June Market Recap: Top Trends of the Month

In June, Indian equity markets extended their upward trend, with the Nifty gaining for the month, supported by strong foreign inflows of approximately ₹8,700 crore. Positive momentum was driven by easing inflation, supportive RBI policies, and strong performances in banking, IT, and financial sectors. Despite late profit booking and rupee fluctuations, upbeat factory output and global cues helped markets close Q2 on a strong note.

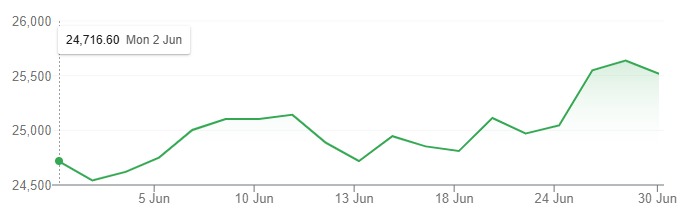

Nifty 50 Performance in June

June Market Roundup: Key Highlights

1. Moderate Recovery & Volatility:

June 2025 concluded with a moderate recovery for the Indian stock market. The Nifty 50 settled at 24,669.7 on June 30th. While demonstrating some positive momentum, the month was characterized by fluctuations influenced by a combination of domestic and global factors.

2. Key Market Drivers:

🠖 Global Economic Landscape: International economic headwinds, including ongoing trade tensions between the US and China and global interest rate uncertainties, continued to exert influence.

🠖 FII Re-engagement: Foreign Portfolio Investors (FPIs) shifted to a net buying stance during the latter half of June, reversing earlier outflows. Preliminary data suggests approximately ₹32,466.4 crore was invested in the last eight sessions of the month, including a significant ₹12,594.38 crore inflow on June 26th.

🠖 Positive Economic Indicators: Encouraging economic data, notably a manufacturing PMI reaching 57.8 – a three-month high – and easing inflation to 4.81%, provided underlying support to market sentiment.

3. Challenges & Considerations:

🠖 Monsoon Progress: Delayed monsoon rains in key agricultural regions raised concerns regarding potential impacts on agricultural output and rural demand.

🠖 US-India Trade Discussions: The ongoing negotiations between India and the U.S. concerning potential tariffs on Indian exports remained a key area of uncertainty for export-oriented sectors.

🠖 RBI & Liquidity Management: The Reserve Bank of India maintained a proactive approach to liquidity management, intervening in forex markets to stabilize the rupee and manage inflationary pressures.

4. Investor Sentiment:

Amidst market volatility, Indian investors demonstrated a preference for safe-haven assets, resulting in increased demand for Gold ETFs as prices exceeded $3,000 per troy ounce.

5. Rupee Performance:

The Indian rupee experienced fluctuations against the US dollar, closing June at 83.45. These movements impacted import costs and contributed to inflationary pressures.

6. Forward Look:

Market sentiment remains cautiously optimistic. Despite remaining approximately 10.5% below its late September peak, analysts anticipate moderate growth driven by improving economic fundamentals and attractive valuations in sectors like banking, financials, and infrastructure.

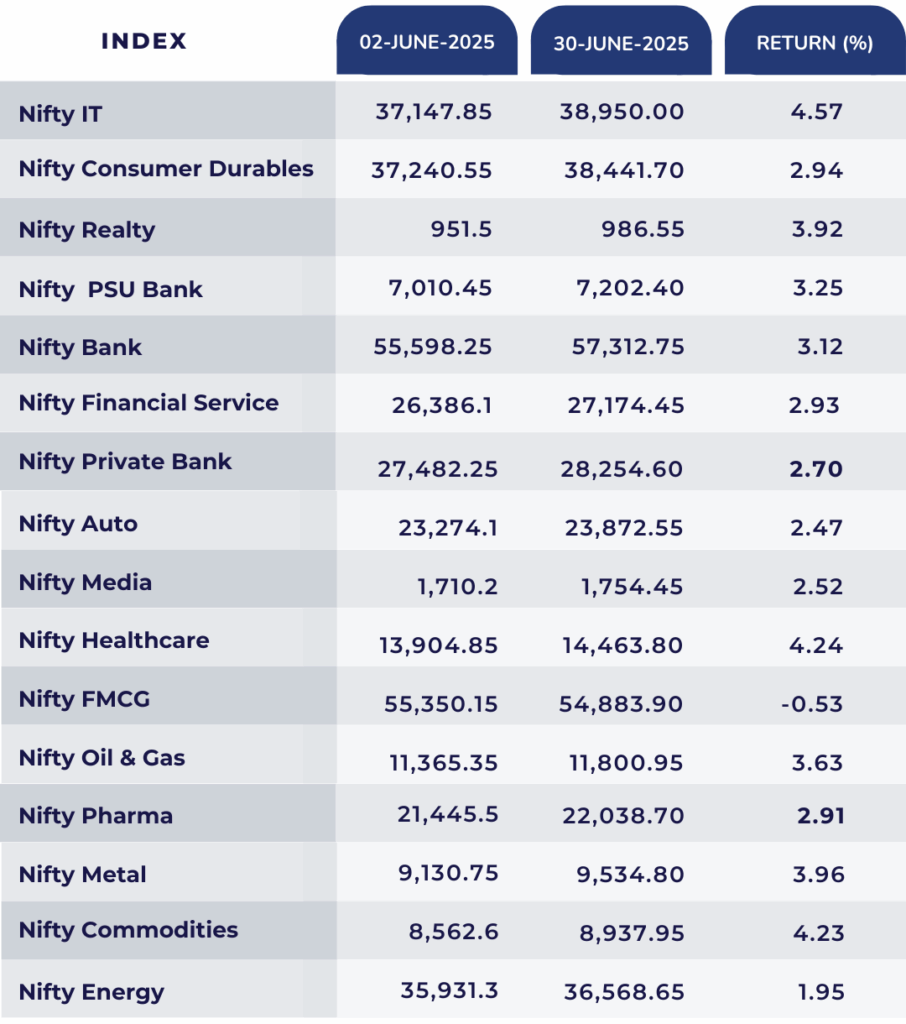

Sectoral Movements

Nifty IT, Healthcare, and Commodity were among the top-performing sectors, while Nifty FMCG fell by 0.53%.

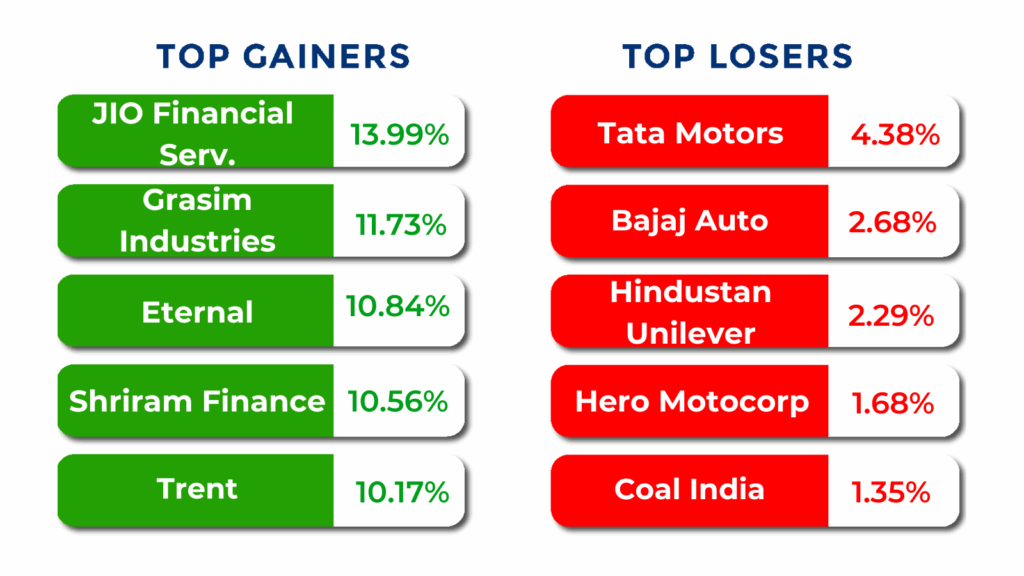

Company Performance

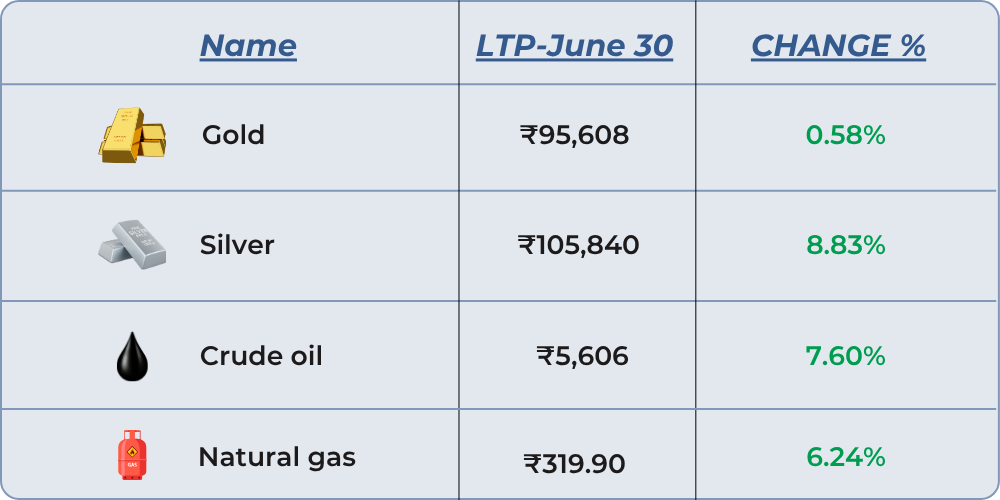

Commodities Month’s Change

SME IPO Performance – June

June SME IPO: In June, India’s SME IPO market remained active and vibrant, with 18 companies making their market debut. Out of these, 11 IPOs delivered positive returns, showcasing strong investor interest and market confidence. 7 IPOs experienced declines or remained flat, reflecting mixed sectoral performance. Despite some underwhelming listings, the overall sentiment stayed positive, underlining continued enthusiasm for new investment opportunities in the SME space.

New NFO’s open

🔸 JioBlackRock Liquid Fund – Direct (G) 30 June- 02 July 2025

🔸 JioBlackRock Money Market Fund – Direct (G) 30 June- 02 July 2025

🔸 JioBlackRock Overnight Fund – Direct (G) 30 June- 02 July 2025

🔸 ICICI Pru Nifty Private Bank Index Fund-Dir (G) 1 July– 14 July 2025

🔸 TRUSTMF Multi Cap Fund – Direct (G) 30 June- 14 July 2025

🔸 Mahindra Manulife Banking & Financial Services Fund-Dir (G) 27 June– 11 July 2025

🔸 SBI Nifty200 Momentum 30 Index Fund – Dir (G) 23 June– 03 July 2025

🔸 Zerodha Silver ETF FoF – Direct (G) 23 June– 04 July 2025

🔸 Kotak Nifty 200 Quality 30 Index Fund – Dir (G) 23 June– 07 July 2025

🔸 Kotak Nifty200 Quality 30 ETF 23 June– 07 July 2025

🔸 Union Low Duration Fund – Direct (G) 26 June– 03 July 2025

🔸 Bajaj Finserv Small Cap Fund – Direct (G) 27 June– 11 July 2025

🔸 HDFC Innovation Fund – Direct (G) 27 June– 11 July 2025

These NFOs are currently open for subscription; investors should evaluate based on their individual goals and risk profiles.

Top Blogs – Navia

1. Intraday Trading Strategies, Tips and Risks

2. What is Speculation in Trading?

4. What are Hybrid Mutual Funds?

5. Difference Between Stock Split and Bonus Issue

7. What are Open-Ended Mutual Funds and How to Invest in them?

8. What are Close-Ended Funds?

9. Difference Between Close-Ended and Open-Ended Funds

10. Jio BlackRock Gets SEBI Approval to Act as Investment Advisers

11. Making Your Investment Payments Safer and Simpler with Validated UPI IDs

12. What is XIRR in Mutual Funds?

13. Why Stock Investing is Often More About Sentiment than Fundamentals!

15. Learn to Share Investment Details with Nominees Through DigiLocker

16. SEBI’s New Rules on Algo Trading for Retail Investors – What You Need to Know!

17. Difference Between Value Stocks and Growth Stocks

18. Introducing MITRA: Helping You Find Forgotten Mutual Fund Investments!

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.