January Outlook: A Comprehensive Review of Market Performance

- Nifty 50 Performance in January

- January Market Roundup

- Sectoral Movements

- Company Performance

- Commodities Month's Change

- SME IPO Performance – January

- Top Reads From January!

- Interactive Zone!

January was a test of nerves for the Indian stock market, shaped by heightened volatility, persistent FII outflows, and growing anticipation ahead of the Union Budget. Early optimism gradually gave way to caution as investors weighed global uncertainties against domestic cues such as RBI policy expectations and economic data. Despite pressure on headline indices, strong DII participation and underlying fundamentals helped cushion the downside. Together, these dynamics set the stage for a market environment that demanded patience, selectivity, and a close watch on policy-driven triggers.

Nifty 50 Performance in January

January Market Roundup

January 2026 marked a volatile month for the Indian stock market, characterized by anticipation ahead of the Union Budget 2026, persistent FII outflows, and mixed domestic cues including upcoming RBI policy expectations. While early gains were seen, sentiment turned cautious towards month-end due to global uncertainties and profit booking.

Key Highlights:

Union Budget Anticipation;

Markets traded range-bound to mildly cautious as investors awaited the Union Budget presentation on February 1, 2026 (with special trading session on Sunday). Expectations centered on fiscal discipline, infrastructure push, and tax rationalization, influencing sectoral rotations.

FII and DII Flows:

Foreign Institutional Investors (FIIs) remained net sellers early in the month, offloading around ₹7,608 crore in the first two sessions and continuing outflows totaling significant amounts amid rupee pressure and global concerns. Domestic Institutional Investors (DIIs) provided counter-support through buying, with net positive institutional flows on several days like January 29 (DIIs bought ₹2,639 crore).

Market Performance:

The BSE Sensex and NSE Nifty showed early resilience, with Nifty around 26,173 on January 1 and weekly gains noted early on, but closed lower towards end-month; Sensex hovered around 82,000-85,000 levels with dips on January 23 and January 30. Overall, broader indices experienced volatility but midcaps outperformed in spots.

Economic Indicators:

GST collections for December 2025 (relevant lead-in) rose 6.1% YoY to ₹1.74 lakh crore, signaling robust activity amid reforms. RBI polls indicated steady repo rate at 5.25% through 2026, prioritizing growth and inflation control.

RBI and Growth Outlook:

Expectations for no rate change in February policy amid comfortable inflation and 6.8-7.2% FY27 GDP forecast from economic survey supported banking stocks.

Outlook

January’s performance underscores the market’s resilience amid FII selling and pre-Budget caution, buoyed by DII support and strong fundamentals. Post-Budget clarity on fiscal measures and RBI stance could drive direction, with long-term optimism intact for infrastructure and growth sectors.

Sectoral Movements

In January 2026, the Indian market displayed a sharp sectoral divide; while broad momentum remained positive, several key indices faced significant downward pressure. Leading the charge on the upside were the Metal and PSU Bank sectors, which surged by 5.91% and 5.76% respectively, followed by a steady 1.42% gain in Commodities. However, these gains were contrasted by steep corrections in interest-rate-sensitive and consumption-driven pockets: the Realty sector was the month’s steepest loser with a sharp 10.80% decline, while FMCG fell by 7.65% and Consumer Durables dropped 6.41%.

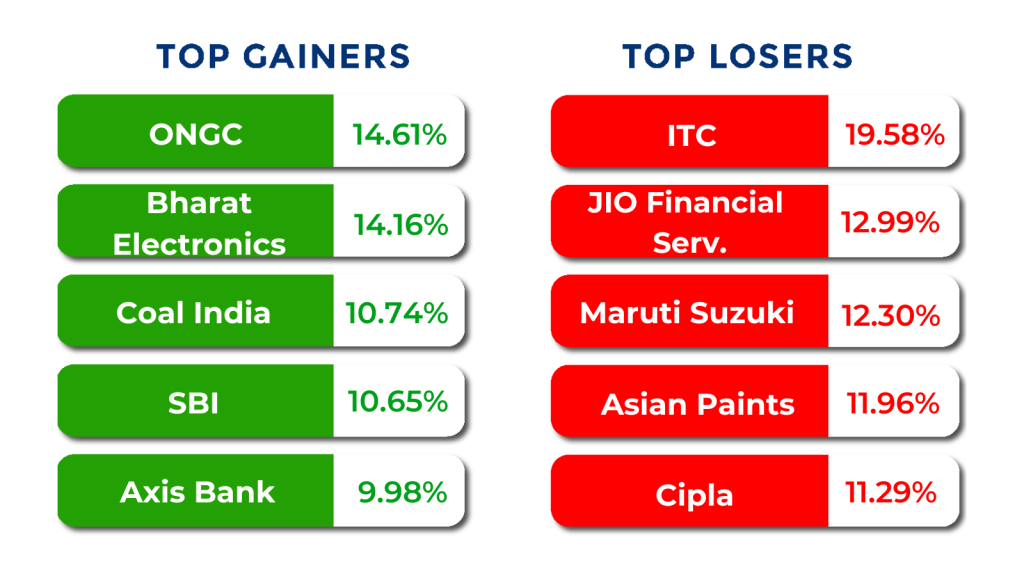

Company Performance

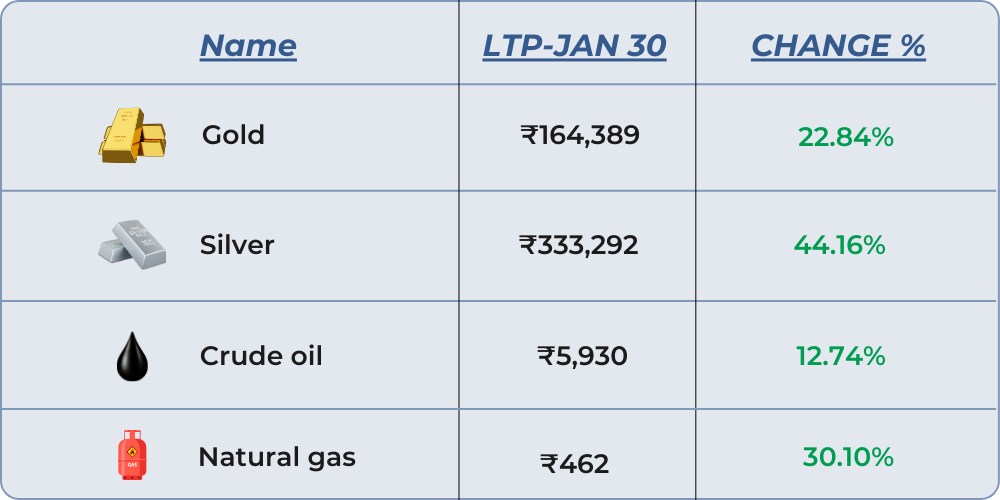

Commodities Month’s Change

SME IPO Performance – January

January SME IPO:

January 2026 proved to be a high-stakes month for the Indian IPO market, with 15 companies making their debut to contrasting results. The primary market delivered standout successes for investors in firms like Defrail Technologies Ltd., which led the pack with a massive 48.15% gain, followed by robust listings from KRM Ayurveda Ltd. (31.7%) and E to E Transportation Infrastructure Ltd. (17.56%). While these historical gains highlight the potential for significant listing-day appreciation, the month also served as a stark warning regarding market volatility. The downside was particularly severe for several debuts that crashed well below their issue prices, most notably Yajur Fibres Ltd., which plummeted 59.57%, alongside steep declines for Victory Electric Vehicles International Ltd. (45.61%) and Armour Security India Ltd. (41.05%).

Disclaimer: The IPO performances mentioned are historical examples and not investment recommendations.

Top Reads From January!

Expand your financial expertise with our January must-reads! Discover essential lessons on market dynamics, strategic planning, and the behavioral patterns that drive today’s investors.

● Navigating the Shift: A Comprehensive Guide to SEBI PMS Regulatory Changes in 2026

● Demat Account Charges Explained: A Comprehensive Guide to Hidden and Visible Costs

● The Digital Revolution: How Technology is Redefining Modern Trading

● SilverBees ETF: A Sparkling Investment Prospect

● The Digital Revolution: How Technology is Redefining Modern Trading

● Understanding NRI Investments: What is the Difference Between a PIS and a NON-PIS Account?

● NRE vs NRO Accounts: The Ultimate Comparison Guide for Global Indians

● The Dark Side of Discounts: How to Outsmart Online Shopping Scams in India

● Understanding the Short Squeeze: When Markets Move Faster Than Traders Can React

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.