August Market Recap: Top Trends of the Month

- Nifty 50 Performance in August

- August Market Roundup

- Sectoral Movements

- Company Performance

- Commodities Month's Change

- SME IPO Performance – August

- Top Reads From August!

- Interactive Zone!

August 2025 proved to be a turbulent month for the Indian stock market, as escalating US sectoral tariffs dominated investor sentiment. While IT and textile sectors faced pressure, FII outflows continued, strong and resilient demand offered glimmers of hope. Amid global trade tensions, the market showed cautious optimism, balancing short-term shocks with long-term potential.

Nifty 50 Performance in August

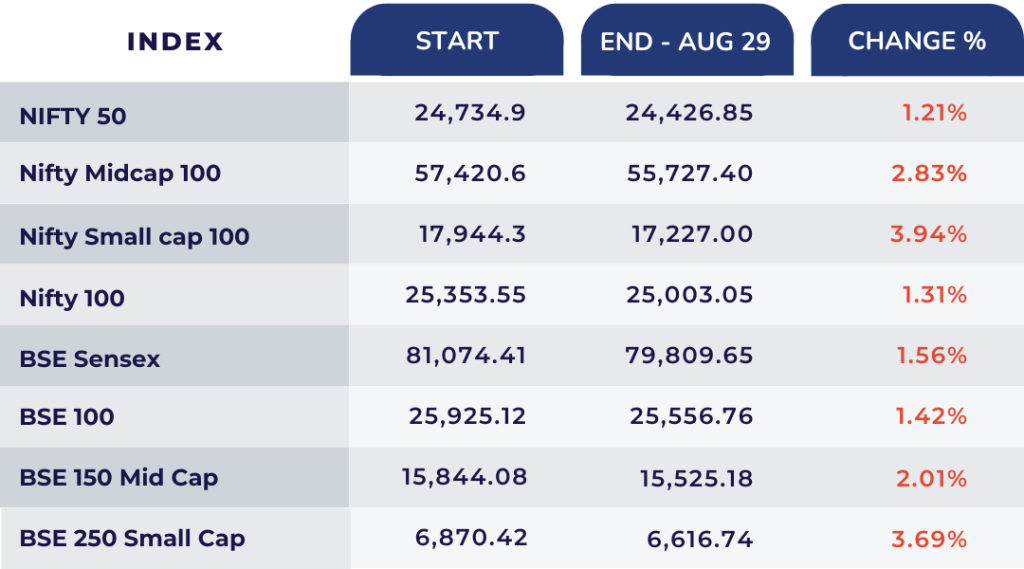

August Market Roundup

August 2025 presented a challenging month for the Indian stock market, significantly impacted by the imposition of substantial US sectoral tariffs. While domestic economic data offered some respite, investor sentiment was largely dampened by escalating trade tensions.

Key Highlights:

US Sectoral Tariffs – Dominant Influence: The implementation of a 50% tariff on Indian imports by the US, effective August 28th, was the defining event of the month. This triggered concerns about export-heavy sectors like textiles and IT, and contributed to significant foreign capital outflows.

Market Reaction: The initial market reaction to the tariffs was negative, with both the Nifty and Sensex experiencing losses in the week leading up to August 29th. However, a subsequent rally towards the end of the month, fueled by positive GDP data and a favorable US court ruling on a separate trade matter, partially offset these losses.

GDP Data Provides Support: Strong Indian GDP data offered some counterbalance to the tariff-related concerns. This positive economic news contributed to a market rebound on September 1st.

FII Outflows: Foreign Institutional Investors (FIIs) continued to be net sellers, offloading over ₹35,000 crore worth of equities during the month, largely driven by the tariff uncertainty.

Sectoral Performance: IT and textile sectors faced the most significant pressure due to the US tariffs. However, sectors benefiting from domestic demand showed relative resilience.

Rupee Depreciation: The Indian Rupee experienced depreciation, further adding to the economic headwinds.

Outlook

August 2025 concluded with a cautious outlook for the Indian stock market. The US tariffs remain a major headwind, and their long-term impact on the Indian economy is still being assessed. While the positive GDP data and the US court ruling provided temporary relief, sustained market recovery will depend on a resolution of the trade tensions and continued domestic economic strength. The upcoming GST Council meeting is also expected to influence market sentiment. Despite the challenges, the Indian economy demonstrates underlying resilience, and opportunities for growth remain.

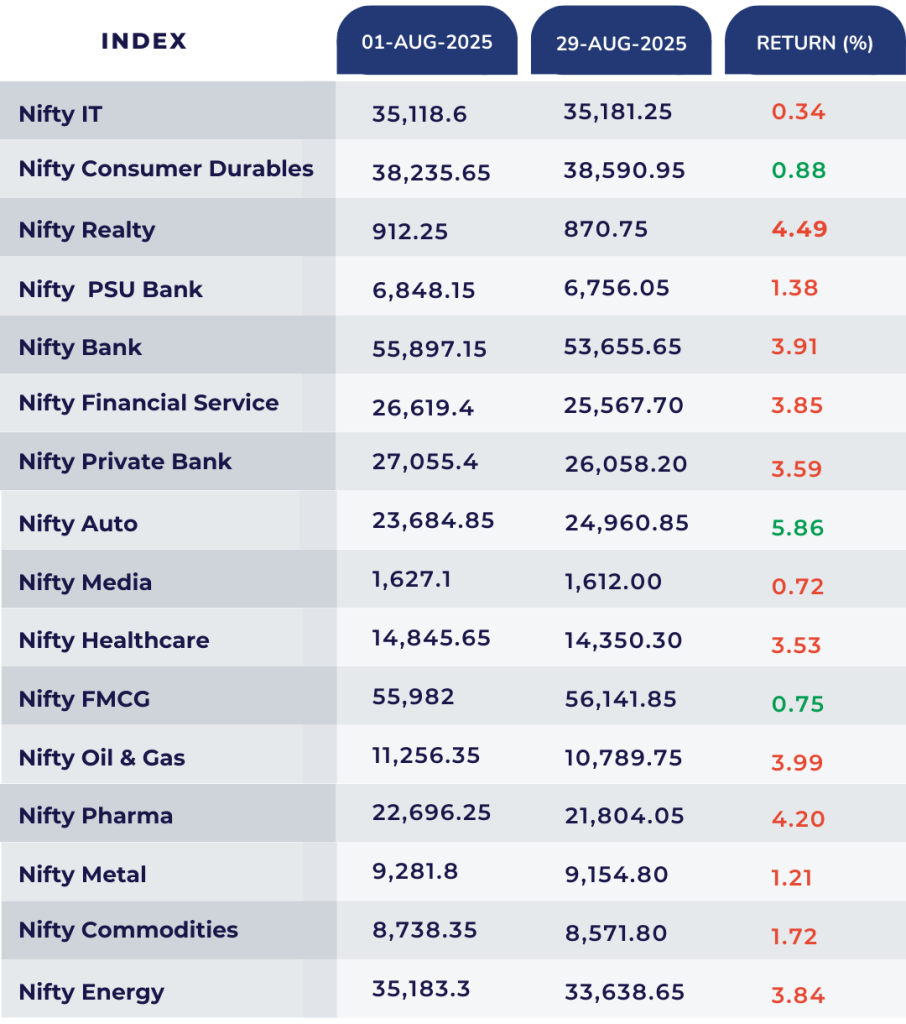

Sectoral Movements

Nifty Auto, Consumer Durables, and FMCG led the gains, while Nifty Realty, Pharma, Bank, Financial Services, Private Bank, Healthcare, Oil & Gas, and Energy were the major laggards, each falling over 3%.

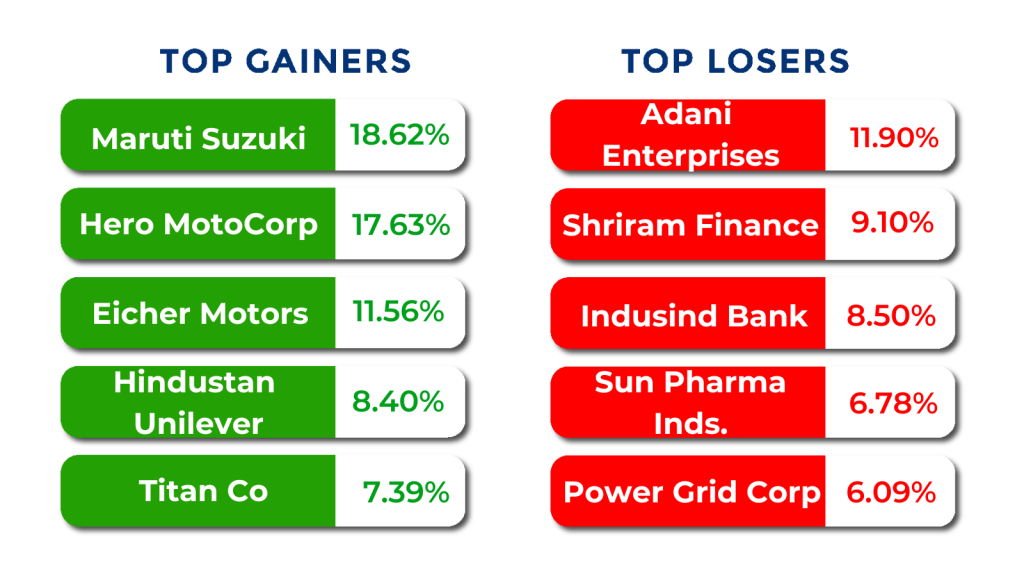

Company Performance

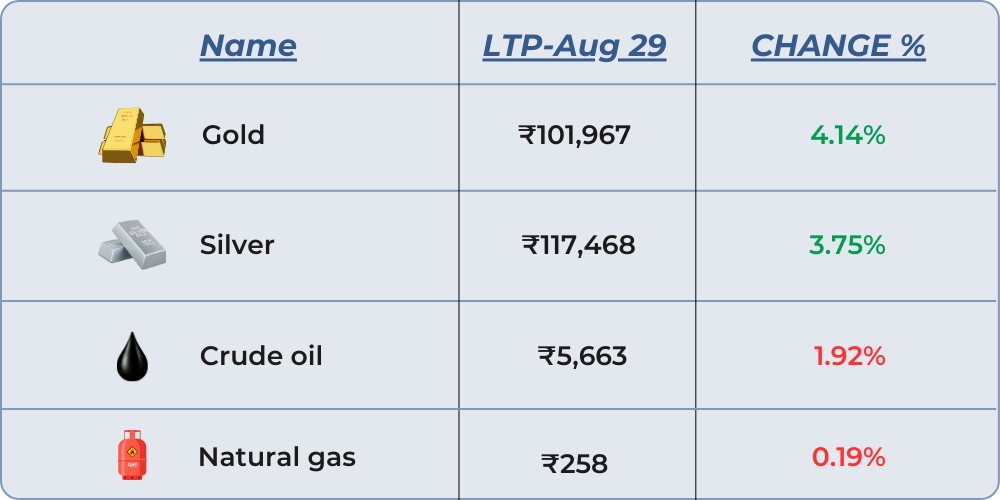

Commodities Month’s Change

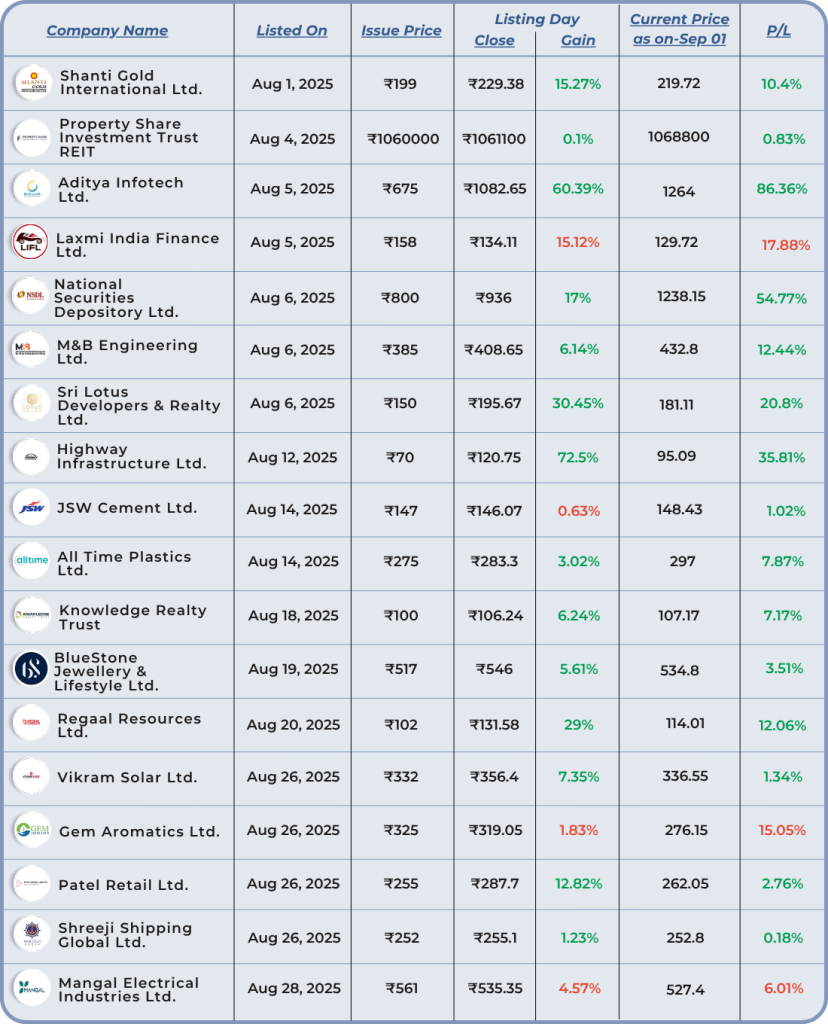

SME IPO Performance – August

August SME IPO:

India’s IPO market in August 2025 delivered a mixed bag for investors. Standout performers included Aditya Infotech Ltd. (86.36%), National SDL (54.77%), and Highway Infrastructure (35.81%), which rewarded shareholders with impressive listing gains. However, not all debuts were positive—Laxmi India (17.88%), Gem Aromatics (15.05%), and Mangal Electronical Industries (6.01%) slipped below issue price, reminding investors of the risks associated with IPO investing.

Disclaimer: The IPO performances mentioned are historical examples and not investment recommendations.

Top Reads From August!

Explore our August month blogs packed with trading strategies, and investing tips to help you stay ahead with smarter financial decisions.

● Simultaneous Access to Navia App on Web and Mobile

● Get 24/7 Smarter Support with Navia’s AI WhatsApp Chatbot

● Portfolio Diversification in 2025: Smart Ways to Build a Winning Stock Market Portfolio

● Common Mistakes to Avoid While Using Margin Trading Facility (MTF)

● Understanding Foreign Institutional Investors (FIIs) and Their Impact

● ESG Investing: Why Sustainable Stocks Are Gaining Popularity

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.