July Market Recap: Top Trends of the Month

The Indian stock market began July 2025 with a two-day rally before experiencing a downturn later in the month. Factors influencing the market included concerns over US tariffs and fluctuations in foreign investment flows.

Nifty 50 Performance in July

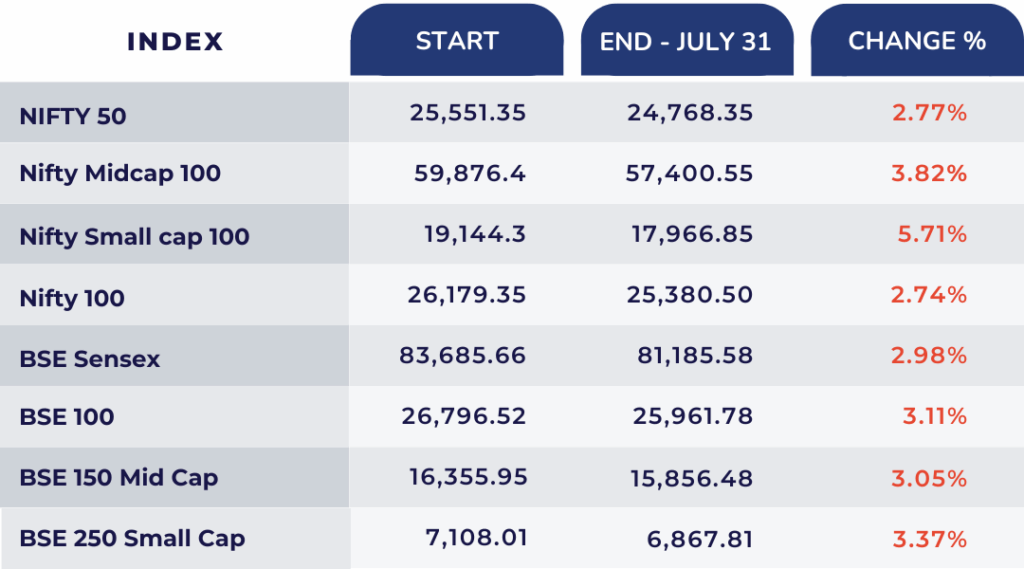

July Market Roundup

The Indian stock market experienced a mixed performance in July 2025, with a slowdown in activity amidst concerns over US tariffs and foreign fund outflows. The Nifty 50 closed at 25,551.35 and the Sensex settled at 83,685.66.

Key Highlights:

📉 Market Decline: Both the Nifty 50 and Sensex experienced declines in July, influenced by global market weakness and domestic concerns.

📦 US Tariffs Impact: The announcement of a 25% tariff on Indian exports by the US President weighed heavily on market sentiment.

💸 FII Outflows: Foreign Institutional Investors (FIIs) continued to offload equities, contributing to the market downturn.

🔻 Sectoral Performance: Cyclical sectors faced sharp losses, while defensive sectors like FMCG showed some resilience.

⚠️ Volatility: India VIX ticked up to 11.54, indicating a slight rise in market volatility.

Strong Manufacturing Growth Fuels Market Sentiment

India’s manufacturing sector saw a significant upswing in July, with the HSBC India Manufacturing Purchasing Managers’ Index rising to 59.1 – a 16-month high. This indicates robust demand and a positive outlook for the industrial sector.

Market Activity Cools Amidst Concerns

Despite the manufacturing growth, market activity slowed down in July, with a 16% drop in cash market turnover—the steepest decline since October 2023. This is attributed to a combination of weak investor sentiment and regulatory adjustments.

US Tariffs Impact Market Performance

A significant development in July was the announcement of a 25% tariff on Indian exports by the US President, causing a negative reaction in the Indian stock markets. The Gift Nifty indicated a gap-down opening. Concerns over newly imposed US tariffs on Indian exports weighed on the market, leading to declines in early trade. Asian markets also showed a downward trend in response to the news.

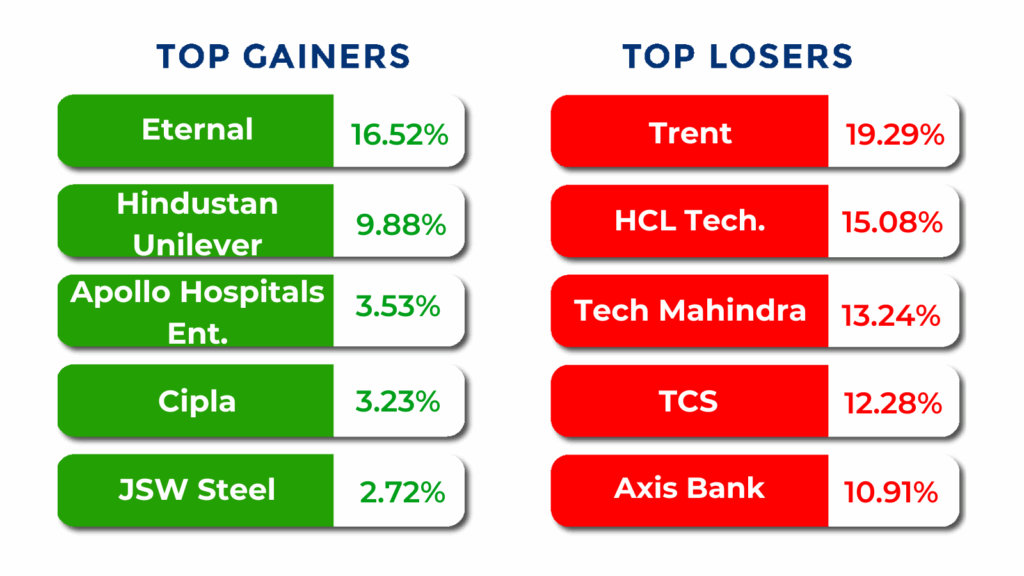

Stock Specific Movements

Several stocks experienced notable movements. 3M India rose 2.02%, while GE Vernova TD India surged 5%. HUL also saw gains, solidifying its position as a key market player.

Dividend Declarations & Short-Term Picks

Several companies announced dividend payouts in July, including Maruti, Marico, and Eicher Motors. Analysts in media reports discussed short-term activity in stocks like Apollo Hospitals, Cipla, and Godrej Consumer Products. These mentions were part of broader market commentary and not investment advice.

Outlook

Despite the short-term dip, the overall outlook remains cautiously optimistic, with analysts expecting flat-to-positive openings based on global market cues.

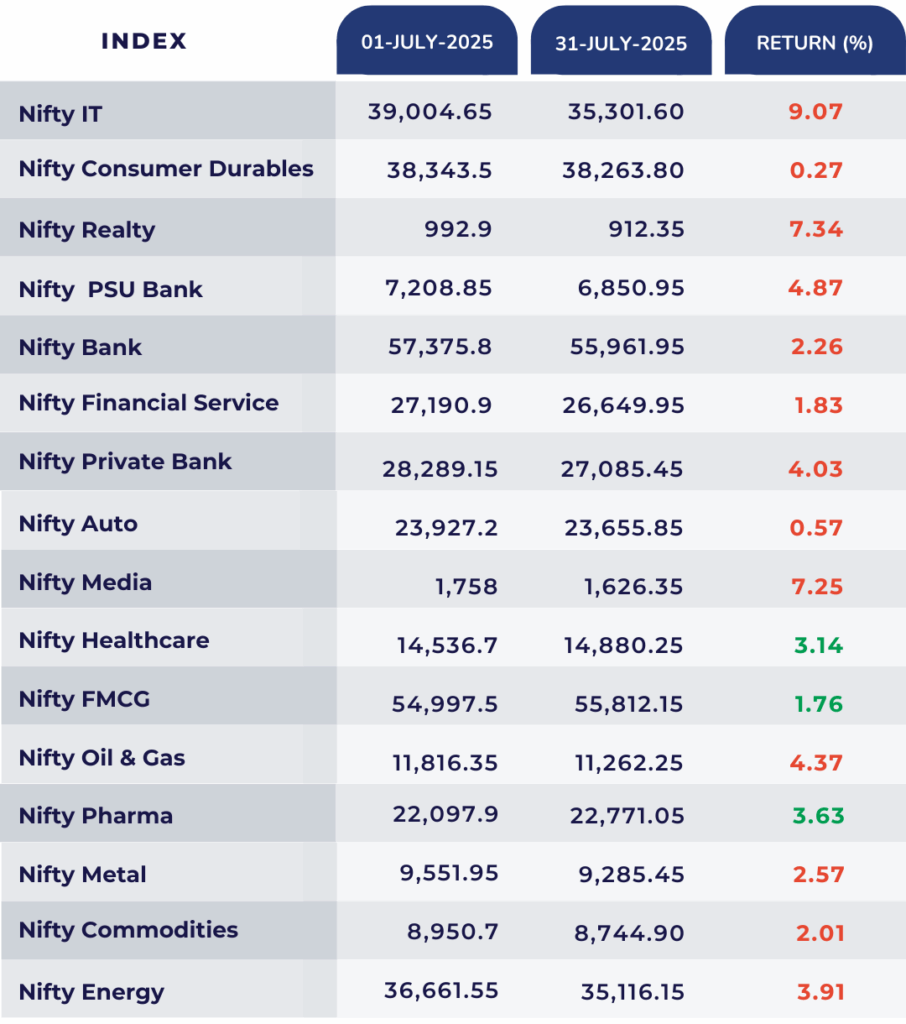

Sectoral Movements

Nifty Healthcare, Pharma, and FMCG emerged as the top-performing sectors, while Nifty Consumer Durables and Auto were the underperformers, declining by nearly 1%.

Company Performance

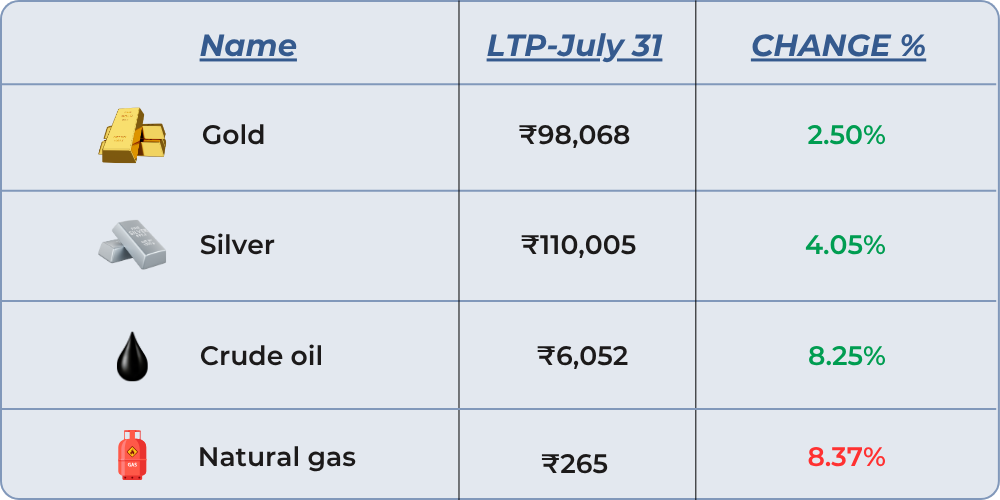

Commodities Month’s Change

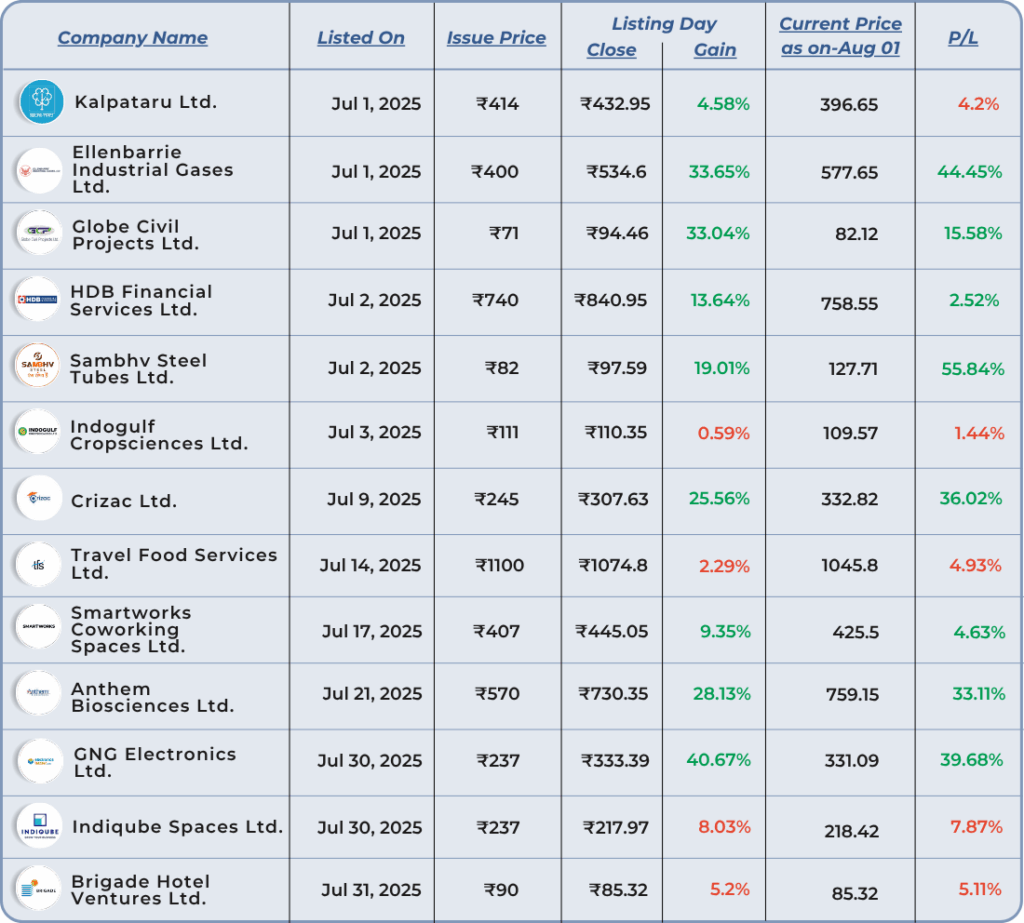

SME IPO Performance – July

July SME IPO:

India’s IPO market witnessed strong momentum in July 2025, with 13 companies making their public debut, indicating solid investor appetite across various sectors. Standout listings such as HDB Financial Services, GNG Electronics, Crizac Limited, Ellenbarrie Industrial Gases, and Anthem Biosciences saw substantial oversubscription. Analysts note that SME IPOs saw strong demand in July. Historically, companies with stronger fundamentals and long-term growth stories tend to attract more sustained interest.

Top Reads From July!

From smart trades to safer investing—explore July’s top blogs in just a few taps!

● SEBI’s Latest Guidelines on F&O Trading – What Retail Traders Should Know!

● Electricity Futures: A New Trading Opportunity

● How Pro Traders Use Put-Call Ratio (PCR) Charts to Time Their Option Trades

● What Is Open Interest Analysis & Why It’s a Game-Changer for Options Traders

● Charting Combined Option Premium: How Pro Traders Time Option Trades Using a Simple Metric

● What is Max Pain in Options Trading?

● Investing ₹1000 in MON100 ETF: Gaining Exposure to Bitcoin via MicroStrategy

● Understanding Candlestick Patterns: A Simple Guide for Traders

● Digital Safety First: Mobile Security Tips Every Investor Must Know!

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.