Fractional Investing: How Small Investors Are Owning Big Stocks

- What is Fractional Investing?

- Why Fractional Investing Matters for Small Investors?

- Benefits of Fractional Investing

- Limitations of Fractional Investing

- The Future of Fractional Investing in India

- Conclusion

- Frequently Asked Questions

Buying shares of premium companies is like a dream for all small investors because of their high stock prices. But with a fractional investing strategy, they can buy a portion of their share instead of purchasing their full share. Making it easier and affordable to own their favorite companies share. It automatically becomes a trend because of the gained global traction and now most people speak about fractional shares in India are gaining momentum.

In this blog we explore what is fractional investing, benefits and how it could change the way small investors build wealth.

What is Fractional Investing?

Fractional Investing means buying less than one full share of a stock. Through this investment strategy, you can easily buy a single share of a high-value company with a much smaller amount.

We can explain the share as a “slice” of a stock, for example, if one share of ABC company costs ₹50,000 and you have ₹5,000, in this case you can use this strategy and buy 0.1 shares. You still become a shareholder with your smaller proportion of ownership.

Why Fractional Investing Matters for Small Investors?

The traditional stock market often makes it difficult for small investors to participate in high-value stocks. Fractional investment strategy considers them and gives a path for them. Here you can see how it matters.

Affordability

The investors do not need to spend huge capital to start investing in big companies. They can utilize their small savings to buy fractions of high-value stocks.

Diversification

By choosing fractional investing, you can easily spread your money across multiple companies. Means, instead of investing ₹50,000 in one stock, you can invest ₹5,000 each in different companies.

Accessibility

This strategy will give you access to the global market. For example, if you are an Indian investor, you can easily own fractional shares of other country’s shares without needing lakhs of rupees.

Flexibility

This strategy will allow the investors to start their investment journey with whatever amount they have. It makes stock market participation less intimidating for new traders.

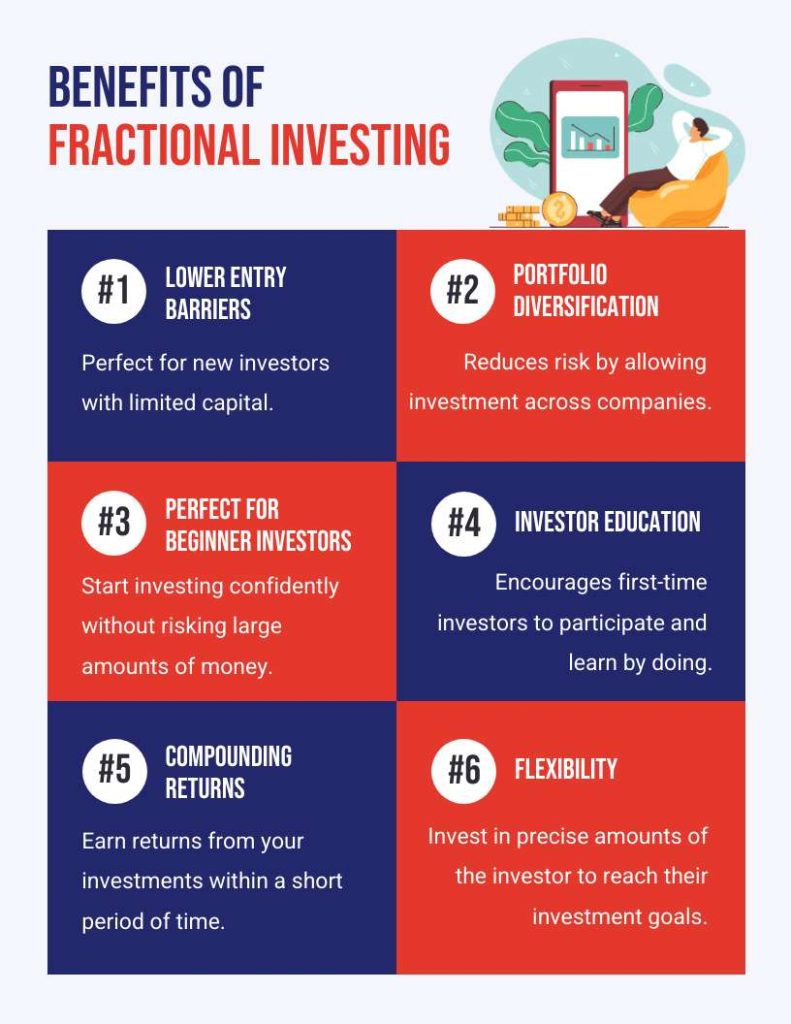

Benefits of Fractional Investing

Let’s see what the key benefits you can achieve by choosing fractional investing.

Limitations of Fractional Investing

While fractional shares in India sounds attractive, but there are some limitations you must keep in mind.

🔸 Regulatory Restrictions: SEBI not officially announce fractional investing framework in the Indian stock market.

🔸 Limited Liquidity: Fractional investing shares may not always be easily tradable.

🔸 Taxation: The tax treatment of fractional shares will be different, especially in investing internationally.

The Future of Fractional Investing in India

The increasing of retail participation and fintech innovation fractional investing in India has a bright future. SEBI’s SM REITs or Small and Medium Real Estate Investment Trust framework formalizes this space and protects investor interests (Source: The Economic Times). The investors are hoping that it may soon expand into stocks too.

If more young investors enter the market with smaller ticket sizes, fractional investing has the potential to reshape how investors participate in high-value stocks, once regulations permit. According to the report by 360 Realtors, fractional ownership in India will be expected to increase at a CAGR of 23% between 2021 and 2026. (Source: altdrx).

Conclusion

Fractional investing can reshape the way people approach the Indian stock market that allows investors to buy fractions of share at affordable price. For small investors, it is like a gateway to build wealth by owning a piece of premium company. In India the strategy is still evolving, once the regulations are in place Indian investors can diversify their portfolio and invest in high-value stocks with ease.

Fractional investing is still evolving in India, and investors should stay informed about SEBI’s upcoming framework before considering such opportunities.

Do You Find This Interesting?

Frequently Asked Questions

What are fractional shares?

Fractional shares are, instead of buying an entire share, investors can purchase a fraction of a stock, making it possible to invest smaller amounts in high-value companies.

Are fractional shares worth buying?

Fractional shares can be useful for small investors who want exposure to premium companies without committing large capital, though risks and regulations must be considered.

What are the benefits of fractional investing?

The benefits of fractional investing include:

➔ Affordability: Start investing in small amounts.

➔ Diversification: Spread investments across multiple companies.

➔ Access to premium stocks: Own shares of top global firms.

➔ Flexibility: Invest at your own pace and budget.

➔ Long-term growth: Benefit from compounding returns over time.

How does a fractional share work?

A fractional share works by allowing investors to own a part of a stock instead of the full unit. Brokers purchase whole shares and then digitally allocate fractions to investors. For instance, if a stock is worth ₹50,000 and you invest ₹5,000, you own 0.1 of that shares and will benefit proportionally from price movements and dividends.

What are the disadvantages of fractional trading?

Some disadvantages of fractional trading are:

➔ Limited availability in certain markets.

➔ There are no guaranteed voting rights for shareholders.

➔ Liquidity issues – fractional shares may not be easy to sell quickly.

➔ Regulatory restrictions in countries like India.

➔ Tax complications, especially for international investments.

Is fractional trading allowed in India?

Currently, fractional investing in India is not yet permitted in domestic markets under SEBI regulations. Once SEBI introduces a framework, fractional shares may become widely available in India.

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.