90% of Traders Fail, But Here’s How You Can Be in the Top 10%

Table of Contents

90% of traders fail. It’s a hard-hitting statistic that strikes fear into the hearts of aspiring traders worldwide. But what if I told you that you don’t have to be part of that majority?

That with the right strategies, mindset, and risk management, you can join the elite 10% who consistently profit in the markets?

In this blog post, we’ll dive deep into the reasons behind the high failure rate among traders and, more importantly, reveal the proven strategies that can help you beat the odds and achieve long-term success in trading.

From developing a robust trading plan to mastering the psychology of successful trading, we’ll cover everything you need to know to avoid the pitfalls that trap most traders and position yourself for consistent profitability.

So, if you’re ready to break free from the 90% and join the ranks of the top 10%, keep reading – your journey to trading success starts here.

What Causes 90% of Traders to Fail?

– Most traders fail due to lack of proper planning, risk management, and emotional control

– Understanding the common pitfalls can help traders avoid them and increase their chances of success

– Developing a solid trading plan, managing risk effectively, and controlling emotions are key to long-term profitability

Lack of a Well-Defined Trading Plan

One of the primary reasons traders fail is the absence of a clear, well-defined trading plan. Many novice traders enter the market without a solid strategy, hoping to make quick profits based on gut feelings or random tips. However, this approach rarely leads to consistent success.

A trading plan should outline specific entry and exit criteria, as well as risk management rules. Without these guidelines, traders often find themselves making impulsive decisions based on short-term market fluctuations. This lack of discipline can lead to significant losses and ultimately, failure.

To develop a robust trading plan, traders should:

– Identify their trading style (e.g., scalping, day trading, swing trading)

– Define clear entry and exit rules based on technical or fundamental analysis

– Set realistic profit targets and stop-loss levels

– Establish position sizing rules to manage risk effectively

Inadequate Risk Management

Risk management is a critical aspect of successful trading, yet many traders fail to prioritize it. Poor risk management can manifest in several ways:

Overexposing Capital on Single Trades

Traders who risk a significant portion of their account on a single trade are setting themselves up for failure. A few losing trades can quickly deplete their capital, leaving them unable to recover. As a general rule, traders should risk no more than 1-2% of their account on any single trade.

Not Properly Diversifying Portfolio

Concentrating all trading activity in one market or asset class can be risky. Diversification helps spread risk across different markets and instruments, reducing the impact of any single losing trade. Traders should consider diversifying across:

– Asset classes (e.g., stocks, forex, commodities)

– Sectors (e.g., technology, healthcare, energy)

– Geographic regions (e.g., US, Europe, Asia)

Ignoring the Importance of Position Sizing

Position sizing refers to the number of units or contracts traded relative to account size. Proper position sizing ensures that no single trade can cause significant damage to the account. Traders should use position sizing calculators or formulas to determine the appropriate trade size based on their account balance and risk tolerance.

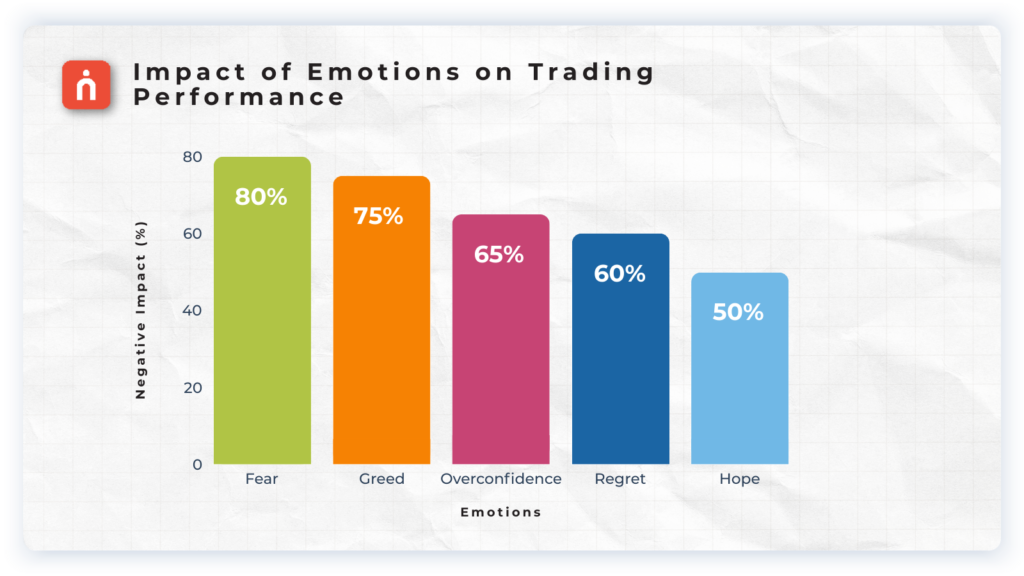

Emotional Decision Making

Emotions are one of the biggest obstacles to trading success. Fear, greed, and hope can cloud judgment and lead to irrational decisions. Many traders fail because they allow their emotions to dictate their actions, rather than following their trading plan.

Letting Fear and Greed Dictate Trading Decisions

Fear can cause traders to miss out on profitable opportunities or close winning positions prematurely. Conversely, greed can lead to overtrading or holding onto losing positions in the hope of a turnaround. Successful traders learn to control their emotions and stick to their plan, even in the face of market volatility.

Chasing Losses or Averaging Down on Losing Positions

When faced with a losing trade, some traders may be tempted to “double down” or add to their position in an attempt to break even. This behavior, known as averaging down, can quickly compound losses if the market continues to move against them. Similarly, chasing losses by immediately entering new trades after a loss can lead to further damage to the account.

Impulsively Entering or Exiting Trades Based on Emotions

Emotional trading often involves making impulsive decisions based on short-term market moves or news events. Traders may enter or exit trades based on fear of missing out (FOMO) or panic, rather than following their predetermined plan. This lack of discipline is a common reason for failure.

To combat emotional decision making, traders should:

– Develop a trading plan and stick to it

– Use a trading journal to track their emotions and identify patterns

– Practice mindfulness and stress management techniques

– Consider using automated trading systems to remove emotion from the equation

Recommended books on trading psychology that can help you delve deeper into emotional control strategies:

🔸 Trading in the Zone by Mark Douglas

This book focuses on the psychological aspect of trading and emphasizes the importance of developing the right mindset. Douglas provides insights into how traders can think in probabilities and manage their emotions.

🔸 The Disciplined Trader by Mark Douglas

In this book, Douglas addresses the psychological barriers traders face and offers practical advice on overcoming them. He explores the mental discipline required to become a successful trader.

🔸 The Psychology of Trading: Tools and Techniques for Minding the Markets by Brett N. Steenbarger

Steenbarger combines psychological principles with practical trading strategies, offering insights on how to manage emotions, stress, and decision-making processes in trading.

🔸 Trading for a Living: Psychology, Trading Tactics, Money Management by Dr. Alexander Elder

Dr. Elder covers a broad range of topics including trading psychology, technical analysis, and money management. The book is well-regarded for its comprehensive approach to trading.

🔸 Mind Over Markets: Power Trading with Market Generated Information by James F. Dalton, Eric T. Jones, and Robert B. Dalton

This book delves into the mental processes involved in trading, focusing on market profile theory and how traders can use it to understand market behavior and improve their trading decisions.

🔸 The Daily Trading Coach: 101 Lessons for Becoming Your Own Trading Psychologist by Brett N. Steenbarger

Steenbarger offers practical lessons and exercises to help traders improve their psychological resilience and performance. The book is structured to provide actionable advice that traders can implement daily.

🔸 Enhancing Trader Performance: Proven Strategies From the Cutting Edge of Trading Psychology by Brett N. Steenbarger

This book provides strategies for improving trading performance by leveraging the latest research in trading psychology. It includes case studies and practical tips for traders at all levels.

🔸 Trading Psychology 2.0: From Best Practices to Best Processes by Brett N. Steenbarger

Steenbarger offers an updated look at trading psychology, focusing on developing processes that enhance trading performance. The book provides actionable strategies and insights based on the latest research.

Insufficient Market Knowledge and Analysis

Many traders fail because they lack a deep understanding of the markets they trade and the factors that drive price action. Without this knowledge, they are essentially gambling rather than making informed decisions.

Trading Without Understanding Market Fundamentals and Dynamics

Each market has its own unique characteristics and drivers. For example, the forex market is influenced by global economic events, central bank policies, and political developments, while the stock market is affected by company earnings, industry trends, and investor sentiment. Traders who do not take the time to understand these fundamental factors are at a significant disadvantage.

Relying Solely on Technical Indicators Without Context

While technical analysis can be a valuable tool, it should not be used in isolation. Many traders make the mistake of relying solely on indicators like moving averages or oscillators without considering the broader market context. This can lead to false signals and poor trading decisions.

Failing to Adapt to Changing Market Conditions and Trends

Markets are dynamic and constantly evolving. What works in one market environment may not work in another. Traders who fail to adapt their strategies to changing conditions often struggle to maintain profitability. They may cling to outdated methods or fail to recognize when a trend has reversed.

To expand their market knowledge and improve their analysis, traders should:

– Study market fundamentals and the economic calendar

– Learn to interpret price action and chart patterns

– Combine technical and fundamental analysis for a more comprehensive view

– Stay up-to-date with market news and sentiment

– Continuously educate themselves through books, courses, and webinars

Recommended resources for further education in both technical and fundamental analysis:

Technical Analysis

1. Technical Analysis of the Financial Markets by John J. Murphy

A comprehensive guide to technical analysis, covering all aspects from the basics to advanced techniques. It’s a must-read for anyone serious about understanding price movements and chart patterns.

2. Technical Analysis Explained by Martin J. Pring

This book provides a detailed explanation of technical analysis, including tools and techniques used by professionals. Pring offers insights into how to interpret market action and make informed trading decisions.

3. Japanese Candlestick Charting Techniques by Steve Nison

A seminal book on candlestick charting, Nison’s work introduces the concepts and patterns used in this form of technical analysis. It’s essential for understanding how price patterns can indicate market sentiment.

4. The New Trading for a Living by Dr. Alexander Elder

Elder combines technical analysis with trading psychology and money management, providing a holistic approach to trading. This updated version includes new insights and techniques relevant to today’s markets.

5. Charting and Technical Analysis by Fred McAllen

McAllen focuses on practical application, offering clear explanations and examples of how to use technical analysis in real-world trading.

Fundamental Analysis

1. Fundamental Analysis for Dummies by Matt Krantz

A beginner-friendly guide that breaks down the principles of fundamental analysis, including how to read financial statements, analyze company performance, and make investment decisions based on fundamental data.

2. The Intelligent Investor by Benjamin Graham

A classic book on value investing, Graham’s work is foundational for understanding fundamental analysis. It provides timeless principles for analyzing companies and making sound investment decisions.

3. Security Analysis by Benjamin Graham and David Dodd

Another foundational text by Graham and Dodd, this book delves deeper into the techniques of analyzing securities. It’s essential reading for those serious about mastering fundamental analysis.

4. Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports by Thomas Ittelson

This book offers a clear and practical approach to understanding financial statements, a key component of fundamental analysis.

5. Common Stocks and Uncommon Profits by Philip Fisher

Fisher’s work focuses on qualitative analysis and the importance of understanding the business behind the stock. It’s a great resource for learning how to evaluate the long-term potential of companies.

Online Courses and Platforms

🔹 Coursera – Offers courses on both technical and fundamental analysis from top universities and institutions. Examples include “Financial Markets” by Yale University and “Introduction to Financial Markets” by University of Illinois.

🔹 Investopedia Academy – Provides comprehensive courses on technical analysis, fundamental analysis, and other trading and investing topics.

🔹 Khan Academy – Offers free educational content on fundamental financial principles, including sections on finance and capital markets.

🔹 Udemy – A wide range of courses on technical and fundamental analysis, suitable for different skill levels.

🔹 CFA Institute – The Chartered Financial Analyst (CFA) program covers both technical and fundamental analysis in depth, and is highly regarded in the finance industry.

Lack of Discipline and Patience

Successful trading requires a high degree of discipline and patience. Many traders fail because they lack these essential qualities, leading to impulsive decisions and poor risk management.

Overtrading and Chasing the Market

Some traders feel compelled to be in the market constantly, fearing that they will miss out on opportunities if they are not actively trading. This can lead to overtrading, which involves entering trades without proper setup or justification. Overtrading often results in increased transaction costs and reduced profitability.

Failing to Wait for High-Quality Trade Setups

Patience is a virtue in trading. Successful traders understand that not every market move represents a trading opportunity. They are willing to wait for high-quality setups that align with their trading plan, even if it means sitting on the sidelines for extended periods.

Not Adhering to Risk Management Rules

Discipline is crucial when it comes to risk management. Traders who lack discipline may fail to honor their stop-loss levels, let winning trades turn into losers, or add to losing positions in the hope of a recovery. These actions can quickly erode trading capital and lead to failure.

To cultivate discipline and patience, traders should:

– Focus on process rather than outcomes

– Set clear rules for trade entry, exit, and risk management

– Use a trading checklist to ensure all criteria are met before entering a trade

– Practice mindfulness and develop a detached, objective mindset

– Accept that losses are an inevitable part of trading and focus on long-term profitability

In conclusion, understanding the common reasons for trading failure can help aspiring traders avoid these pitfalls and increase their chances of success. By developing a solid trading plan, managing risk effectively, controlling emotions, expanding market knowledge, and cultivating discipline and patience, traders can position themselves for long-term profitability in the markets.

Proven Strategies for Successful Trading

– Implement a well-defined trading plan with clear entry and exit criteria

– Manage risk effectively through proper position sizing and diversification

– Cultivate a disciplined mindset and continuously educate yourself

Develop a Robust Trading Plan

A well-defined trading plan is the foundation of successful trading. It should include clear entry and exit criteria for each trade, realistic profit targets, and stop-loss levels. Developing a consistent trading methodology aligned with your goals is crucial.

When defining entry criteria, consider factors such as price action, technical indicators, and fundamental analysis. For example, you may decide to enter a trade when the price breaks above a key resistance level with strong volume. Similarly, establish clear exit criteria, such as taking profits at predetermined levels or cutting losses when the price moves against you by a certain percentage.

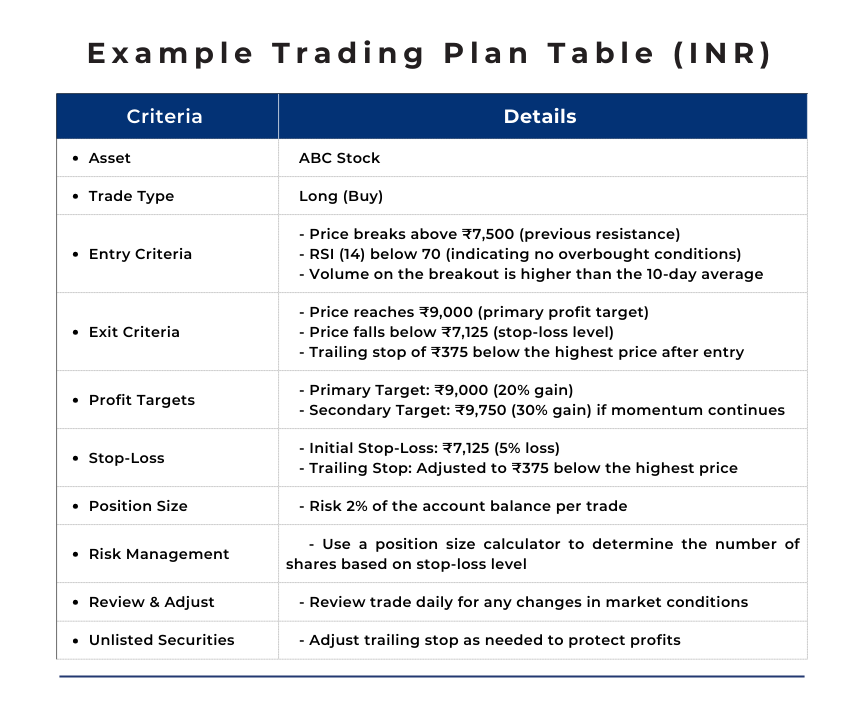

Table illustrating an example trading plan with entry and exit criteria, profit targets, & stop-loss levels.

Setting realistic profit targets is essential to avoid greed and manage expectations. Base your targets on historical market data and the volatility of the asset you’re trading. Likewise, determine appropriate stop-loss levels to limit your risk exposure. A common approach is to set a stop-loss at a level where the trade’s premise is invalidated.

Implement Effective Risk Management Techniques

Risk management is paramount to long-term trading success. Limit your risk exposure to a small percentage of your trading capital per trade, typically 1-2%. This ensures that no single trade can significantly impact your account balance.

Diversification is another key risk management technique. Spread your trades across multiple markets, assets, and timeframes to reduce the impact of any single losing trade. For example, you may trade a combination of forex pairs, stocks, and commodities across different time horizons.

Proper position sizing is crucial to managing risk. Calculate your position size based on your account size, risk tolerance, and the trade’s stop-loss level. The general formula is:

Position Size = (Account Size * Risk Percentage) / (Trade Risk in Pips or Points)

Example Calculation

Let’s go through an example for clarity:

1. Account Size: ₹500,000

2. Risk Percentage: 2% (0.02)

3. Trade Risk: ₹50 (difference between entry price and stop-loss price per share)

Step-by-Step Calculation:

Calculate the Amount to Risk:

Amount to Risk = Account Size × Risk Percentage

Amount to Risk = ₹ 500,000 × 0.02 = ₹ 10,000

Calculate the Position Size:

Position Size = Amount to Risk / Trade Risk

Position Size = ₹10,000 / ₹50 = 200 shares

So, for an account size of ₹500,000, risking 2% of the account on a trade with a trade risk of ₹50 per share, the trader should buy 200 shares.

Risk Management Books and Resources

To delve deeper into risk management techniques, consider reading the following books:

1. “The Definitive Guide to Position Sizing” by Van K. Tharp

2. “Trading Risk: Enhanced Profitability through Risk Control” by Kenneth L. Grant

3. “The Mathematics of Money Management: Risk Analysis Techniques for Traders” by Ralph Vince

These books provide in-depth insights into advanced risk management concepts and techniques, such as the Kelly Criterion, optimal f, and portfolio optimization.

Cultivate a Disciplined Trading Mindset

A disciplined trading mindset is essential for success. Emotions such as fear, greed, and hope can cloud judgment and lead to poor decision-making. Develop strategies to separate emotions from trading decisions, such as using pre-defined trading rules and automating your trades.

Sticking to your trading plan, even during drawdowns, is crucial. Avoid the temptation to deviate from your strategy when faced with losses. Accept that losses are an inevitable part of trading, and focus on learning from them to improve your approach.

Trading Psychology Resources

To further explore the psychological aspects of trading, consider the following resources:

1. “Trading in the Zone” by Mark Douglas

2. “The Disciplined Trader” by Mark Douglas

3. “The Daily Trading Coach” by Brett N. Steenbarger

These books delve into the mental and emotional challenges traders face and provide practical techniques for developing a winning mindset.

Personal anecdote from an experienced trader about the importance of discipline in trading.

A Lesson in Trading Discipline

In my early years of trading, I remember a particular experience that truly ingrained the importance of discipline in my mind. At that time, I had been trading for a few months, and I had experienced a mix of wins and losses. Like many novice traders, I believed I had a solid understanding of the market and felt confident in my abilities.

One morning, I spotted what I thought was a golden opportunity. A popular stock, let’s call it XYZ, was showing signs of a breakout. The technical indicators were aligning perfectly, and I was convinced it was going to be a big win. Without much hesitation, I decided to go all-in, ignoring my risk management rules and exceeding my usual position size.

As the day progressed, the stock initially moved in my favor, and I felt a rush of excitement. I was on the verge of a substantial profit. However, the market is unpredictable, and soon after, the stock reversed direction sharply. Panic set in, and I found myself glued to the screen, watching my potential gains evaporate and turn into significant losses.

In the heat of the moment, I made another critical mistake—I refused to cut my losses. I kept holding onto the position, hoping the market would turn back in my favor. Instead, the stock continued to plummet, and I ended up losing a substantial portion of my trading account in a single day.

That experience was a harsh wake-up call. It taught me that no matter how confident I was in a trade, sticking to a disciplined approach was crucial. I realized the importance of setting clear entry and exit points, adhering to position sizing rules, and, most importantly, managing my emotions.

From that day forward, I made a commitment to follow a disciplined trading plan. I set strict risk management rules and never deviated from them, no matter how tempting a trade appeared. This approach helped me recover from my losses and eventually achieve consistent profitability.

The lesson I learned is simple yet profound: Discipline is the cornerstone of successful trading. Without it, even the most promising strategies can lead to significant losses. By maintaining discipline, I was able to control my risks, manage my emotions, and build a sustainable trading career.

Continuously Educate Yourself and Adapt

Markets are constantly evolving, and successful traders must continuously educate themselves and adapt to changing conditions. Study market fundamentals, price action, and market psychology to gain a comprehensive understanding of the markets you trade.

Incorporate multiple analysis techniques, such as fundamental analysis, technical analysis, and sentiment analysis, to make informed trading decisions. Fundamental analysis involves studying economic indicators, company financial statements, and geopolitical events that impact market sentiment. Technical analysis focuses on price action, chart patterns, and indicators to identify trends and potential entry and exit points. Sentiment analysis gauges market participants’ emotions and opinions to assess the overall market mood.

Stay informed about economic events and adapt your trading strategies accordingly. Regularly review economic calendars and news sources to stay abreast of key data releases, central bank decisions, and geopolitical developments that may impact your trades.

Continuous Education Resources

To further your trading education, consider the following resources:

1. “Technical Analysis of the Financial Markets” by John J. Murphy

2. “Fundamental Analysis for Dummies” by Matthew Krantz

3. “The Art and Science of Technical Analysis” by Adam Grimes

4. Online courses and webinars from reputable trading educators and platforms

These resources offer in-depth insights into various aspects of market analysis and trading strategies, allowing you to refine your skills and adapt to changing market conditions.

Here are some recommended trading blogs, podcasts, and YouTube channels:

Trading Blogs (India)

● Moneycontrol – Moneycontrol provides comprehensive market news, analysis, and trading strategies focused on the Indian markets.

● Economic Times Markets – Economic Times Markets offers news, analysis, and insights into the Indian stock market.

● Nitin Bhatia – Nitin Bhatia covers a wide range of topics related to trading, investing, and market analysis in the Indian context.

● Trade Brains – Trade Brains provides educational content, market analysis, and trading strategies focused on the Indian markets.

Trading Podcasts (India)

● Alpha Moguls by Finshots- Alpha Moguls features interviews with successful Indian traders and investors, discussing their strategies and insights.

● The Indian Startup Show – The Indian Startup Show covers a broad range of topics, including trading and investing, with insights from Indian entrepreneurs and financial experts.

● Paisa Vaisa – Paisa Vaisa hosted by Anupam Gupta, covers various financial topics, including trading and investing in India.

● Investing with IIFL – Investing with IIFL by IIFL offers insights into Indian markets, investment strategies, and trading tips.

● Equitymaster Stock Market WrapUp – Equitymaster Stock Market WrapUp provides weekly updates and analysis of the Indian stock market.

YouTube Channels (India)

1. TradingChanakya

TradingChanakya offers educational videos on trading strategies, technical analysis, and market insights specifically for Indian traders.

2. CA Rachana Phadke Ranade

CA Rachana Phadke Ranade covers a wide range of financial topics, including trading, investing, and market analysis in India.

3. MarketGurukul

MarketGurukul offers educational content on technical analysis, trading strategies, and market insights focused on Indian markets.

4. Smart Trader

Smart Trader provides tutorials and tips on trading strategies, technical analysis, and market updates for Indian traders.

5. FinnovationZ

FinnovationZ offers educational videos on stock market investing, trading strategies, and financial planning in India.

Mastering the Psychology of Successful Trading

– Develop the right mindset and emotional discipline for trading success

– Learn to make rational decisions based on market data, not emotions

– Cultivate patience, objectivity, and a focus on long-term profitability

Develop a Growth Mindset

Successful traders approach trading with a growth mindset. They embrace challenges as opportunities to learn and improve, rather than seeing them as threats or failures. By focusing on continuous improvement and learning from mistakes, traders with a growth mindset are better equipped to adapt to changing market conditions and refine their strategies over time.

Maintaining realistic expectations is another key aspect of a growth mindset. Traders must understand that losses are an inevitable part of trading, and that no strategy can guarantee 100% success. By avoiding perfectionism and accepting that occasional setbacks are normal, traders can maintain a healthy perspective and avoid becoming discouraged by short-term losses.

Strategies for Developing a Growth Mindset:

1. Set realistic goals and celebrate incremental progress

2. Regularly review and analyze your trades to identify areas for improvement

3. Study successful traders and learn from their experiences and insights

4. Embrace challenges as opportunities to test and refine your skills

5. Avoid comparing yourself to others and focus on your own growth and development

Recommended reading:

– “Mindset: The New Psychology of Success” by Carol S. Dweck

– “Trading in the Zone” by Mark Douglas

Practice Emotional Discipline

Emotions can be a trader’s worst enemy, leading to impulsive decisions, overtrading, and deviating from proven strategies. To succeed in trading, it’s essential to develop emotional discipline and learn to make rational decisions based on market data and analysis, not fear, greed, or hope.

One effective way to practice emotional discipline is to create a pre-trade checklist that outlines your entry and exit criteria, risk management rules, and other key factors. By referring to this checklist before each trade, you can ensure that you’re making rational, rule-based decisions and not succumbing to emotional impulses.

Keeping a trading journal is another powerful tool for managing emotions. By tracking your trades, emotions, and thought processes, you can identify patterns and triggers that lead to poor decision-making. This self-awareness can help you develop strategies to manage stress, maintain focus, and make more objective trading decisions.

Techniques for Managing Emotions

1. Practice mindfulness and deep breathing exercises to reduce stress and maintain focus

2. Take regular breaks and engage in physical activity to clear your mind and manage emotions

3. Set clear boundaries between trading and personal life to avoid letting emotions from one area affect the other

4. Develop a support network of fellow traders or mentors who can provide guidance and perspective

Recommended reading:

– “The Daily Trading Coach” by Brett N. Steenbarger

– “The Disciplined Trader” by Mark Douglas

Cultivate Patience and Objectivity

Patience is a virtue in trading, as it allows you to wait for high-probability setups that align with your strategy, rather than forcing trades out of boredom or fear of missing out. By being patient and disciplined, you can avoid overtrading and focus on quality trades with favorable risk-reward ratios.

Objectivity is another essential quality for successful traders. By basing your decisions on objective market data and analysis, rather than subjective opinions or emotions, you can make more informed and rational trading decisions. This involves studying charts, monitoring economic news and indicators, and using well-defined entry and exit criteria.

It’s also important to accept that not every trade will be a winner, and that losses are a normal part of the trading process. By focusing on long-term profitability rather than short-term results, you can maintain a more objective and balanced perspective, and avoid letting individual losses affect your confidence or decision-making.

Strategies for Cultivating Patience and Objectivity

1. Develop a well-defined trading plan and stick to it, even during periods of low market activity

2. Use a systematic approach to analyze markets and identify high-probability setups

3. Set realistic profit targets and risk levels for each trade, and avoid chasing unrealistic returns

4. Regularly review your trading performance and adjust your strategy based on objective data and analysis

5. Practice patience and discipline in all aspects of your life, not just trading

Recommended reading:

– “The Art and Science of Technical Analysis” by Adam Grimes

– “The New Market Wizards” by Jack D. Schwager

As you develop a growth mindset, practice emotional discipline, and cultivate patience and objectivity, you’ll be better equipped to navigate the challenges of trading and make rational, informed decisions. By mastering the psychology of successful trading, you can increase your chances of long-term profitability and join the ranks of the top 10% of traders.

Effective Risk Management: The Key to Trading Longevity

– Protect your trading account by managing risk effectively

– Learn to allocate capital wisely and limit potential losses

– Ensure long-term success through diversification and strategic position sizing

Risk management is a critical aspect of trading that separates successful traders from those who struggle to maintain profitability. By implementing robust risk management strategies, you can protect your trading account, limit potential losses, and increase your chances of long-term success in the markets. In this section, we will explore the key components of effective risk management and provide actionable steps to help you incorporate these principles into your trading plan.

Determine Appropriate Position Sizing

Position sizing refers to the amount of capital you allocate to each trade, and it plays a crucial role in managing risk. To determine the appropriate position size, start by calculating the percentage of your account you are willing to risk per trade, typically ranging from 1-2%. This approach ensures that no single trade can significantly impact your overall account balance.

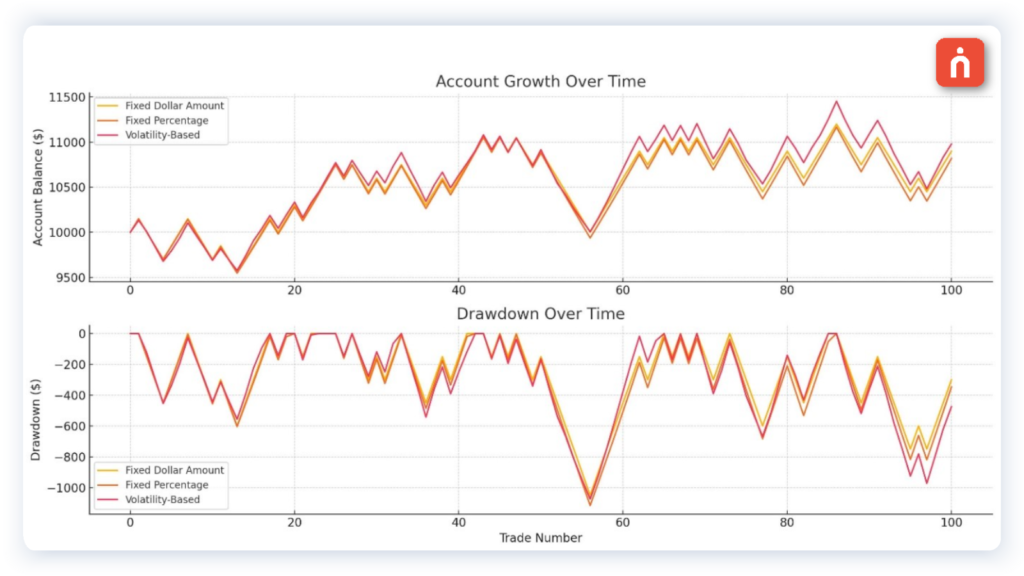

Adjust Position Size Based on Market Volatility

Market volatility can greatly influence the risk associated with each trade. During periods of high volatility, consider reducing your position size to account for the increased risk. Conversely, during low volatility periods, you may be able to slightly increase your position size while maintaining the same level of risk.

Avoid Overleveraging and Ensure Sufficient Account Liquidity

Overleveraging occurs when traders use excessive amounts of borrowed capital to increase their position size, amplifying both potential gains and losses. To avoid overleveraging, ensure that your total position size across all open trades does not exceed a reasonable percentage of your account balance. Additionally, maintain sufficient account liquidity to cover margin requirements and withstand short-term market fluctuations.

Use Stop-Loss Orders to Limit Downside Risk

Stop-loss orders are essential tools for limiting potential losses on each trade. By placing a stop-loss order at a predetermined price level, you can automatically exit a trade if the market moves against you, preventing further losses.

Place Stop-Losses at Logical Levels

When setting stop-loss levels, consider the market structure, support and resistance levels, and the volatility of the asset. Aim to place stop-losses at logical points where the market has a higher probability of respecting the level. Avoid placing stop-losses too close to your entry price, as this may lead to premature exits due to normal market fluctuations.

Adjust Stop-Losses as the Trade Progresses

As your trade moves in your favor, consider adjusting your stop-loss to protect profits. Techniques such as trailing stops, which move the stop-loss level in the direction of the trade, can help lock in gains while allowing the trade to continue benefiting from favorable market movements.

Diversify Across Markets and Timeframes

Diversification is a key principle of risk management that involves spreading your risk across multiple markets, assets, and timeframes. By diversifying your trading portfolio, you can reduce the impact of any single losing trade on your overall performance.

Allocate Capital to Different Trading Strategies

Consider allocating your trading capital to different trading strategies, such as trend-following, counter-trend, or breakout strategies. Each strategy may perform differently under various market conditions, and by diversifying across strategies, you can potentially smooth out your equity curve and reduce overall risk.

Regularly Review and Rebalance Your Portfolio

Periodically review your trading portfolio to ensure that your diversification remains aligned with your risk management goals. As market conditions change and your trading strategies evolve, you may need to rebalance your portfolio to maintain optimal risk exposure.

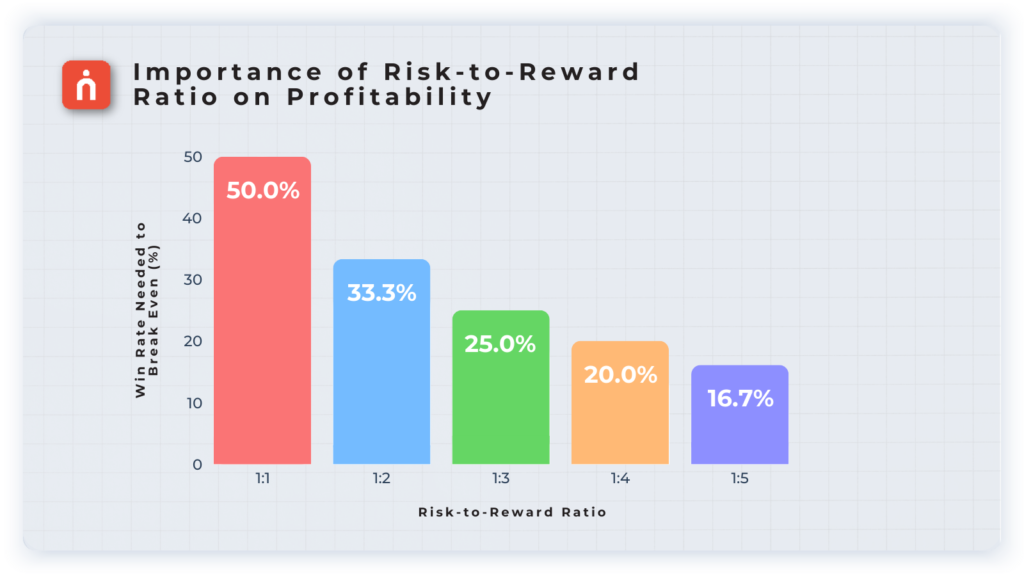

Manage Your Risk-to-Reward Ratio

The risk-to-reward ratio compares the potential loss of a trade to its potential gain. By maintaining a favorable risk-to-reward ratio, you can ensure that your winning trades more than compensate for your losing trades, ultimately leading to overall profitability.

Set Realistic Profit Targets

When setting profit targets, consider the market structure, historical price action, and the risk-to-reward ratio you are comfortable with. Aim for profit targets that are at least 1.5 to 2 times your risk, ensuring that your winning trades have a more significant impact on your account than your losing trades.

Be Willing to Adjust Your Targets

In some cases, the market may present opportunities to achieve a higher risk-to-reward ratio than initially anticipated. Be flexible in adjusting your profit targets when the market conditions warrant it, but always ensure that you maintain a favorable risk-to-reward ratio.

Keep Detailed Records and Analyze Your Performance

Maintaining detailed records of your trades and regularly analyzing your performance is crucial for refining your risk management strategies over time. By tracking your trades, you can identify patterns in your trading behavior, pinpoint areas for improvement, and optimize your risk management approach.

Use a Trading Journal

A trading journal is an essential tool for recording your trades, including entry and exit points, position sizes, and the rationale behind each trade. By documenting your trades, you can review your performance objectively and make informed adjustments to your risk management plan.

Conduct Regular Performance Reviews

Set aside time to conduct regular performance reviews, analyzing your trading results over various timeframes. Look for trends in your winning and losing trades, assess the effectiveness of your risk management strategies, and identify areas where you can refine your approach.

By implementing these risk management strategies consistently, you can protect your trading account, limit potential losses, and increase your chances of long-term success in the markets. Remember that risk management is an ongoing process that requires continuous refinement and adaptation as market conditions evolve and your trading skills develop.

Developing a Profitable Trading Edge

– Identify your unique strengths and develop a trading strategy that plays to them

– Combine multiple analysis techniques to find high-probability trade setups

– Maintain a favorable risk-reward ratio and let profits run while cutting losses short

Identify and Specialize in a Specific Market or Strategy

To develop a profitable trading edge, it’s essential to focus on markets or assets that align with your skills and interests. This allows you to build expertise and confidence in your chosen area. Consider your background, risk tolerance, and the time you can dedicate to trading when selecting your niche.

Once you’ve identified your preferred market, develop a trading style that suits your personality and goals. Some traders excel at trend-following, capturing large moves in the market direction. Others prefer counter-trend strategies, looking for reversals or fading extreme moves. Experiment with different approaches and timeframes to find what works best for you.

Remember that markets are dynamic, and your trading edge must evolve. Continuously refine and adapt your strategy based on changing market conditions, new technologies, and your own performance. Regularly review your trades, identify areas for improvement, and make necessary adjustments to stay ahead of the curve.

Recommended Books for Developing a Trading Edge

– “Trading in the Zone” by Mark Douglas – This book focuses on the psychological aspects of trading, helping you develop a winning mindset and overcome mental barriers.

– “Market Wizards” series by Jack D. Schwager – These books feature interviews with top traders across various markets, providing insights into their strategies, risk management, and lessons learned.

Incorporate Multiple Confluence Factors

Relying on a single indicator or analysis technique can lead to false signals and poor trade decisions. To increase the probability of success, look for trade setups that are supported by multiple confluence factors.

Combine fundamental analysis, studying economic and company-specific data, with technical analysis, examining price patterns and indicators. Additionally, consider market sentiment, which gauges the overall mood and positioning of market participants. When these factors align, the trade setup becomes more compelling.

For example, if a stock has strong fundamentals, a bullish chart pattern, and positive investor sentiment, it may present a high-probability long trade opportunity. Conversely, if a currency pair has weak economic data, a bearish technical setup, and negative sentiment, it could be a signal to enter a short position.

Confluence Factors to Consider

Economic data releases and geopolitical events that impact market sentiment

– Company earnings reports, management guidance, and industry trends

– Price patterns, support/resistance levels, and momentum indicators

– Options market data, such as implied volatility and put/call ratios

– Positioning data from the Commitment of Traders (COT) report

Maintain a Favorable Risk-Reward Ratio

A key aspect of a profitable trading edge is maintaining a favorable risk-reward ratio. This means ensuring that your potential profit on a trade is significantly larger than your potential loss. A common target is a risk-reward ratio of at least 1:2, where you aim to make $2 for every $1 you risk.

To achieve this, set your stop-loss orders at a level that represents the maximum loss you’re willing to accept on a trade. This could be based on technical levels, such as a key support/resistance or a percentage of your account balance. Once your stop-loss is set, aim for a profit target that is at least twice the size of your potential loss.

By letting your profits run and cutting your losses short, you can maximize your overall profitability. Even if you have a win rate of less than 50%, a favorable risk-reward ratio can help you come out ahead in the long run.

Risk Management Tips

– Use position sizing to limit your risk on each trade to a small percentage of your account (e.g., 1-2%).

– Avoid moving your stop-loss orders in the wrong direction or widening them to accommodate more losses

– Consider using trailing stop-loss orders to lock in profits as the trade moves in your favor

– Be willing to exit trades early if the market conditions change or the trade no longer meets your criteria

Mastering the Art of Trading Success

Becoming a consistently profitable trader requires more than just a few clever strategies. It demands a well-defined trading plan, robust risk management, emotional discipline, and a commitment to continuous learning and adaptation. By focusing on these critical areas, you can avoid the pitfalls that lead to failure for 90% of traders.

Develop a trading plan that aligns with your goals, implement strict risk management rules, and cultivate a disciplined mindset that separates emotions from decision-making. Specialize in a specific market or strategy, incorporate multiple confluence factors, and maintain a favorable risk-reward ratio to build a profitable trading edge.

Are you ready to put in the work required to join the top 10% of successful traders? Start by reviewing your current trading approach and identifying areas for improvement. Commit to ongoing education, practice emotional discipline, and stay focused on your long-term objectives. With dedication and persistence, you can master the art of trading success and achieve the consistent profitability you desire.

What’s one action you can take today to begin optimizing your trading plan and mindset for success?

We’d Love to hear from you