May Market Recap: Top Trends of the Month

In May, the Indian stock market extended its winning streak, with the Nifty 50 rising around 2% for a third straight month. Strong foreign inflows of $5.5 billion through large block deals supported the rally. Positive sentiment was driven by easing U.S. trade concerns and hopes of growth-friendly domestic policies. However, the pace slowed from March’s surge as $2 billion in short positions hinted at caution.

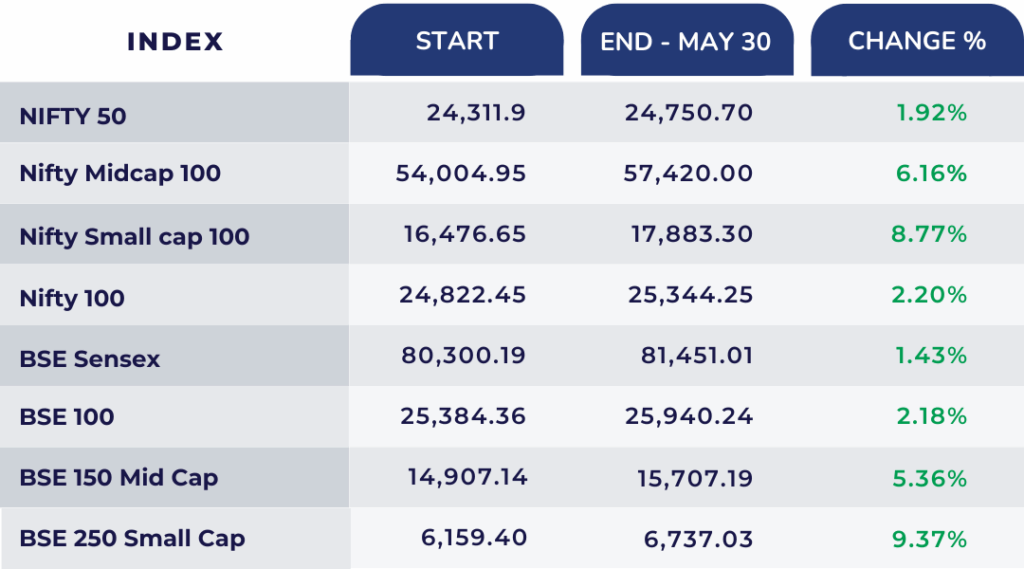

Nifty 50 Performance in May

May Market Roundup: Key Highlights

1. Modest Gains Amid Volatility

The Nifty 50 index concluded May 2025 with a 1.9% increase, despite experiencing a 0.4% decline in the final week. This performance indicates a period of consolidation, with the index trading between 24,200 and 25,500 over the next 2–3 months.

2. Surge in Foreign Portfolio Investments

May witnessed a significant resurgence in foreign portfolio investments (FPIs), with net inflows reaching ₹19,860 crore—the highest monthly inflow in 2025. This marked a substantial increase from April’s ₹4,243 crore, signaling renewed investor confidence in Indian equities.

3. Shift Toward Gold ETFs

Investors demonstrated a growing preference for gold ETFs, with investments surging by 170% year-on-year in Q1 2025. This shift is attributed to record-high gold prices exceeding $3,000 per troy ounce and declining jewelry demand due to elevated prices.

4. Currency Dynamics: Rupee Fluctuations

The Indian rupee experienced fluctuations against the U.S. dollar in May, influenced by global economic factors. The exchange rate varied between ₹84.22 and ₹85.97 per dollar, with the rupee closing at ₹85.47 on May 30.

5. Market Outlook: Cautious Optimism

Despite the gains in May, analysts anticipate a period of consolidation for the Nifty 50, projecting it to trade within the 24,200–25,500 range over the next few months. While foreign investments have bolstered market sentiment, concerns about high valuations and potential corrections persist.

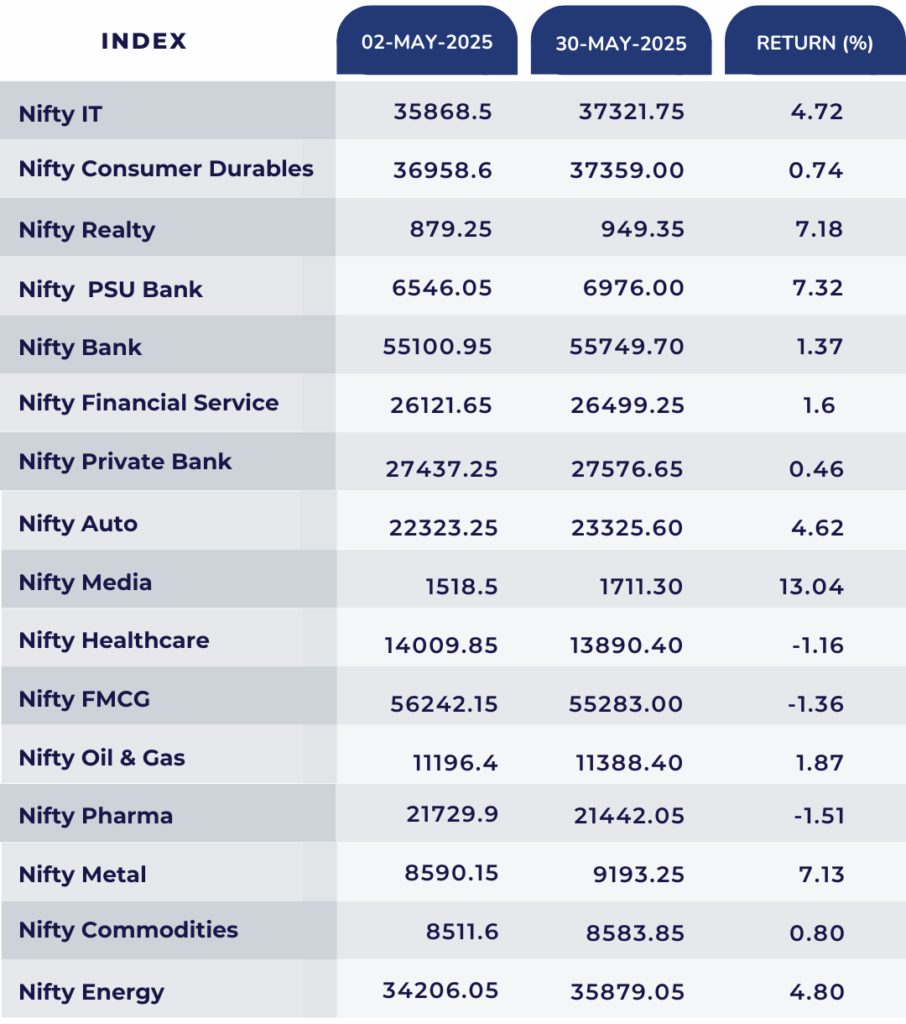

Sectoral Movements

Nifty Media, PSU Bank, and Realty were among the top-performing sectors, while Nifty Healthcare declined by 1.16%, FMCG fell by 1.36%, and Pharma dropped 1.51%.

Company Performance

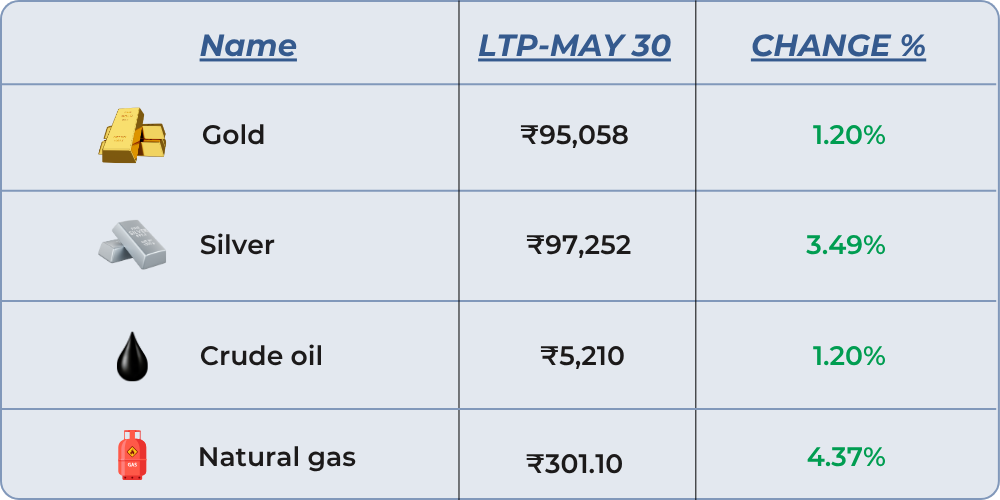

Commodities Month’s Change

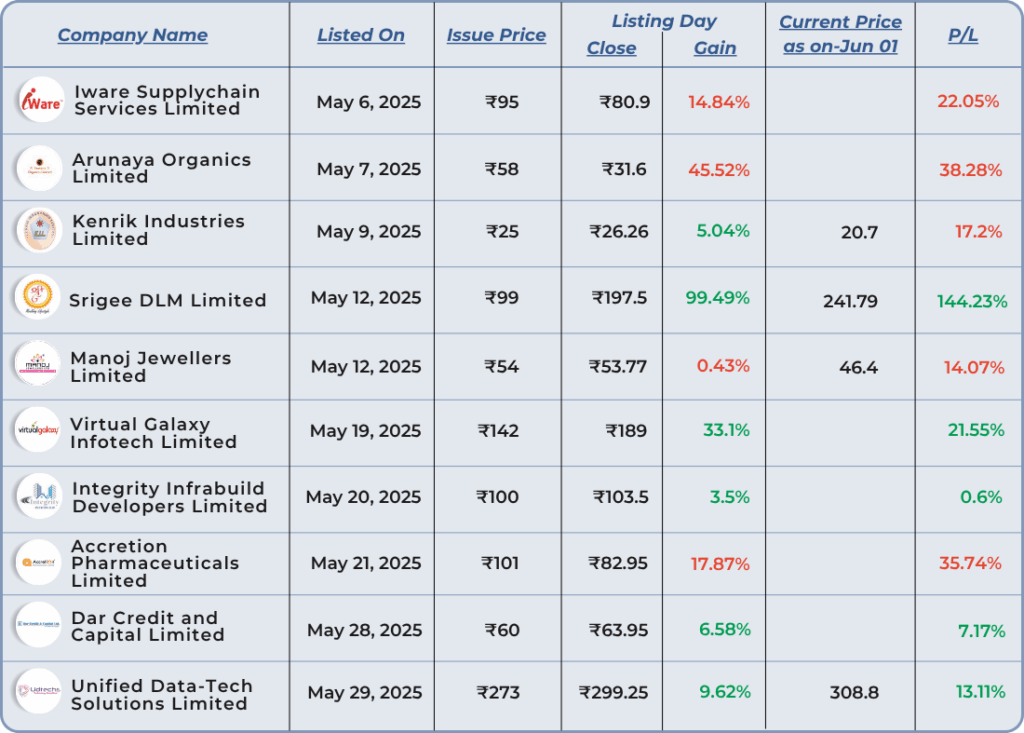

SME IPO Performance – May

May SME IPO: In May, India’s SME IPO market remained vibrant, with 10 listings; 5 stocks delivering positive returns while another 5 experienced declines. Despite mixed sectoral performances, the market sustained solid momentum, fostering a supportive backdrop for IPO activity. Several notable listings garnered significant investor attention, indicating ongoing trust and enthusiasm for newly listed companies.

New NFO’s open

🔸 ICICI Pru Nifty200 Quality 30 Index Fund-Dir (G) 21 May- 04 June 2025

🔸 Motilal Oswal Services Fund – Direct (G) 20 May– 03 June 2025

🔸 Nippon India BSE Sensex Next 30 ETF 21 May– 04 June 2025

🔸 Nippon India BSE Sensex Next 30 Index Fund-Dir (G) 21 May– 04 June 2025

🔸 Union Income Plus Arbitrage Active FOF – Dir (G) 22 May– 05 June 2025

🔸 Groww Nifty 500 Low Volatility 50 ETF 28 May– 11 June 2025

🔸 DSP Nifty Healthcare Index Fund – Direct (G) 2 June– 16 June 2025

🔸 DSP Nifty IT Index Fund – Direct (G) 2 June– 16 June 2025

🔸 Nippon India Income Plus Arbitrage Active FOF-Dir (G) 2 June– 11 June 2025

🔸 Tata Nifty Midcap 150 Index Fund – Direct (G) 2 June– 16 June 2025

Top Blogs – Navia

1. Call Options Vs. Put Options

2. The Rise of ETFs in India: What Investors Should Know?

3. The Men’s Underwear Index: A Silent Indicator of Economic Strain

4. The Lipstick Index: A Quirky Yet Powerful Economic Indicator

5. What is IDCW in Mutual Funds?

6. What is ELSS in Mutual Funds?

7. What is ETF in the Share Market?

8. IDCW Vs Growth: What is the Difference?

9. Gold Price Decoded: From Global Rates to Your Local Jeweller

11. What is Algo Trading or Algorithmic Trading?

12. What ChatGPT Says About Navia!

14. What Gemini Says About Navia!

15. Introducing the All-New Navia All-in-One App – Your Ultimate Trading & Investment Companion!

16. What is an IPO and How to Invest in it?

17. Unlock Market Opportunities with Pay Later (MTF) – Amplify Your Returns in Momentum Markets!

18. Swing Trading vs Day Trading: What’s the Difference?

19. AI in Trading: How to Use AI in Trading?

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.