April Market Recap: Top Trends of the Month

This April, the Indian stock market continued its dynamic streak, and Navia was right in the thick of it! From key market movers to emerging trends that shaped investor sentiment, we’ve gathered all the essential highlights to keep you informed. Want to dive into the numbers and insights that defined April 2025? Let’s explore what really moved the markets!

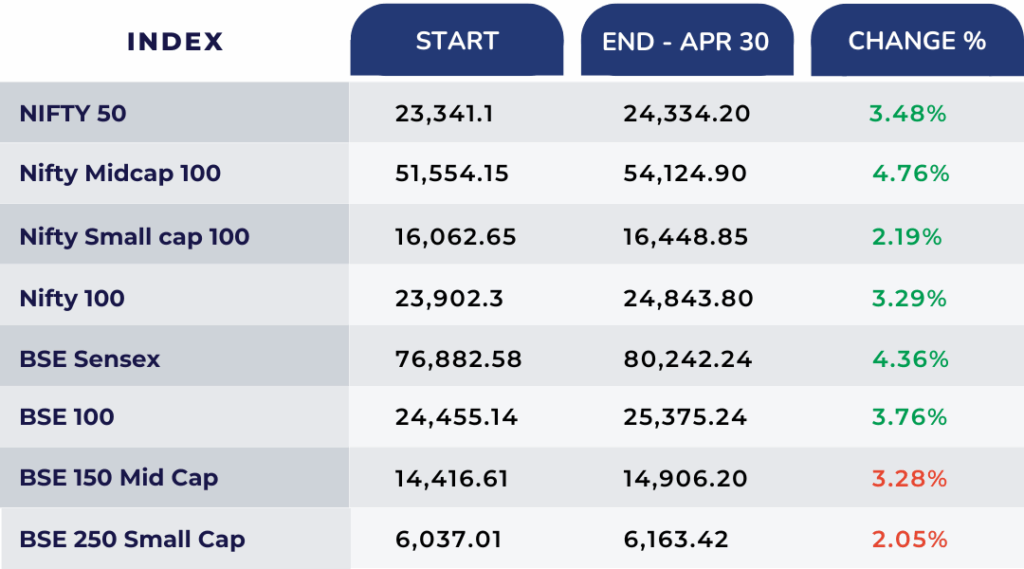

Nifty 50 Performance in April

April Market Roundup: Key Highlights

1. Sustained Market Momentum:

In April 2025, the Nifty 50 index rose by 3.46%, continuing its upward trajectory after March’s strong rebound. The rally lifted broader investor sentiment and reduced the index’s drawdown from its September 2024 peak to around 7.4%, indicating a gradual market recovery.

2. Factors Driving the Rally:

🠖 Foreign Inflows: The Indian equity market witnessed a significant revival in foreign investor participation. Over nine consecutive trading sessions in April, foreign portfolio investors (FPIs) poured in approximately $4.11 billion, marking the longest buying streak since July 2023.

🠖 Corporate Earnings: Robust quarterly results from key constituents like Reliance Industries (which gained over 5% post-results) contributed to overall index strength. The earnings season reinforced expectations of a cyclical recovery in domestic consumption and credit growth.

🠖 Trade Deal Optimism: Investors were buoyed by optimism around an emerging trade agreement between India and the U.S., potentially easing tariff threats on Indian exports and enhancing cross-border trade flows.

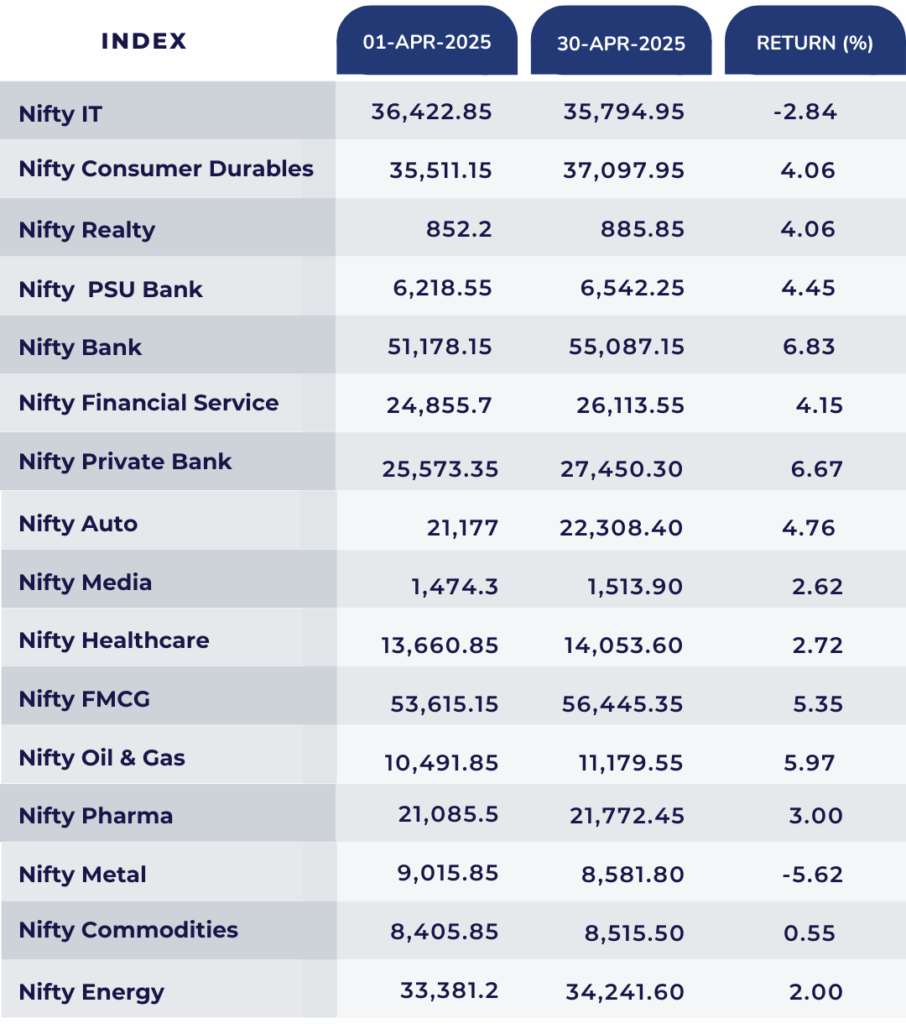

🠖 Sectoral Performance: Financials led the rally with the Nifty Bank index climbing 6.83%, while sectors like Oil & Gas, FMCG, PSU Banks, and Realty also posted 4–6% gains, reflecting broad-based participation.

3. Persistent Challenges:

🠖 Geopolitical Tensions: Market volatility was briefly heightened by a militant attack in Kashmir, which reignited tensions between India and Pakistan and caused a dip in investor risk appetite mid-month.

🠖 Technology Sector Drag: The Nifty IT index declined for the fourth consecutive month, losing 3% in April. Concerns over U.S. tariff policies, declining deal pipelines, and rupee appreciation pressured margins and investor sentiment toward the sector.

4. Shift in Investment Preferences:

As volatility in equities persisted, Indian investors continued shifting allocations toward gold ETFs. Holdings rose sharply, reaching over 63 tonnes, compared to ~21 tonnes in 2020.

This trend reflects growing retail demand for safe-haven assets. In fact, gold ETFs delivered annual returns of 45–55%, vastly outperforming Nifty 50 ETFs, which returned just 2.87–3.03% over the same period.

5. Currency Dynamics:

The Indian rupee appreciated by 1.2%, closing April at ₹84.49 per U.S. dollar, its strongest level since November 2024.

This rally was supported by FPI inflows, exporter dollar sales, and a weaker U.S. dollar index (which fell nearly 4.5% during the month). While this strength helped reduce imported inflation pressures, it continued to pose export competitiveness concerns.

6. Outlook:

Despite recent gains, Indian benchmarks remain below their all-time highs. However, with sustained foreign buying, earnings optimism, and easing global headwinds, market sentiment for FY2025–26 remains constructive.

Analysts expect reasonable valuations and attractive risk-reward setups, especially in banking, oil & gas, infrastructure, and real estate. Continued focus on macroeconomic stability and geopolitical developments will remain key to sustaining this momentum.

Sectoral Movements

Nifty Bank and Private Bank were among the best-performing sectors, while Nifty Metal shed 5.62 and IT lose 2.84 percent.

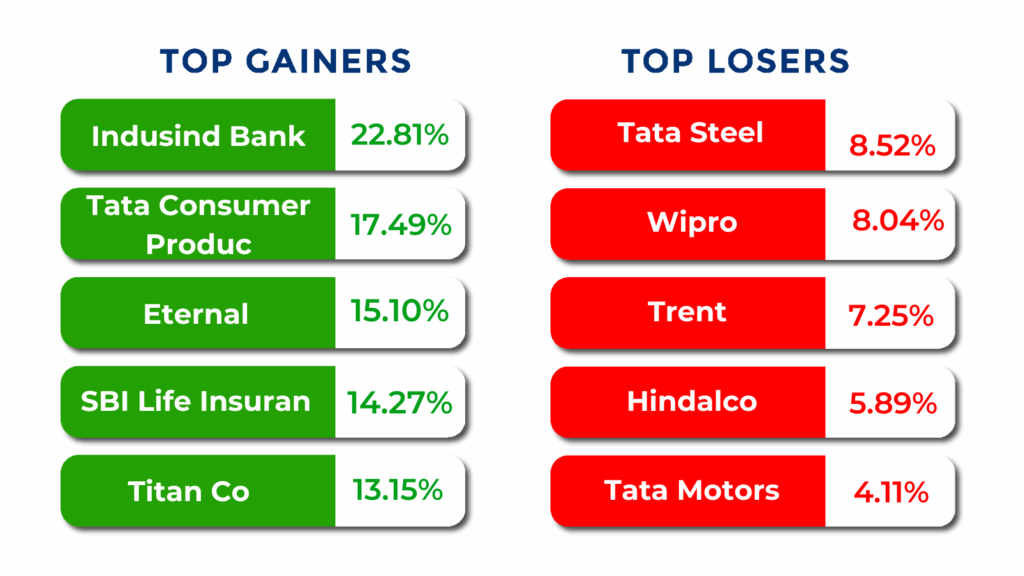

Company Performance

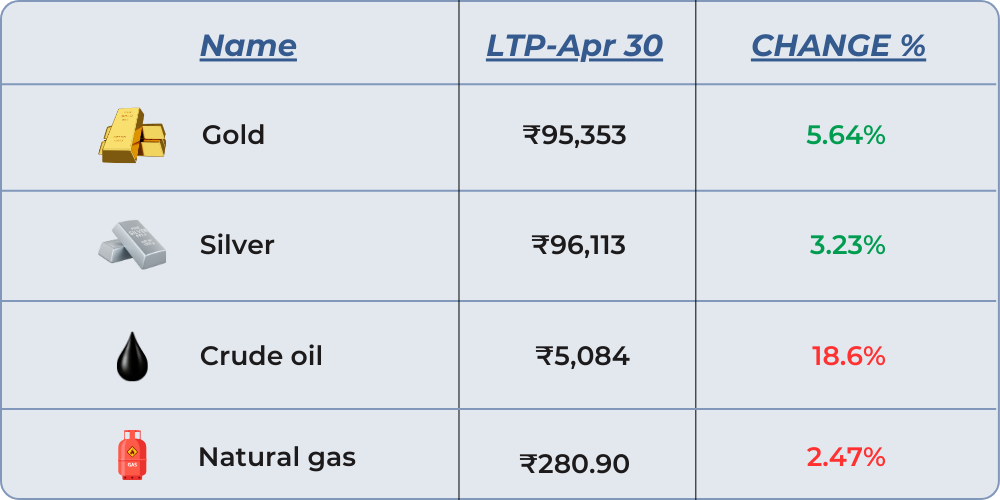

Commodities Month’s Change

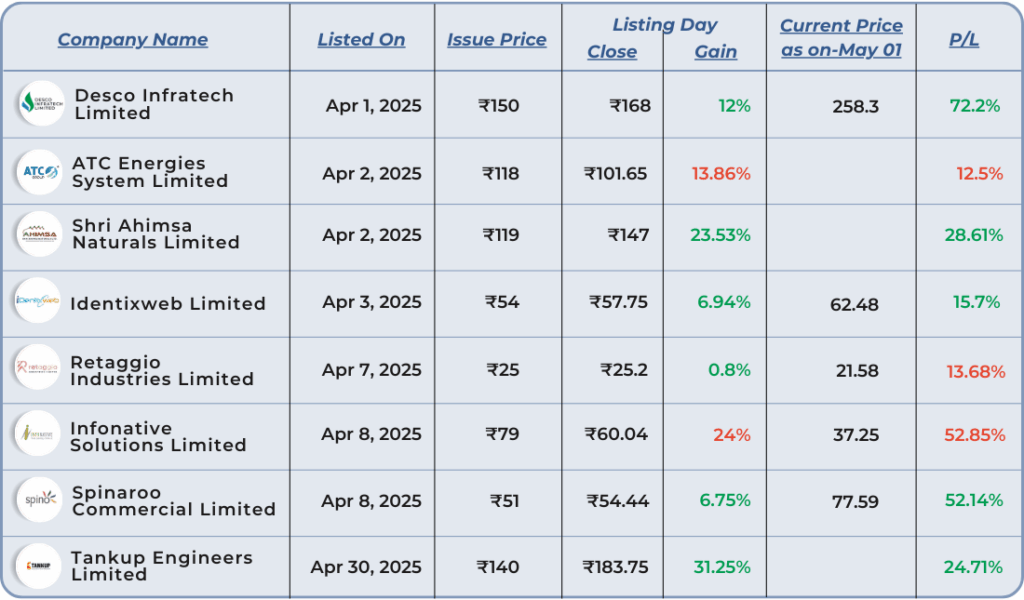

SME IPO Performance – April

April SME IPO: Market witnessed 8 listings, with 5 stocks delivering positive returns while 3 experienced slight declines. Despite varied performances across sectors, April 2025 maintained strong market momentum, creating a favorable environment for IPO activity. Several high-profile listings drew investor interest, signaling continued confidence in new market entrants.

New NFO’s open

🔸 HDFC CRISIL-IBX Fin Services 3-6 Months Debt Index Fund – Direct Plan- Growth 28 Apr- 5 May 2025

🔸 Bajaj Finserv Nifty Next 50 Index Fund – Direct Plan- Growth 22 Apr- 6 May 2025

🔸 Groww Gilt Fund – Direct Plan- Growth 23 Apr- 7 May 2025

🔸 Motilal Oswal Infrastructure Fund – Direct Plan- Growth 23 Apr- 7 May 2025

🔸 Edelweiss BSE Internet Economy Index Fund – Direct Plan- Growth (G) 25 Apr- 9 May 2025

🔸 Bajaj Finserv Nifty 50 Index Fund – Direct Plan- Growth 25 Apr- 9 May 2025

🔸 UTI-Multi Cap Fund – Direct Plan- Growth 29 Apr- 13 May 2025

Top Blogs – Navia

1. Understanding the Cup and Handle Pattern in Technical Analysis

2. Get Instant Trade Reports on WhatsApp with Navia Markets’ BO Chatbot

3. Mastering Moving Averages: A Beginner’s Guide

4. Mastering the Relative Strength Index (RSI): A Guide for Beginners

6. Understanding Upward and Downward Price Manipulation in Technical Analysis

7. Understanding Tariff Wars: What They Are and How They Impact Economies?

9. Investing in Gold Through Sovereign Gold Bonds

10. The Case for Investment in Gold

11. Be Alert: Safeguard Yourself Against Merge Call Scams

12. Trading Crude Oil on MCX: Key Specs, Insights & Market Dynamics

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.