Navia Weekly Roundup ( Dec 23 – Dec 27, 2024)

Week in the Review

After witnessing a biggest weekly fall in more than 2 years in the previous week, the Indian markets made smart recovery to end with a percent gain in the week ended December 27 amid DII support, ignoring mixed global markets and extended FIIs selling.

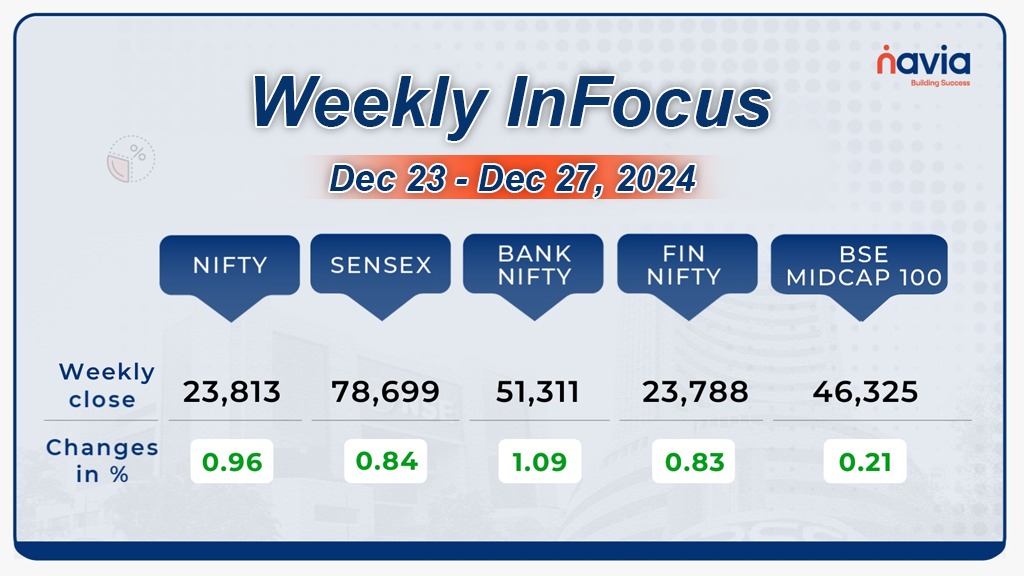

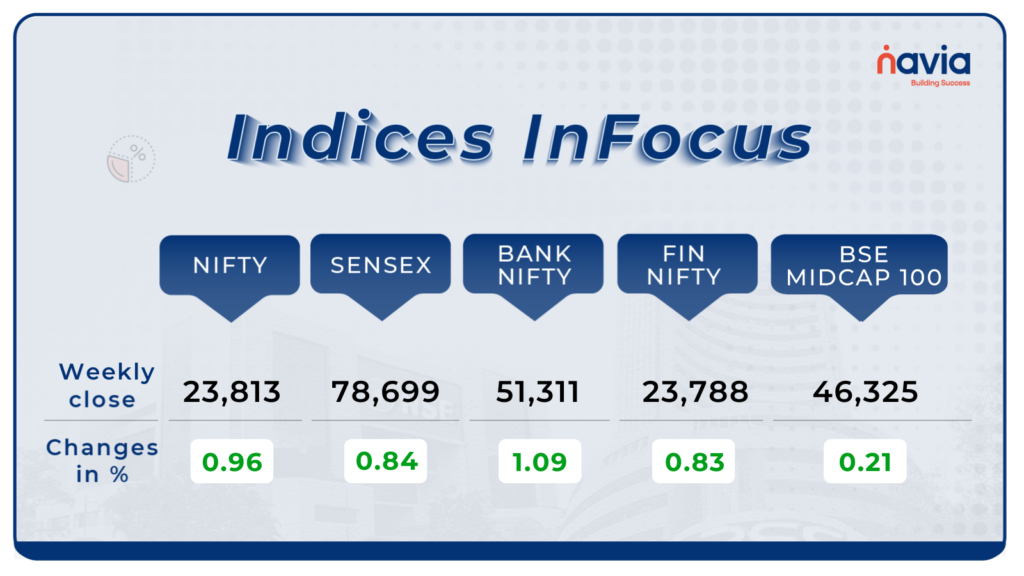

Indices Analysis

This week, BSE Sensex added 657.48 points or 0.84 percent to end at 78,699.07, while the Nifty50 index rose 225.9 points or 0.96 percent to end at 23,813.40.

The BSE Large-cap Index added 0.7 percent led by Interglobe Aviation, Bajaj Holdings & Investment, Adani Energy Solutions, Mahindra and Mahindra, Avenue Supermarts, Trent, Adani Ports and Special Economic Zone. However, losers included JSW Energy, Vedanta, Siemens, Shree Cements, Zomato, ICICI Lombard General Insurance Company, Hindustan Zinc.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

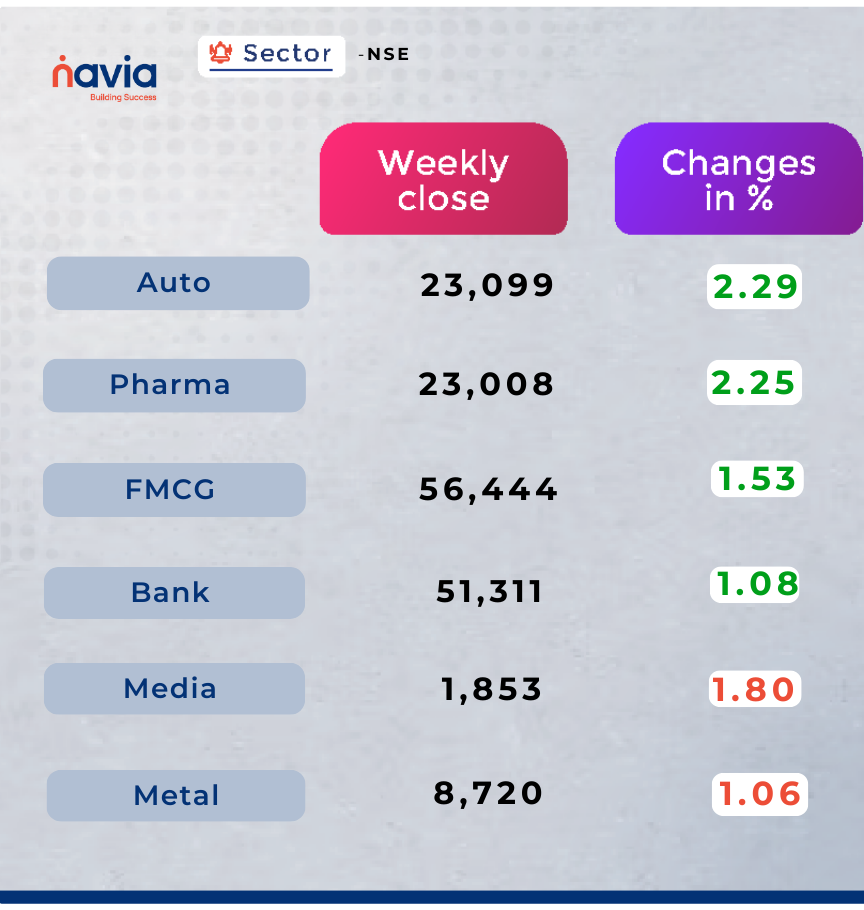

Sector Spotlight

Among sectors, Nifty Auto and Pharma indices rose more than 2 percent each, Nifty FMCG index added 1.5 percent, while Nifty Bank gained 1 percent. On the other hand, Nifty Media index shed nearly 2 percent and Nifty Metal index declined 1 percent.

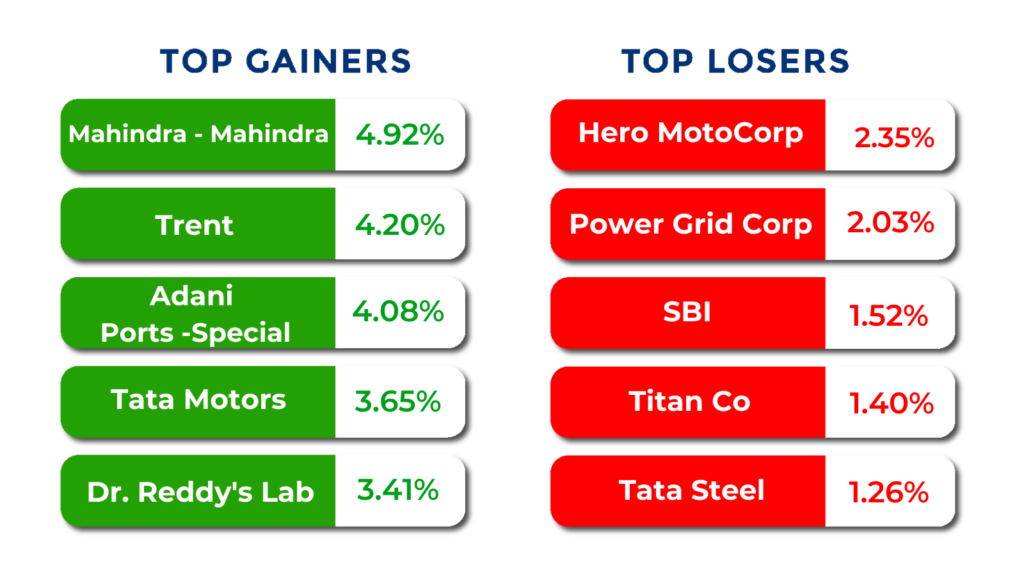

Top Gainers and Losers

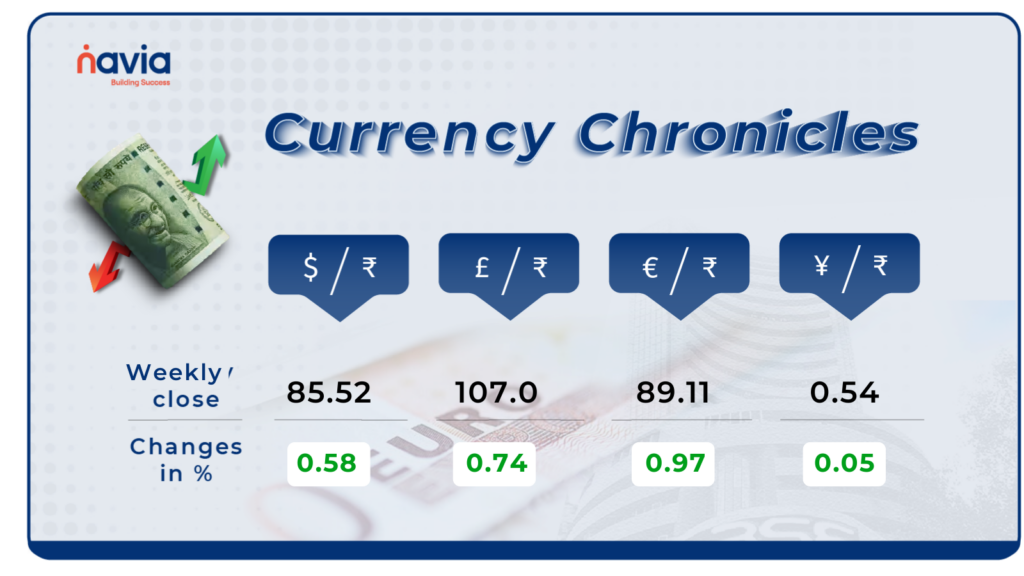

Currency Chronicles

USD/INR:

The Indian rupee depreciated sharply, hitting a fresh record low of ₹85.81 on Friday. It closed at ₹85.52 on December 27, down 52 paise from its December 20 closing of ₹85.02.

EUR/INR:

The euro gained momentum, rising by 0.97% for the week to settle at ₹89.11. Sentiment in the EUR/INR market has turned positive, reflecting renewed support for the euro.

JPY/INR:

The Japanese yen remained steady, edging up by 0.05% to close at ₹0.5426. Sentiment in the JPY/INR market remains neutral, reflecting a balanced outlook for the yen.

Stay tuned for more currency insights next week!

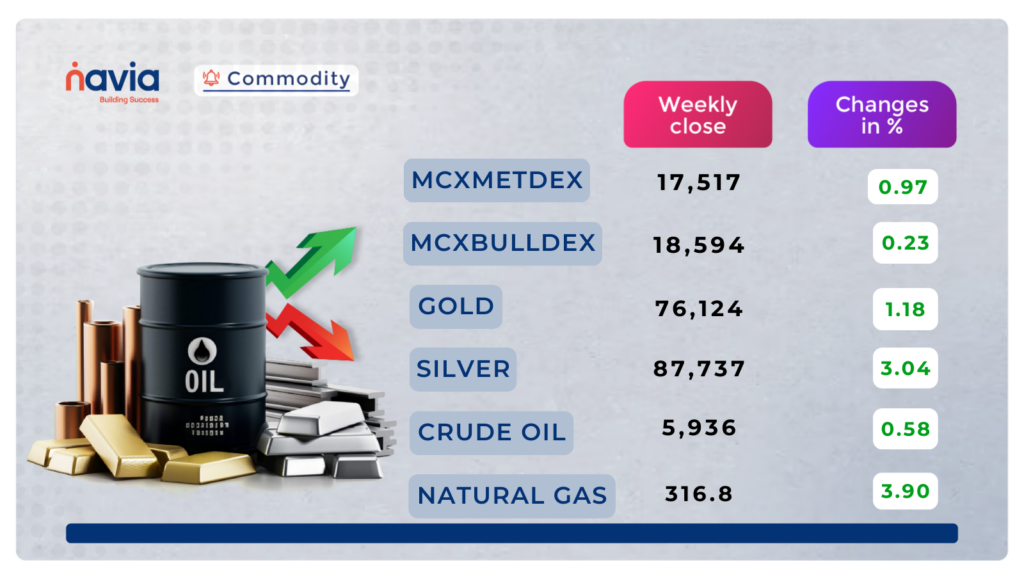

Commodity Corner

Crude oil closed the last session at 5936, up by a negligible gain of 0.08%. On the 3-hour time frame, it is trading in an ascending triangle, with strong momentum expected on a breakout above 6050 or below 5900. Brent crude is trading at 73.20, down by 0.08%.Intraday momentum can be expected above 5977 and below 5948.

Gold is in a small rising channel, as shown in the chart. In the last session, gold was up by 0.77%, closing at 76,124. However, strong upward momentum can be expected only above 77500.On an intraday basis, momentum can be expected above 77000 and below 76500.

Natural gas is trading in an ascending broadening wedge on the broader time frame. In yesterday’s session, it encountered resistance from its ascending channel, as shown in the chart, and fell by 5%, closing at 316.Technically, another intraday momentum is possible above 322 and below 313. These levels may act as key zones for any significant movements.

Silver is trading in a descending channel on the 3-hour chart, with the last session ending at 87,737, up by 0.31%. On an intraday basis, 90200 may act as resistance, and 89550 may act as support. Momentum above or below these levels might trigger an intraday movement.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Mastering Position Sizing: Why It’s the Key to Trading Success

Position sizing isn’t just about numbers—it’s the difference between surviving a losing streak and thriving in the long run. Through a real-life example of two traders, discover how disciplined risk management can protect your capital and boost your profits. Dive in to transform your trading game!

Key Trading Psychologies Influencing Trader Behavior

Did you know your emotions can shape your trading success? From fear to overconfidence and the infamous hope-despair cycle, understanding these psychological traps is key to mastering the markets. Dive into this blog to learn how to overcome these behaviors and trade with discipline and clarity!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?