Market Movements of 2024: Navia’s Annual Highlights

📈 A Look Back at the Indian Stock Market in 2024

2024 was a year of ups and downs for the Indian stock market, filled with record highs, volatility, and a mix of global and domestic factors. Here’s a recap:

Key Highlights

● A Rollercoaster Start: The year began with the Sensex and Nifty hitting all-time highs in January, followed by corrections due to global concerns like recessions in the UK and Japan. Despite these challenges, the Indian market showed resilience.

● Election-Driven Optimism: The return of the BJP-led government in June boosted market sentiment, with the Nifty 50 and Sensex reaching new highs by July.

● Global Headwinds Hit in H2: Rising global interest rates, geopolitical tensions in the Middle East, and the return of Donald Trump to the US presidency brought significant volatility in October and November.

● FII Exodus, DII Support: Foreign Institutional Investors (FIIs) withdrew nearly ₹3 lakh crore, while Domestic Institutional Investors (DIIs) injected ₹5 lakh crore, stabilizing the market during volatile times.

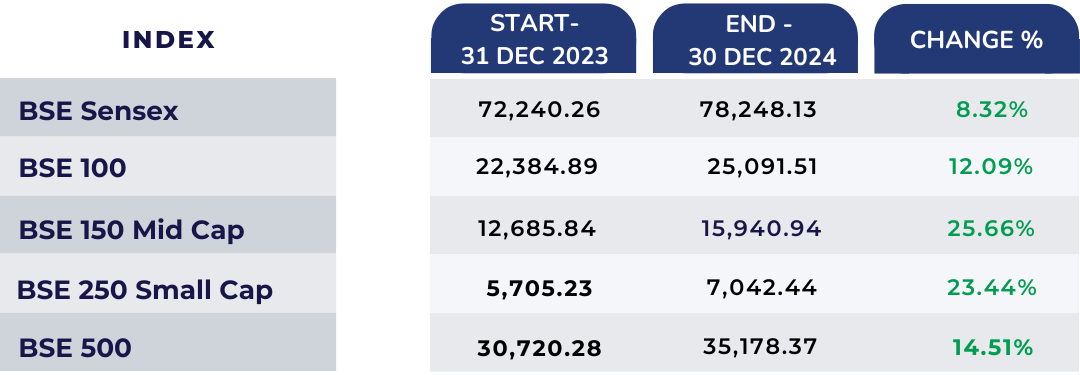

Market Performance

Sensex: Gained 8.32% in 2024, a modest growth compared to 19% in 2023.

Midcap and Smallcap Indices: Outperformed large-caps, with the BSE 150 Mid Cap up by 25.66% and the BSE 250 Small Cap gaining 23.44%

Top Sectors: Healthcare, Pharma, and Realty were the biggest winners, with Nifty Healthcare gaining 40.01%.

Lagging Sectors: Nifty Media dropped 23.83%, while FMCG saw a marginal decline of 0.65%.

Sectoral Movements

This year, most sectors closed in the green. Nifty Healthcare remained the top-performing sector for 2024, with a gain of 40.01 percent. Nifty Media was the worst-performing index, losing 23.83 percent of its value. Below is the performance of all Nifty sectoral indices for 2024.

IPO Boom

2024 was a strong year for IPOs

● 91 IPOs launched: 73% listed in green.

● BSE IPO Index: Gained 31.53%, while SME IPOs surged by 139.44%.

Looking Ahead to 2025

The outlook for 2025 remains optimistic but cautious. Key drivers include:

● Domestic Strength: Strong rural consumption and infrastructure investments.

● Service Sector Momentum: Growth in IT, telecom, and financial services.

● Global Challenges: Inflation, geopolitical uncertainties, and global slowdowns may pose risks.

Key Takeaways for Investors

1) Stay Flexible: Adapt to market volatility.rs

2) Diversify: Balance your portfolio across sectors and market caps.

3) Focus on India’s Strength: The domestic economy offers long-term growth potential.

4) Monitor Global Cues: Be ready to align your portfolio with global trends.

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.