ITbees ETF: Tapping into the Tech Revolution

In today’s fast-evolving world, technology is at the forefront of innovation and growth. For investors looking to capitalize on this trend, the Nippon India ETF Nifty IT (ITBEES) offers a compelling opportunity. This ITbees ETF provides exposure to India’s leading technology companies, allowing investors to benefit from the tech revolution driving the future.

Why Invest in ITBEES ETF?

The ITBEES ETF is designed to track the performance of the Nifty IT Index, which comprises the top IT companies in India. With the tech industry booming, this ETF offers a diversified and efficient way to invest in the sector’s growth. Here’s a closer look at why the ITBEES ETF might be the right choice for you.

Performance Overview

The ITBEES ETF has demonstrated robust performance over the years, reflecting the growth trajectory of the technology sector. Below is a summary of the fund’s returns compared to its benchmark and category.

| Time Period | Fund Returns (%) | Benchmark Returns (%) | Category Returns (%) |

|---|---|---|---|

| 3 Months | 21.87 | 22.95 | 20.87 |

| 6 Months | 9.26 | 11.04 | 11.00 |

| 1 Year | 35.48 | 35.74 | 37.87 |

| 3 Years Annualized | 8.38 | 7.77 | 9.47 |

The ITBEES ETF has consistently provided strong returns, closely tracking the Nifty IT Index. The fund’s performance highlights its ability to deliver growth in line with the broader technology market, making it a solid choice for tech-focused investors.

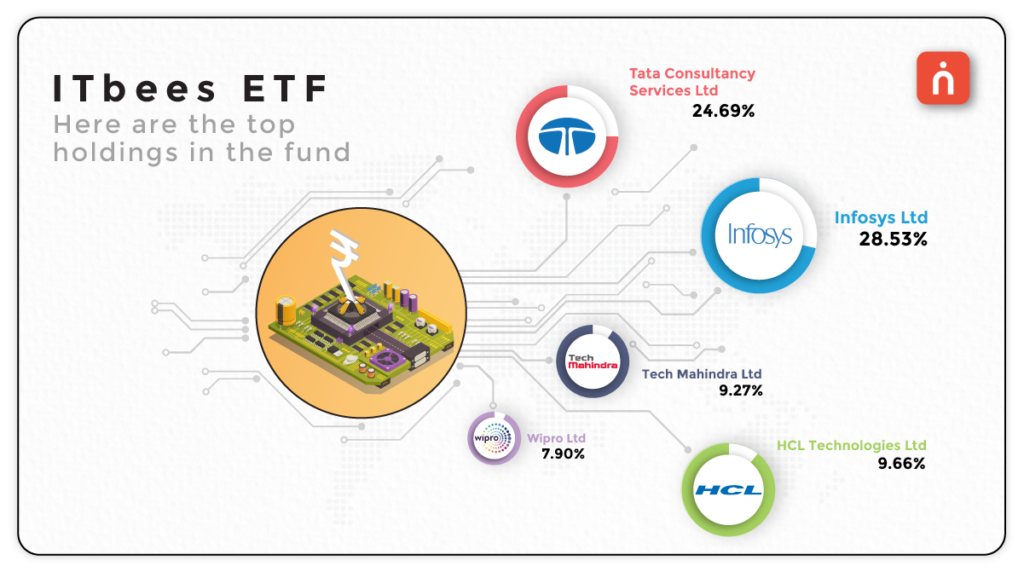

Top Holdings

The ITBEES ETF is heavily weighted towards some of the biggest names in the Indian IT sector. Here are the top holdings in the fund:

With 99.62% of its assets invested in the top 10 technology companies, the ITBEES ETF provides concentrated exposure to the sector’s leaders. These companies are not only driving growth in the IT industry but are also pivotal in shaping the future of technology globally.

Advantages of Investing in ITBEES ETF

🔹 Sector-Specific Exposure: The ITBEES ETF allows investors to focus on the technology sector, which is poised for continued growth due to increasing digitalization, innovation, and global demand for IT services.

🔹 Diversification: By investing in a basket of top IT companies, the ETF reduces the risk associated with individual stock investments while providing exposure to the sector’s overall growth.

🔹 Cost-Effective: With a low expense ratio of 0.22%, the ITBEES ETF is a cost-effective way to gain exposure to the technology sector, making it an attractive option for both retail and institutional investors.

🔹 Liquidity: As an ETF, ITBEES offers the advantage of liquidity, allowing investors to buy and sell shares on the exchange throughout the trading day.

Is ITBEES Right for You?

If you’re bullish on the technology sector and looking for a way to invest in the future of India’s IT industry, the ITBEES ETF is an excellent option. It provides a balanced mix of growth potential, diversification, and cost efficiency, making it a smart choice for both long-term investors and those looking to capitalize on short- to medium-term trends in the tech industry.

How to Invest in ITBEES ETF?

Investing in the ITBEES ETF is simple and straightforward. You can purchase units through any brokerage account, just like you would with individual stocks. Additionally, if you’re interested in systematic investments, you can set up an SIP to regularly invest in the ETF, allowing you to build your exposure over time.

Why Choose Navia’s Zero Brokerage Stock Investing App to invest in ITBEES ETF?

Investing in the ITBEES ETF through Navia’s zero brokerage stock investing app offers several advantages:

🔸 Cost Savings: Zero brokerage ensures that investors save on transaction costs, enhancing overall returns.

🔸 User-Friendly Interface: Navia’s app is designed to be intuitive and easy to use, making the investment process seamless

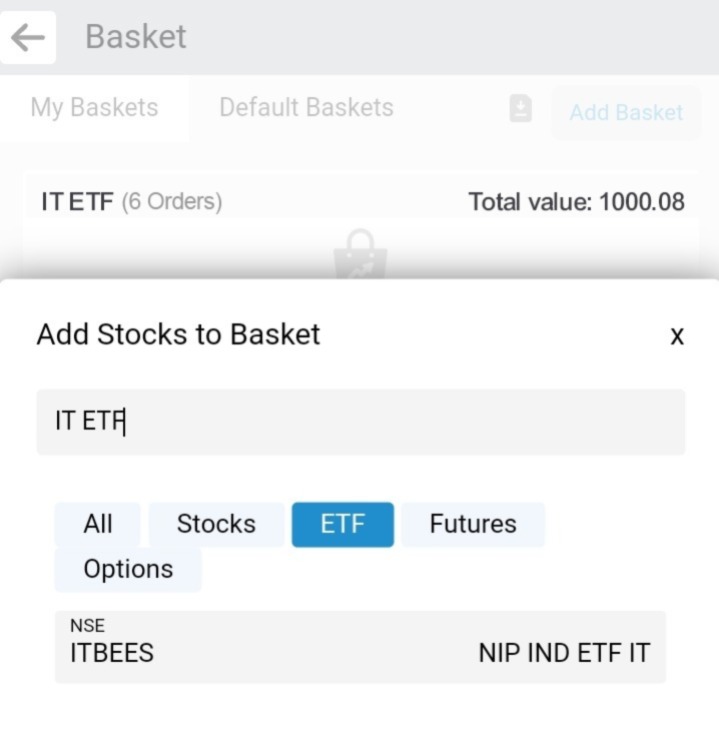

🔸 Easy Stock/ETF SIP baskets: Easily create a stock/ETF basket of your choice and start an SIP.

🔸 24/7 Accessibility: Investors can manage their investments anytime, anywhere, providing convenience and flexibility. Know more about the APP here. Check out the how to video’s here.

Here is a list of other Information Technology ETF’s and their returns as on 28th September 2024.

| ETF Name | NSE Symbol | 30 Day Return | 365 Day Return | Underlying Index | Live NAV |

| Nifty IT ETF (ITBEES) | ITBEES | -0.15% | 35.18% | Nifty IT TRI Index | Click here |

| Mirae Asset Nifty IT ETF | ITETFADD | 0.05% | Not Available | Nifty IT Index | Click here |

| SBI Nifty IT ETF | SBIETFIT | 0.46% | 35.36% | Nifty IT Index | Click here |

| UTI Nifty IT ETF | NIFITETF | 0.22% | Not Available | Nifty IT Index | Click here |

| Axis Nifty IT ETF | AXISTECETF | -0.15% | 33.48% | Nifty IT Index | Click here |

Steps to Set up SIP for IT Bees ETF on Navia APP:

1. Download and Log In to the Navia app.

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add IT Bees to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

Conclusion

The Nippon India ETF Nifty IT (ITBEES) offers a powerful way to tap into the ongoing tech revolution. With its strong performance, strategic holdings, and sector-specific focus, it’s an ideal vehicle for investors looking to benefit from the continued growth of India’s technology sector.

Don’t miss out on the opportunity to be a part of this dynamic industry. Start investing in the ITBEES ETF today and position yourself for future success.

Explore the ITBEES ETF and start your investment journey now!

(All Figures mentioned in this blog are as on the date of publishing).

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to hear from you