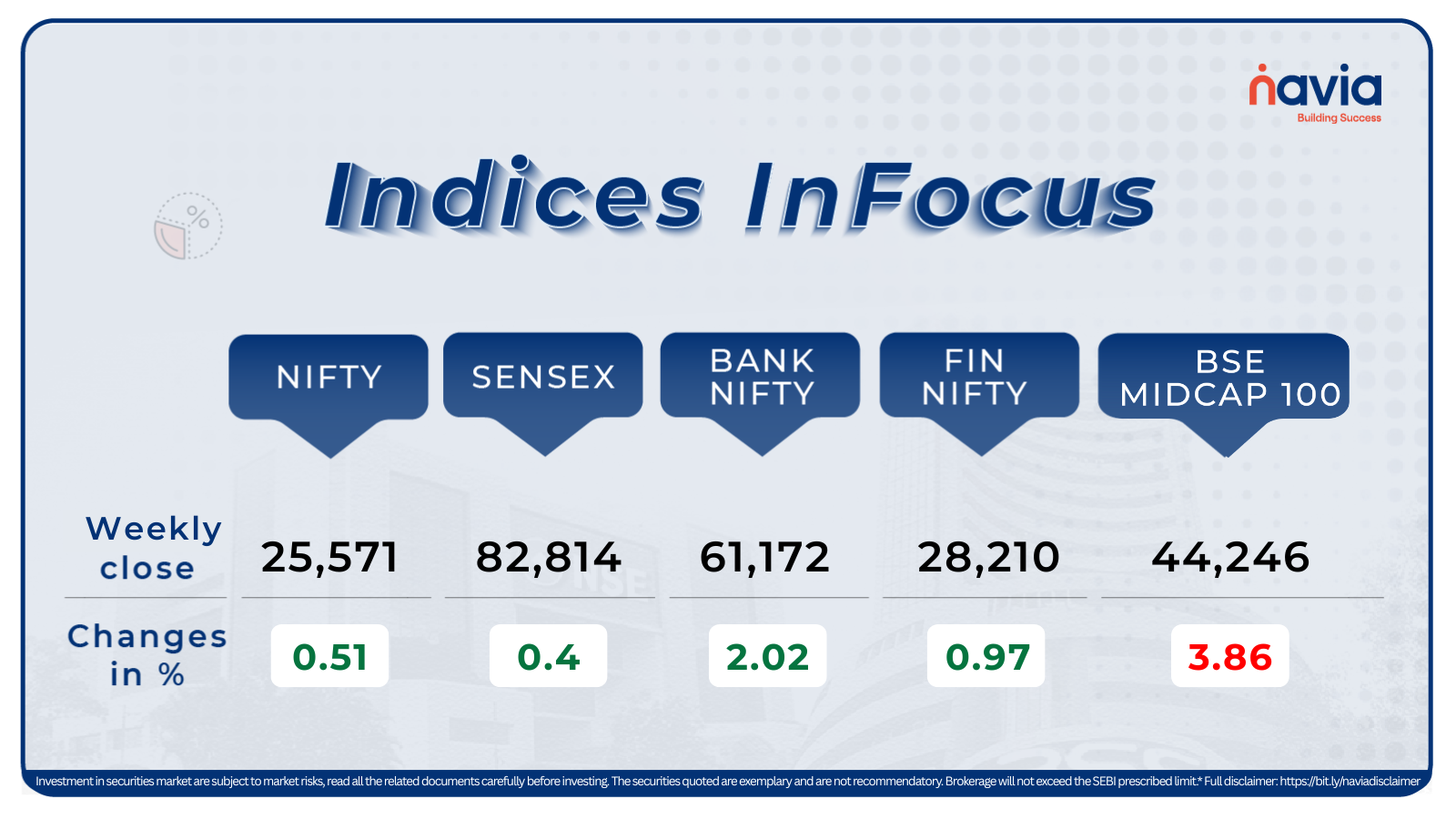

Indices Analysis

In this week, the BSE Sensex added 0.4 percent, to finish at 82,814.71, while the Nifty50 rose 0.51 percent, to close at 25,571.25.

The Nifty Midcap index rose 0.35 percent during the week. Thermax, Indian Bank, Godrej Industries, Hitachi Energy India, Bank of India, GMR Airports, Petronet LNG, Bharat Dynamics, and Bank of Maharashtra were among the major gainers. On the other hand, Brainbees Solutions, Ola Electric Mobility, Hexaware Technologies, Persistent Systems, Vedant Fashions, and Clean Science & Technology declined between 6–18 percent.

The BSE Largecap index gained 0.4 percent during the week, led by advances in Punjab National Bank, Canara Bank, Union Bank of India, Cummins India, Bank of Baroda, and Hyundai Motor India. Meanwhile, laggards included Waaree Energies, Info Edge (India), Eternal, SRF, Tech Mahindra, LTIMindtree, and Swiggy.

The BSE Smallcap index shed 0.5 percent during the week, with stocks such as Aqylon Nexus, Filatex Fashions, Transworld Shipping Lines, Zaggle Prepaid Ocean Services, Stallion India Fluorochemicals, SEPC, Shoppers Stop, and Pennar Industries declining between 16–22 percent. On the other hand, VL E-Governance and IT Solutions, Novartis India, RACL Geartech, KRN Heat Exchanger and Refrigeration, Godfrey Phillips India, Aeroflex Industries, Netweb Technologies India, Jyoti Structures, Newgen Software Technologies, Sadhana Nitrochem, and Jindal Poly Investment and Finance Company gained between 16–28 percent.

Foreign Institutional Investors (FIIs) extended their selling for the second consecutive week, offloading equities worth ₹637.68 crore in this week. In contrast, Domestic Institutional Investors (DIIs) continued their buying streak, purchasing equities worth ₹6,883.81 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

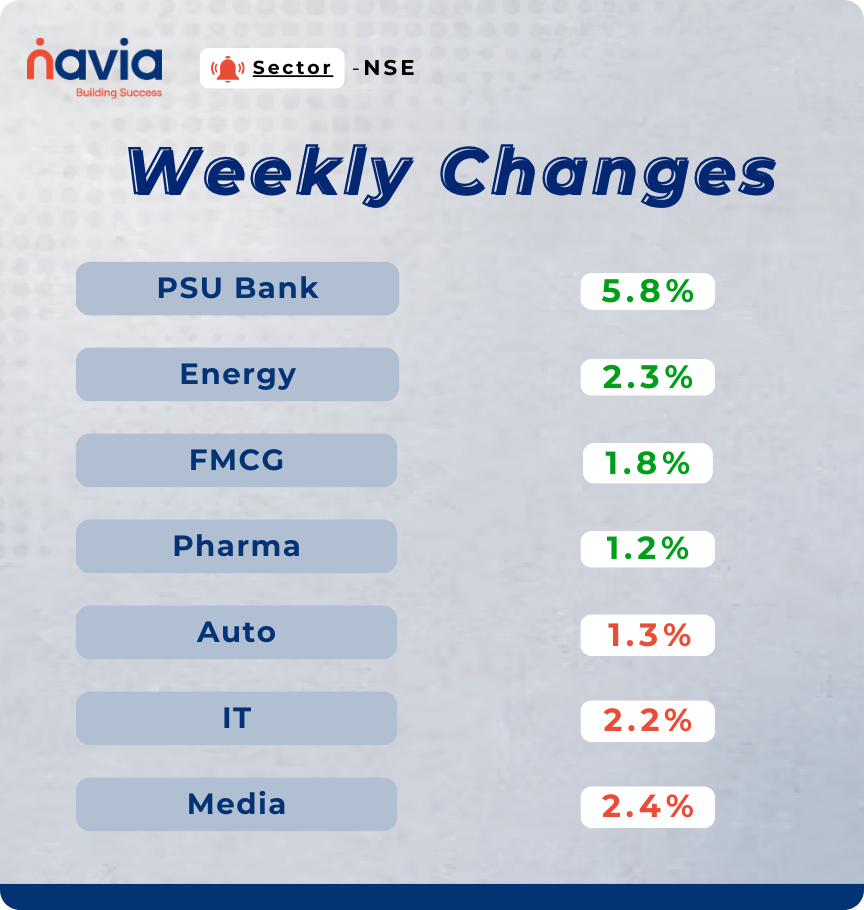

Sector Spotlight

Sectoral performance remained mixed during the week. The Nifty PSU Bank index rose 5.8 percent, while the Nifty Energy index gained 2.3 percent and the Nifty FMCG index added 1.8 percent. The Nifty Pharma indices advanced 1.2 percent. However, the Nifty Auto, IT, and Media indices declined between 1.3–2.4 percent during the period.

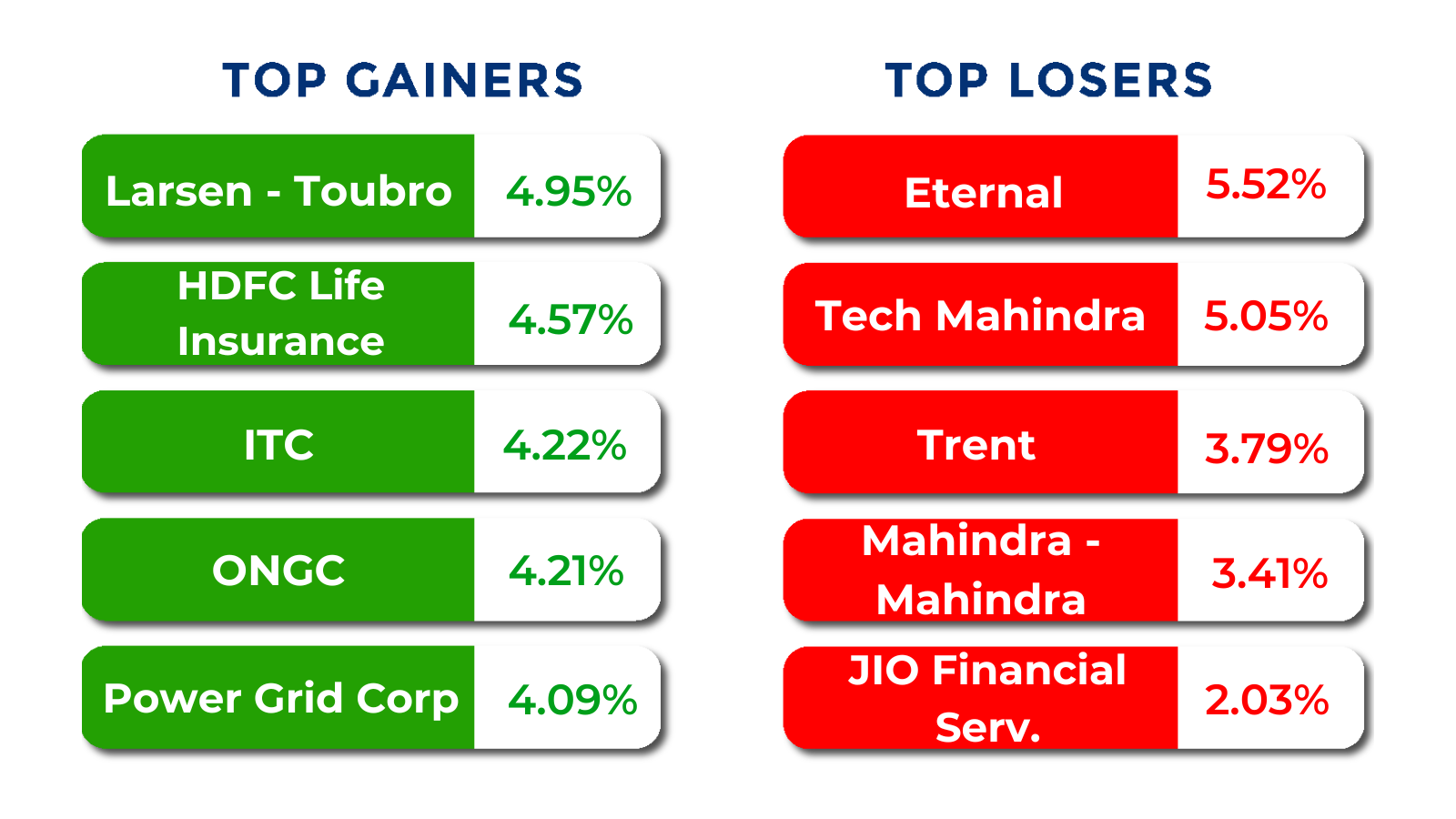

Top Gainers and Losers

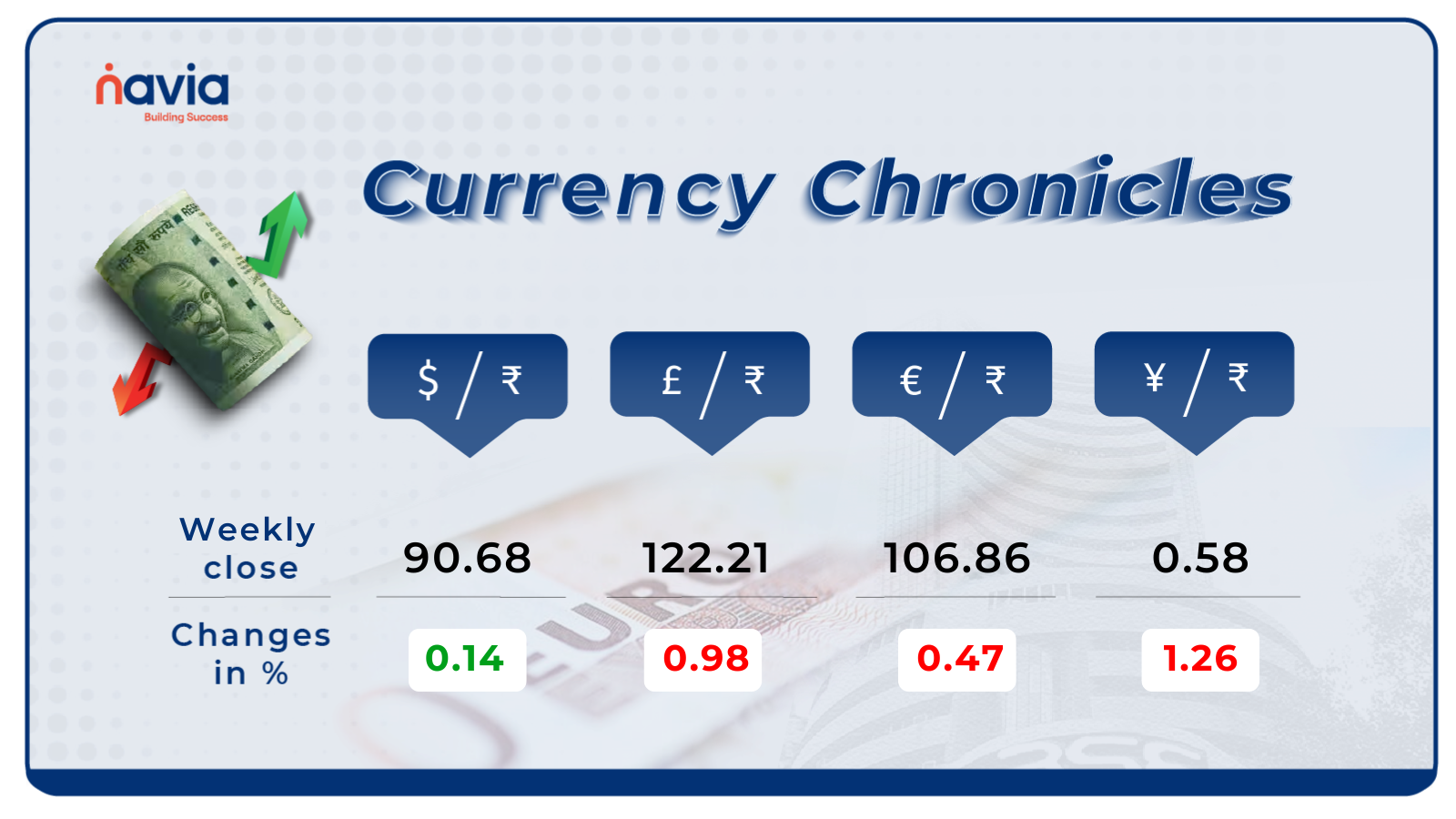

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹90.68 per dollar, gaining 0.14% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹106.86 per euro, losing 0.47% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, losing 1.26% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

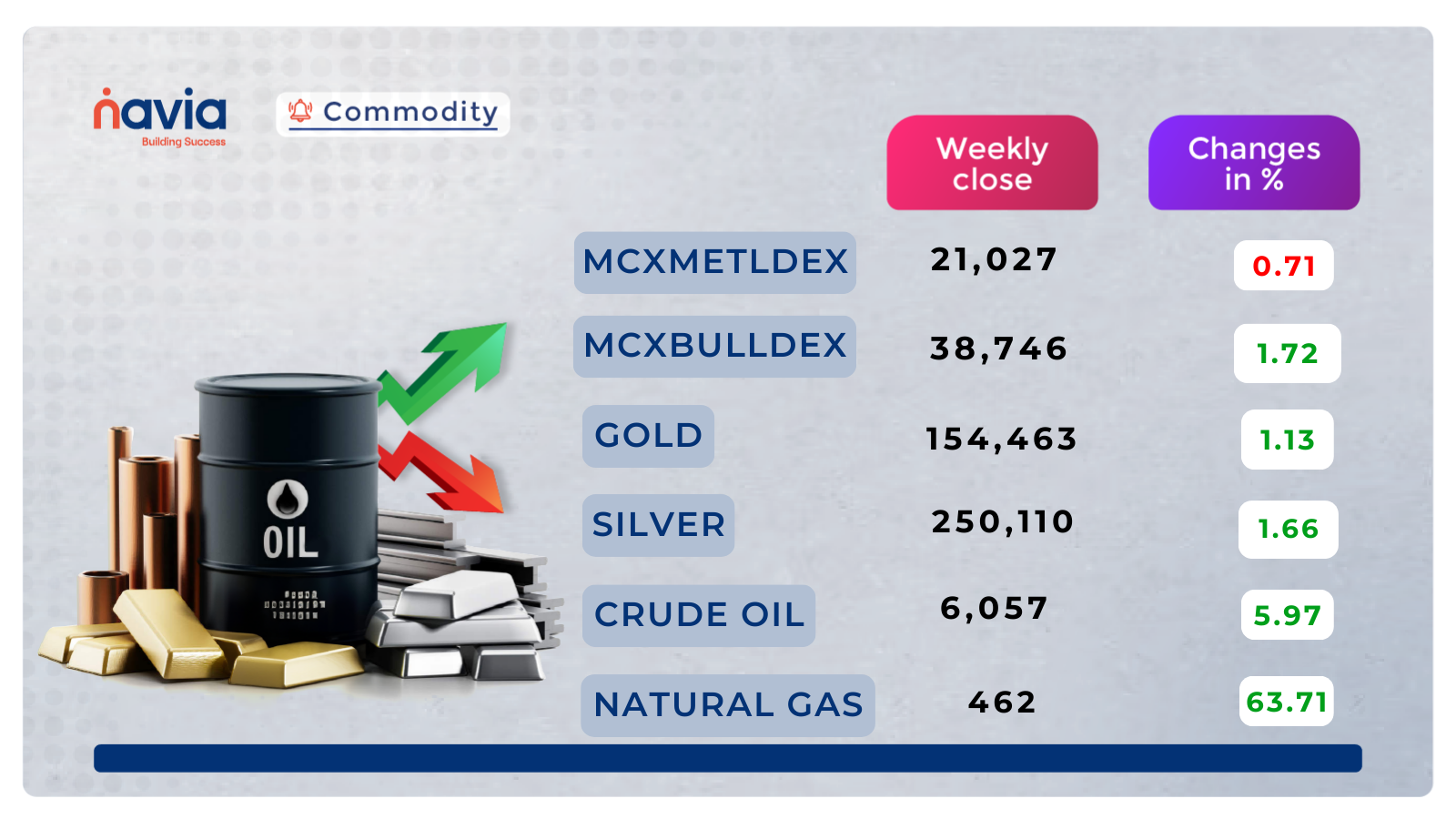

Commodity Corner

Crude Oil has delivered a strong upside recovery from the 5600 support base and is now testing the major resistance zone near 6030. The broader structure still reflects higher highs and higher lows within an ascending channel, and price has reclaimed 5890 decisively. However, 6030 remains a critical supply barrier; a clean breakout above this level can trigger fresh momentum toward the upper channel extension. Failure to sustain above 5890 after this retest could result in a pullback toward 5600. Overall bias remains bullish above 5890, but breakout confirmation above 6030 is crucial for continuation.

Gold remains trapped inside a broad consolidation band between 159464 resistance and 151960 support. The contract has repeatedly failed to sustain above 159464, forming short-term lower highs, while 151960 continues to act as a strong demand base. Current price action around 154700 reflects range-bound movement with no decisive breakout yet. A sustained move above 159464 would shift momentum bullish toward 166437, whereas a breakdown below 151960 could trigger fresh downside pressure toward the 145000–140000 demand zone. Until a breakout occurs, bias remains sideways with a slight negative tilt below 159464.

Natural Gas continues to trade under a dominant descending trendline, maintaining a clear lower high–lower low structure. The recent bounce from the 270 zone failed to break above 313 resistance, and price is now hovering just below the 280 pivot band. This area is acting as immediate supply after repeated rejections. As long as the contract sustains below the falling trendline and 313 resistance, the broader bias remains bearish. A decisive breakdown below 270 can extend the decline toward the 255 demand base, while only a strong breakout above 313 would signal structural reversal and short covering.

Silver continues to trade under a dominant descending trendline, maintaining a broader lower high structure after rejection from the 284700 zone. Price recently bounced from the 228000–230000 demand base and is now hovering around 241400, attempting a recovery within a corrective pullback. However, the 266600–268000 resistance band remains a critical supply area. Unless price decisively breaks and sustains above this zone, the broader bias remains bearish. Immediate support is placed around 236000; a breakdown below this area can re-open downside toward the deeper 225000 demand cluster. Trend remains weak below the falling trendline.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Zero Balance Demat Accounts: Your No-Cost Entry to the 2026 Stock Market

In the past, entering the stock market felt like joining an exclusive club, you needed a heavy wallet just to open the door. But in 2026, the Indian brokerage landscape has shifted. If you’ve ever wondered, “Can I open a demat account with zero balance?” the answer is a resounding Yes!

The Art of Trading Pure Price Action

In the modern trading arena of 2026, where algorithms and complex indicators often clutter the screen, a growing movement of traders is returning to the “source”: Price Action.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.