Navia Weekly Roundup (Apr 7 – 11, 2025)

Week in the Review

Indian benchmark indices ended with marginal losses in the volatile (truncated) week ended on April 11 on concern over tariff war, but an unexpected pause on reciprocal tariffs by the US president provided some relief to the investor on the final day of the week.

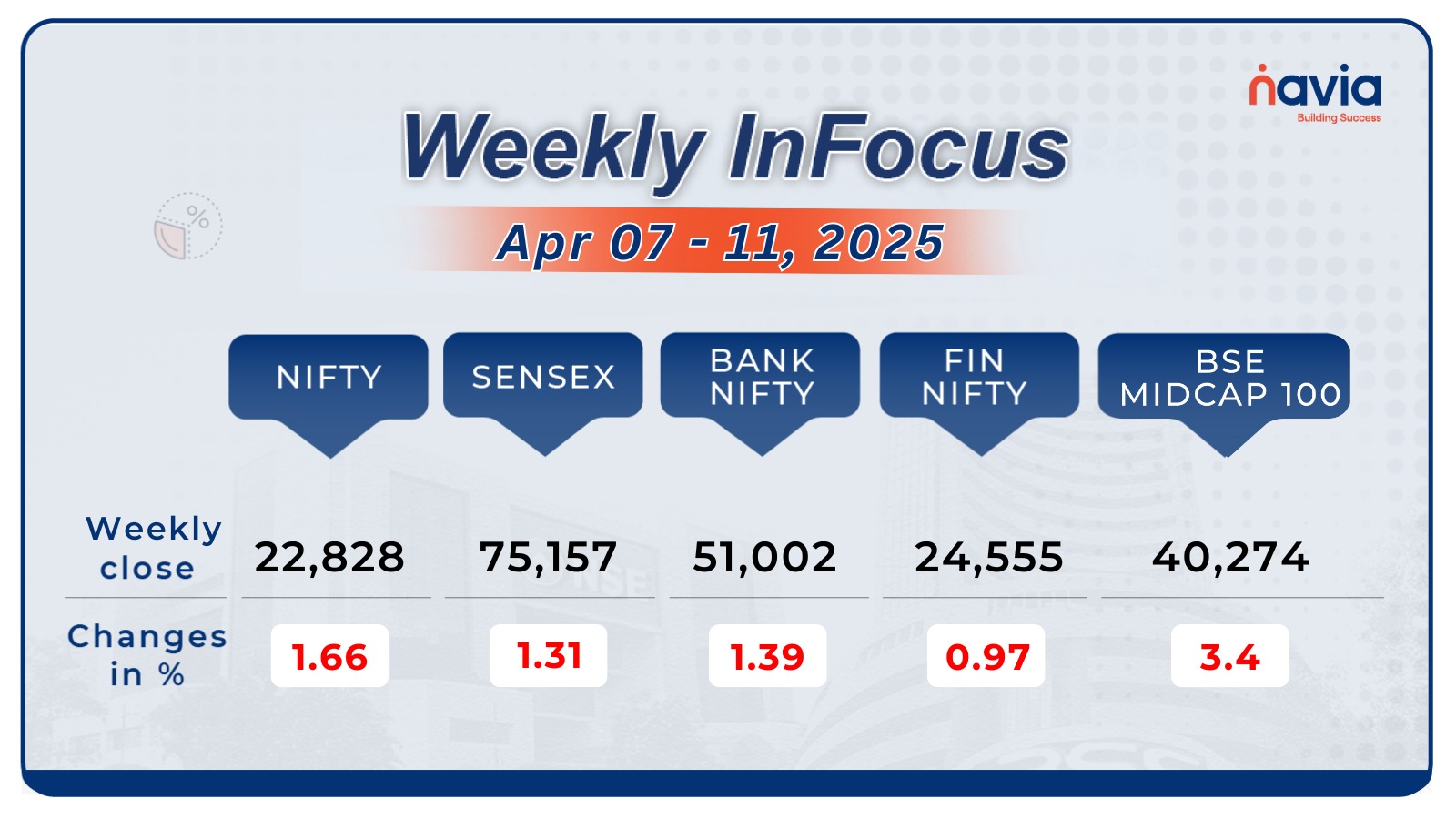

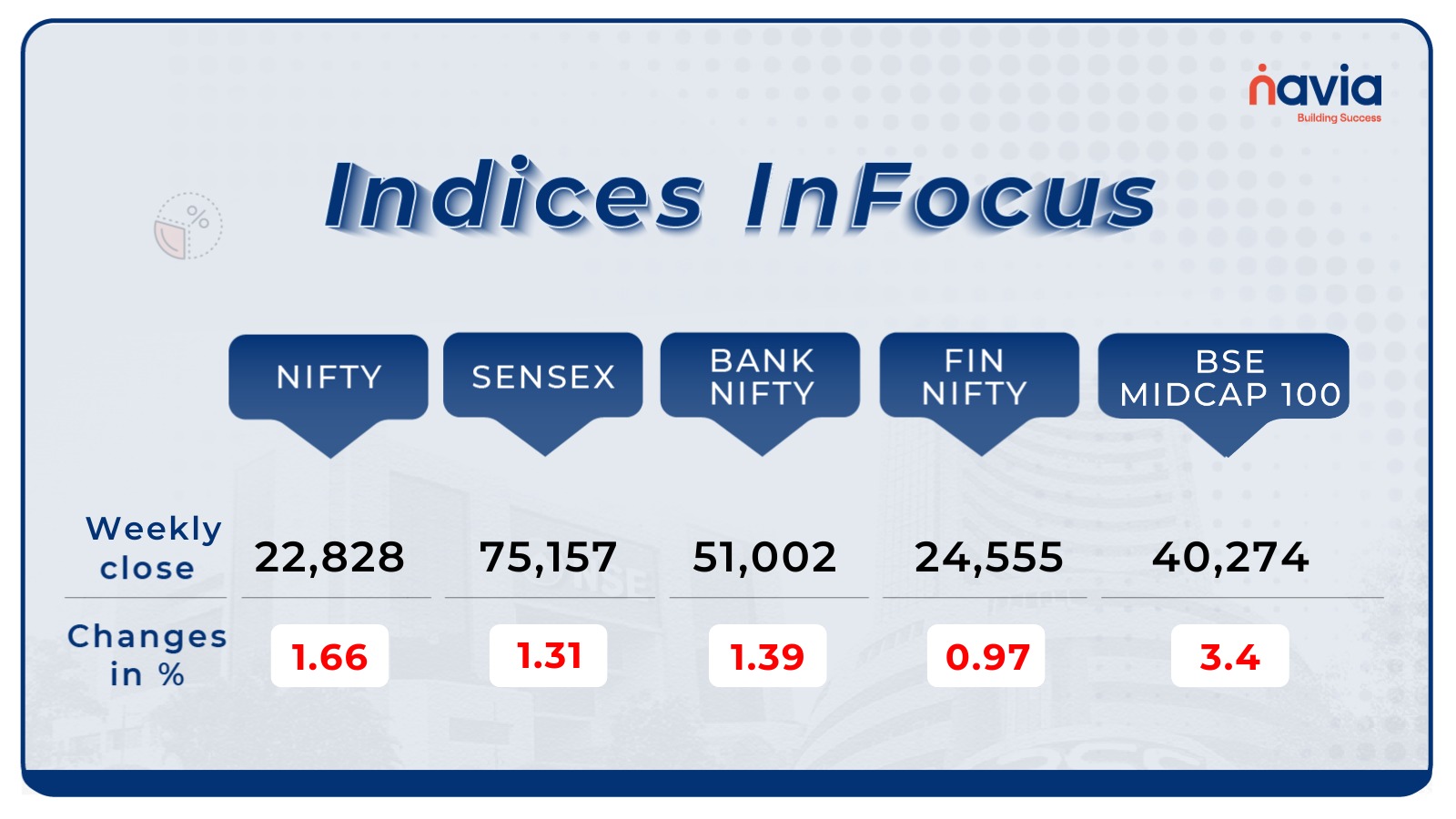

Indices Analysis

For the week, the BSE Sensex index fell 1.31 percent to end at 75,157.26, and Nifty50 declined 1.66 percent to close at 22,828.55.

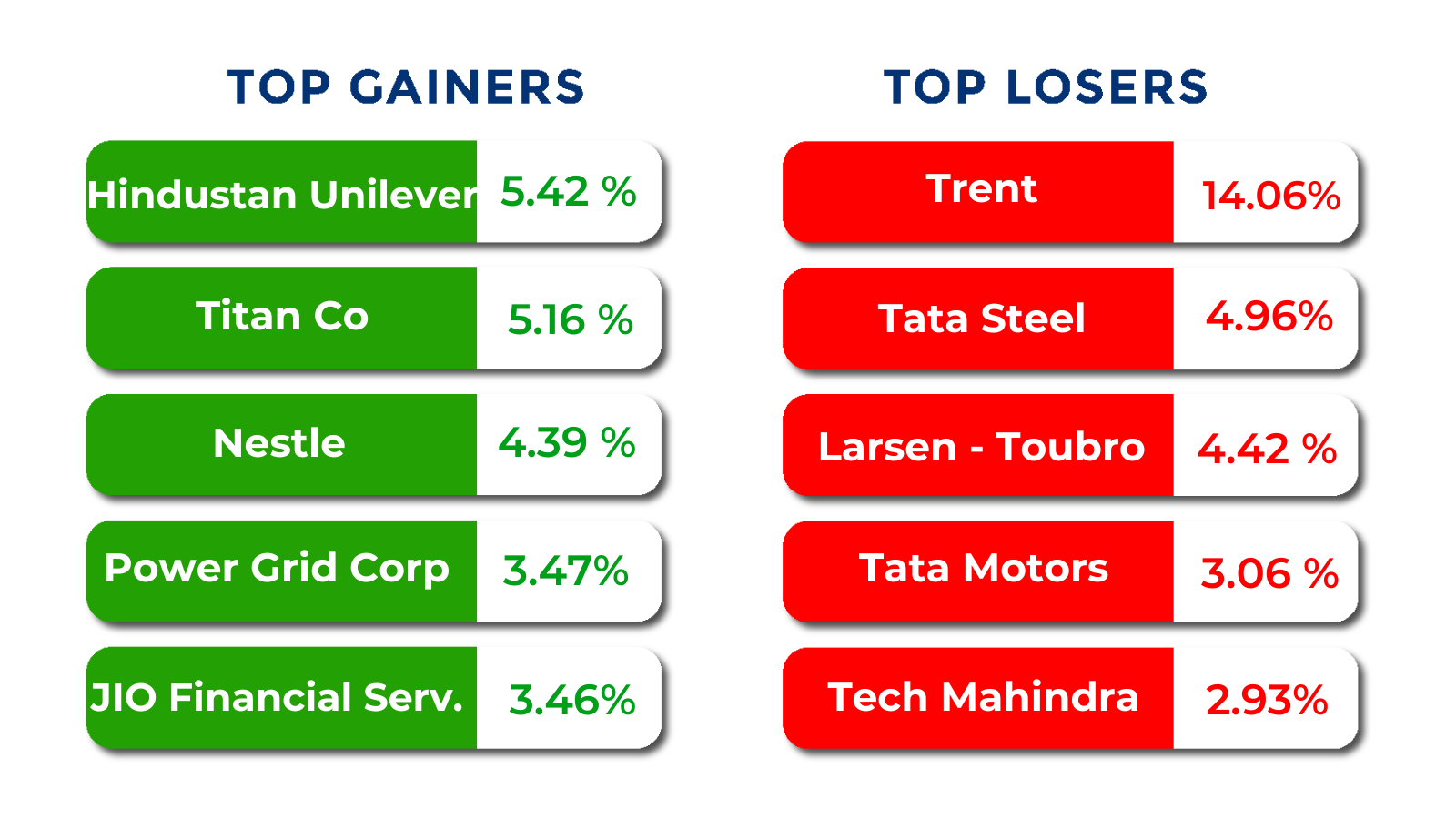

The BSE Large-cap Index was down 0.2 percent. Gainers included Britannia Industries, Godrej Consumer Products, Hindustan Unilever, Titan Company, Bharat Petroleum Corporation, Marico, Nestle India, Havells India, while losers were Siemens, Trent, ICICI Lombard General Insurance Company, Indian Overseas Bank, Vedanta, Jindal Steel & Power.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

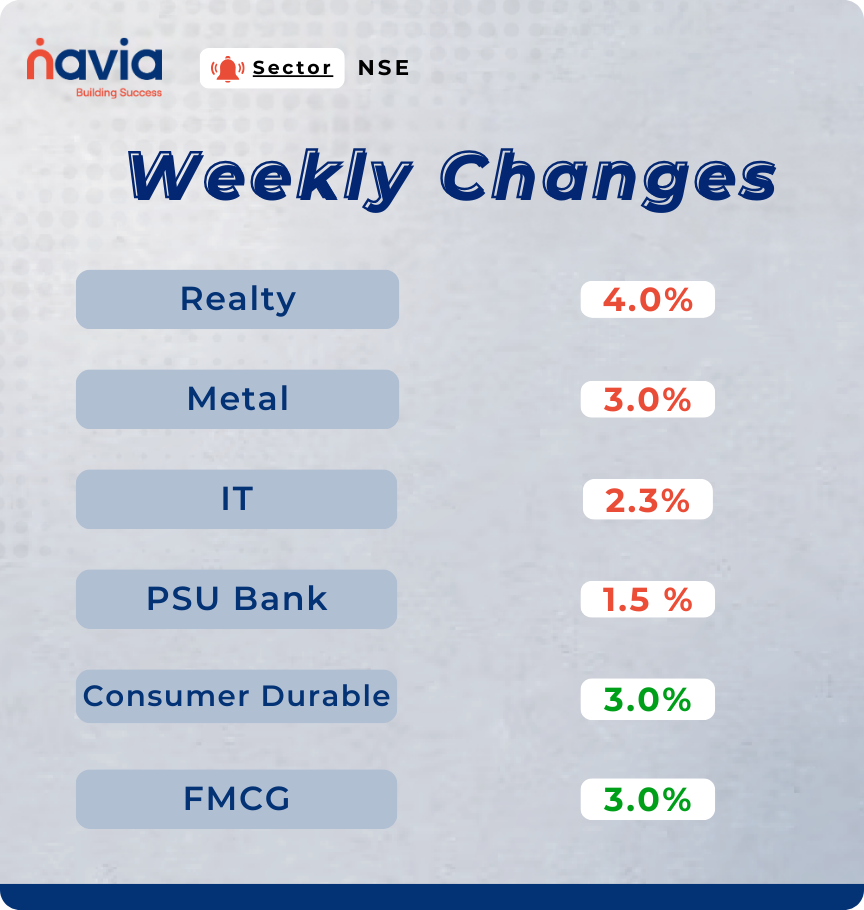

Sector Spotlight

On the sectoral front, Nifty Realty index shed 4 percent, Nifty Metal index down 3 percent, Nifty IT index declined 2.3 percent, Nifty PSU Bank index shed 1.5 percent. On the other Nifty Consumer Durable and FMCG added more than 3 percent each.

Top Gainers and Losers

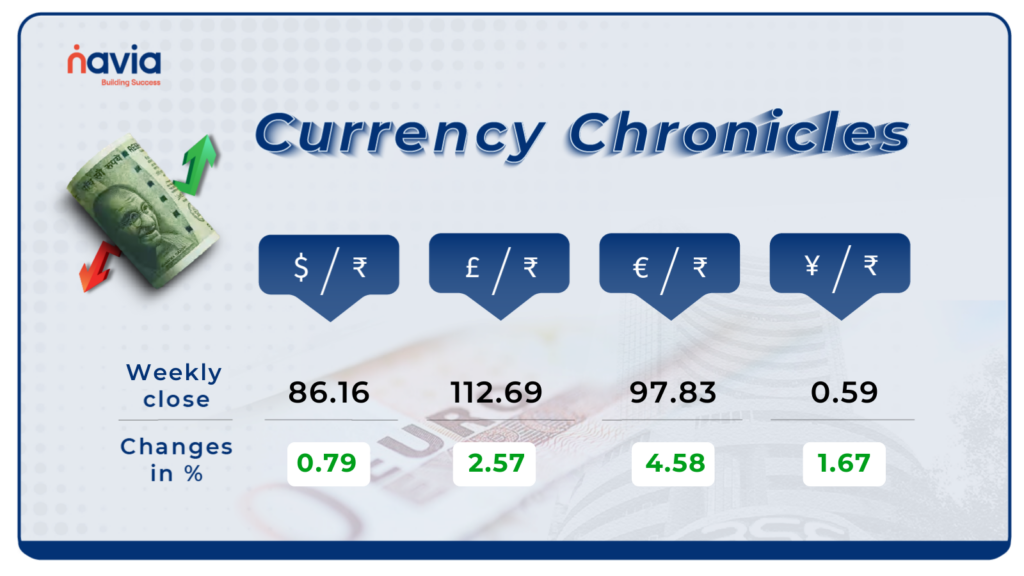

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹86.16 per dollar on April 11, compared to ₹85.48 on April 4. The rate rose by 0.79% during the week, reflecting a neutral market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹97.83 per euro, gaining 4.58% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining 1.67% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

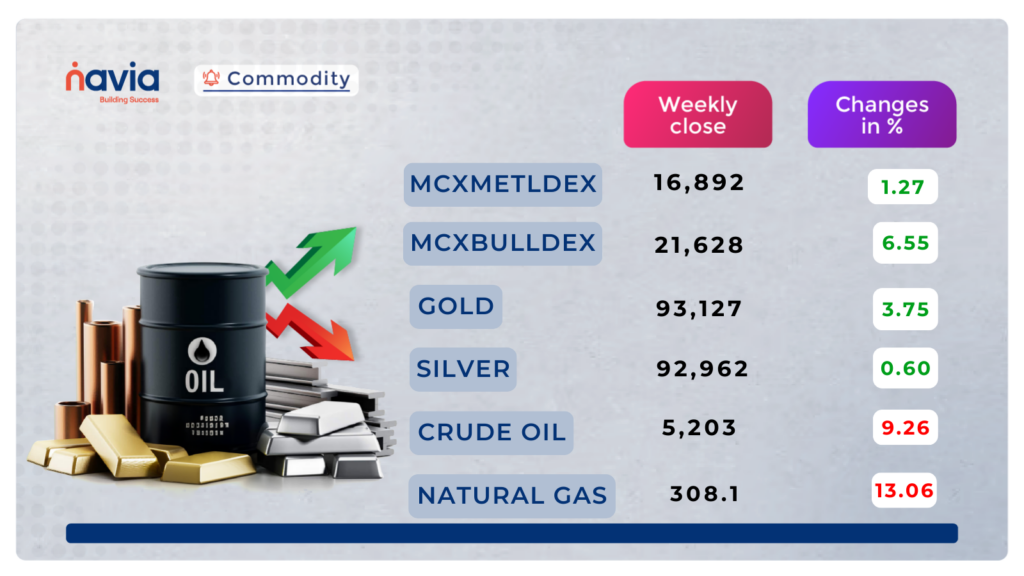

Commodity Corner

Crude oil is experiencing a strong sell-off over the last few sessions, closing at 5,203, down by 96 points. Further momentum is expected above 5360 for an upside move or below 5200 for a downside move. The ongoing trade war is significantly impacting crude oil prices, and a further decline can be expected if crude holds below the 5200 range. Market participants are advised to stay cautious amid global uncertainty and volatility.

Gold experienced significant volatility in the last session, trading within an ascending channel on the 4-hour chart. It closed at 93,127, up by 2,229 points. It is currently trading near the ascending channel breakout area. If it sustains above the 91,500 zone, further upward momentum is expected. For intraday trades, movement above 92,200 may signal an upside move, while a dip below 91,700 could indicate further downside.

Natural gas is trading in a broken descending channel on the 15-minute chart, currently trading at 308. If it sustains above 325, further positive momentum could follow. Another intraday move can be expected above 310 for upside or below 300 for downside momentum. The last session closed down by 16.7 points, settling at 308.1.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Mastering the Relative Strength Index (RSI): A Guide for Beginners

Unlock the power of the Relative Strength Index (RSI) to spot momentum shifts, avoid false entries, and time your trades with confidence—learn the smart way to trade with Navia’s expert support by your side!

Money Flow Index (MFI)

Discover how the Money Flow Index (MFI) helps you read price and volume like a pro—spot breakouts, divergences, and hidden strength in the market. Ready to trade smarter?

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?