Navia Weekly Roundup (AUGUST 19 – AUGUST 23, 2024)

Week in the Review

The markets are still reeling from the crash on August 5, 2024, triggered by a combination of factors, including a Japanese rate hike and recession fears in the US. The impact was severe in Asia, with Japan’s Nikkei index dropping over 12%, while the US markets saw a smaller but significant dip, with the S&P 500 and Nasdaq falling over 3%

Sensex and Nifty both experienced a rough start, due to weak earnings reports, especially from banking and metal sectors. Despite the early downturn, there was some recovery towards the end of the week, supported by gains in the IT sector

Indices Analysis

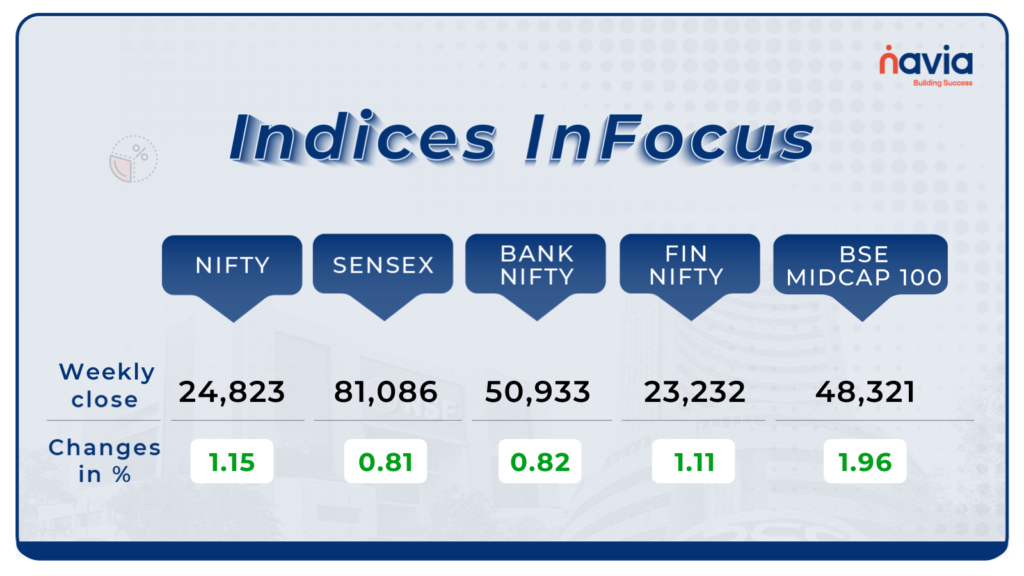

The NSE Nifty 50 index inched up by 1.15% to close at 24,823, while the S&P BSE Sensex added 0.81%, ending at 81,086. and formed a bullish candlestick pattern on the weekly timeframe, continuing the formation of higher highs and higher lows for another week, which is a positive sign.

Interactive Zone!

Last week’s poll:

Q) The worth of a derivative contract ____ throughout the term of the contract.

a) Increases.

b) Decreases.

c) Varies in accordance with the price of the contract’s “underlying” worth.

d) None of the above.

Last week’s poll Answer: c) Varies in accordance with the price of the contract’s “underlying” worth.

Poll for the week: ____ is not the concern of the Securities and Exchange Board of India (SEBI).

Sector Spotlight

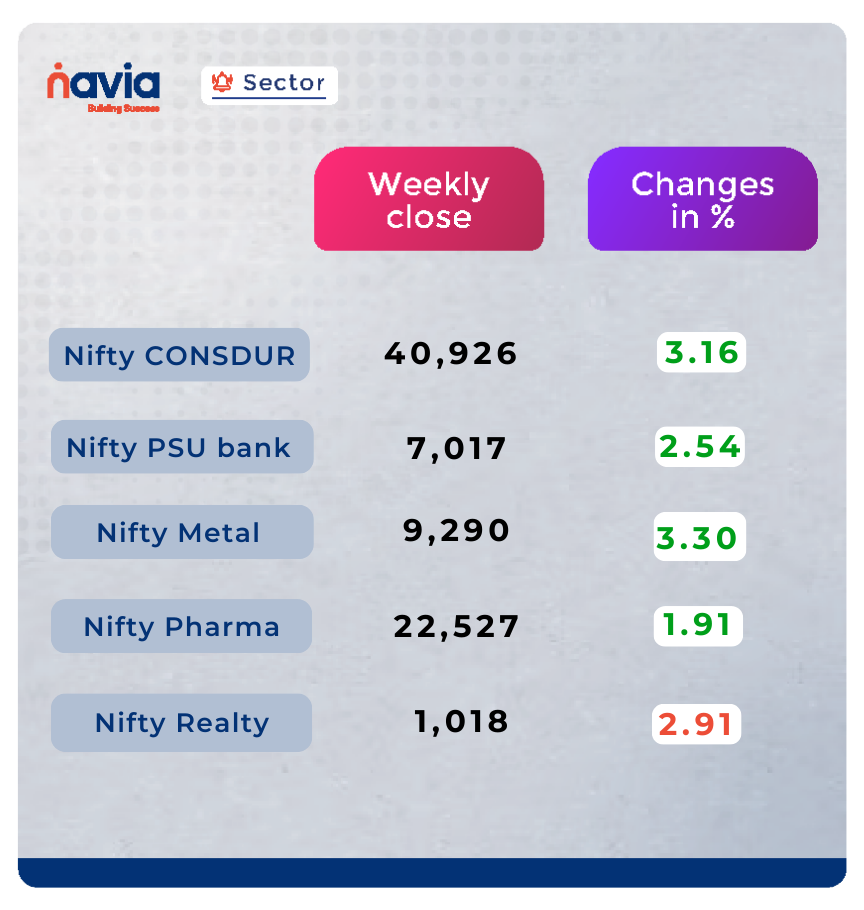

Among sectoral indices, NIFTY Consumer Durables rose by 3.16%, NIFTY PSU Bank increased by 2.54%, and NIFTY Metal also gained 3.30%. NIFTY Pharma advanced 1.91%, while NIFTY Realty was the lone loser, dropping by 2.91%.

Explore Our Features!

Navia App’s Stock SIP: Your Path to Smart Stock Investing!

Discover how to efficiently shortlist the best stocks using the Navia app! Our tutorial offers a step-by-step guide to leveraging its powerful features for effective stock selection.

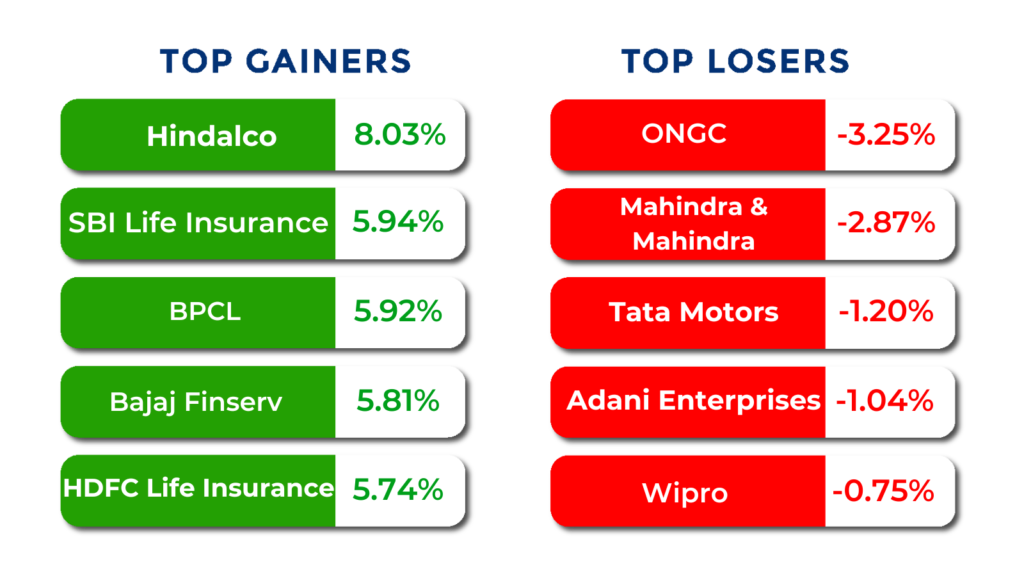

Top Gainers and Losers

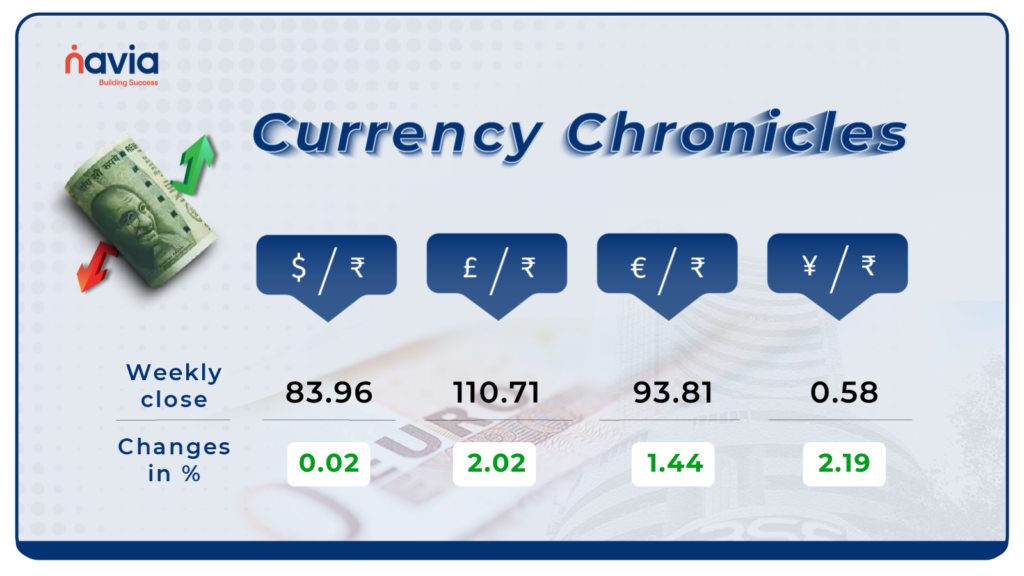

Currency Chronicles

USD/INR:

The Indian rupee remained steady against the U.S. dollar this week, closing slightly higher at ₹83.96 compared to last week’s ₹83.94. The currency exhibited minimal fluctuations throughout the week.

EUR/INR:

The euro gained strength against the rupee, rising by 1.44% over the week to reach ₹93.81. Market sentiment for the EUR/INR pair remains bullish, reflecting confidence in the euro’s performance.

JPY/INR:

The Japanese yen saw a significant increase, climbing 2.19% against the rupee. The JPY/INR rate closed at ₹0.586025 for the week, supported by positive market sentiment.

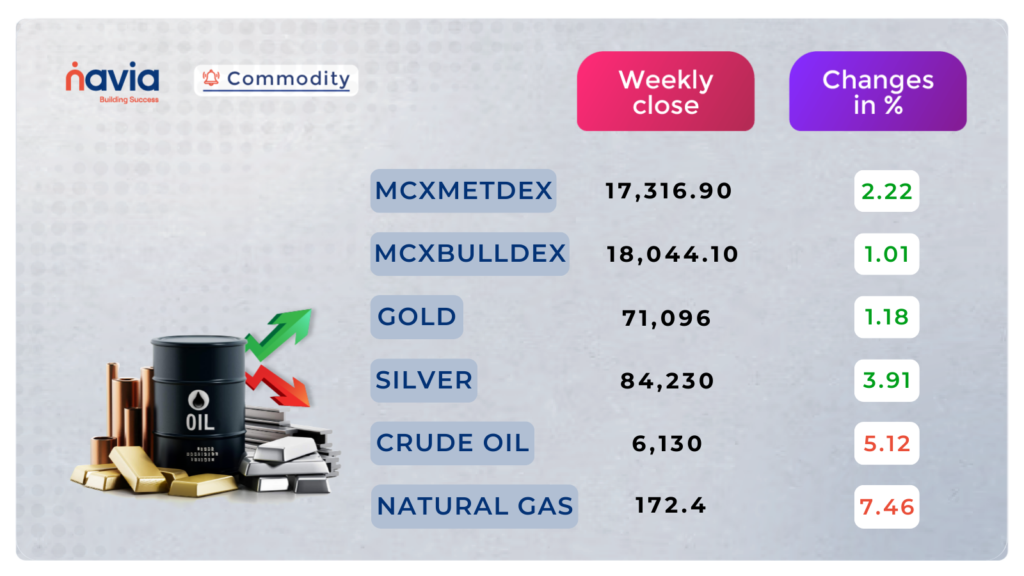

Commodity Corner

At the 72,000 level, gold experienced selling pressure, which may be due to a technical correction in gold prices. The current resistance level (R1) is at 72,996, and the support level (S1) is at 70,103.

Crude oil experienced strong selling pressure, weighed down by lingering demand concerns from major oil markets. The current resistance level (R1) is placed at 6,330, and the support level (S1) is placed at 5,944

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blog of the Week!

Mastering the Swing Trader’s Market: A Guide for Beginner Traders and Investors

Master swing trading with our latest blog! Learn to identify and capitalize on the perfect market conditions, spot key indicators, and time your trades for maximum profit. Read more to sharpen your trading skills!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?