Navia Weekly Roundup ( Dec 30 – Jan 03,2024)

Table of Contents

Week in the Review

The Indian equity market continued the winning run on second consecutive week led by FIIs buying during the week, robust auto sales dat, better GST collections, however, erased some of the weekly gains amid Friday’s sell-off.

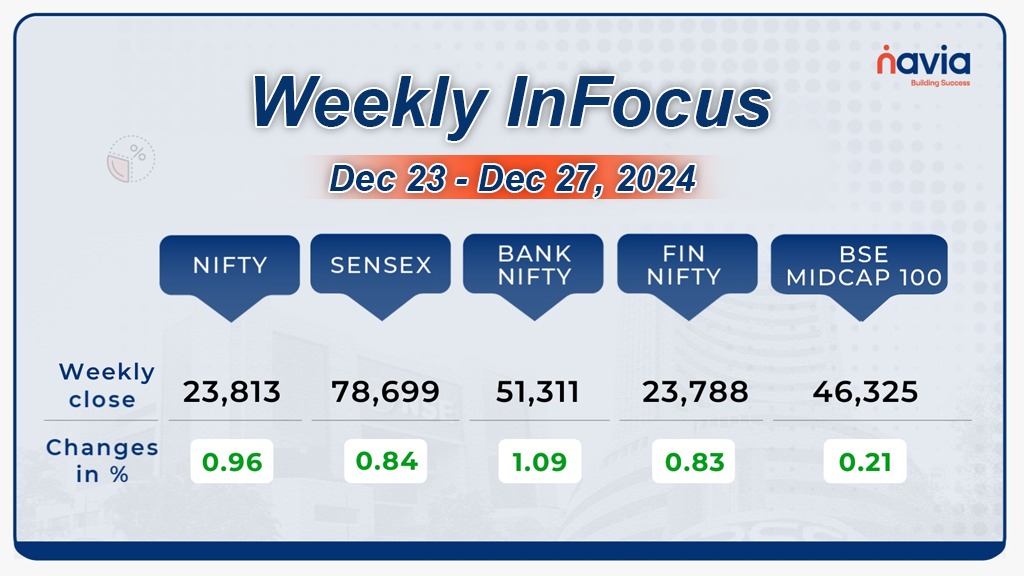

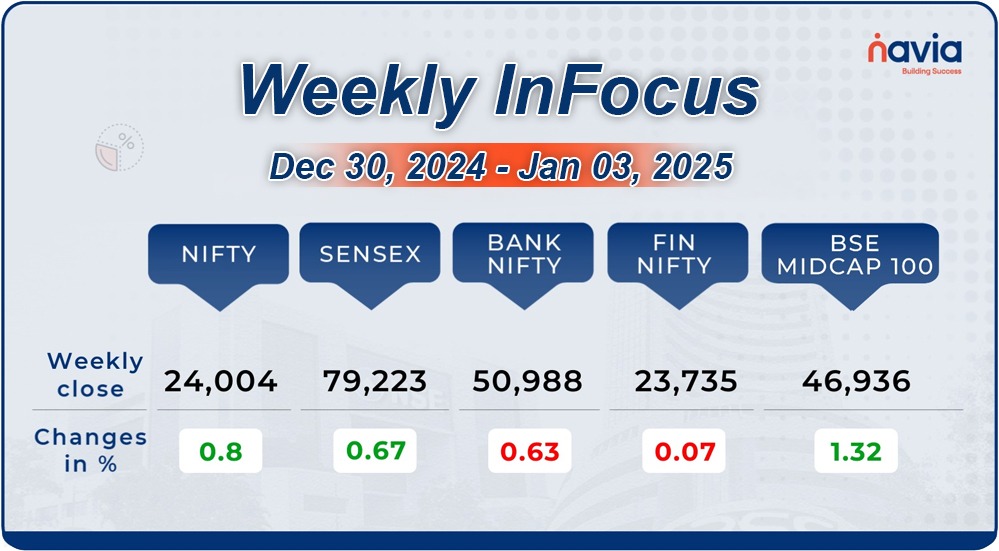

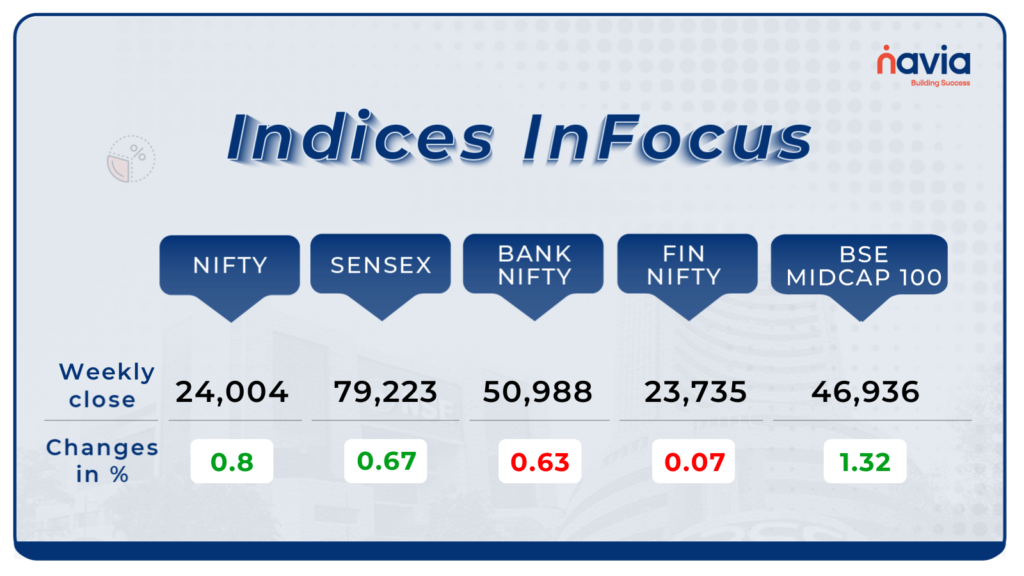

Indices Analysis

This week, BSE Sensex rose 524.04 points or 0.67 percent to close at 79,223.11, while the Nifty50 index added 191.35 points or 0.80 percent to finish at 24,004.75.

BSE Mid-cap Index rose 1.3 percent with Indian Renewable Energy Development Agency, Oil India, Indraprastha Gas, CRISIL, Muthoot Finance, PB Fintech, Kalyan Jewellers India, Voltas, Jubilant Foodworks rising 7-17 percent. However, Jindal Stainless, Crompton Greaves Consumer Electrical, Phoenix Mills, Gujarat Fluorochemicals, Thermax, Ajanta Pharma, Prestige Estates Projects fell between 5-8 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

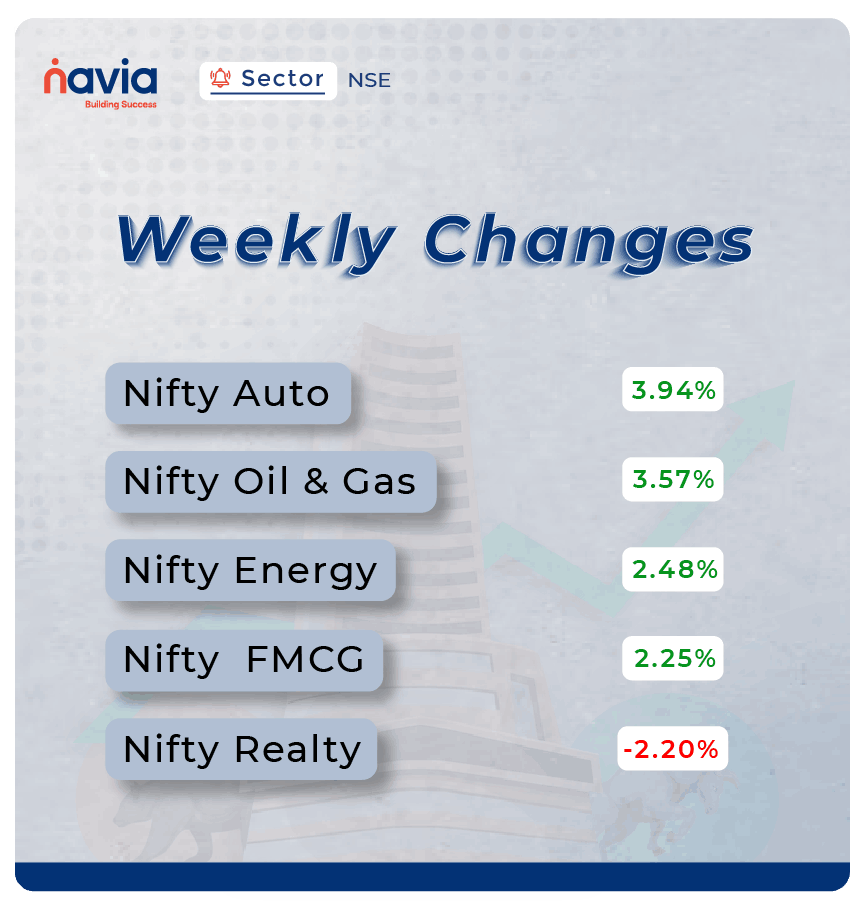

Sector Spotlight

Among sectors, Nifty Auto index surged 4 percent, Nifty Oil & Gas index rose 3.5 percent, while Nifty Energy and FMCG index added nearly 2.5 percent each, while Nifty Realty index shed 2.20 percent.

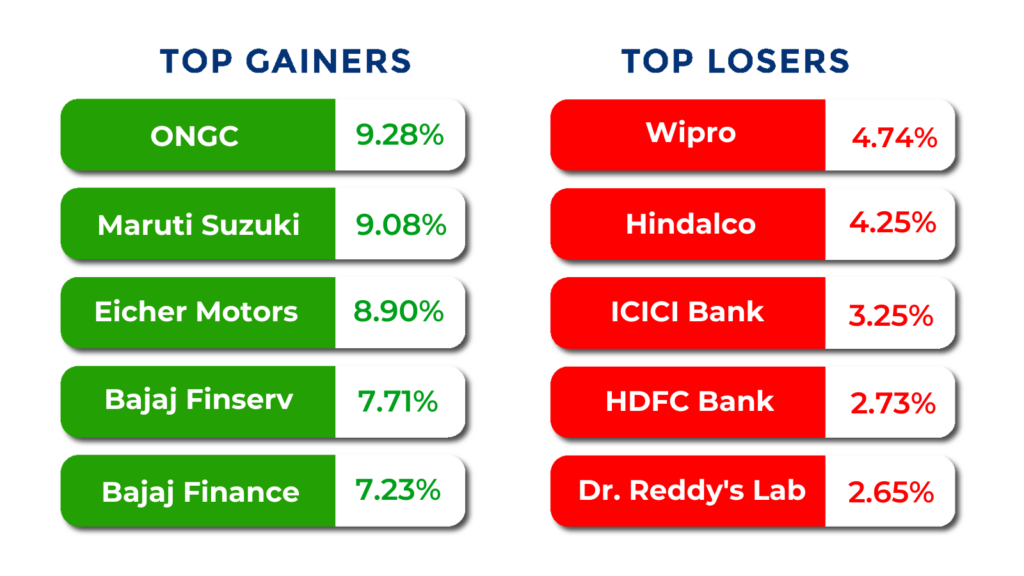

Top Gainers and Losers

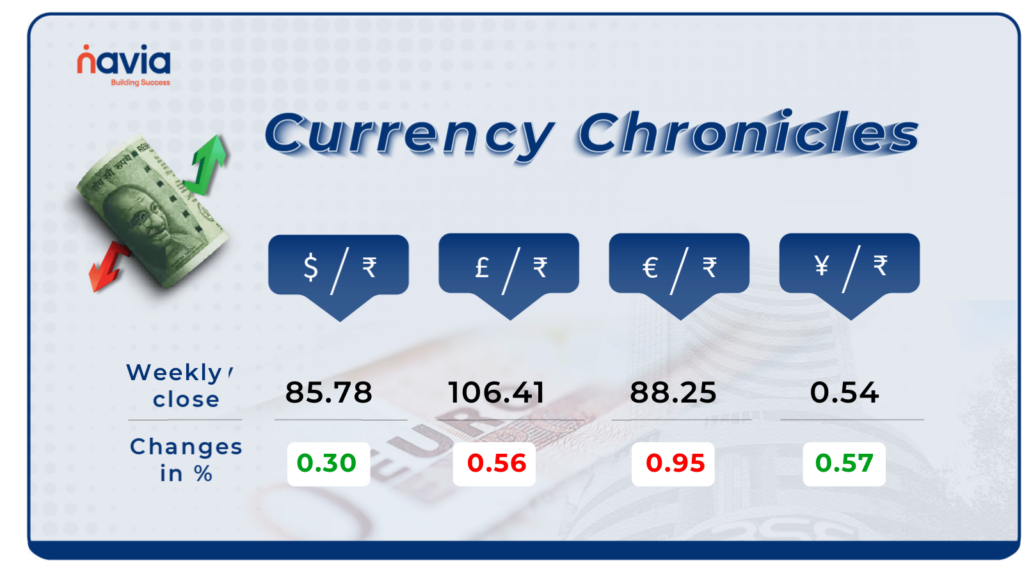

Currency Chronicles

USD/INR:

The rupee’s depreciation persisted this week, with the currency closing 24 paise lower at ₹85.78 per dollar on January 3, compared to ₹85.54 on December 27.

EUR/INR:

The euro faced a decline, dropping by 0.56% for the week to settle at ₹88.25. Sentiment in the EUR/INR market remains bearish, reflecting ongoing pressure on the euro.

JPY/INR:

The Japanese yen gained 0.57% this week, closing at ₹0.5457. Sentiment in the JPY/INR market remains positive, reflecting a slight rebound in the yen.

Stay tuned for more currency insights next week!

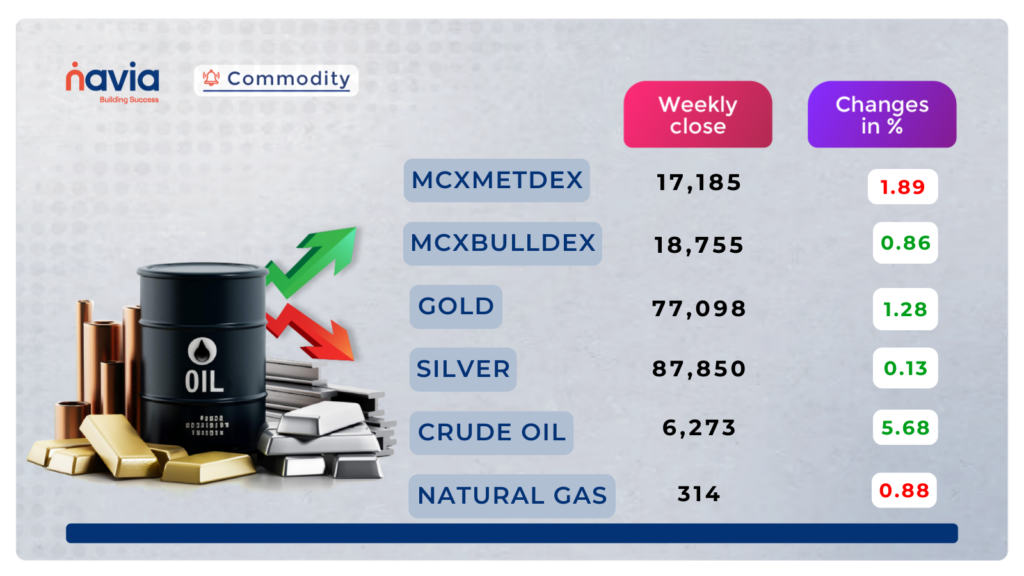

Commodity Corner

Crude oil has been bullish over the last five days, with the last session closing at 6,273, weekly up by 5.68%. The rally is supported by optimism around global economic policies, which are expected to boost fuel demand, alongside increased factory activity in China, indicating higher energy consumption. Geopolitical tensions in the Middle East, particularly in the Red Sea region, have raised supply concerns, further supporting the price movement. Additionally, a surge in natural gas prices has driven increased demand for crude oil as an alternative energy source. Technically, intraday momentum is anticipated above 6,324 for an uptrend and below 6,290 for a potential downside.

Gold is trading in an ascending channel, with the last session closing at 77,098, weekly up by 1.28%. Further upward momentum is expected above 78,220, potentially driving gold towards the 78,700–79,100 range. Levels below 77,800 should also be monitored for potential intraday moves.

Natural gas is trading in an ascending broadening wedge pattern, with the last session closing down by 2.9% at 314. Further momentum can be expected below 311 or above 320.

Silver is currently trading within a descending channel on the 3-hour chart, with the last session closing at 89,850, after gaining 1,595 points. Intraday upside momentum can be expected above 89,570, while a decline below 88,740 could indicate further weakness. In the short term, holding above 90,250 will be crucial for maintaining a sustained positive outlook.

On the demand side, silver continues to experience increasing interest from industrial applications, particularly in renewable energy and electronics, which is likely to provide strong support for prices in the medium term.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Large Cap, Mid Cap, or Small Cap SIP – Which is Better for Long-Term Investing?

Choosing the right SIP—Large Cap, Mid Cap, or Small Cap—can shape your long-term investment journey. Large Cap funds offer stability with consistent returns, Mid Cap funds balance growth and risk, while Small Cap funds promise higher returns but come with greater volatility. Explore this blog to discover which suits your financial goals best!

Crack the Code to Smarter Investing: Unlock Better Risk-Adjusted Returns

Unlock the secrets to smarter investing with our latest blog! Discover how strategic diversification across equity, debt, and gold can maximize returns while reducing risk. From understanding asset correlations to building a robust multi-asset portfolio, this guide will help you navigate market uncertainties with confidence. Read on to crack the code to better risk-adjusted returns!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?