Investing in Bharat 22 ETF: A Strong Diversified Play on India’s Growth

The Bharat 22 ETF (B22) offers investors exposure to a diverse range of blue-chip public sector companies in India. Launched as part of the Indian government’s disinvestment program, the Bharat 22 ETF tracks the BSE Bharat 22 Total Return Index, allowing investors to tap into some of the largest and most profitable companies across sectors like utilities, energy, financial services, and consumer goods. In this blog, we will explore the key features of the Bharat 22 ETF, its top holdings, historical performance, and how it can fit into your portfolio as a part of systematic investing.

What is Bharat 22 ETF?

The Bharat 22 ETF is an exchange-traded fund (ETF) launched by ICICI Prudential Asset Management that invests in the constituents of the BSE Bharat 22 Total Return Index. The index consists of 22 stocks from six sectors—Industrials, Utilities, Financial Services, Energy, Consumer Defensive, and Basic Materials.

The ETF offers a low-cost option for investors to participate in the growth of India’s top public sector companies, making it a valuable tool for Stock Market Investing.

Key Features of Bharat 22 ETF

➝ Stock Market Investing: Gain exposure to India’s top public sector enterprises.

➝ Low-Cost ETF: The ETF has a competitive expense ratio of 0.07%, making it a cost-effective choice for investors.

➝ Systematic Investing: Ideal for long-term investing through Systematic Investment Plans (SIP), which can be easily set up using the Navia Zero Brokerage Stock Investing APP.

Top 10 Holdings of Bharat 22 ETF

The Bharat 22 ETF provides exposure to India’s largest companies across multiple sectors. Here are the top 10 holdings:

| Company Name | Sector | Holding (%) |

| ITC Ltd | Consumer Defensive | 16.19% |

| Larsen & Toubro Ltd | Industrials | 13.36% |

| NTPC Ltd | Utilities | 10.29% |

| Power Grid Corp of India Ltd | Utilities | 8.00% |

| Axis Bank Ltd | Financial Services | 7.20% |

| State Bank of India | Financial Services | 6.76% |

| Oil & Natural Gas Corporation | Energy | 5.73% |

| Coal India Ltd | Energy | 5.32% |

| Bharat Electronics Ltd | Industrials | 5.21% |

| National Aluminium Co Ltd | Basic Materials | 4.91% |

These top 10 companies make up 82.98% of the fund’s assets, providing a concentrated exposure to high-performing sectors like industrials, utilities, and financial services.

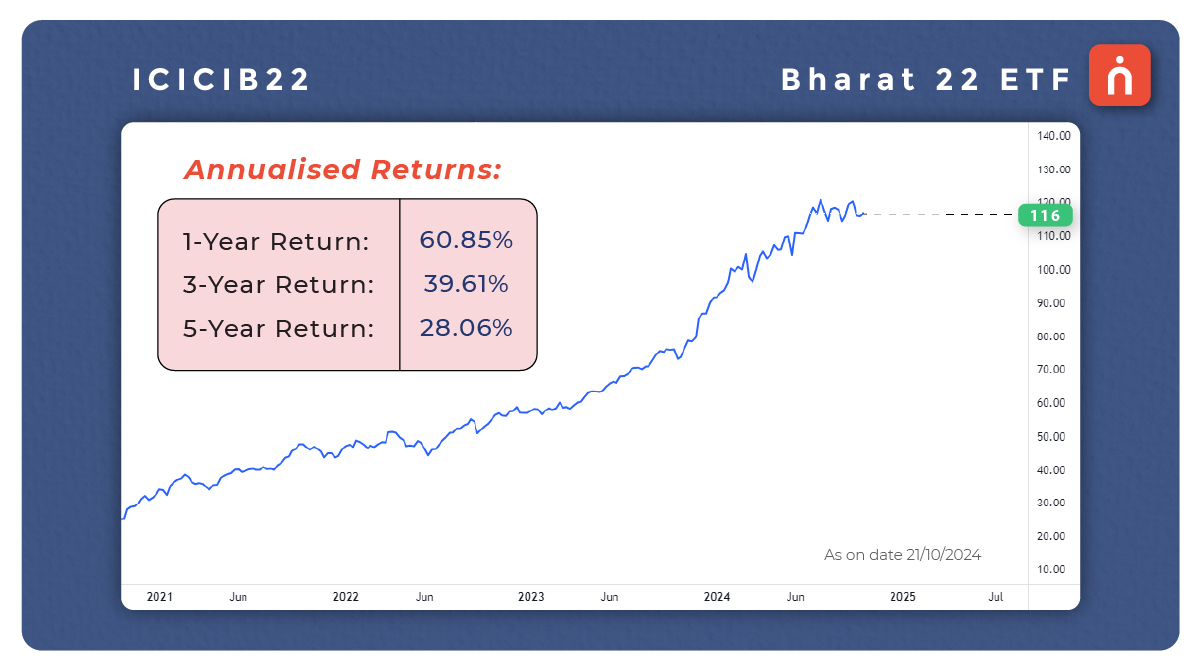

Performance of Bharat 22 ETF

The ETF has delivered strong returns over the years, supported by the performance of its underlying index.

Annualised Returns:

1-Year Return: 60.85%

3-Year Return: 39.61%

5-Year Return: 28.06%

Growth of ₹1 Lakh Investment

Let’s calculate how ₹1 Lakh would have grown over different periods based on the historical returns:

| Period | Annualised Return | Investment Growth (₹) |

| 1 Year | 60.85% | ₹1,60,850 |

| 3 Years (Annualised) | 39.61% | ₹2,20,490 |

| 5 Years (Annualised) | 28.06% | ₹3,50,710 |

This showcases the ETF’s potential for generating substantial returns, particularly for investors with a long-term horizon.

Sector Allocation

The Bharat 22 ETF is well-diversified across various sectors, ensuring that investors benefit from the overall growth of multiple industries in India. Below is the sector allocation:

| Sector | Weighting (%) |

| Industrials | 19.56% |

| Utilities | 23.25% |

| Financial Services | 18.86% |

| Energy | 17.15% |

| Consumer Defensive | 16.19% |

| Basic Materials | 4.93% |

This diversified sector exposure makes the Bharat 22 ETF an attractive choice for investors looking to balance risk while investing in public sector enterprises.

Benefits of Investing in Bharat 22 ETF

Low Cost

With an expense ratio of just 0.07%, the Bharat 22 ETF is one of the most affordable options for Indian investors looking for exposure to public sector companies.

Diversified Exposure

The ETF invests in 22 top-performing public sector companies across six sectors, offering a diversified portfolio to reduce risk.

Strong Performance

The ETF has consistently delivered impressive returns over the past few years, making it a great option for long-term investors.

Systematic Investment Plans (SIPs)

Investors can easily set up SIPs using the Navia Zero Brokerage Stock Investing APP, allowing for a disciplined approach to investing in this ETF.

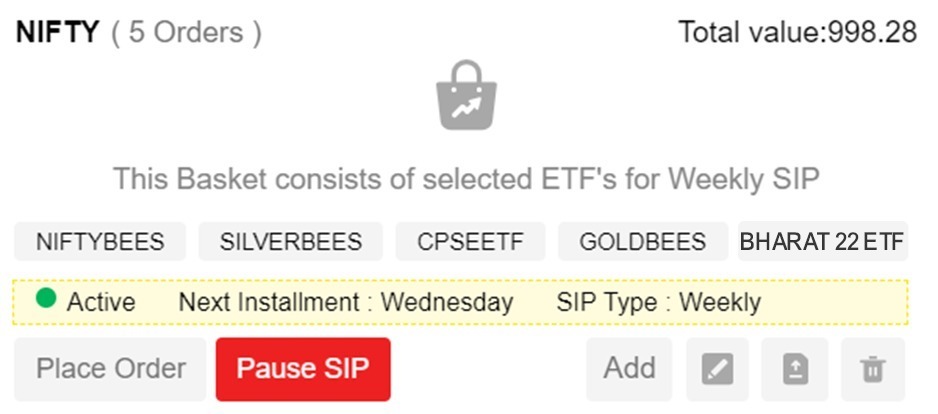

Steps to Set up SIP for Bharat 22 ETF on Navia:

1. Download and Log In to the Navia app.

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add Bharat 22 ETF to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

Is Bharat 22 ETF Right for You?

For investors looking to gain exposure to some of India’s most profitable public sector companies, the Bharat 22 ETF is an excellent choice. The ETF provides a low-cost, diversified, and high-growth investment opportunity with significant returns over the past 1, 3, and 5 years.

Whether you’re a seasoned investor or just starting out with stock market systematic investing, the Bharat 22 ETF offers a balanced way to invest in the future of India’s public sector. By setting up a SIP through the Navia Zero Brokerage Stock Investing APP, investors can take advantage of this high-growth ETF while minimizing costs. With its diversified portfolio and impressive performance, the Bharat 22 ETF is a low-cost ETF that should be considered by any investor looking to grow their wealth through India’s public sector enterprises.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.