Expense Ratio in Mutual Funds – A Complete Guide

When investing in mutual funds, one crucial factor that impacts your returns is the expense ratio. It’s important for every investor to understand how the expense ratio works, how it is calculated, and how it can affect long-term returns.

In this article, we will break down the concept of the expense ratio in mutual funds, explain how it’s computed, especially in the case of SIPs (Systematic Investment Plans), and show how a lower expense ratio in passive funds like ETFs can lead to higher returns over time.

What is Expense Ratio in Mutual Funds?

The expense ratio represents the annual fee that mutual fund companies charge their investors to manage and operate the fund. These expenses typically include administrative costs, management fees, marketing costs, and other operational expenses. The expense ratio is expressed as a percentage of the fund’s average assets under management (AUM).

For example, if a mutual fund has an expense ratio of 1.5%, it means that for every ₹100 invested, ₹1.50 goes toward covering the fund’s expenses annually.

Types of Costs Included in the Expense Ratio

● Management Fees: The fee paid to the fund manager for managing the investment portfolio.

● Administrative Costs: Day-to-day operating costs, including record-keeping and other necessary functions.

● Distribution and Marketing Expenses: Costs related to promoting the fund and paying commissions to brokers.

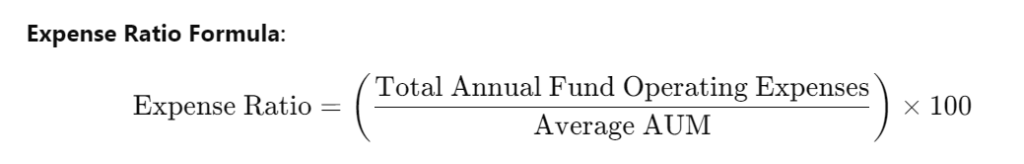

How is Expense Ratio Calculated?

The expense ratio is typically calculated and deducted from the fund’s Net Asset Value (NAV) daily, rather than being charged as a lump sum at the end of the year. The NAV represents the per-unit value of the mutual fund, and it fluctuates based on the performance of the assets in the portfolio.

Let’s break it down with an easy example:

Example:

Suppose you invest ₹1,20,000 in a mutual fund with an NAV of ₹10. You will receive 12,000 units.

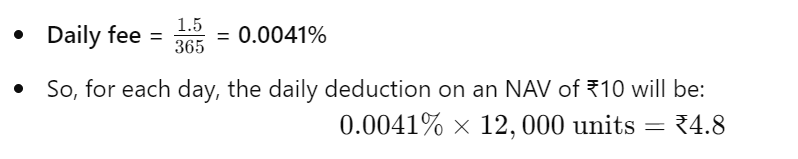

If the annual expense ratio is 1.5%, the daily fee will be calculated as:

Over the year, these small daily deductions add up, reducing the NAV and, ultimately, impacting your returns.

How Expense Ratio is Charged Daily?

The expense ratio is deducted daily from the NAV, which means the cost is not explicitly taken out of your account. Instead, it reduces the NAV of the fund by a small amount each day. So, even though you won’t see a direct deduction, the NAV drops slightly daily, thereby reducing your overall returns.

In the previous example, we saw that a ₹4.8 charge is deducted daily based on your 12,000 units. However, this amount fluctuates as the NAV changes. If the NAV rises or falls, the daily expense will also adjust accordingly.

How is Expense Ratio Calculated for SIPs?

For Systematic Investment Plans (SIPs), calculating the expense ratio works a bit differently because you’re investing a set amount at regular intervals. With each SIP instalment, the number of units you own increases, and hence the expenses increase.

SIP Example:

Let’s say you are investing ₹5,000 every month in a mutual fund with an NAV of ₹10 and an expense ratio of 1.5% annually.

→ In the first month, you buy 500 units.

→ The daily expense in the first month is: ₹0.00041×500=₹0.205 daily

→ By the end of the year, you’ll have 6,000 units (₹5,000 x 12 / ₹10), and your expenses will be calculated based on the total units you own.

Each month, the number of units grows, and as the total units increase, the daily expense will also increase. The expense ratio is applied daily to the growing number of units, which means your annual cost will also increase as you accumulate more units through SIPs.

Why Expense Ratio Matters: Impact on Returns

The expense ratio directly affects your returns. A higher expense ratio eats into your profits, while a lower expense ratio helps you retain more of your returns. This is particularly relevant when comparing actively managed funds (with higher expense ratios) to passive funds like ETFs, which usually have much lower expense ratios.

Expense Ratio in Active vs. Passive Funds

→ Actively Managed Funds (Mutual Funds)

Actively managed mutual funds generally have higher expense ratios because they require active management, research, and frequent trading. These funds might charge anywhere from 1.5% to 2.5% in annual expenses.

Also read: A Beginner’s Guide on How to Choose Mutual Funds

→ Passive Funds (ETFs)

On the other hand, Exchange Traded Funds (ETFs) are passively managed, which means they simply track a market index (like Nifty 50) and don’t require active management. Hence, the expense ratio for ETFs can be as low as 0.1% to 0.5%.

Also read: What is ETF in the Share Market?

Example of Expense Ratio Impact Over Time:

Let’s assume you invest ₹1,00,000 in two funds:

● Fund A (actively managed) with an expense ratio of 2%.

● Fund B (ETF) with an expense ratio of 0.5%.

Both funds generate a return of 10% annually before expenses.

● After 1 year, in Fund A, the net return after deducting the 2% expense ratio would be:

10%−2%=8%

So, your investment would grow to:

₹1,00,000×1.08=₹1,08,000

● In Fund B with a 0.5% expense ratio, the return would be:

10%−0.5%=9.5%

So, your investment would grow to:

₹1,00,000×1.095=₹1,09,500

At the end of 1 year, the difference may seem small. However, over 10-15 years, the compounding effect of the lower expense ratio will make a significant difference.

How Lower Expense Ratios Lead to Higher Returns Over the Long Term

Let’s extend the previous example for 10 years to see the full impact of a lower expense ratio:

Impact of Expense Ratio on Returns (10-Year Horizon)

| Year | Fund A (Expense Ratio: 2%) | Fund B (Expense Ratio: 0.5%) | Difference in Value |

|---|---|---|---|

| 0 | ₹1,00,000 | ₹1,00,000 | ₹0 |

| 1 | ₹1,08,000 | ₹1,09,500 | ₹1,500 |

| 2 | ₹1,16,640 | ₹1,19,990 | ₹3,350 |

| 3 | ₹1,25,971 | ₹1,31,489 | ₹5,518 |

| 4 | ₹1,35,049 | ₹1,43,996 | ₹8,947 |

| 5 | ₹1,44,853 | ₹1,57,516 | ₹12,663 |

| 6 | ₹1,55,442 | ₹1,72,065 | ₹16,623 |

| 7 | ₹1,66,878 | ₹1,87,664 | ₹20,786 |

| 8 | ₹1,79,228 | ₹2,04,341 | ₹25,113 |

| 9 | ₹1,92,566 | ₹2,22,126 | ₹29,560 |

| 10 | ₹2,06,911 | ₹2,41,051 | ₹34,140 |

Explanation:

● Fund A (Expense Ratio: 2%) grows more slowly because a larger portion of the returns is deducted as expenses each year. After 10 years, your ₹1,00,000 investment grows to ₹2,06,911.

● Fund B (Expense Ratio: 0.5%) grows faster due to lower expenses. After 10 years, your ₹1,00,000 investment grows to ₹2,41,051.

Conclusion: The Importance of Expense Ratio in Long-Term Investing

This is a critical factor that every mutual fund investor should consider. It may seem like a small percentage, but over time, it can significantly impact your returns, especially when investing through SIPs or over a long horizon. While actively managed funds may have higher expense ratios due to their nature, passive funds like ETFs offer a low-cost alternative that can help investors maximize their returns over time.

Always review the expense ratio before choosing a mutual fund, and opt for funds with lower expense ratios to ensure that more of your money stays invested and working for you.

We’d Love to Hear from you

Frequently Asked Questions

What is an expense ratio in mutual funds?

The expense ratio in mutual funds is the annual fee charged by mutual fund companies to cover management, administrative, marketing, and operational costs. It is expressed as a percentage of the fund’s average assets under management (AUM).

How is the expense ratio charged to investors?

The expense ratio in mutual funds is deducted daily from the Net Asset Value (NAV) of your fund units, slightly reducing the NAV each day rather than appearing as a direct charge in your account.

Which costs are included in the expense ratio?

Expense ratio includes management fees, administrative costs, distribution and marketing expenses, as well as other operational costs associated with running the fund.

How does the expense ratio affect my returns?

A higher expense ratio means more of your returns are used to cover fund expenses, reducing your net investment gains. Lower expense ratios help you retain more of your returns, especially over the long term.

Is the expense ratio different for SIPs?

Expense ratio in SIPs is applied daily to the total units accumulated with each installment. As your units grow with each SIP, the expense charged also increases.

What is the difference in expense ratio between actively and passively managed funds?

Actively managed funds usually have higher expense ratios (typically 1.5% to 2.5%) due to active management and frequent trading. Passive funds like ETFs have much lower expense ratios, often ranging from 0.1% to 0.5%.

Why do expense ratios matter for long-term investing?

Over time, especially across 10-15 years, higher expense ratios compound and significantly eat into your returns. Lower expense ratios have a more favorable impact on your investment growth.

Are expense ratios the only charges I should consider in mutual funds?

No, you should also account for factors like exit load, entry load (if any), transaction fees, and tax implications.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.