Navia Weekly Roundup (Feb 01 – 06, 2026)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

In the extended Budget week, Indian equity indices managed to extend gains for a second consecutive week, led by continued DII support, FIIs turning buyers, the announcement of a US-India trade agreement, and an in-line RBI policy outcome. However, rising US–Iran tensions and underperformance in IT stocks weighed on investor sentiment.

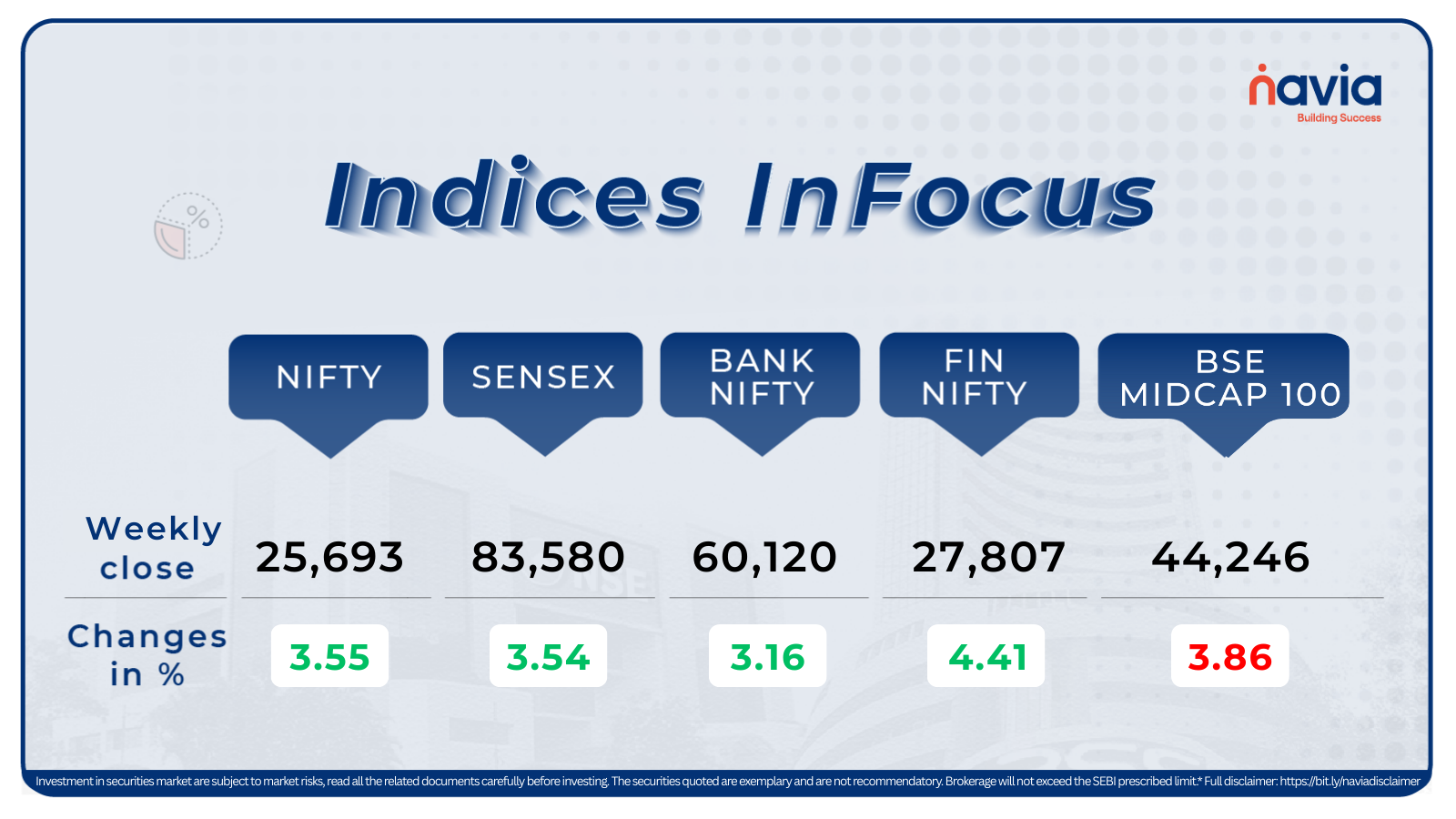

Indices Analysis

During the week, the BSE Sensex rose 3.54 percent, to close at 83,580.40, while the Nifty50 gained 3.55 percent, to settle at 25,693.70.

The Nifty Midcap index gained 1.6 percent during the week, with stocks such as Aarti Industries, Balkrishna Industries, FSN E-Commerce Ventures, Hitachi Energy India, Lloyds Metals and Energy, Gujarat Fluorochemicals, Escorts Kubota, KEI Industries, MRF, Crompton Greaves Consumer Electrical, Premier Energies, Whirlpool of India, Bharti Hexacom, and Dixon Technologies rising between 10–18 percent. However, Bharat Dynamics, Hexaware Technologies, Cochin Shipyard, PB Fintech, Rail Vikas Nigam, and KPIT Technologies were among the major losers.

The BSE Smallcap index gained 1.2 percent during the week, with stocks such as VTM, Gokaldas Exports, Garware Hi-Tech Films, Faze Three, United Foodbrands, Pokarna, Nelcast, Kabra Extrusion Technik, Avanti Feeds, ADF Foods Industries, Indo Count Industries, Sterlite Technologies, Sindhu Trade Links, GNA Axles, Quality Power Electrical Equipments, Steelcast, Kitex Garments, Sigachi Industries.

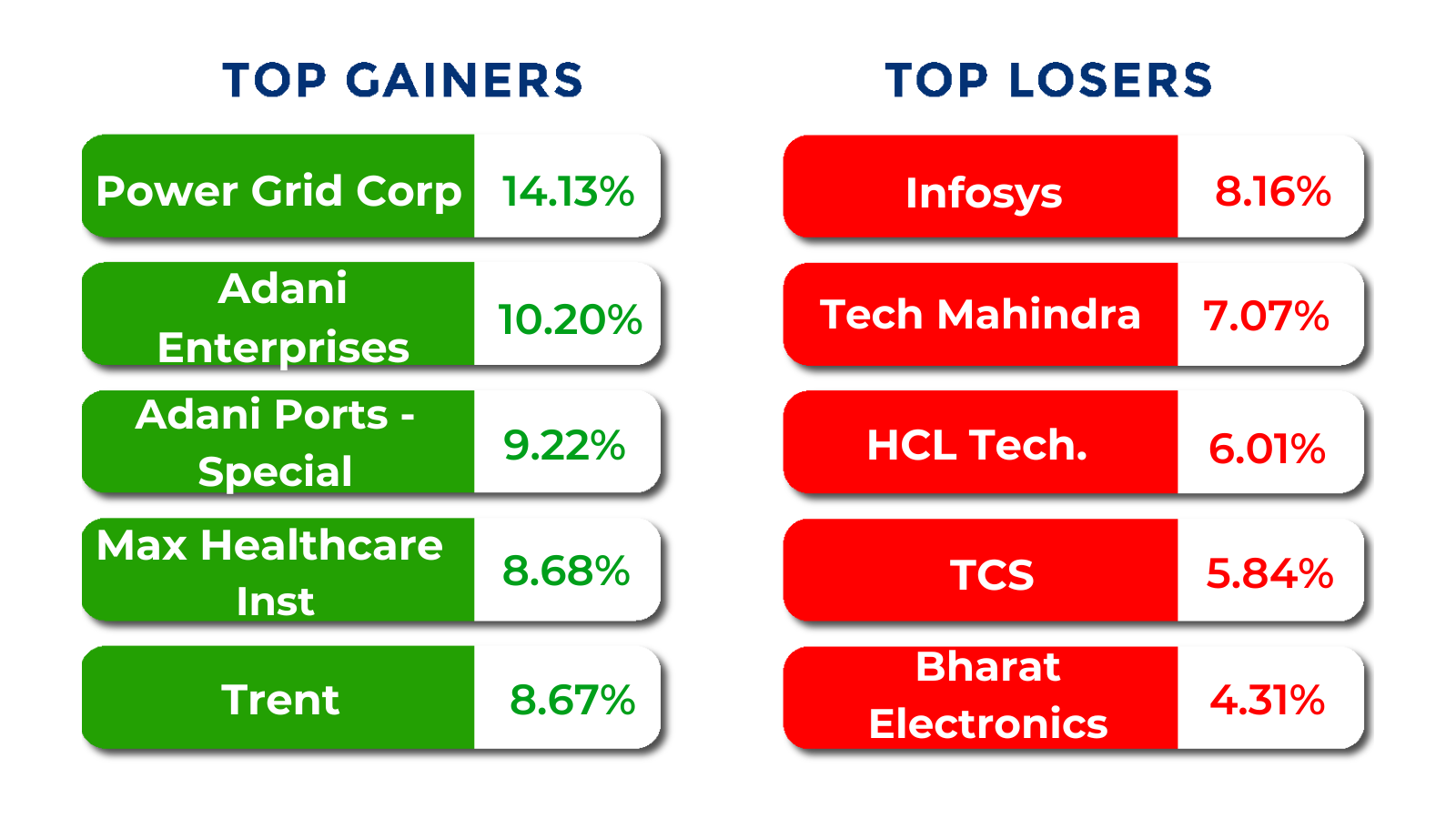

The BSE Largecap index rose 1.6 percent during the week, with CG Power and Industrial Solutions, Power Grid Corporation of India, Adani Green Energy, Adani Energy Solutions, Adani Power, Waaree Energies, Power Finance Corporation, and Adani Enterprises gaining more than 10 percent each. On the downside, stocks such as Hindustan Aeronautics, Meesho, Info Edge India, Infosys, Tech Mahindra, LTIMindtree, Varun Beverages, and Mazagon Dock Shipbuilders were among the key losers.

Foreign Institutional Investors (FIIs) turned net buyers this week, purchasing equities worth ₹2,645.53 crore, while Domestic Institutional Investors (DIIs) continued to lend support to the market with net purchases of ₹2,892.14 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

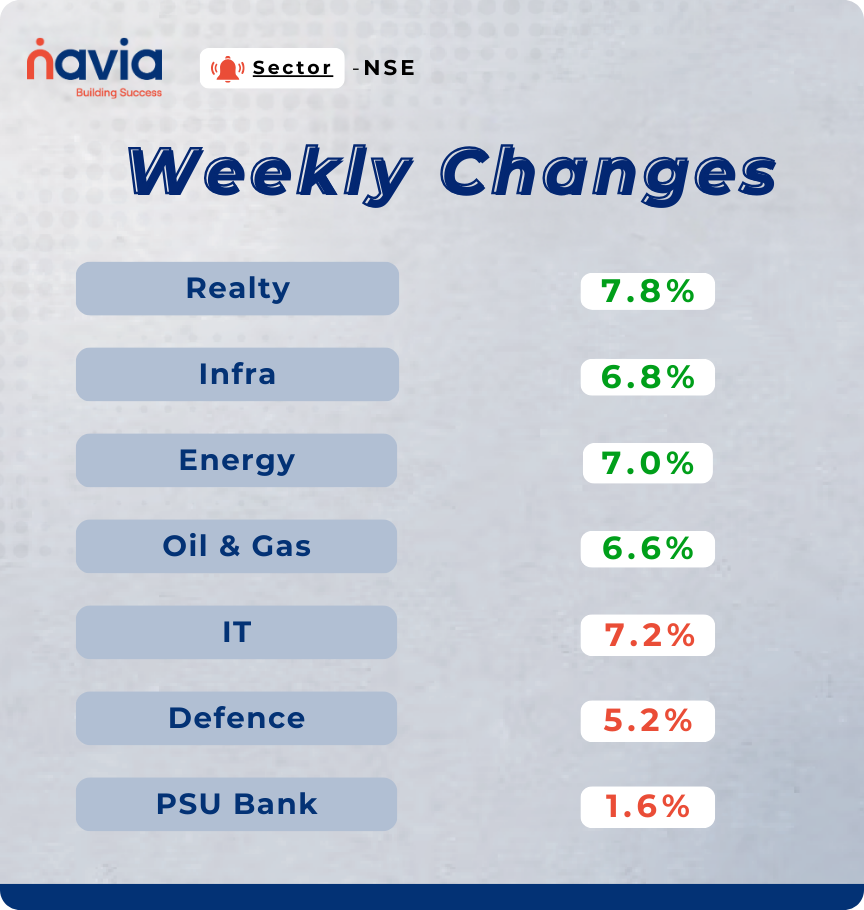

Sector Spotlight

Among sectors, Nifty Realty, Nifty Infra, Nifty Energy, and Nifty Oil & Gas gained between 6 and 7 percent. However, the Nifty IT index shed 7.2 percent, the Nifty Defence index fell 5.2 percent, and the Nifty PSU Bank index declined 1.6 percent.

Top Gainers and Losers

Currency Chronicles

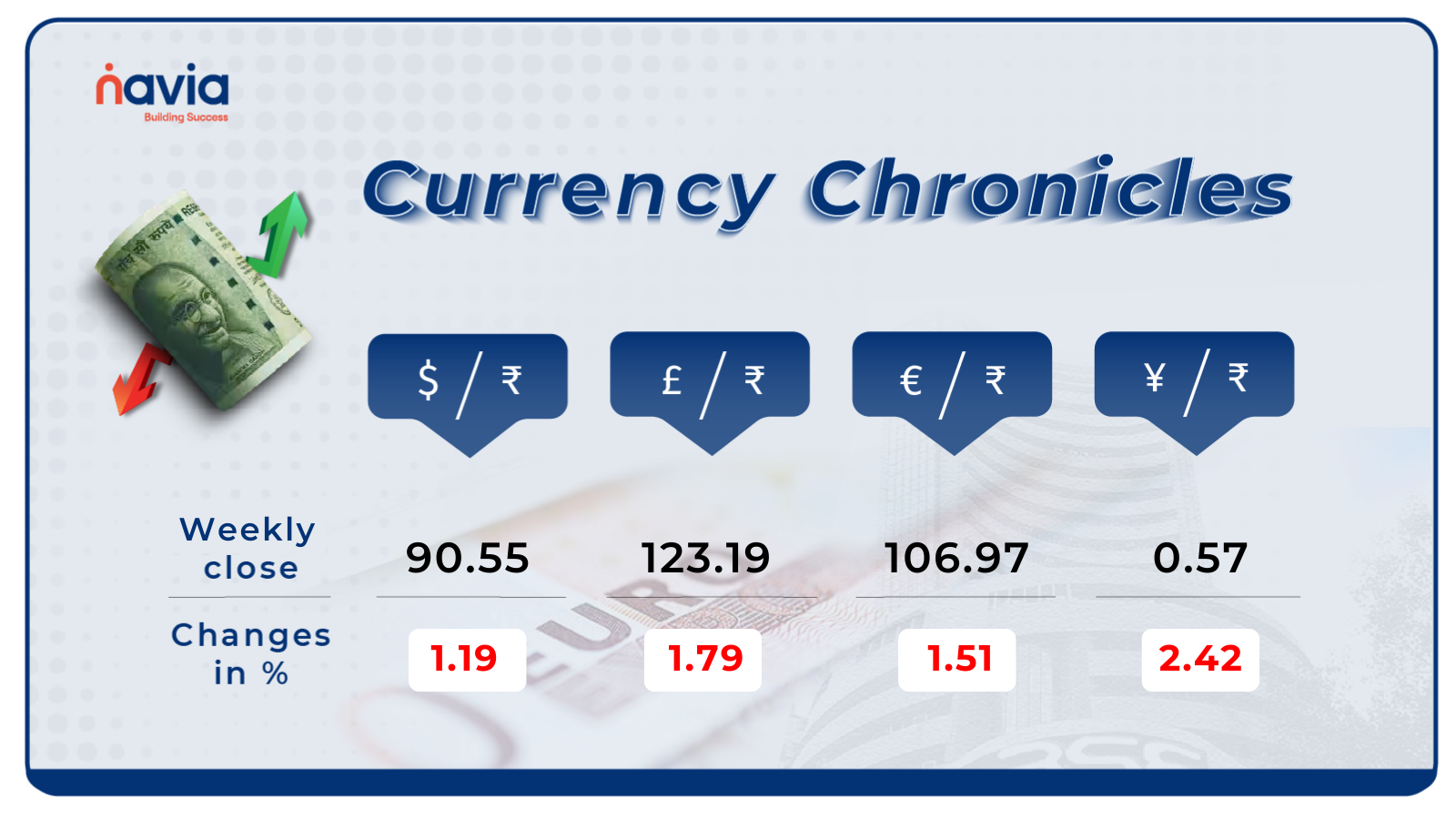

USD/INR:

The USD/INR rate closed at ₹90.55 per dollar, losing 1.19% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹106.97 per euro, losing 1.51% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, losing 2.42% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

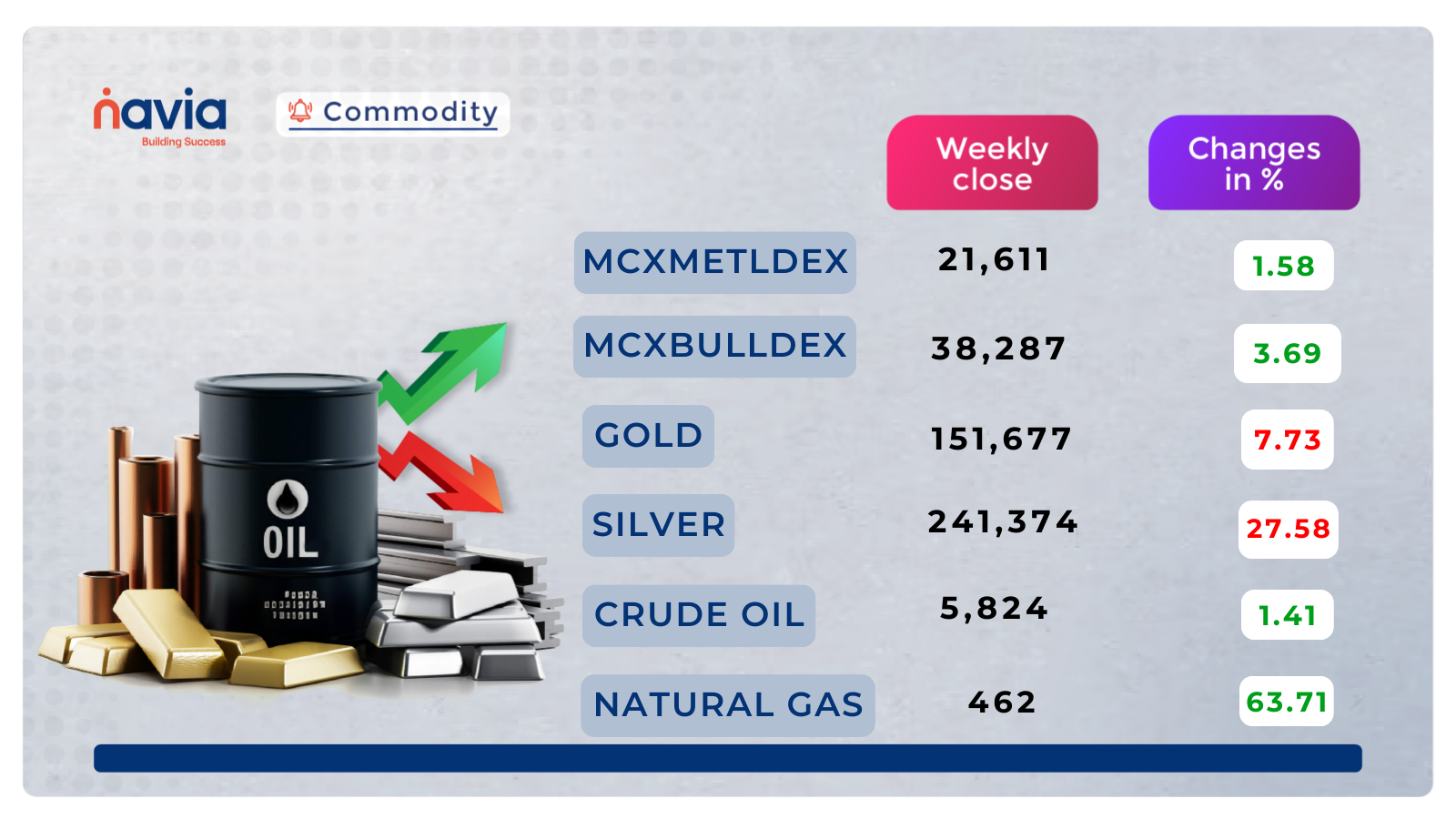

Commodity Corner

Crude Oil Futures continue to trade within a strong ascending channel, maintaining a bullish structure with higher highs and higher lows intact. Price recently faced supply pressure near the 6031 zone, leading to a short-term pullback, but the decline was well absorbed above the 5602 breakout base, indicating healthy retracement rather than trend reversal. The ability to hold above 5602–5533 keeps the broader bullish momentum intact, while the recent rebound toward 5736 signals renewed buying interest. As long as price sustains above the channel support and the 5600 region, the trend bias remains positive, with upside continuation favored after consolidation.Overall bias: Bullish with controlled pullbacks above key support.

Gold Futures are currently consolidating after a sharp corrective decline from the 175817 supply zone. The impulsive sell-off was arrested near the 143000–140000 demand band, from where price staged a technical rebound. However, upside momentum is still capped below the 159464 resistance, indicating that the structure remains corrective rather than trend-resumptive. The price is now oscillating around the 151900–151960 pivot, which is acting as a short-term equilibrium zone. A sustained hold above this level can extend the recovery toward higher resistance clusters, while failure may invite renewed selling pressure back into the demand region. Overall bias: Neutral with recovery attempts above support, bearish on rejection from resistance.

Natural Gas Futures remain in a volatile corrective phase after a sharp vertical rally that exhausted near the 618.7 supply zone. Post-rejection, price has unwound aggressively and is now stabilising around the 313.3–317.5 demand pocket, which is acting as an immediate short-term base. The broader structure shows a completed parabolic move followed by mean reversion, with price now transitioning into a range-bound recovery attempt. As long as 300–313 holds, chances of a technical pullback rally remain open; however, any decisive breakdown below this base can reopen downside continuation toward lower demand zones. Overall bias: Neutral to mildly bearish below resistance, recovery only if demand sustains.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Union Budget 2026: Decoding the Latest Budget Highlights

The Union Budget 2026 stands as a strategic manifesto for an India in transition. Presented in early February 2026, the budget moves away from populist short-termism, focusing instead on infrastructure longevity, fiscal consolidation, and tech-driven governance.

Understanding the Impact of the Union Budget 2026 STT Hike

The Union Budget 2026, presented on February 1, has delivered a decisive “calibrated revision” to the tax structure of the Indian derivatives market.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.