Navia Weekly Roundup (August 11 – 14, 2025)

Week in the Review

The Indian market snapped a six-week losing streak, ending with a percent gain in the volatile truncated week, backed by persistent DII buying powered by ease in US and Indian CPI data, raising hopes of a rate cut by the respective central banks at the upcoming monetary policy meetings. Satisfactory monsoon, extension of China’s tariff deadline, rupee appreciation, falling oil prices, and better earnings also added to the positive sentiments.

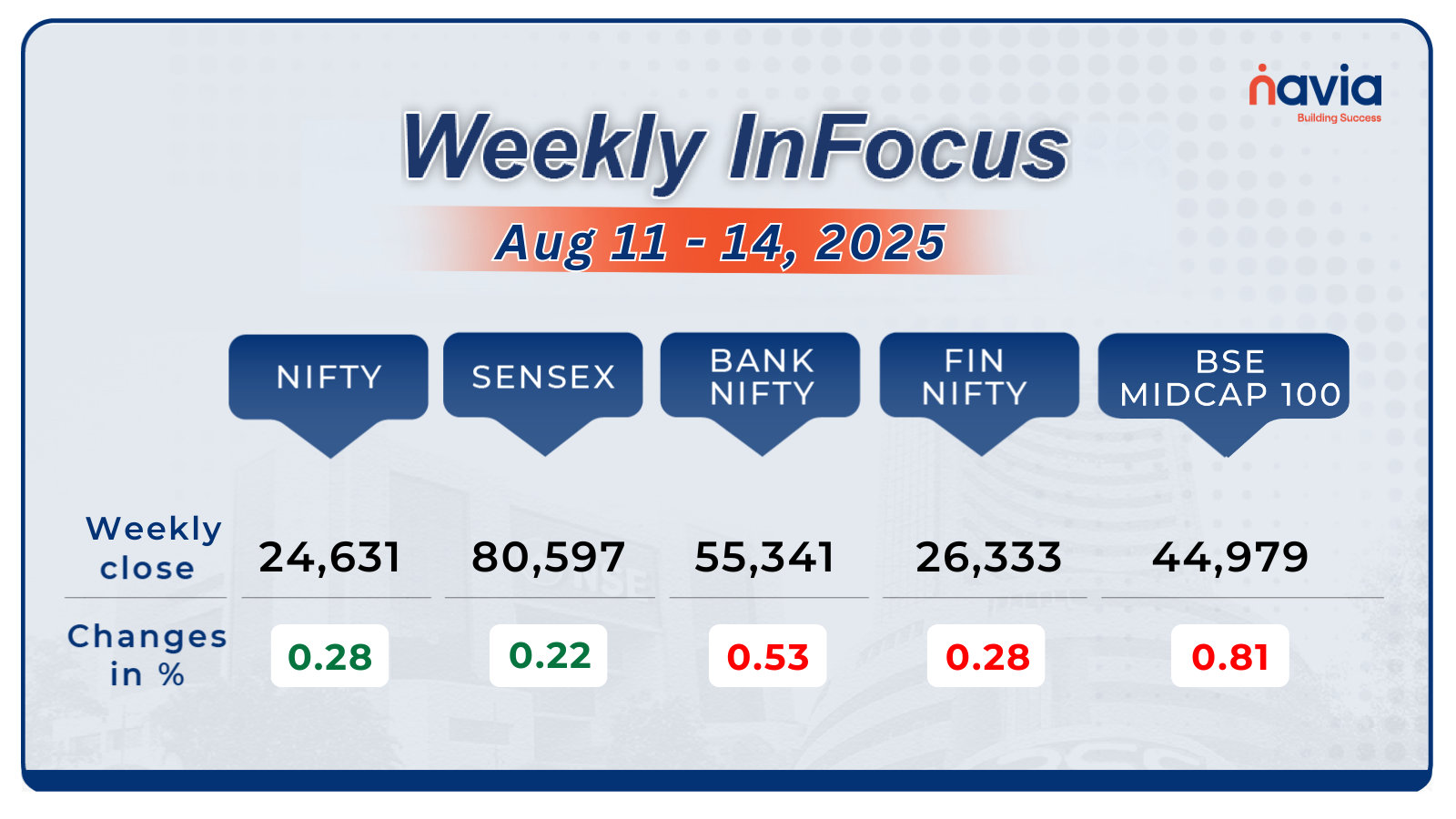

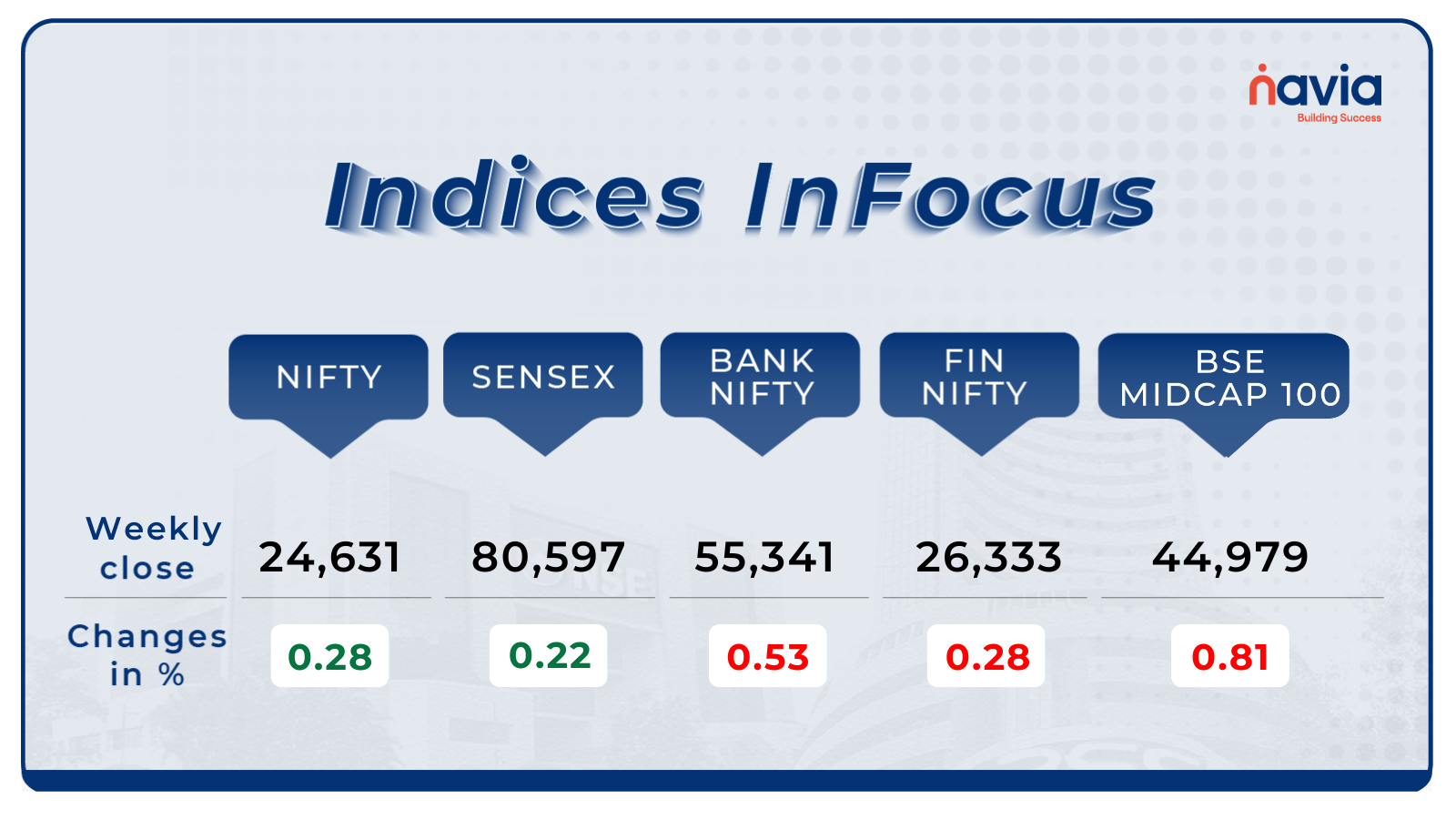

Indices Analysis

For the week, the BSE Sensex index added 0.22 percent to close at 80,597.66, and Nifty50 rose 0.28 percent to end at 24,631.30.

The BSE Large-cap Index added 1 percent, supported by Apollo Hospitals Enterprises, Hyundai Motor India, Zydus Lifesciences, Cipla, while losers were Waaree Energies, Bajaj Housing Finance, Life Insurance Corporation of India, IDBI Bank, and Berger Paints India.

BSE Mid-cap Index rose nearly 1 percent, led by Alkem Laboratories, One 97 Communications (Paytm), Godrej Industries, Sun TV Network, FSN E-Commerce Ventures (Nykaa), while losers included Coromandel International, Astral, Oil India, Suzlon Energy,and Muthoot Finance.

The BSE Small-cap index ended with a 0.4 percent gain, led by Yatra Online, HBL Engineering, NMDC Steel, JM Financial, Rico Auto, EIH,and VST Tillers Tractors. However, losers included PG Electroplast, NIBE, Camlin Fine Sciences, Best Agrolife, Marksans Pharma, and Action Construction Equipment.

The Foreign Institutional Investors (FIIs) continued their selling in the 7th week, as they sold equities worth Rs 10,172.64 crore. On the other hand, Domestic Institutional Investors (DII) extended their buying in the 17th week, as they bought equities worth Rs 18,999.76 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

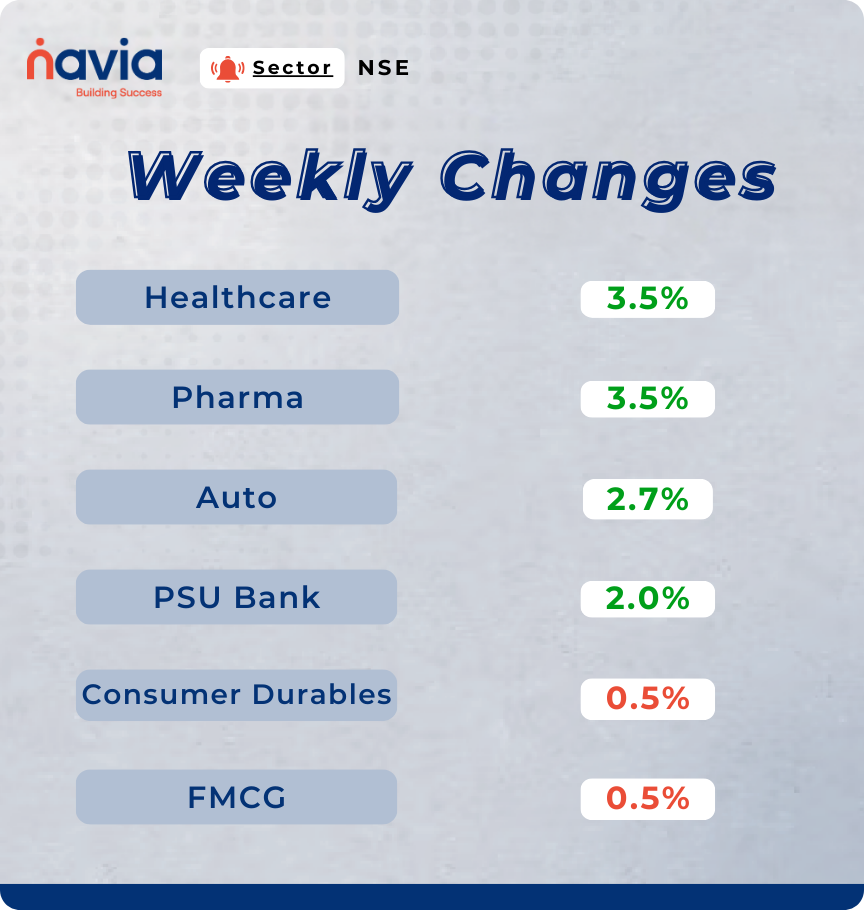

Sector Spotlight

On the sectoral front, Nifty Healthcare and Pharma indices rose 3.5 percent each, Nifty Auto index rose 2.7 percent, and Nifty PSU Bank index gained 2 percent. On the other hand, Nifty Consumer Durables and FMCG indices shed 0.5 percent each.

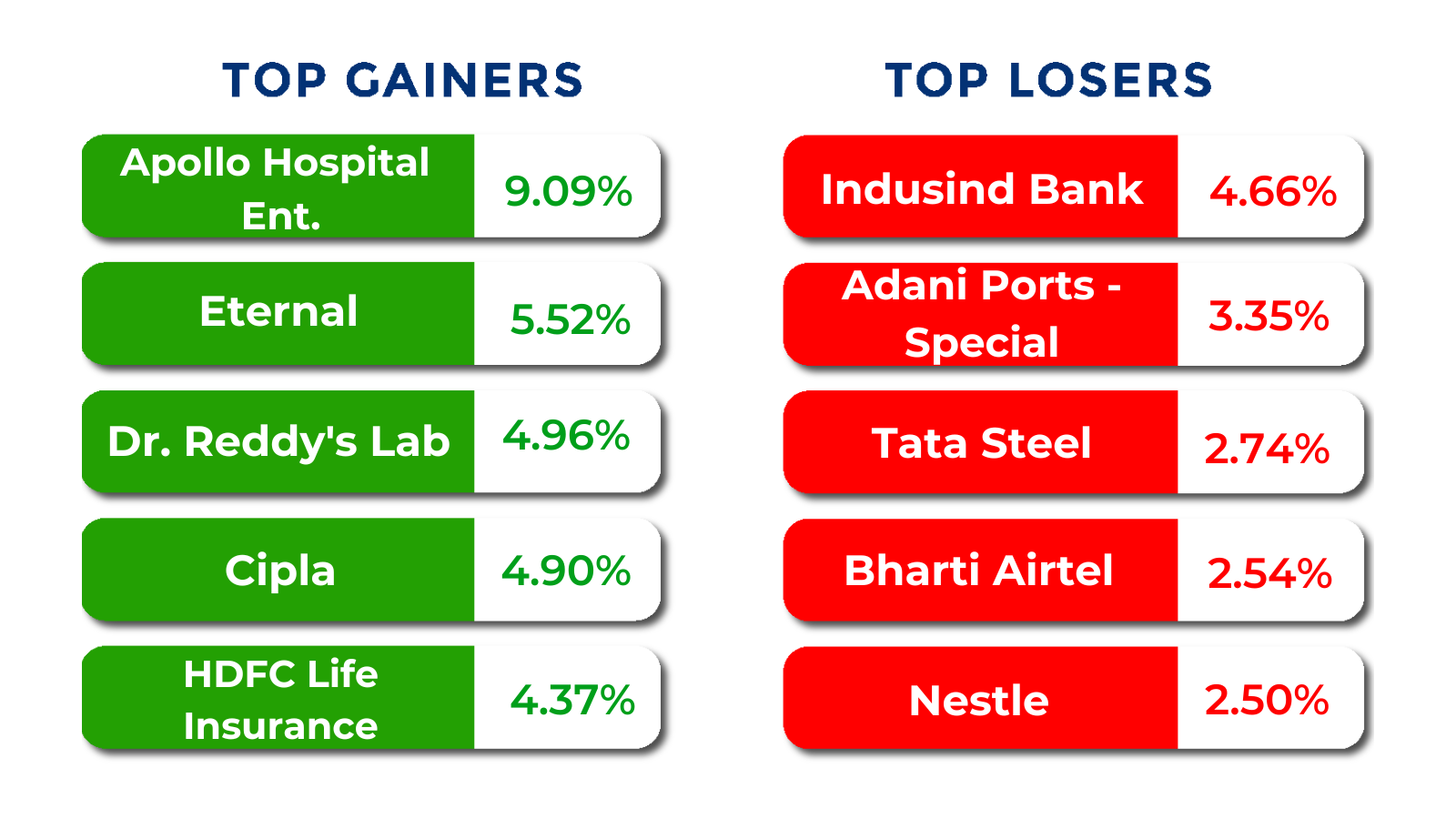

Top Gainers and Losers

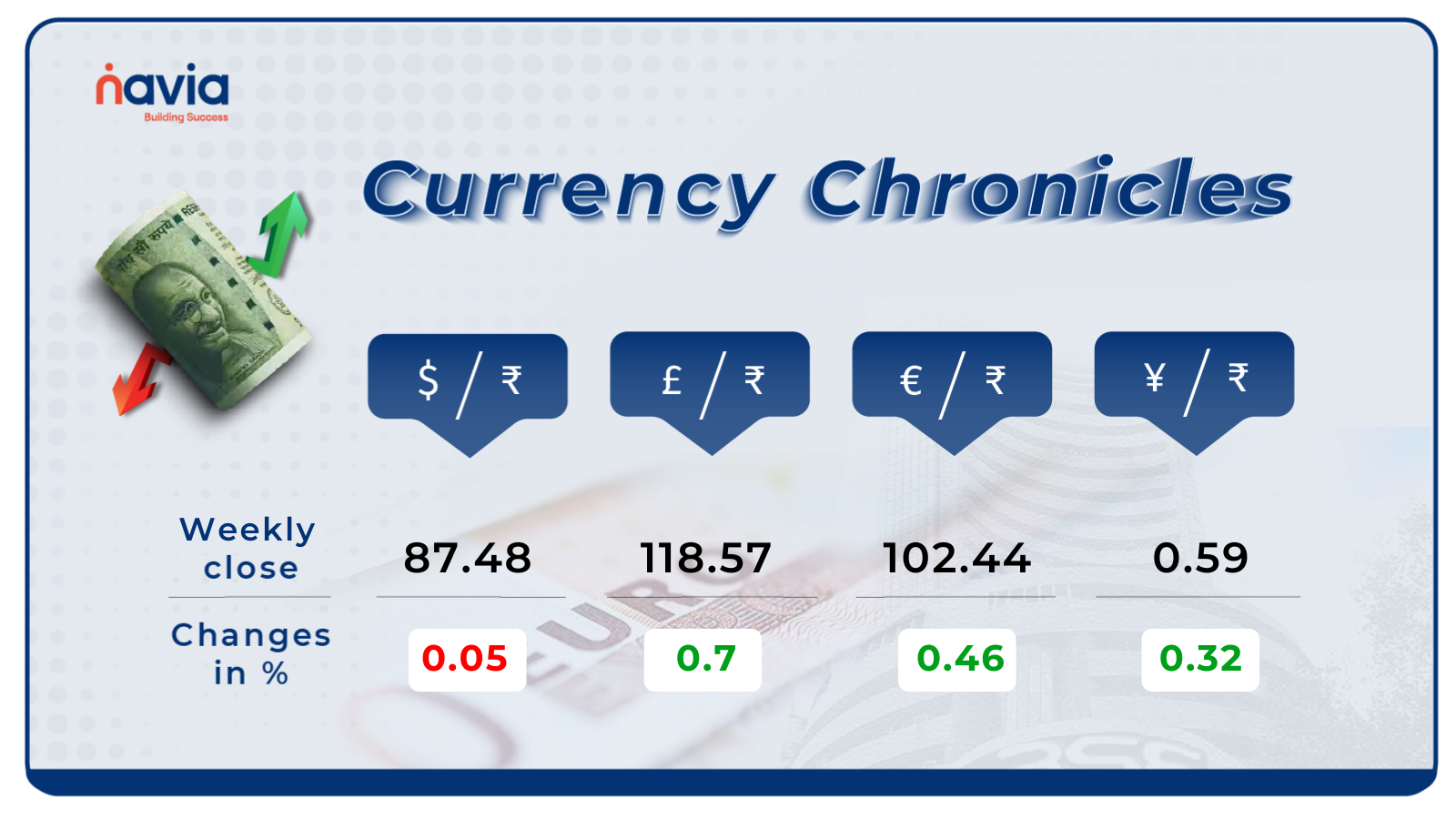

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹87.48 per dollar, losing 0.05% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹102.44 per euro, gaining 0.46% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining by 0.32% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

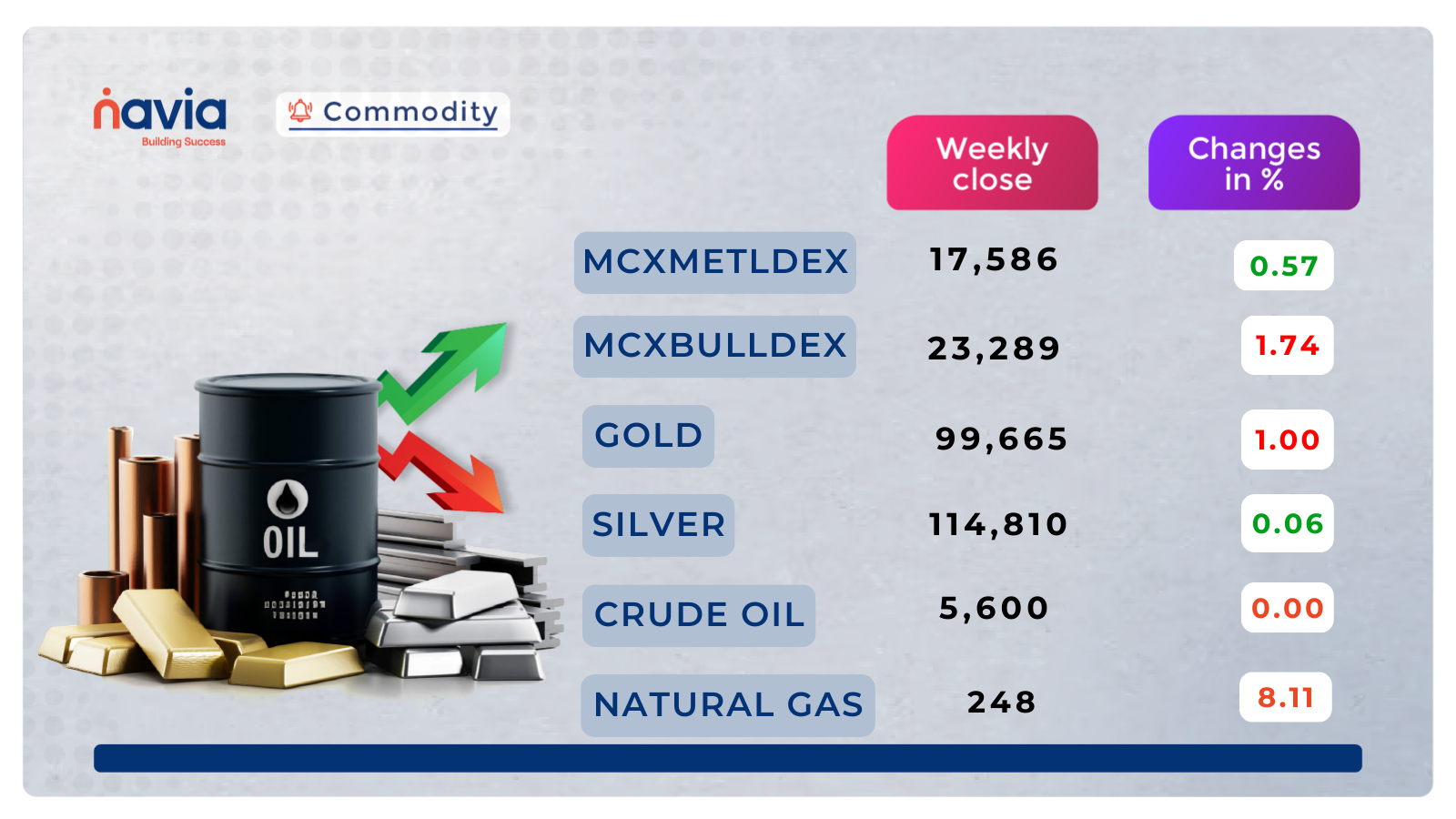

Commodity Corner

Crude Oil futures (MCX) have broken below the crucial 5,600 support, indicating sustained neutral momentum. On the global front, bearish fundamentals persist—OPEC’s decision to increase production and robust U.S. output continue to pressure prices. Interestingly, some analysts believe a short-term recovery is plausible, with support near 5,580 and resistance around 5,700. MCX Crude Oil is experiencing downward pressure amid weak fundamentals and technical breakdowns. The trading bias is cautiously bearish, with possible rebounds near 5,580—but only a decisive move above 5,700 would shift that bias. Until then, the commodity remains weak, and lower targets remain the primary focus.

Gold is consolidating after a strong rally, showing resilience near 1 lakh. Safe-haven demand continues to support prices, though near-term upside may be capped amid easing trade tensions. It is consolidating near the 1 lakh level; price action above 1,00,700 may indicate strength, while below 98,800 could signal weakness. Gold futures on MCX have surged over 2,400 per 10 grams in August, reflecting strong momentum despite a recent intraday drop to around 1,01,052. After a dip earlier this week, prices rebounded to about 1,00,342, underscoring solid support near the 1 lakh mark.

Natural Gas remains entrenched in weak territory, with a clear neutral-to-bearish bias. While oversold indicators suggest potential for a counter-trend bounce, broader technical weariness persists. Price action around the 266–270 pivot zone is the primary driver to watch for intraday direction. The current technical consensus across major platforms like TradingView and Investing.com rates Natural Gas as a “Strong Sell”, signaling prevailing bearish momentum. Natural Gas is trading in a tight range near 268–269, sitting just above crucial support at 266.7. Immediate resistance lies at 279–282, where recent selling has emerged.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

How to Use MTF in the Stock Market: A Beginner’s Guide

MTF in the stock market allows traders to amplify buying power by borrowing funds from brokers. This blog explains how MTF works, its benefits, key components, and precautions every beginner must know before diving in. A must-read guide to trading smarter with leverage.

Bond Yields Explained: Meaning, Importance & How to Calculate Them

This blog simplifies the concept of bond yields—what they are, how to calculate them, and why they matter. It explains the inverse link between bond prices and yields, different yield types like YTM and YTC, and their impact on your portfolio. Perfect for investors seeking steady income and smarter fixed-income strategies.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.