Navia Weekly Roundup (Feb 09 – 13, 2026)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Indian benchmarks indices erased some of the previous week gains and ended the week in the red, led by weak global cues and continued selling in the IT names amid growing concerns over the impact of artificial intelligence.

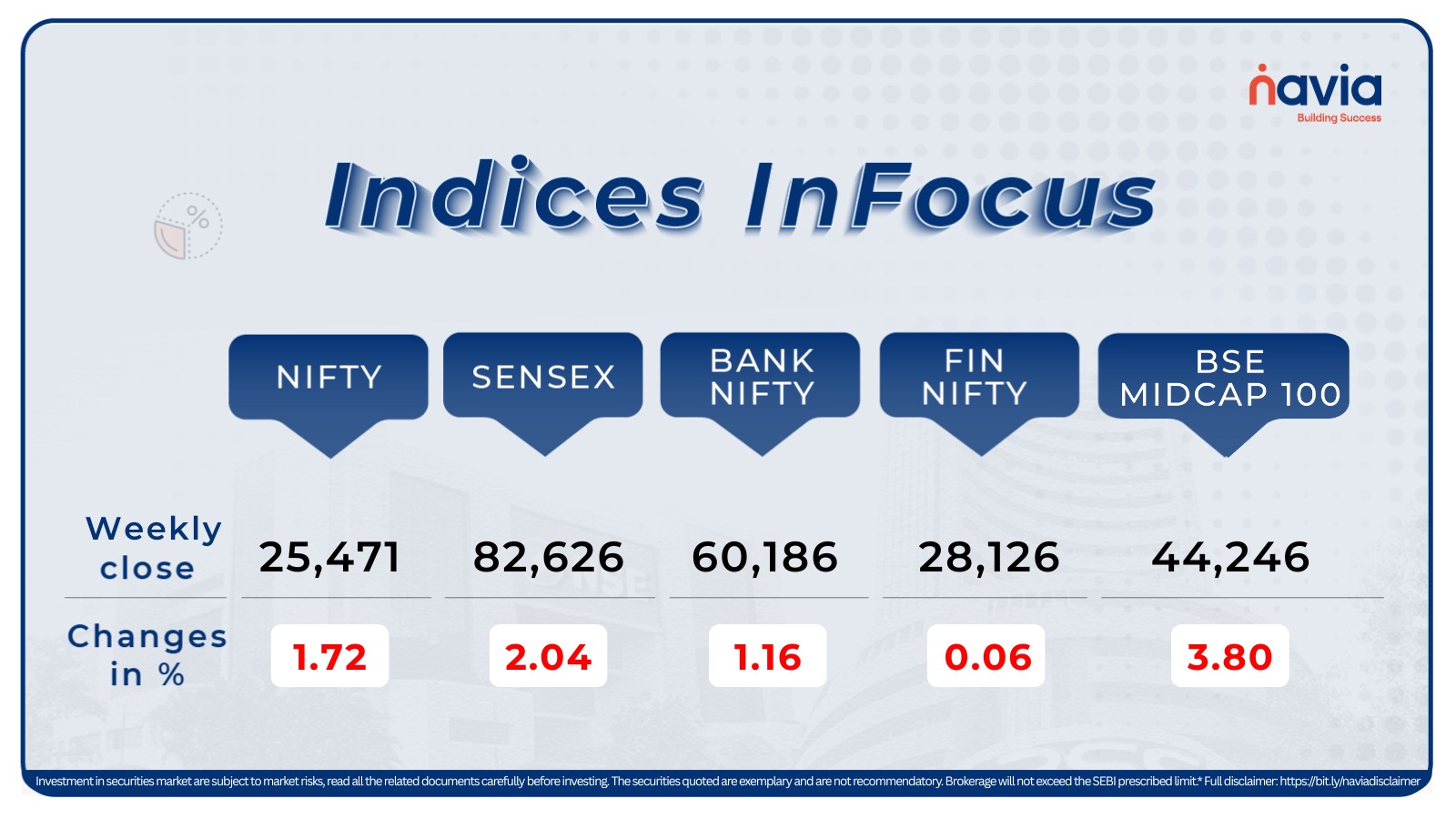

Indices Analysis

In this week, the BSE Sensex declined 2.04 percent, to close at 82,626.76, while the Nifty50 shed 1.72 percent, to end at 25,471.10.

The Nifty Midcap index fell 0.4 percent during the week, dragged by Coforge, KPIT Technologies, LT Technology Services, Hexaware Technologies, Oracle Financial Services Software, Oil India, Tata Elxsi, while gainers included Linde India, Bharat Forge, Kalyan Jewellers India, Crompton Greaves Consumer Electrical, Astral, Tube Investments of India.

The BSE Smallcap index rose 0.8 percent during the week, with JITF Infralogistics, GE Power India, Lincoln Pharmaceuticals, Avanti Feeds, Blue Cloud Softech Solutions, TVS Supply Chain Solutions, Axiscades Technologies,Sika Interplant Systems, SML Mahindra, Lumax Industries adding between 25-46 percent, while SpiceJet, Ecos India Mobility & Hospitality, Safari Industries (India), Jyoti Resins and Adhesives, CarTrade Tech,Ceinsys Tech, Pearl Global Industries, HLE Glascoat, Foods and Inns, Reliance Infrastructure, Mastek losing between 13-23 percent.

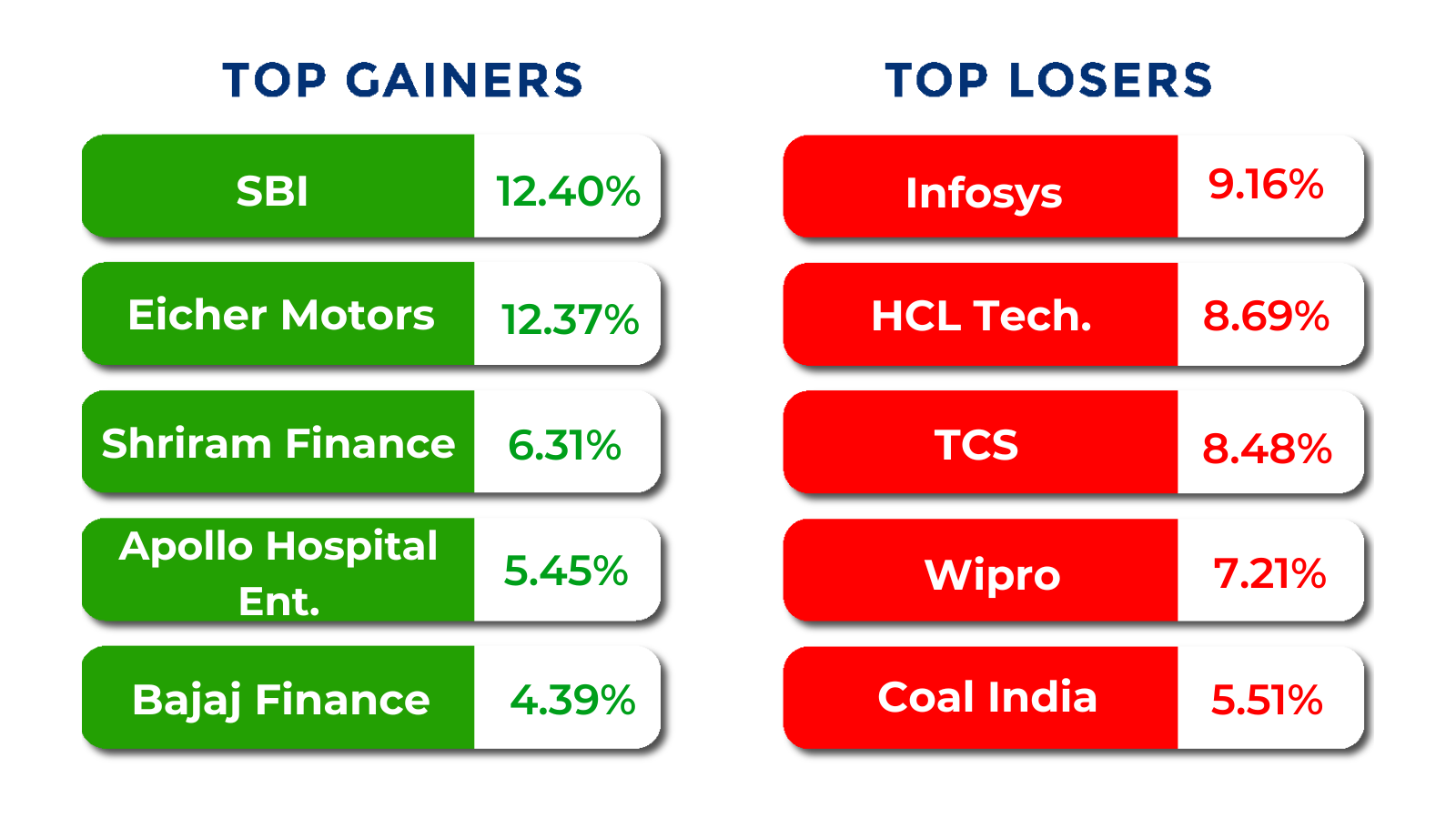

The BSE Largecap index shed 0.6 percent during the week, dragged by Infosys, HCL Technologies, Tata Consultancy Services, Adani Power, LTIMindtree,Wipro, REC, DLF, Coal India, Tech Mahindra, while gainers were State Bank of India, Eicher Motors, Samvardhana Motherson International,Lenskart Solutions,Shriram Finance, Tata Motors, Swiggy, Apollo Hospitals Enterprises, Indus Towers.

Foreign Institutional Investors (FIIs) turned net sellers during the week after offloading equities in Friday’s session, reversing their buying trend seen in the first four trading sessions. Overall, FIIs sold equities worth Rs 4,019.09 crore during the week. In contrast, Domestic Institutional Investors (DIIs) extended support to the market, with net purchases of Rs 6,883.81 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

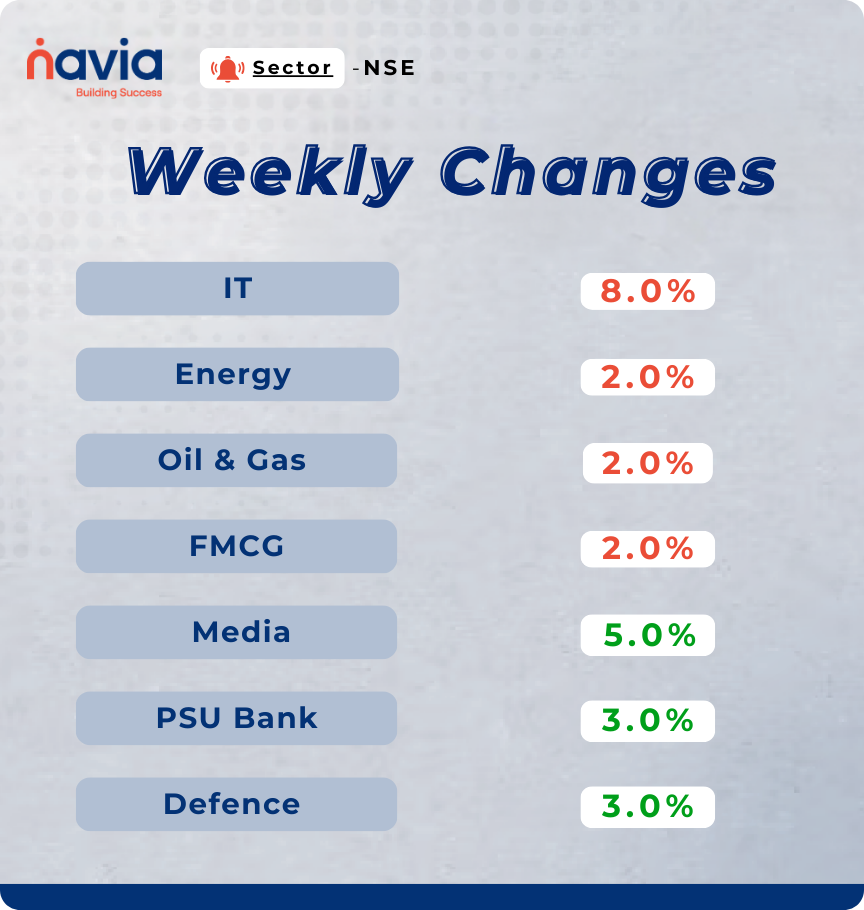

Sector Spotlight

Sectoral performance remained mixed during the week, with heavy selling seen in technology stocks. The Nifty IT index declined more than 8 percent, Nifty Energy and Oil & Gas indices fell around 2 percent each, while the Nifty FMCG index slipped nearly 2 percent. On the other side, the Nifty Media index surged 5 percent, Nifty PSU Bank, and Defence indices advanced roughly 3 percent each.

Top Gainers and Losers

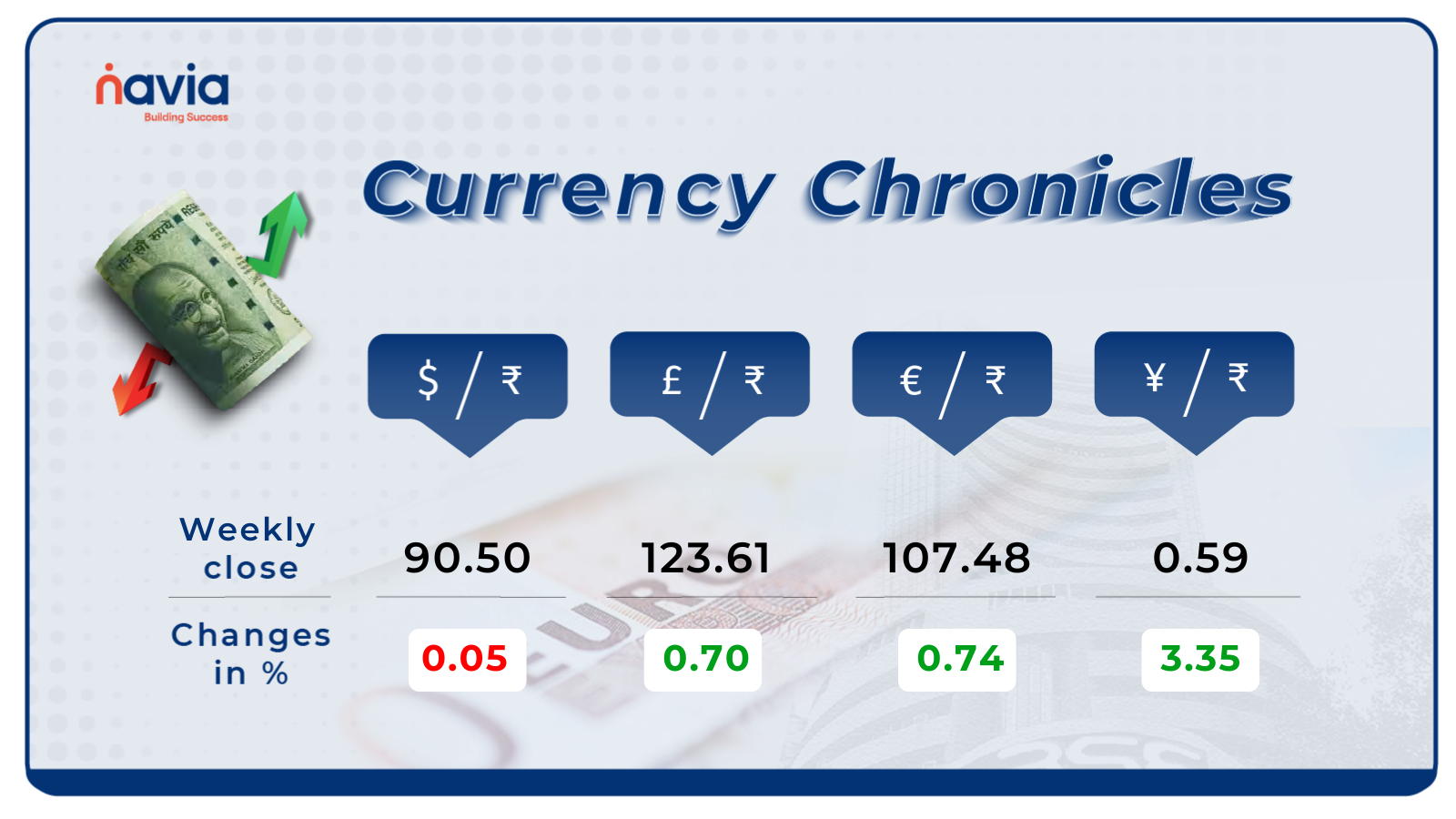

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹90.50 per dollar, losing 0.05% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹107.48 per euro, gaining 0.74% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining 3.35% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

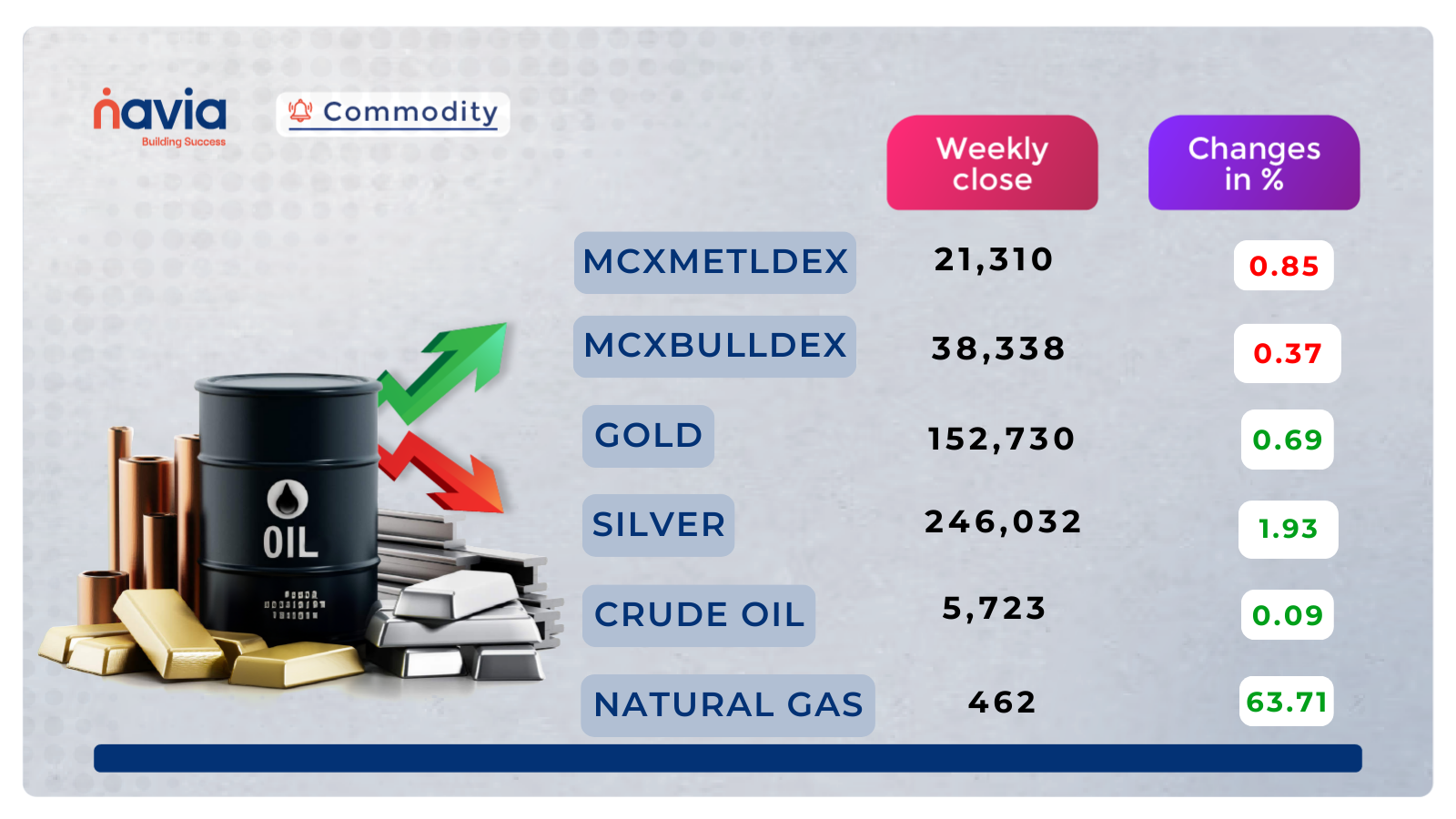

Commodity Corner

Crude Oil last session close at 5,723. The structure shows a rejection from the upper boundary of the rising channel followed by strong bearish momentum, indicating distribution at higher levels. Price is currently hovering near the 5,680–5,700 zone, and sustained trading below 5,700 keeps short-term bias negative. If selling pressure continues, the market is likely to test the horizontal demand base near 5,600, and a breakdown below that could accelerate further downside. Only a recovery above 5,890 would negate immediate bearish pressure and re-open the path toward the upper supply zone.

Gold Futures last session close at 152,730. Price has failed to sustain above the mid-range resistance and is now approaching the 151,960 support area. The broader structure shows lower highs forming after the major rejection from 175,817, indicating short-term distribution. Momentum has shifted negative, and unless price reclaims 159,464 decisively, downside pressure may extend toward the demand cluster around 145,000–140,000.

Natural Gas last session close at 462, indicating sustained bearish control on the higher time frame. After the sharp breakdown from the 410–420 rejection zone, price formed a lower high and resumed its decline, confirming continuation of the downtrend. Currently trading near 293, the structure reflects weak pullbacks and compression near immediate support. The zone around 280 remains a critical demand base; a decisive breakdown below this level could extend the decline toward the lower structural support near 255. On the upside, only a sustained breakout and close above the descending trendline would signal short-covering and shift short-term momentum positive. Until then, rallies are likely to face selling pressure.

Silver Futures last session close at 246,032. The structure confirms a lower high formation below 284,709 after a strong rejection from 408,765, indicating a clear shift from bullish channel to distribution phase. The trendline breakdown and inability to sustain above 266k reflect persistent selling pressure. As long as price trades below 266,683, the bias remains negative, with downside extension possible toward the broader demand band near 230,000–220,000.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

The Demat Guard: Why the New SEBI App Mandate is a Win for You

SEBI now mandates that brokers promote official depository apps: CDSL’s MyEasi and NSDL’s Speede, to ensure you have a secure, broker-independent “single source of truth” for your holdings.

Global Wealth, Local Rules: Mastering NRI Equity Tax in 2026

Investing in the Indian growth story is more accessible than ever for the 35-million-strong diaspora, but 2026’s new regulatory landscape demands a sharper eye on tax efficiency.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.