Navia Weekly Roundup (Dec 01 – 05, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian equity indices ended on a flat note in the volatile week ended December 5 amid sharp surged seen in the Friday’s session on the back of unexpected interest rate cut by the Reserve Bank of India (RBI) with FY26 GDP forecast upgradation to 7.3% and downward revision of inflation.

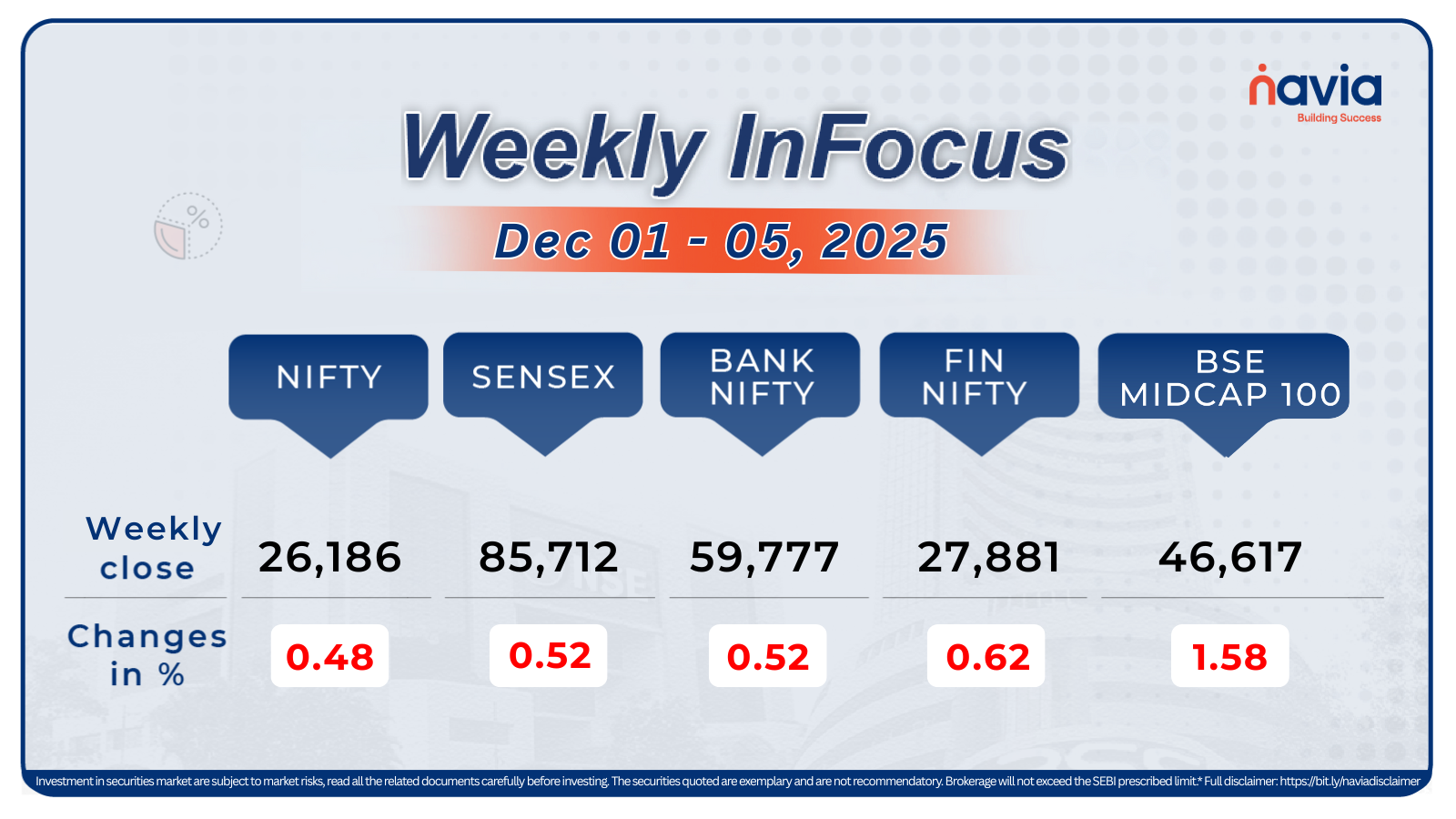

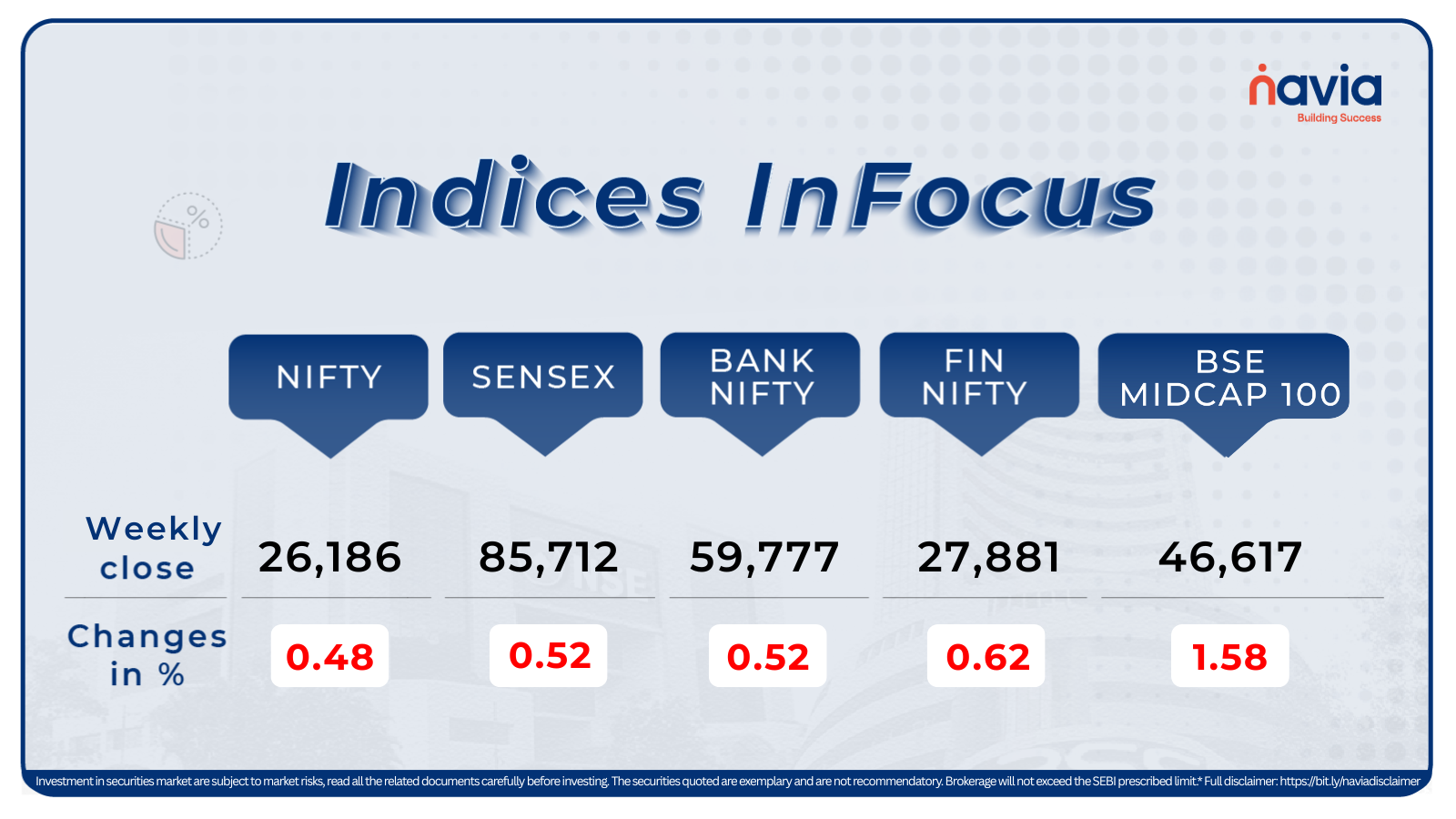

Indices Analysis

BSE Sensex index ended flat at 85,712.37, hitting all-time high of 86,159.02, while Nifty50 index also ended with little change at 26,186.45, after touching fresh record high of 26,325.8, during the week.

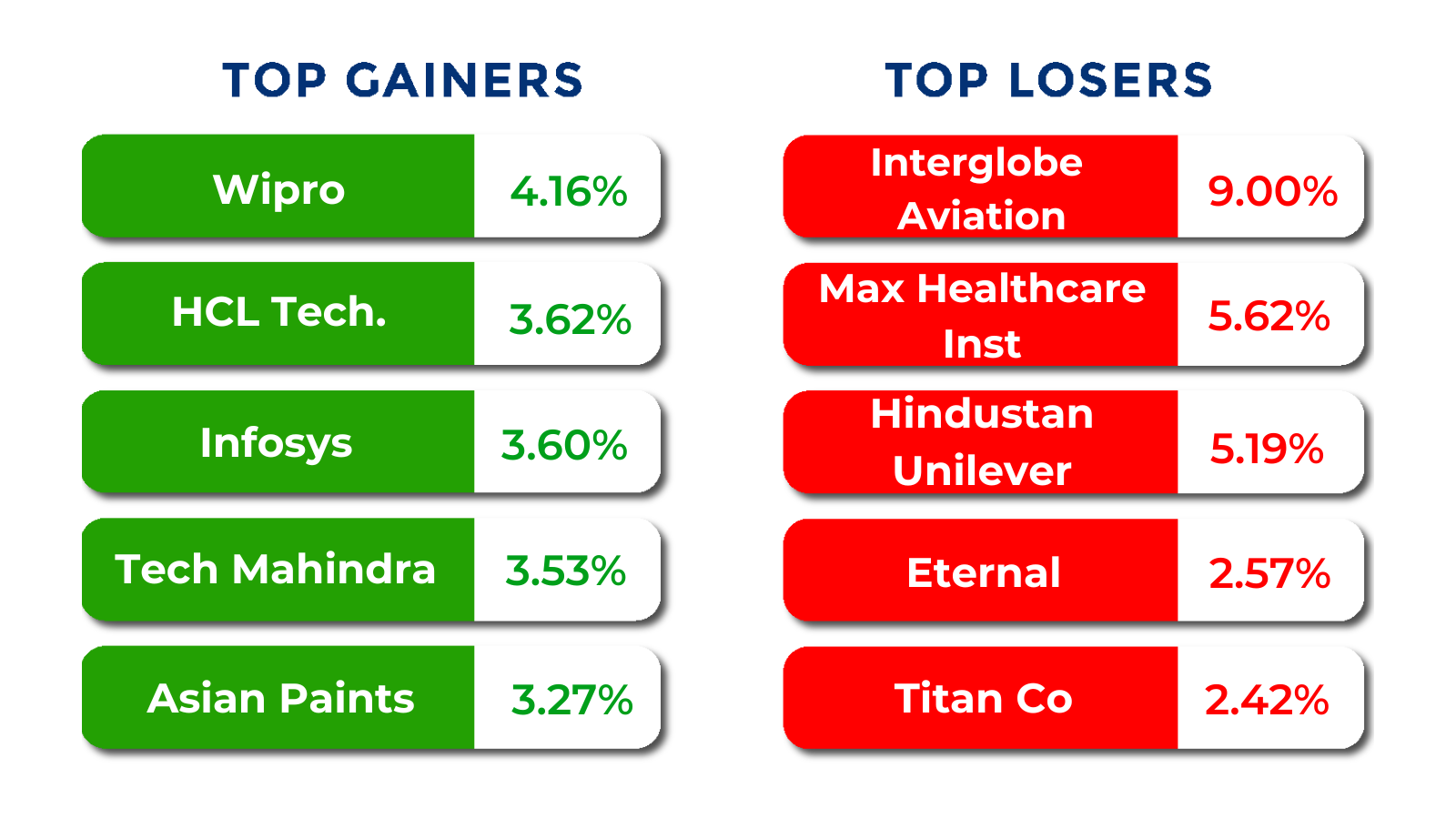

The BSE Large-cap Index ended on a flat note. Waaree Energies, Bajaj Housing Finance, Interglobe Aviation, Max Healthcare Institute, JSW Energy, Hindustan Unilever fell between 5-9 percent, while Vodafone Idea, Info Edge India, Wipro, Swiggy, TVS Motor Company, Indus Towers, Infosys, Tech Mahindra, HCL Technologies, Asian Paints, LTIMindtree, Tata Consultancy Services added between 3-8 percent.

BSE Mid-cap Index shed 1.2 percent dragged by Kaynes Technology India, Ola Electric Mobility, Hitachi Energy India, Whirlpool of India, Motilal Oswal Financial Services, Premier Energies, Nippon Life India Asset Management, Indian Bank. However, gainers were National Aluminium Company, MphasiS, PB Fintech, KPIT Technologies, Coforge, NMDC, Balkrishna Industries, Ajanta Pharma.

The BSE Small-cap index shed nearly 2 percent dragged by Kothari Industrial Corporation, Spectrum Electrical Industries, Thyrocare Technologies, Tuticorin Alkali Chemicals and Fertilizers, Transworld Shipping Lines, TVS Electronics, Transformers and Rectifiers India, LE Travenues Technology (IXIGO), SEPC, Kingfa Science & Technology, PRAVEG, Shakti Pumps (India), however, Nectar Lifesciences, SMC Global Securities, Integrated Industries, InfoBeans Technologies, Birlasoft, Hindustan Copper, Sun Pharma Advanced Research Company, ZF Commercial Vehicle Control Systems India added between 12-23%.

The Foreign Institutional Investors’ (FIIs) extended their selling at they sold equities worth Rs 10403.62 crore, while Domestic Institutional Investors (DII) continued their buying as they bought equities worth Rs 19785.5 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

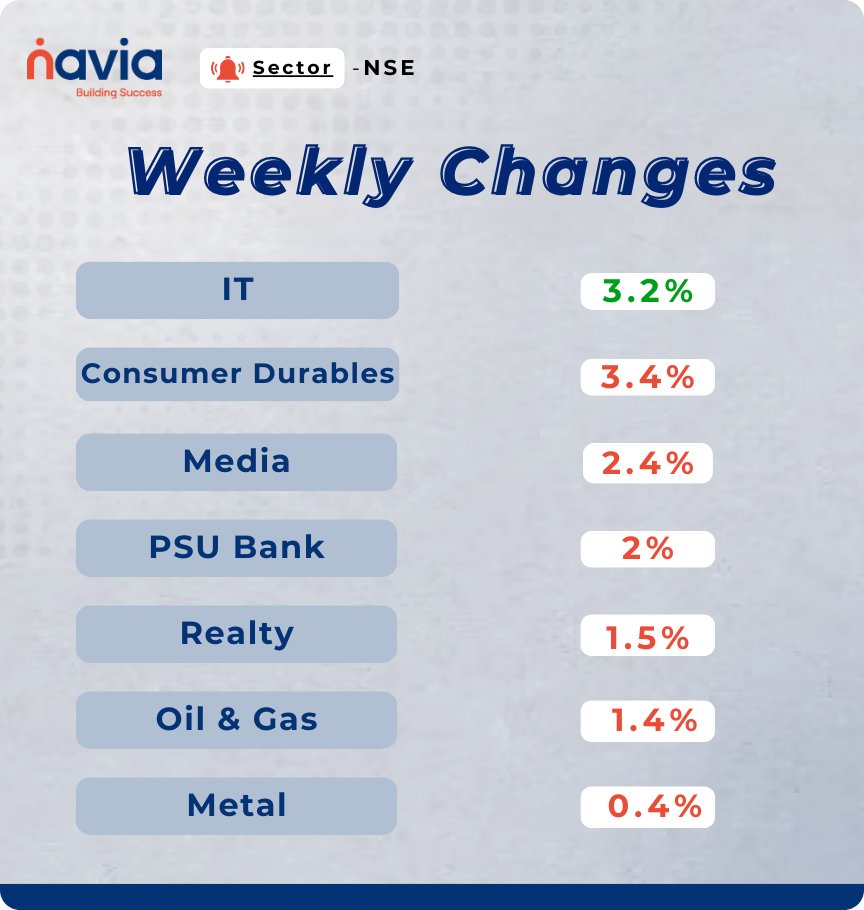

Sector Spotlight

On the sectoral front, the Nifty IT index gained 3.2 percent, sharply contrasting with losses across several other sectors. Leading the decline was Nifty Consumer Durables, which shed over 3 percent, followed by Nifty Media and Nifty PSU Bank, both losing 2 percent. Nifty Realty and Nifty Oil & Gas were down more than 1 percent, while Nifty Metal saw a loss of nearly 1 percent.

Top Gainers and Losers

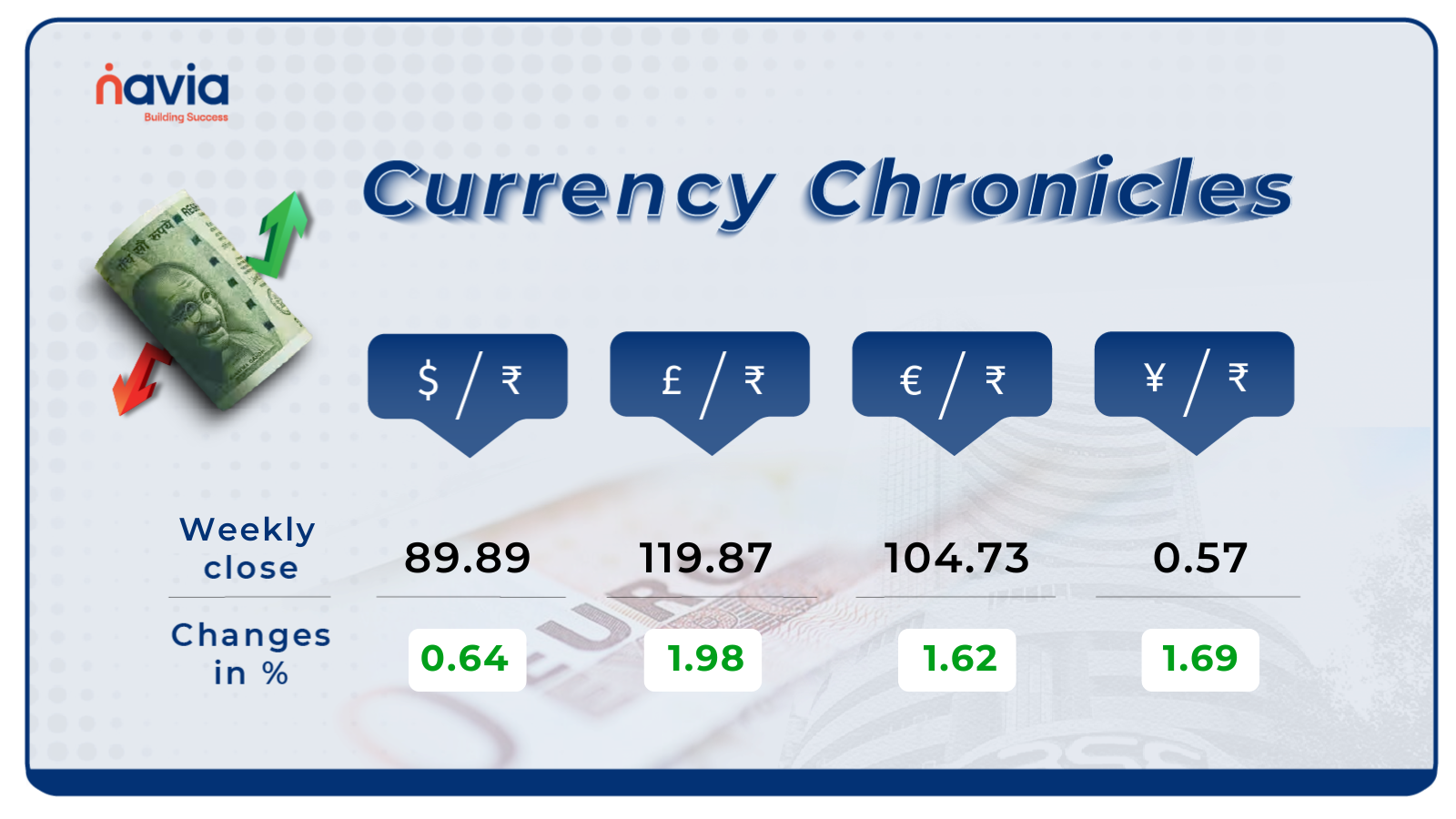

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹89.89 per dollar, gaining 0.64% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹104.73 per euro, gaining 1.62% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, gaining 1.69% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

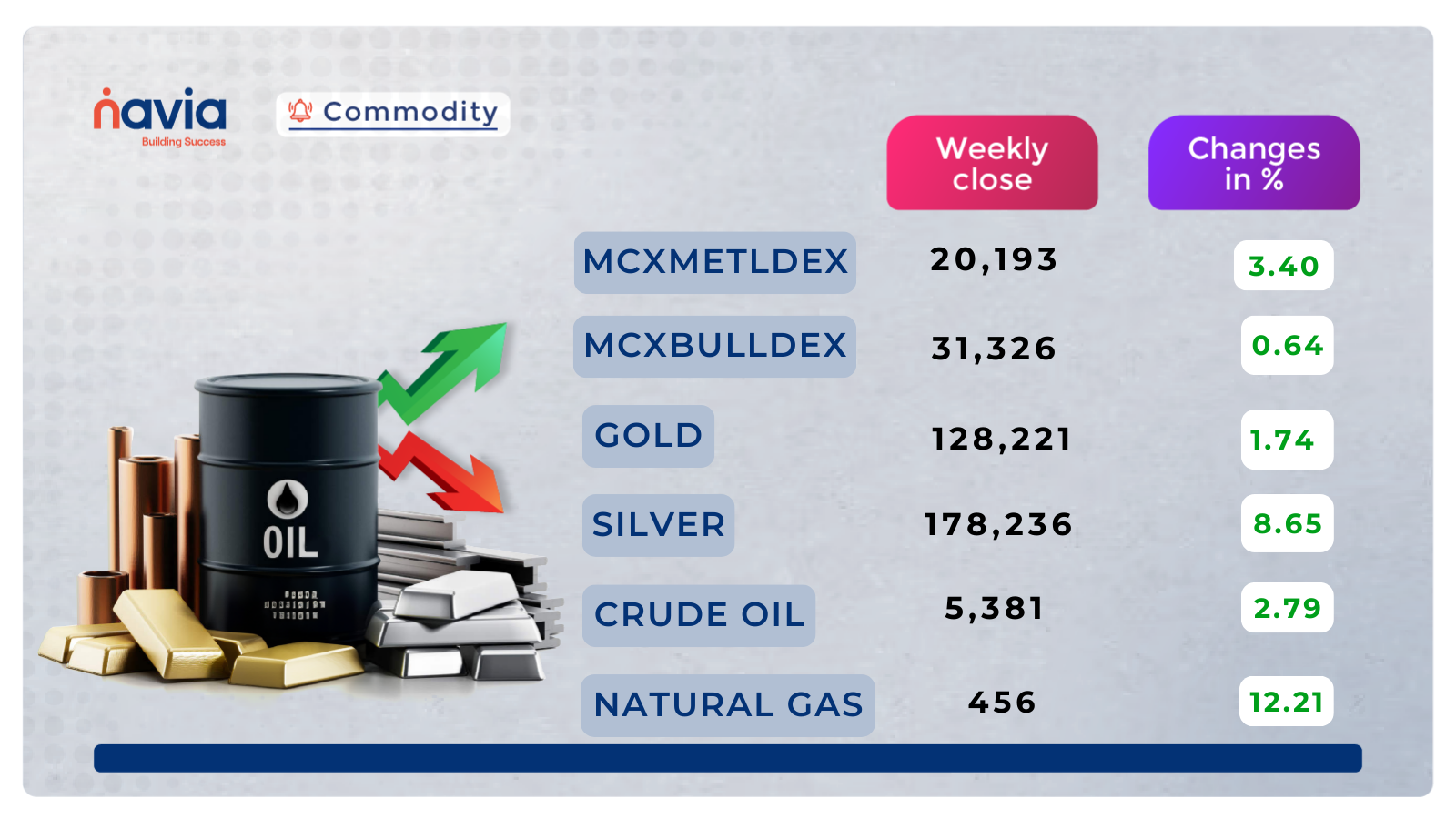

Commodity Corner

Crude Oil is moving inside a short-term rising channel, indicating improving bullish momentum after weeks of consolidation. The price has recently bounced from the channel’s lower trendline and is now approaching the 5,400 resistance zone. The major supply zone remains between 5,480–5,540, where multiple rejections were seen earlier this is the critical hurdle for any strong upside continuation. As long as price sustains above 5,300, the structure stays bullish within the rising channel. A breakout above 5,400 strengthens the move, while failure to hold the channel support may trigger a pullback.

In the last session, Gold closed at 128,221. MCX Gold continues to trade within a rising channel, reflecting a stable medium-term uptrend, though prices are currently consolidating after encountering resistance near 132,400. The setup remains bullish as long as the lower channel trendline holds, with immediate support at 129,200–128,600 offering potential buying opportunities. A decisive move above 131,800–132,400 would resume the upward momentum toward 133,200–134,000, while a fall below 128,600 could shift sentiment weaker and pull prices toward 127,400–126,500. Overall, the outlook stays positive, but short-term consolidation may continue until Gold breaks above the key 132,400 resistance.

Natural Gas continues to trade within a well-defined rising channel, maintaining a strong short-term uptrend despite a recent pullback from the upper resistance zone at 456–458. The overall structure remains bullish, with the trend intact as long as price holds above the mid-channel region. The current dip appears healthy and may offer buy-on-dips opportunities around 444–446. A decisive breakout above 458 could accelerate bullish momentum toward 465–472. However, sustained weakness below 438 would signal a breakdown from the channel, shifting the outlook to neutral-to-bearish.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

The Price Rejection Alert: Understanding the Psychology of the Shooting Star

The Shooting Star Candlestick Pattern is a powerful bearish reversal signal that appears after an established uptrend, indicating a catastrophic failure by buyers to sustain higher prices.

The Investor’s Therapist: Mastering the Market with the Fear and Greed Index

The Fear and Greed Index is a critical market sentiment indicator scaled from 0 (Extreme Fear) to 100 (Extreme Greed). It acts as a psychological thermometer for the market, measuring the dominant emotion driving investor behavior at any given time.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.