A Comprehensive Guide to Investing in BANK BeES ETF

Nippon India ETF Nifty Bank BeES (BANKBEES) is a popular exchange-traded fund (ETF) that tracks the performance of the Nifty Bank Index. This index includes some of India’s largest and most prominent banks, making BANK BeES an attractive investment option for those looking to gain exposure to the banking sector. In this blog, we will explore the advantages of investing in BANK BeES, why it’s an essential tool for stock market investing, and how it compares to other investment options.

What is BANK BeES?

BANK BeES is an exchange-traded fund (ETF) that seeks to provide returns that closely correspond to the total returns of the Nifty Bank Index, which includes leading Indian banks like HDFC Bank, ICICI Bank, and Kotak Mahindra Bank. The Nifty Bank Index is a benchmark index for the banking sector, representing the performance of India’s largest and most liquid banking stocks.

Investment Objective: The fund aims to replicate the performance of the Nifty Bank Index before expenses, providing investors with exposure to India’s top banking institutions. This makes the ETF a perfect choice for investors who want exposure to the banking sector but do not wish to take on the risks associated with picking individual stocks.

Why Choose BANK BeES for Stock Market Investing?

1. Focused Exposure to India’s Banking Sector

It offers a way to gain exposure to the Nifty Bank Index, which is made up of 12 of the largest and most influential banks in India. These include HDFC Bank (27.99%), ICICI Bank (24.39%), and Kotak Mahindra Bank (10.19%), among others. These banks represent the financial backbone of India, and investing in BANK BeES allows you to tap into this essential sector.

By focusing exclusively on the banking sector, BANK BeES allows investors to take advantage of the growth opportunities in the financial services industry, one of the most significant sectors of the Indian economy.

2. Diversification Within the Banking Sector

Although BANK BeES is sector-specific, it still offers diversification by investing in multiple banks. The top 10 holdings account for around 96.91% of the fund’s total assets. This means that, while the ETF is concentrated in the banking sector, the diversification within the sector reduces the risks associated with investing in a single company.

For investors who are confident in the banking sector’s growth prospects but don’t want to take the risk of selecting individual bank stocks, BANK BeES offers a well-balanced option.

3. Cost Efficiency

BANK BeES, like other ETFs, is a low-cost ETF compared to actively managed mutual funds. With an expense ratio of 0.19%, investors can access a basket of India’s largest banks at a fraction of the cost of traditional investment options.

Additionally, by using the Navia Zero Brokerage Stock Investing APP, you can enjoy zero brokerage on BANK BeES trades, further lowering your costs and maximizing your investment returns. This makes BANK BeES a fantastic option for cost-conscious investors looking to build wealth in the banking sector without the burden of hefty fees.

4. Systematic Investing with SIP

For investors looking to adopt a disciplined approach to stock market systematic investing, BANK BeES allows for easy investment through a Systematic Investment Plan (SIP). You can set up a SIP to invest regularly in BANK BeES, thus averaging out the cost of investment over time.

With Navia’s app, you can start investing in BANK BeES with a SIP as low as ₹100, allowing you to take advantage of the rupee cost averaging method. This systematic approach ensures that you buy more units when prices are low and fewer units when prices are high, reducing the impact of market volatility.

5. Liquidity and Flexibility

One of the major benefits of investing in ETFs like BANK BeES is the liquidity they offer. As an ETF, BANK BeES is traded on the stock exchange just like a regular stock. This means that investors can buy and sell units at any time during market hours, providing them with flexibility and control over their investments.

This is particularly useful for traders and short-term investors who want the ability to quickly react to market movements, while long-term investors can hold onto their BANK BeES units with the confidence that the ETF tracks the broader banking sector.

With the Navia Zero Brokerage Stock Investing APP, you can monitor real-time prices and track the performance of your BANK BeES investment effortlessly. The app’s advanced features make it easy to invest in BANK BeES and take advantage of both short-term trading opportunities and long-term growth potential.

Performance Overview

BANK BeES has consistently delivered competitive returns over various time frames. Let’s take a look at its performance as of August 2024:

1-Year Return: 22.55%

3-Year Annualized Return: 13.57%

5-Year Annualized Return: 12.70%

5-Year Growth:

If you had invested ₹1 Lakh five years ago with an annualized return of 12.70%, your investment would have grown to approximately:

₹1,81,622

3-Year Growth:

If you had invested ₹1 Lakh three years ago with an annualized return of 13.57%, your investment would have grown to approximately:

₹1,46,456

The returns generated by BANK BeES closely follow the performance of the Nifty Bank Index, ensuring that investors benefit from the sector’s growth while minimizing tracking error.

Key Holdings and Sector Breakdown

As of August 2024, the top holdings of BANK BeES include:

| Company | Sector | Weightage |

| HDFC Bank Ltd | Financial Services | 27.99% |

| ICICI Bank Ltd | Financial Services | 24.39% |

| Kotak Mahindra Bank Ltd | Financial Services | 10.19% |

| State Bank of India | Financial Services | 9.87% |

| Axis Bank Ltd | Financial Services | 9.42% |

The fund is entirely concentrated in the financial services sector, providing 100% exposure to banking stocks. This sector focus makes BANK BeES an ideal investment for investors confident in the growth of the Indian banking sector.

Risk Measures

BANK BeES exhibits a stable risk profile, particularly for investors seeking exposure to large-cap financial stocks. Key risk metrics include:

🔷 3-Year Beta: 0.99 (indicating that BANK BeES moves almost in line with the overall market)

🔷 3-Year Sharpe Ratio: 0.48 (suggesting favorable risk-adjusted returns)

The ETF’s performance closely mirrors that of the Nifty Bank Index, offering predictable returns for investors over the long term.

Here is a list of other BANK ETF’s and their returns as on 28th September 2024

| ETF Name | 30 Day Return | 365 Day Return | Underlying Index | Live NAV |

| BANKBEES (Nifty Bank ETF) | 5.41% | 22.46% | Nifty Bank | Click here |

| DSP Nifty Bank ETF | 5.62% | Not Available | Nifty Bank | Click here |

| SBI Nifty Bank ETF | 5.69% | Not Available | Nifty Bank | Click here |

| Bajaj Finserv Nifty Bank ETF | 5.38% | Not Available | Nifty Bank | Click here |

| Mirae Asset Nifty Bank ETF | 5.41% | 21.98% | Nifty Bank | Click here |

| DSP Nifty Private Bank ETF | 5.57% | Not Available | Nifty Private Bank Index | Click here |

| SBI Nifty Private Bank ETF | 5.31% | 18.27% | Nifty Private Bank Index | Click here |

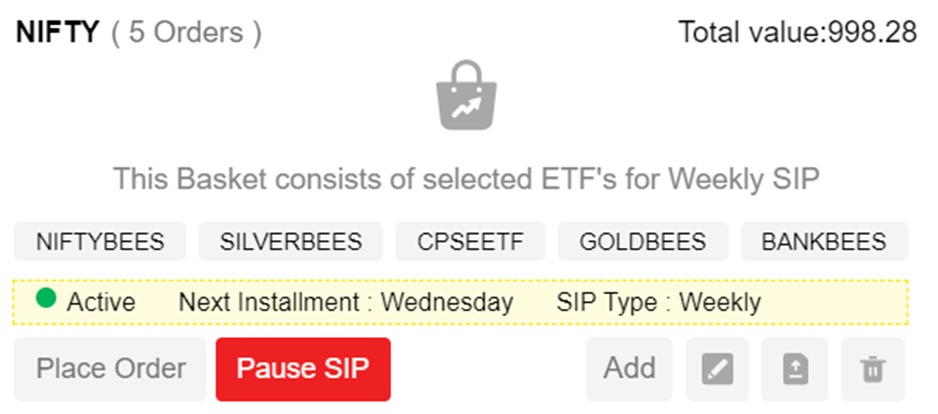

Steps to Set up SIP for BANK Bees ETF on Navia APP:

1. Download and Log In to the Navia app.

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add BANKBEES to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

Why BANK BeES is a Smart Choice for Investors

BANK BeES offers a focused and cost-effective way to invest in India’s leading banks, providing exposure to the Nifty Bank Index. With its low expense ratio, diversified holdings within the banking sector, and easy accessibility through the Navia Zero Brokerage Stock Investing APP, BANK BeES is an excellent investment option for both beginner and seasoned investors.

Investing through the Navia Zero Brokerage Stock Investing APP also enhances the cost-efficiency of BANK BeES by eliminating brokerage fees. Additionally, features like SIP, real-time tracking, and systematic investing tools make it easier to incorporate BANK BeES into a long-term wealth-building strategy.

For investors seeking to benefit from the growth of the Indian banking sector through a low-cost ETF, BANK BeES is an ideal choice. Whether you’re looking for long-term growth or short-term trading opportunities, BANK BeES offers the liquidity, flexibility, and cost savings to help you achieve your financial goals.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear from you-