A Comprehensive Guide to Investing in JUNIOR BEES ETF

The Nippon India ETF Nifty Next 50 Junior BeES (JUNIOR BEES) is a popular exchange-traded fund (ETF) that tracks the performance of the Nifty Next 50 Index. This ETF is a great way for investors to gain exposure to the 50 companies that are next in line to potentially enter the prestigious Nifty 50 Index. These companies represent a mix of well-established and emerging firms across various sectors, making JUNIOR BEES a smart choice for both growth and value investors.

In this blog, we’ll explore the benefits of investing in JUNIOR BEES, its importance in stock market investing, and how systematic investment in this low-cost ETF can provide long-term returns. We will also discuss how using the Navia Zero Brokerage Stock Investing APP can make investing in this ETF more accessible and cost-effective.

What is JUNIOR BEES ETF?

JUNIOR BEES aims to replicate the performance of the Nifty Next 50 Index, which includes companies that are ranked 51 to 100 in terms of market capitalization on the National Stock Exchange (NSE). The ETF’s objective is to closely track the total returns of the Nifty Next 50 Index, offering investors exposure to a diversified portfolio of companies across different sectors.

Investment Objective: The investment objective of JUNIOR BEES is to provide returns that, before expenses, closely correspond to the performance of the Nifty Next 50 Index. However, due to tracking errors, there may be slight deviations between the fund’s performance and the index.

Why Choose JUNIOR BEES ETF for Stock Market Investing?

1. Diversified Exposure to Emerging Companies

JUNIOR BEES offers investors diversified exposure to a range of companies that are poised for growth. The Nifty Next 50 Index is often considered the breeding ground for future Nifty 50 companies, as many of the constituents have the potential to become the blue chips of tomorrow. This ETF provides exposure to sectors like consumer goods, financial services, industrials, and energy, ensuring that investors can benefit from India’s broad economic growth.

2. Cost Efficiency

JUNIOR BEES is a low-cost ETF with an expense ratio of just 0.17%, making it an affordable way for investors to gain exposure to a diversified portfolio of high-potential companies. This is significantly lower than many actively managed funds, allowing investors to maximize their returns by minimizing costs.

By using the Navia Zero Brokerage Stock Investing APP, investors can further reduce their costs by avoiding brokerage fees on JUNIOR BEES trades. This zero-brokerage advantage makes JUNIOR BEES an ideal option for long-term investors looking to minimize expenses and maximize returns.

3. Systematic Investment in JUNIOR BEES with SIP

Investors can set up a Systematic Investment Plan (SIP) for JUNIOR BEES ETF, allowing them to invest regularly in the ETF. This approach is known as stock market systematic investing, where you invest a fixed amount at regular intervals. This strategy helps investors to accumulate units of the ETF over time, reducing the impact of market volatility.

Using the Navia Zero Brokerage Stock Investing APP, you can easily set up a SIP for JUNIOR BEES, starting with as little as 1 unit. By investing consistently, you can benefit from rupee cost averaging, ensuring that you buy more units when prices are low and fewer units when prices are high.

4. Liquidity and Flexibility

As an ETF, JUNIOR BEES offers the same liquidity and flexibility as individual stocks. It can be bought or sold on the stock exchange during market hours, providing investors with the flexibility to manage their investments according to market conditions.

With the Navia Zero Brokerage Stock Investing APP, you can monitor real-time prices, track the performance of JUNIOR BEES, and execute transactions seamlessly without any brokerage fees. This makes JUNIOR BEES an attractive option for both short-term traders and long-term investors.

Top 10 Holdings of JUNIOR BEES ETF

As of August 2024, JUNIOR BEES includes the following top 10 holdings, which collectively account for 37.84% of the fund’s total assets:

| Company | Sector | Weightage |

| Trent Ltd | Consumer Cyclical | 6.85% |

| Bharat Electronics Ltd | Industrials | 4.65% |

| Hindustan Aeronautics Ltd | Industrials | 3.80% |

| InterGlobe Aviation Ltd | Industrials | 3.48% |

| Power Finance Corporation Ltd | Financial Services | 3.46% |

| Vedanta Ltd | Basic Materials | 3.42% |

| REC Ltd | Financial Services | 3.33% |

| Tata Power Co Ltd | Utilities | 3.19% |

| TVS Motor Co Ltd | Consumer Cyclical | 2.84% |

| Indian Oil Corp Ltd | Energy | 2.82% |

This diversified portfolio provides exposure to a wide range of sectors, making JUNIOR BEES a balanced investment option for those looking to capture growth across multiple industries. nger vehicles, two-wheelers, and commercial vehicles.

Performance Overview

JUNIOR BEES has delivered strong performance over various time periods, showcasing its potential as a long-term investment. Below is a summary of its performance as of August 2024:

● 1-Year Return: 71.00%

● 3-Year Annualized Return: 22.02%

● 5-Year Annualized Return: 23.33%

These returns highlight the strong growth potential of the companies in the Nifty Next 50 Index, making JUNIOR BEES an attractive option for investors seeking long-term capital appreciation.

How Much Would Rs. 1 Lakh Invested in JUNIOR BEES Have Grown?

5-Year Growth:

With an annualized return of 23.33%, ₹1 Lakh invested 5 years ago would have grown to approximately:

🠖 ₹2,85,032

3-Year Growth:

With an annualized return of 22.02%, ₹1 Lakh invested 3 years ago would have grown to approximately:

🠖 ₹1,82,289

This shows the strong growth potential of JUNIOR BEES ETF, making it an ideal choice for investors seeking significant capital appreciation over the medium to long term.

Steps to Set Up a SIP for JUNIOR BEES ETF Using the Navia APP

Setting up a SIP for JUNIOR BEES ETF using the Navia Zero Brokerage Stock Investing APP is simple and convenient. Follow these steps to get started:

1) Download and Log In to the Navia app.

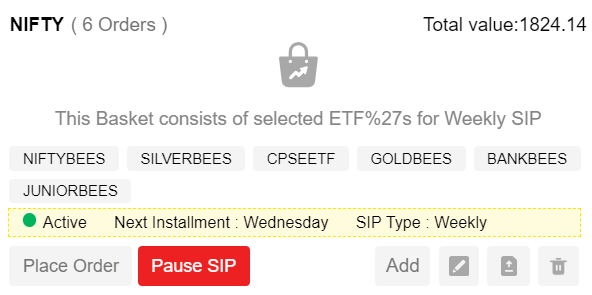

2) Navigate to Tools -> Basket and create a basket with a name of your choice.

3) Set up a Weekly or Monthly SIP, selecting the day of the week or month for the SIP to be executed.

4) Use the Add option to add JUNIOR BEES to your basket and choose the quantity and price (market price is most suitable for SIPs).

5) Confirm and Activate the SIP. You can pause, edit the stock price, or adjust the quantity anytime using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket read here.

Why JUNIOR BEES ETF is a Smart Choice for Investors

JUNIOR BEES ETF provides investors with exposure to high-potential companies that are poised to become the blue chips of tomorrow. With its low-cost structure, diversified holdings, and strong performance, JUNIOR BEES ETF is an excellent option for long-term investors looking for capital appreciation.

By investing through the Navia Zero Brokerage Stock Investing APP, investors can further reduce their costs and benefit from features like zero brokerage, SIP setup, and real-time tracking. Whether you’re a seasoned investor or just starting, JUNIOR BEES offers a simple and effective way to participate in the growth of India’s emerging companies.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear From you