Unlocking Growth: Benefits of Mirae Asset NYSE FANG+ ETF (MAFANG ETF)

Investing in the stock market offers a dynamic way to grow wealth, and exchange-traded funds (ETFs) provide a convenient and diversified approach to this endeavor. The Mirae Asset NYSE FANG+ ETF (MAFANG ETF) is an excellent investment vehicle that allows Indian investors to gain exposure to the top innovative and technology-driven companies listed on the NYSE. This blog will delve into the advantages of investing in the MAFANG ETF, emphasizing the benefits of investing through systematic investment plans (SIPs).

Introduction to MAFANG ETF

The MAFANG ETF is an open-ended scheme that replicates/tracks the NYSE FANG+ Total Return Index. This ETF provides investors with an opportunity to invest in leading technology and innovation-driven companies such as Apple, Microsoft, Amazon, and Alphabet. The fund aims to achieve returns that correspond to the performance of the NYSE FANG+ Total Return Index, subject to tracking error.

Key Attributes of the NYSE FANG+ Index

➝ Tech-Focused: The NYSE FANG+ Index is heavily weighted towards the technology sector, making it an attractive option for investors seeking growth opportunities in tech-driven companies.

➝ Global Exposure: The companies in the NYSE FANG+ Index have significant global reach, offering investors exposure to international markets and trends.

➝ High Growth Potential: The companies in this index are known for their innovation and market leadership, providing strong growth prospects.

➝ Diversification: By investing in the MAFANG ETF, investors can achieve substantial diversification across high-performing technology and media sectors.

NYSE FANG+ Index: Companies That Capture Current Megatrends

The NYSE FANG+ Index consists of companies that are at the forefront of several transformative megatrends. These include:

● E-Commerce: Amazon’s development of Prime Air delivery service using drones.

● Internet Surfing: Google’s significant influence on global internet usage.

● Streaming: Netflix’s massive subscriber base.

● Social Media: Meta Platforms’ extensive global user base.

● Cloud Computing: Microsoft’s leadership in cloud services.

● Electric Vehicles: Tesla’s innovation in the electric vehicle market.

● Cybersecurity: Ongoing advancements in cybersecurity technologies.

● Industrial Automation: Automation technologies transforming industries.

● Data Centers: Significant investments in data center infrastructure.

Interesting Facts About FANG Companies

Meta Platforms: Monthly active users across the globe total 2.79 billion.

Apple: The largest company in the world with a market cap of $2.6 trillion and total revenue of $394 billion.

Amazon: Innovating with Prime Air delivery service to deliver packages in less than 30 minutes.

Netflix: Nearly 231 million paid subscribers worldwide as of Q4 2022.

Google: A 5-minute downtime in 2013 led to a 40% decrease in global internet usage.

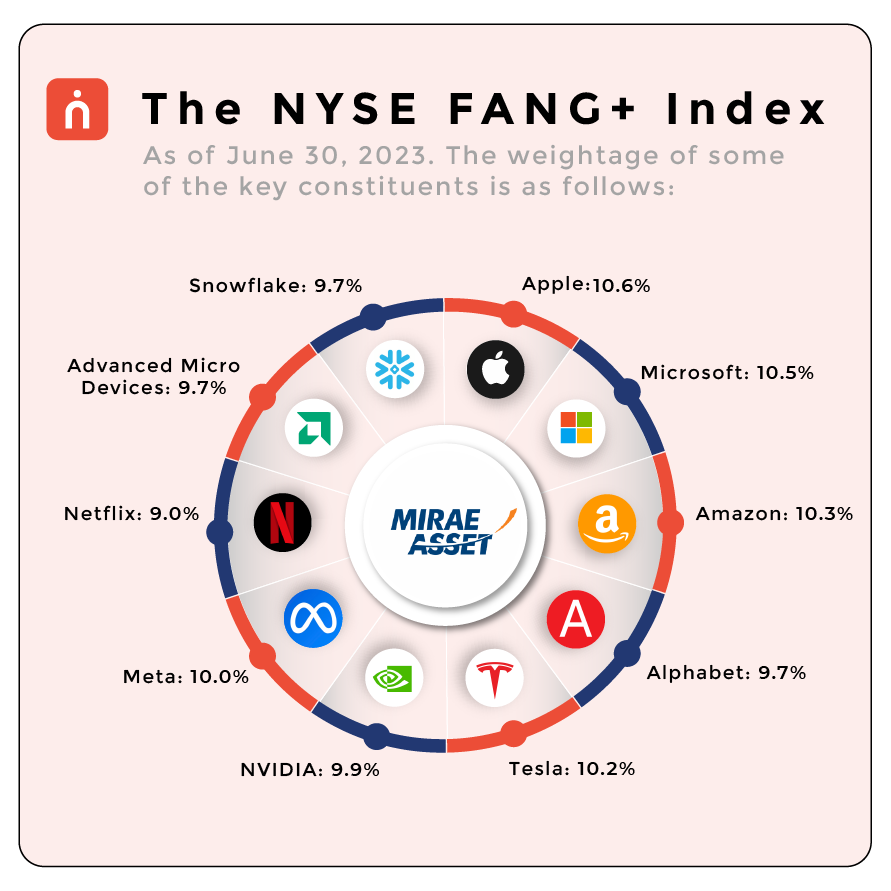

Weightage of Index Constituents

The NYSE FANG+ Index is equally weighted, with each constituent having significant influence on the index’s performance. As of June 30, 2023, the weightage of some of the key constituents is as follows:

Apple Inc.: 10.6%

Microsoft Corp.: 10.5%

Amazon.com Inc.: 10.3%

Alphabet Inc.: 9.7%

Tesla Inc.: 10.2%

NVIDIA Corp.: 9.9%

Meta Platforms Inc.: 10.0%

Netflix Inc.: 9.0%

Advanced Micro Devices Inc. (AMD): 9.7%

Snowflake Inc.: 9.7%

Serial Innovators: In Pursuit of the Next Big Disruption

The companies in the NYSE FANG+ Index are recognized as serial innovators, constantly pursuing the next big disruption. Here are some key insights:

🔸 Apple: Continuously leading in innovation and market capitalization.

🔸 Microsoft: Dominating the cloud computing space with Azure.

🔸 Amazon: Revolutionizing e-commerce and logistics with technology.

🔸 Meta Platforms: Pioneering social media and virtual reality.

🔸 NVIDIA: Leading in graphics processing units (GPUs) and AI technology.

🔸 Tesla: Innovating in the electric vehicle and renewable energy sectors.

Advantages of Investing in MAFANG ETF

➝ Diversification: By investing in the MAFANG ETF, investors gain exposure to some of the largest and most influential technology and media companies, thereby achieving significant diversification.

➝ Cost Efficiency: ETFs generally have lower expense ratios compared to mutual funds. The MAFANG ETF, with a competitive expense ratio, is a low-cost investment option.

➝ Liquidity: ETFs can be bought and sold on stock exchanges like shares, providing liquidity and flexibility to investors.

➝ Transparency: The holdings of the MAFANG ETF are disclosed on a daily basis, ensuring transparency for investors.

Systematic Investment Plans (SIP) in MAFANG ETF

Systematic investment plans (SIPs) allow investors to invest a fixed amount regularly irrespective of market conditions. Here’s why SIPs in the MAFANG ETF are beneficial:

● Rupee Cost Averaging: SIPs help in averaging the purchase cost over time, reducing the impact of market volatility.

● Discipline and Consistency: SIPs instill investment discipline and encourage consistent investing, which is crucial for long-term wealth creation.

● Affordability: SIPs make it affordable for investors to participate in the stock market with small regular investments rather than lump-sum amounts.

● Compounding Benefits: Regular investments over time benefit from the power of compounding, leading to significant wealth accumulation.

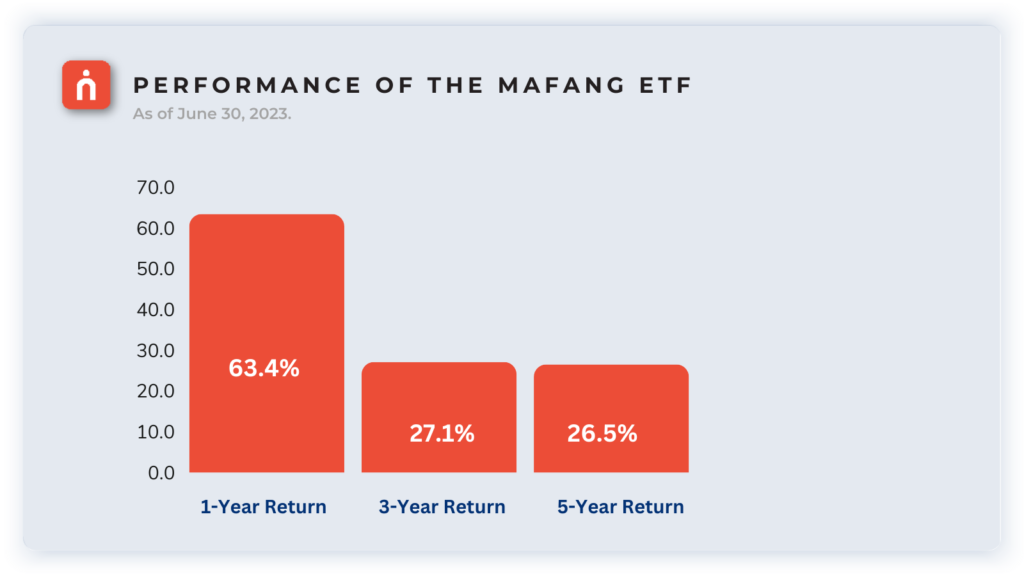

Performance of the MAFANG ETF

According to the information provided by Mirae Asset, the MAFANG ETF has demonstrated strong historical performance. Here are some key performance metrics as of June 30, 2023:

These returns highlight the potential for substantial growth, especially for long-term investors.

Investment Process

Investors can buy or sell units of the MAFANG ETF through the NSE/BSE in round lots of 1 unit. This process is facilitated through the Navia APP at Zero Brokerage and Zero Charges through nCoins, providing a cost-effective and convenient investment experience.

Why Choose Navia’s Zero Brokerage Stock Investing App?

Investing in the MAFANG ETF through Navia’s zero brokerage stock investing app offers several advantages:

🔸 Cost Savings: Zero brokerage ensures that investors save on transaction costs, enhancing overall returns.

🔸 User-Friendly Interface: Navia’s app is designed to be intuitive and easy to use, making the investment process seamless.

🔸 Easy Stock/ETF SIP Baskets: Easily create a stock/ETF basket of your choice and start an SIP.

🔸 24/7 Accessibility: Investors can manage their investments anytime, anywhere, providing convenience and flexibility.

For more information, you can visit the Mirae Asset Mutual Fund website.

The Mirae Asset NYSE FANG+ ETF (MAFANG ETF) offers a compelling investment opportunity for those looking to capitalize on the growth of leading technology and innovation-driven companies. By tracking the NYSE FANG+ Total Return Index, the MAFANG ETF provides exposure to some of the most influential and high-growth tech giants such as Apple, Microsoft, and Amazon, ensuring diversification and potential for significant returns. Investing through systematic investment plans (SIPs) further enhances this opportunity by allowing regular, disciplined investments and benefiting from rupee cost averaging.

With its competitive expense ratio, liquidity, and transparency, the MAFANG ETF is an attractive choice for investors seeking to tap into the transformative megatrends shaping the global technology landscape. As you consider adding this ETF to your portfolio, remember that consistent investing and a long-term perspective are key to unlocking its full potential. For a seamless investment experience, explore options like the Navia app, which offers zero brokerage and user-friendly features.

Invest wisely and let the Mirae Asset NYSE FANG+ ETF be a part of your strategy to achieve long-term financial growth and success.

We’d Love to hear from you

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.