How to Grow Your Money: 6 Essential Investing Rules for Building Wealth

Investing is much like a game with straightforward rules for success, yet it’s filled with emotional pitfalls. To navigate the unpredictable world of investing, it’s crucial to follow some key principles. These rules simplify the complex financial landscape, helping you make informed decisions, set realistic goals, and work towards long-term financial success.

Here are six essential investing rules to help you become a successful and wealthy investor.

➤

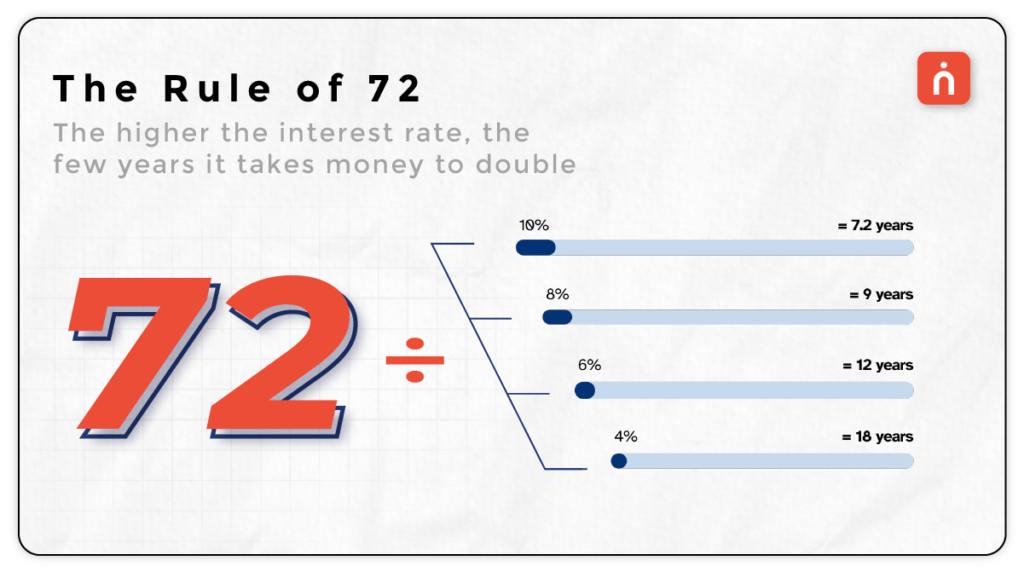

Rule of 72: Doubling Your Money

Curious about how long it will take for your money to double? The Rule of 72 provides a straightforward method to estimate. Divide 72 by the annual rate of return on your investment to estimate the number of years it will take for your money to double. For example, with a 6% return, your money will double in approximately 12 years.

This rule offers a convenient way to gauge how much your investments could grow. It allows you to compare different investment options and their growth potential, helping you decide where to allocate your funds for optimal returns.

⮩

Formula:

72 ÷ Annual Rate of Return = Years it takes to Double the Money

➤

Rule of 114: Tripling Your Money

The Rule of 114 helps you determine how long it will take for your money to triple. Similar to the Rule of 72, you divide 114 by your investment’s rate of return. For instance, with a 6% return, your money will triple in about 19 years. Understanding this rule can help you set realistic financial goals and make wise investment choices. Knowing how long it takes for your investments to triple can motivate you to start investing early and stay invested for the long term, maximizing your wealth-building potential.

⮩

Formula:

114 ÷ Annual Rate of Return = Years it takes to Triple the Money

Quadrupling Your Money: Rule of 144

For those aiming higher, the Rule of 144 tells you how long it takes for your money to quadruple. Divide 144 by your rate of return, and you’ll find the number of years required. At a 6% return, your money will quadruple in around 24 years. This rule is particularly useful for long-term financial planning, helping you understand the power of compound interest over extended periods.

➤

Rule of 70: Measuring Inflation’s Impact

Considering how quickly your money can lose value is crucial. The Rule of 70 helps you understand the impact of inflation on your wealth. Divide 70 by the inflation rate to estimate how long it will take for your money’s value to halve. For instance, with a 5% inflation rate, your wealth will be halved in about 14 years. This rule underscores the importance of accounting for inflation in your investment decisions. Inflation erodes the purchasing power of your money, so investing in assets that can outpace inflation is essential to maintaining and growing your wealth over time.

⮩

Formula:

70 ÷ Inflation Rate = Years for Value to Halve

➤

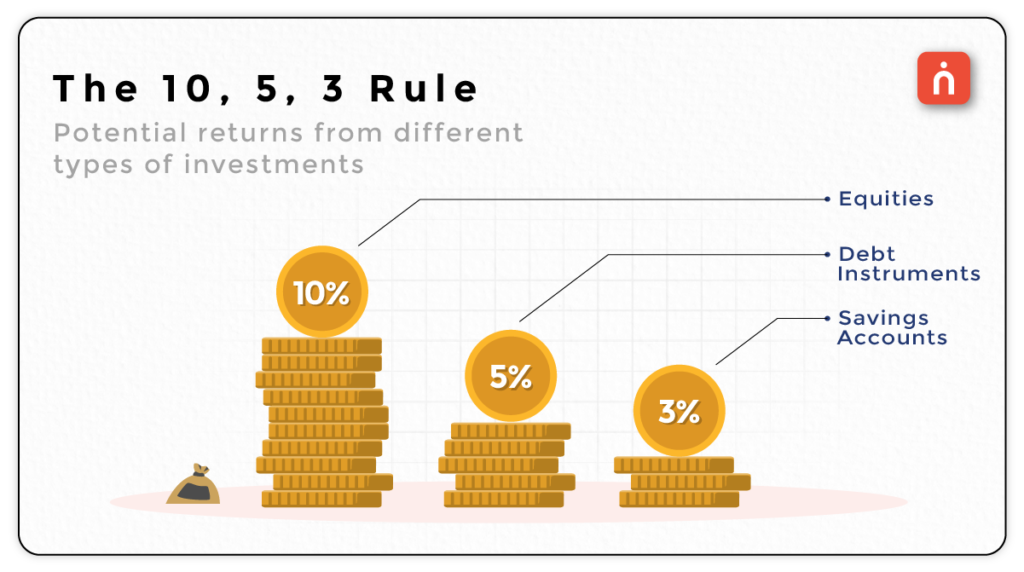

The 10, 5, 3 Rule: Setting Realistic Investment Expectations

The 10, 5, 3 rule offers a simple guideline for expected returns: around 10% from long-term equity investments, 5% from debt instruments, and 3% from savings accounts. This rule helps you set realistic expectations and allocate your investments accordingly. By understanding typical returns for different asset classes, you can create a diversified portfolio that balances risk and reward. This rule also helps manage your expectations and prevents disappointment from unrealistic return assumptions.

➤

100 Minus Age Rule: Balancing Risk and Reward

Managing risk in your investment portfolio is essential, and asset allocation is key. The “100 minus age” rule is a common method for determining asset allocation. Subtract your age from 100 to find the percentage of your portfolio that should be invested in equities, with the remainder in debt. For example, if you are 25 years old, you might allocate 75% to equities and 25% to debt. This rule helps achieve a balanced approach to risk and return, tailored to your age and risk tolerance. Younger investors can afford to take more risks with equities, while older investors might prefer the stability of debt instruments.

⮩

Formula:

100 – Age = Percentage of Portfolio in Equities

➤

The Net Worth Rule: Assessing Your Financial Health

The net worth rule offers a straightforward formula: multiply your age by your gross income and divide by 10 (or 20 in India). This gives a quick snapshot of your financial status and progress toward wealth-building goals. For example, if you are 30 years old with a gross income of Rs 12 lakh, your net worth should be at least Rs 18 lakh to be considered wealthy. This rule helps you track your financial health over time, ensuring you are on the right path to achieving your financial goals. It provides a benchmark for assessing whether your savings and investments are adequate for your age and income level.

⮩

Formula:

(Age × Gross Income) ÷ 10 (or 20 in India)

By applying these six investing rules, you can navigate the financial world with confidence and work towards achieving your long-term wealth goals. Happy investing!

We’d love to Hear from you –

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.