Navia Weekly Roundup ( Feb 03 – 07, 2025)

Week in the Review

The Indian equity market extended the gains in the second consecutive week ended February 7 amid volatility led by uncertain tariff policies by the US President Trump, mixed corporate earnings and as expected 25 bps rate cut by the RBI.

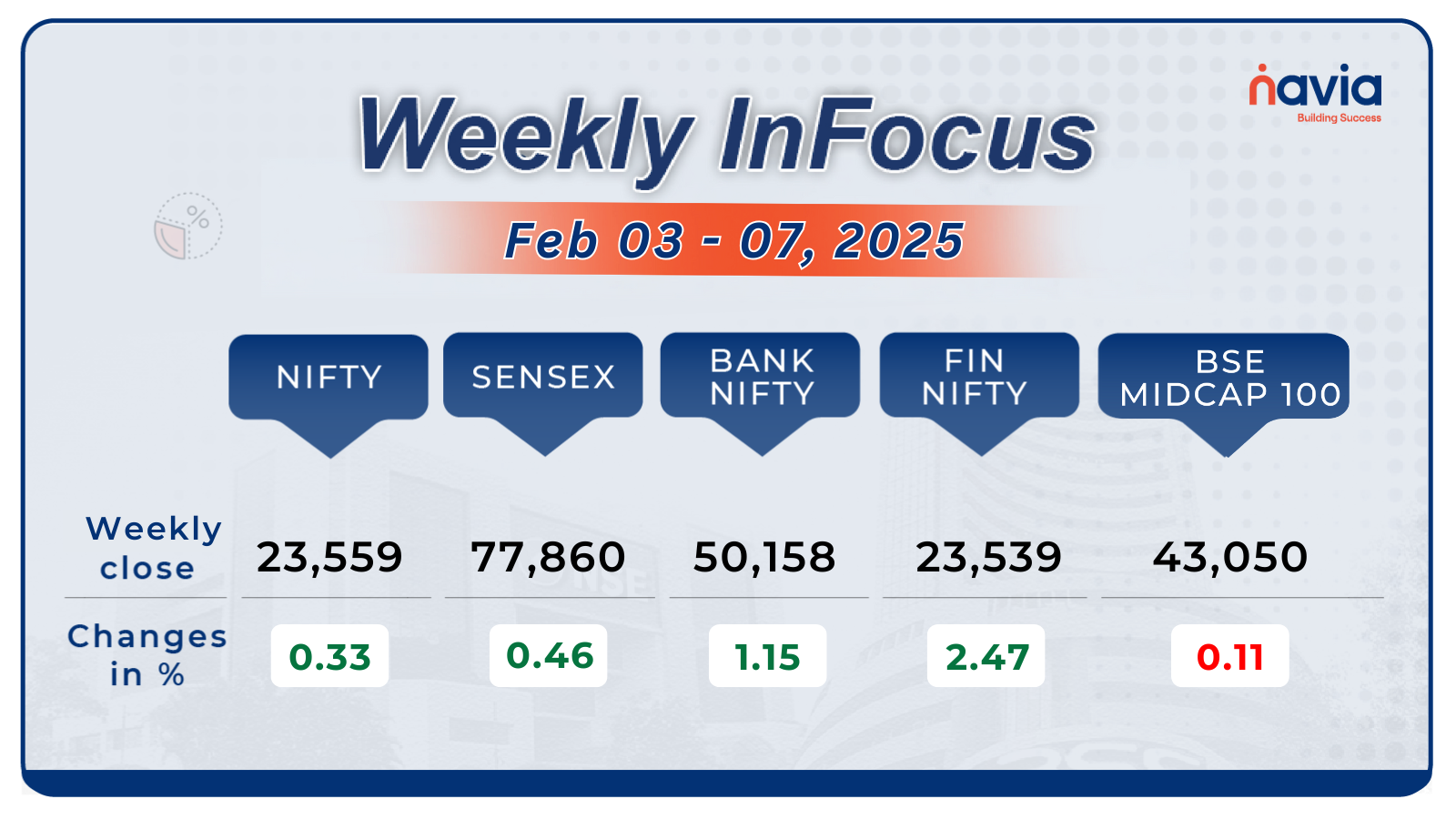

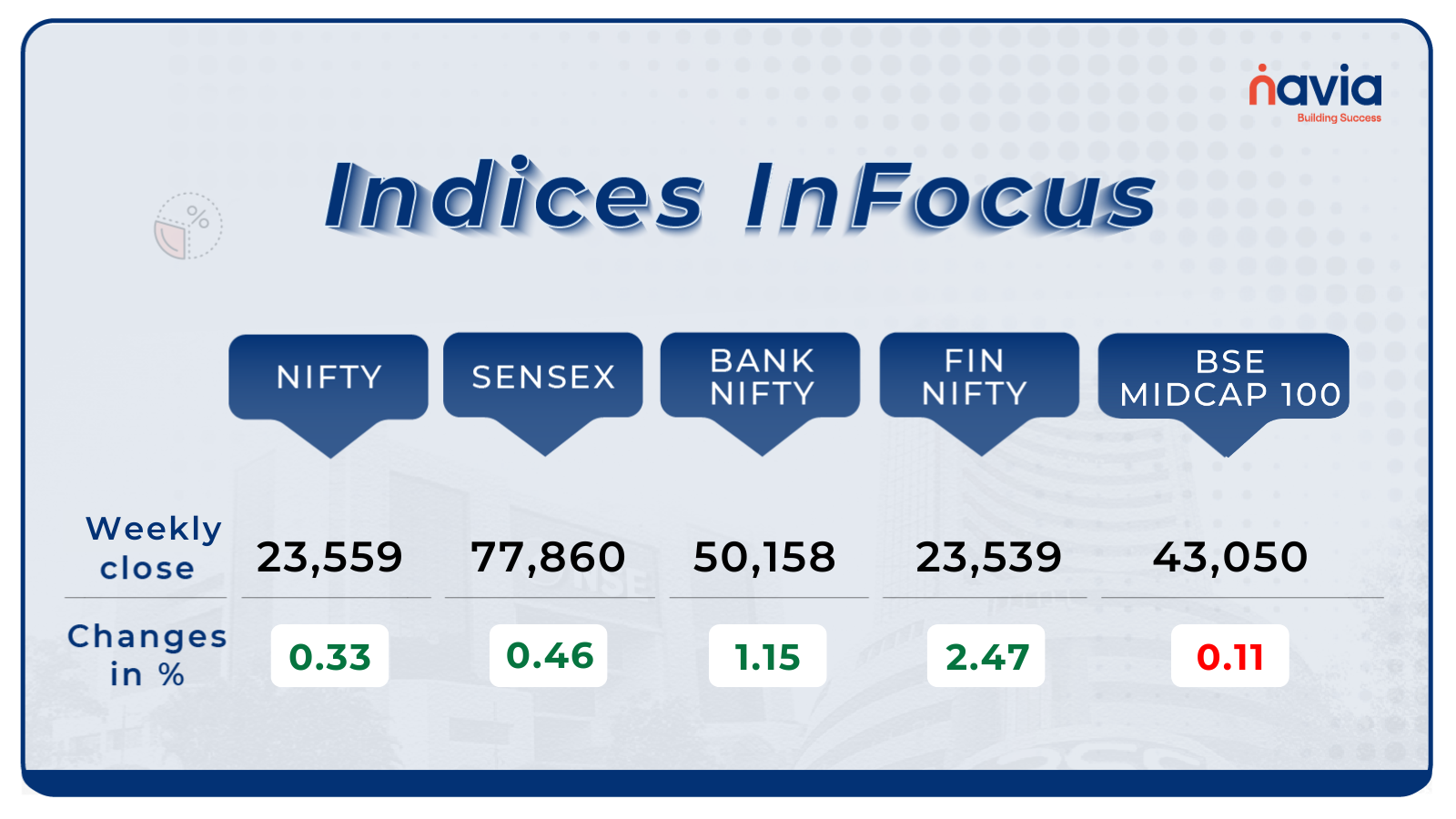

Indices Analysis

This week, BSE Sensex added 354.23 points or 0.46 percent to finish at 77,860.19, while the Nifty50 index rose 77.8 points or 0.33 percent to close at 23,559.95.

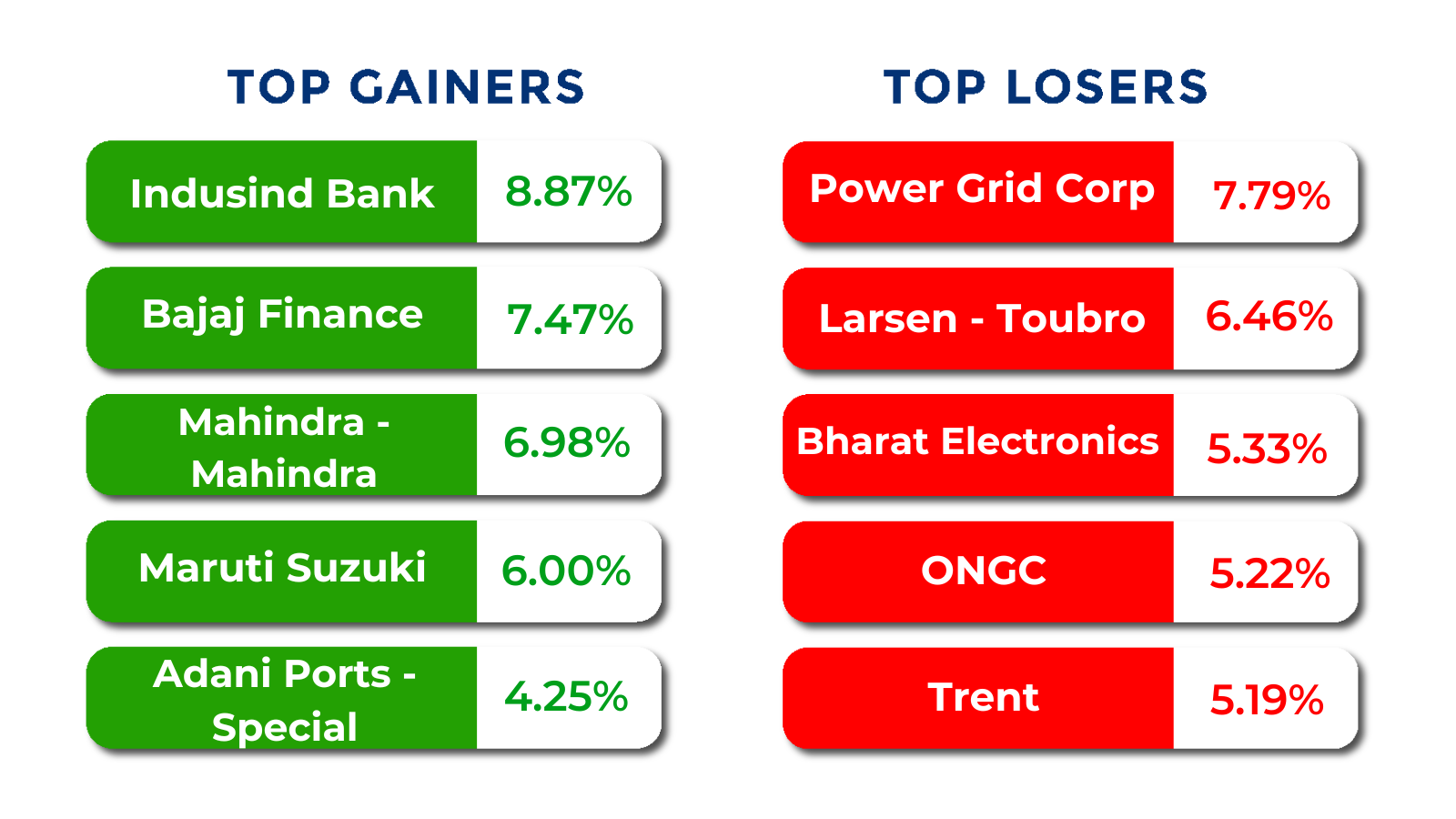

The BSE Large-cap Index rose 0.3 percent with Divis Laboratories, Cholamandalam Investment, Jindal Steel & Power, IndusInd Bank, Bajaj Finance, Adani Ports, Shriram Finance, JSW Steel rising between 5-9 percent, while Trent, Godrej Consumer Products, ITC, Marico, Avenue Supermarts, Britannia Industries, Hindustan Unilever, Indian Railway Finance Corporation fell between 5-11 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

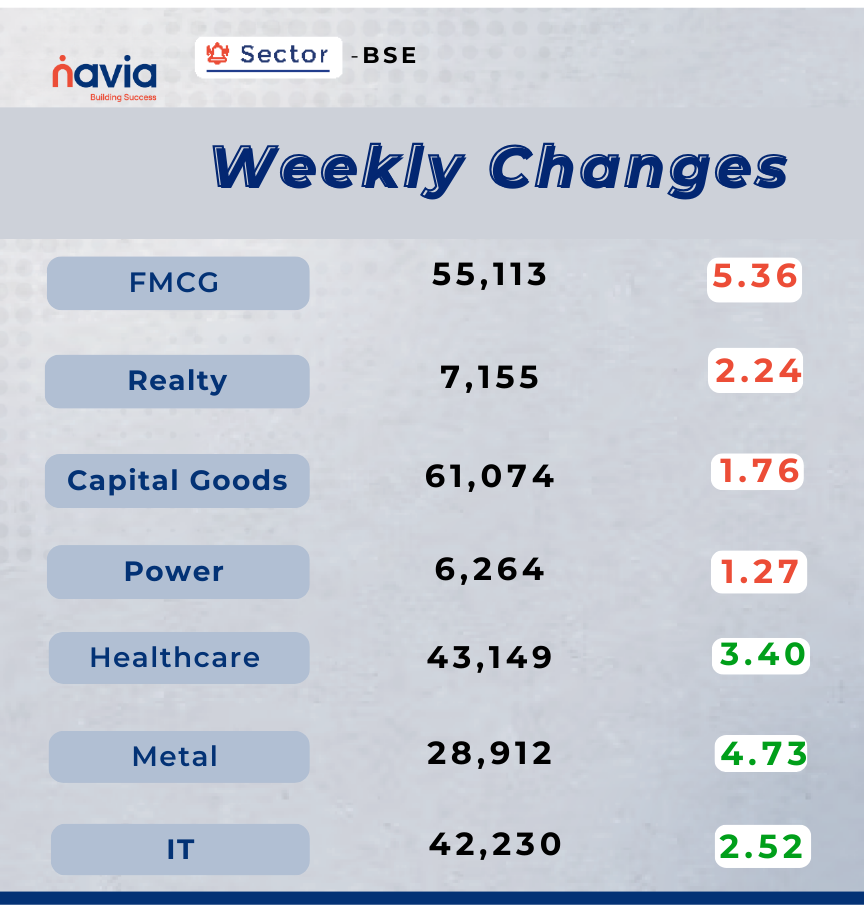

Sector Spotlight

On the sectoral front, BSE FMCG index shed more than 5 percent, BSE Realty Index fell 2.2 percent, BSE Capital Goods index declined nearly 2 percent, BSE Power index fell nearly 1.5 percent. However, BSE Healthcare added 3 percent, BSE Metal index gained nearly 5 percent, BSE Information Technology rose 2.5 percent.

Top Gainers and Losers

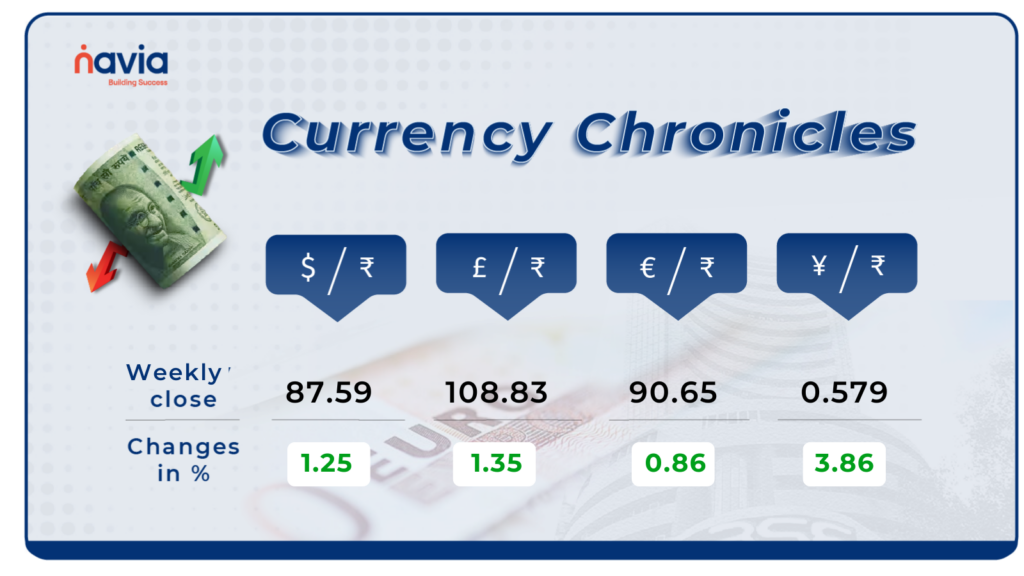

Currency Chronicles

USD/INR:

The India rupee touched fresh record low of 86.70 during the week and closed lower by 64 paise to end at 86.61 per dollar on January 17 against the January 10 closing of 85.97.

EUR/INR:

The euro gained momentum during the week, rising by 0.86% to touch a high of 90.65. It closed higher, reflecting continued strength in the EUR/INR market.

JPY/INR:

The Japanese yen faced a sharp decline this week, dropping by 3.86% to close at 0.579. Sentiment in the JPY/INR market remains bearish, reflecting significant pressure on the yen.

Stay tuned for more currency insights next week!

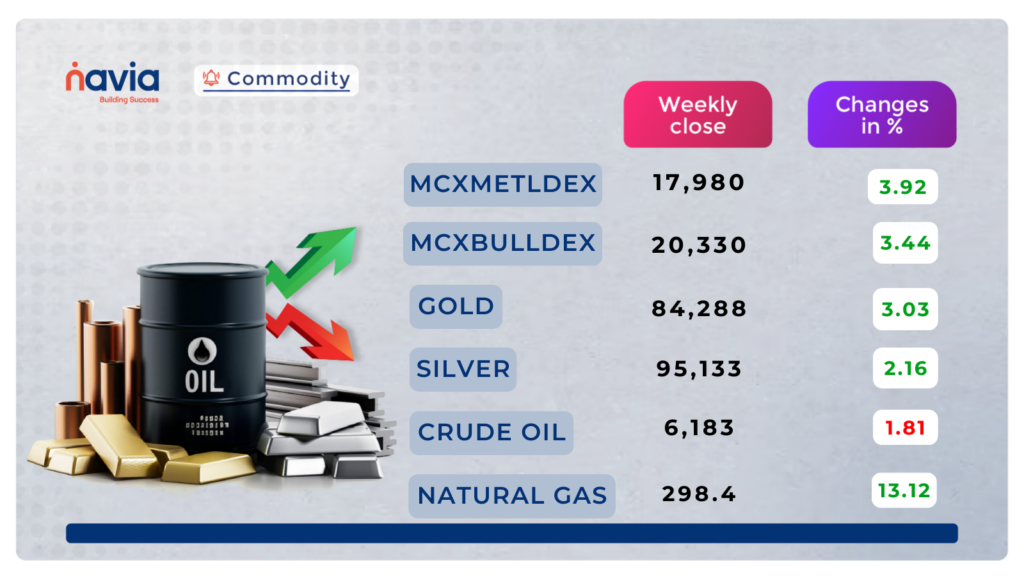

Commodity Corner

Crude oil is trading in a broadening descending wedge pattern on the 3-hour chart. The last session closed down by 20 points at 6,183. Technically, a strong close above the 6,495–6,510 range could push crude prices higher; otherwise, it may create negative sentiment. The broadening channel resistance is placed at 6,440–6,460. Intraday momentum can be expected above 6,250, while support lies below 6,190.

Crude oil prices are influenced by China’s retaliatory tariffs on U.S. crude, increased U.S. inventory levels, renewed U.S. sanctions on Iran, and shifts in U.S. refinery crude mix, leading to price volatility.

Gold consolidated in the last session, closing at 84,288, down by 123 points, nearing the resistance of the ascending channel.

Technically, gold has given a breakout from its ascending channel around the 82,900–83,000 range. Another strong resistance is placed at 85,100–85,200, the resistance range of a secondary ascending channel. Intraday momentum can be expected above 84,850 and below 84,150.

Gold prices are driven by record highs, central bank buying, geopolitical tensions, and investor demand as a hedge against inflation and economic uncertainty.

Natural gas is trading in an ascending channel on the 30-minute chart, respecting its support and resistance levels. A breakout is expected above the 304–305 range, while a downside move is likely below the 282–281 range. The last session closed up by 10 points at 298.4.

Prices are influenced by rising U.S. storage withdrawals, geopolitical tensions affecting LNG exports, and potential supply disruptions in Australia and Colombia, which may lead to price volatility.

Silver has been trading in a broken ascending channel, and the last session closed after retesting the breakout level, ending 377 points lower at 95,133. Silver needs to sustain above 96,400 to confirm a further uptrend. A fall below 94,700 could add negative sentiment, while a breakout above 96,400 could provide a buying opportunity.

The price movement is driven by global trade uncertainties, dovish central bank signals, and strong U.S. manufacturing data, which impact silver’s industrial demand and safe-haven appeal.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Budget 2025: Big Tax Savings! See How Much You Can Save Under the New Slabs

Big tax savings are here! Budget 2025 has revamped the income tax slabs, offering major relief to taxpayers. Read on to see how much you can save under the new structure!

Does a SIP Top-Up Make Sense, and Who Should Consider It?

Should you increase your SIP contributions over time? A SIP Top-Up helps you invest more as your income grows, accelerating wealth creation. Find out how this strategy boosts discipline and achieves financial goals faster

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?