Stay Calm and Invest Wisely: The Stock Market Beyond Elections

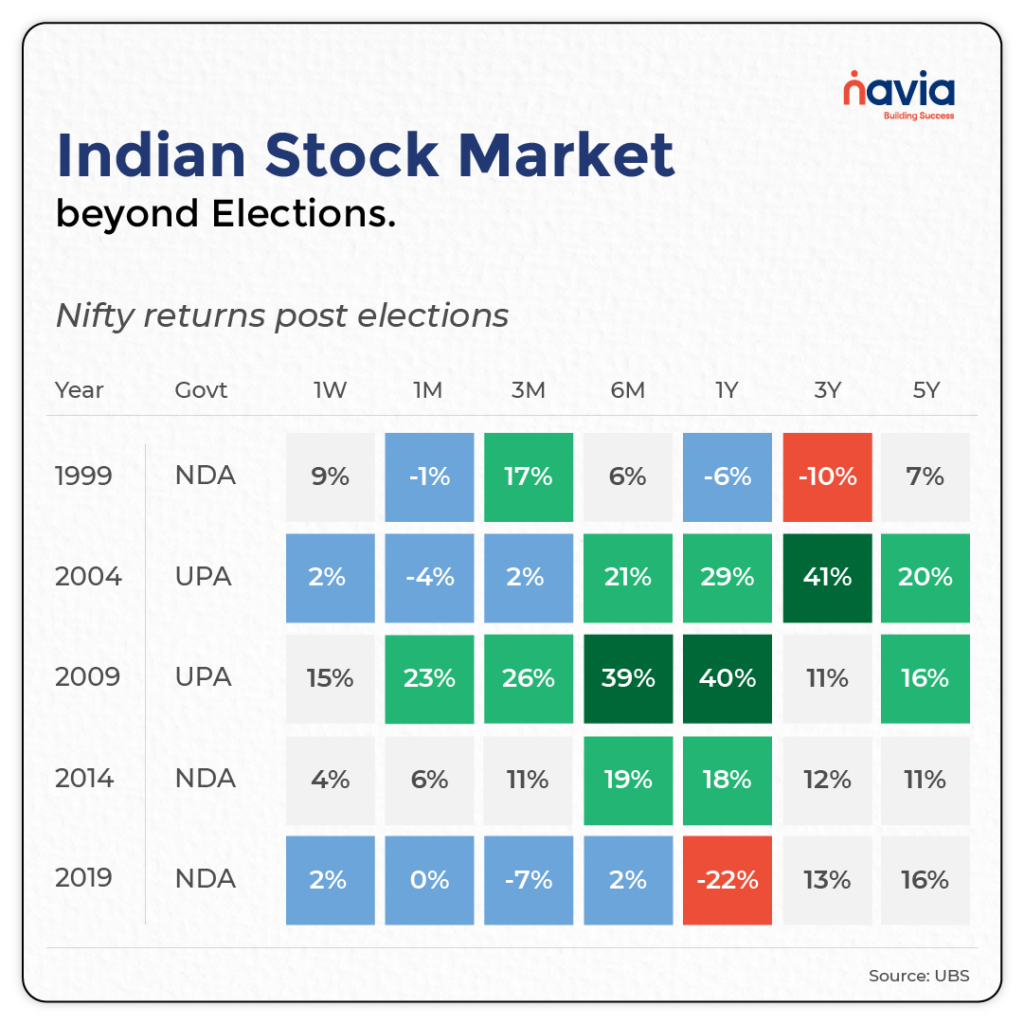

The stock market often fluctuates due to fear and greed, particularly around election times. While election outcomes can trigger short-term emotional reactions, history has shown that the market consistently recovers from elections—both favorable and unfavorable—without suffering long-term damage.

Industries are the backbone of the economy, and regardless of which government is in power, there is a vested interest in their protection. While market sentiment may experience short-term volatility, long-term growth is driven by business performance and fundamentals.

Therefore, don’t let election-related anxieties disrupt your investment strategy. Focus on strong, fundamentally sound stocks. The market’s resilience and history of growth should reassure you. Stay invested and trust in the enduring strength of solid businesses.

🡆

Anticipated Market Stability Pre-Elections

Experts forecast that the Indian stock market will experience volatility until the final phase of the election on June 1. However, they do not anticipate a major correction before the election results are announced.

As we approach the Lok Sabha election outcome, the market is likely to maintain its current trajectory without significant corrections, since the potential results are already being considered. Despite recent declines due to foreign investor sell-offs, substantial corrections are unlikely unless an unexpected major event occurs.

Although a major correction is not predicted before the Lok Sabha elections, increased volatility is expected. The market appears to have already factored in a victory for the ruling party, with the exact number of seats likely to cause short-term emotional reactions.

🡆

What Happens After Elections?

Following the election, market sentiment will be shaped by central bank monetary policy decisions, geopolitical events, and the Union Budget in July.

🡆

Understanding Stock Prices

The dynamics of supply and demand affect stock market pricing for different stocks. The price of a stock increases when there is a greater demand—that is, when there are more buyers than sellers—for that specific stock. Similarly, stock prices fall when there are more sellers than buyers.

🡆

How Investors Make Decisions

When deciding whether to buy or sell a stock, investors take into account recent news and events. Positive market sentiments encourage individuals to purchase a firm’s shares when the company releases good news, and vice versa. For instance, if the Airports Authority of India gives the Adani Group maintenance control over Jaipur International Airport, the corporation is seen as growing and gaining more power. As a result, the market views the Adani Group’s shares favorably, boosting demand and driving up share prices. Conversely, if the Indian government decides to raise corporate taxes, it will probably cause negative market sentiment and a general decline in stock prices.

🡆

Election Impact on the Stock Market

Elections are among the most volatile periods for the stock market due to the uncertainty they entail. Political events, such as elections or changes in legislation, significantly impact the stock market. A positive election result for the current administration often boosts the stock market as it signals political stability and vice versa. However, there are multiple rationales for the impact of elections on stock market values.

🡆

Industry Sectors Poised for Growth

The uncertainty surrounding the election and post-election period impacts several industries beyond the stock market overall. For instance, the stocks of the real estate and infrastructure sectors will rise if the winning party intends to focus on building the nation’s infrastructure. Similarly, pharmaceutical stocks may drop if the winning party’s election program contains policies that could negatively impact the industry.

🡆

Influence of Leadership

The stock market’s price trend is also determined by a leader’s personality. A well-liked and powerful leader can attract more foreign investment, boosting the nation’s economy and good sentiment, and driving the stock market upward. Although the stock market is unpredictable, elections are a significant indicator that can help forecast its movements. There’s always a spike in stock market sensitivity right before an election. By examining the election platform, ideology, policies, and exit poll findings, one can forecast the stock market’s direction.

🡆

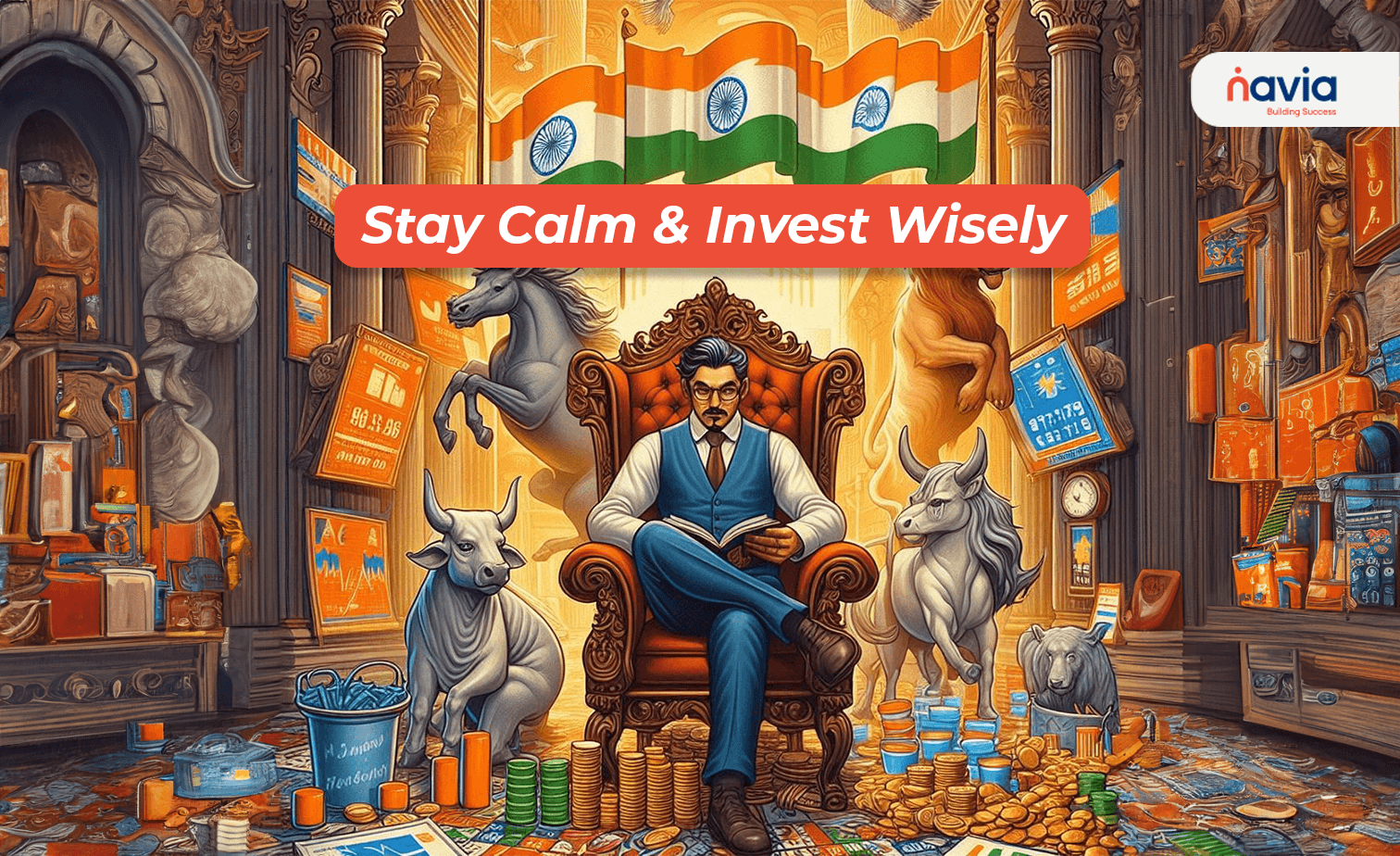

Market Performance During Elections

India’s election years have historically seen increased investor interest and market activity, reflecting the anticipation and unpredictability around prospective policy changes and government stability. Past data shows a distinct pattern: markets typically perform well both before and after elections due to expectations of stable political conditions and continued economic policies.

In the six months leading up to elections, market indices frequently experience an uptrend as investors strategically adjust their portfolios in anticipation of election results. Prior elections have resulted in increased average market returns, indicating a positive sentiment among investors driven by the possibility of a stable government and the expectation of reformative measures. This rally usually lasts after the election since established policies and new government structures give market movements a more defined course.

🡆

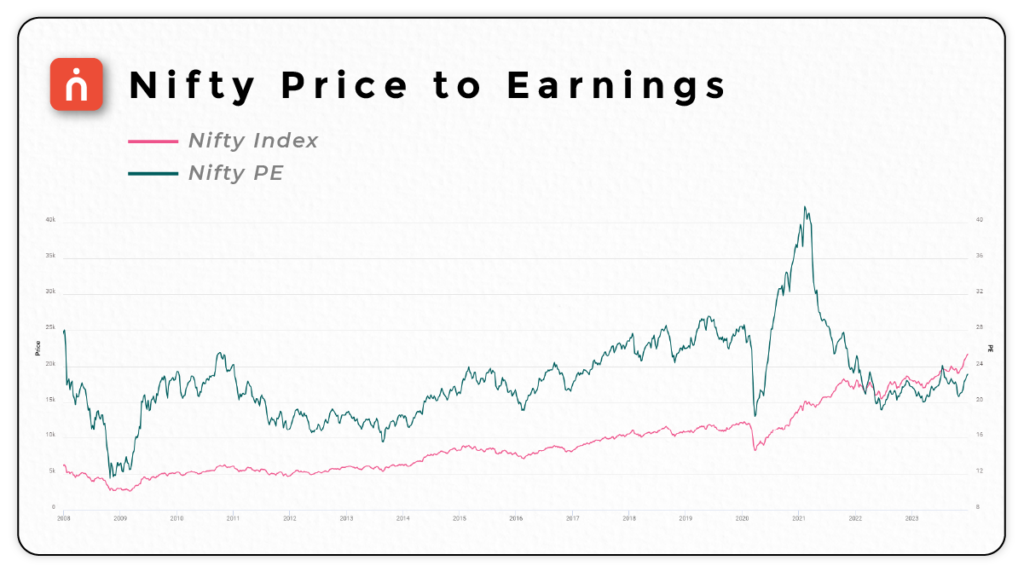

High Valuations and Global Tensions

High market valuations in India reflect the country’s anticipated rapid future growth. However, these valuations require careful consideration because, should earnings growth fall short of expectations, they could result in compressed future returns.

Investors need to assess whether the fundamental strengths and potential for profit growth of the companies they are investing in justify the elevated valuations.

Tensions in the global economy, such as trade wars, geopolitical conflicts, or other international issues, can affect India in various ways, including trade, investment, and commodities prices. For example, geopolitical unrest in oil-producing areas may cause oil prices to rise, which would be detrimental to the Indian economy.

While elections bring uncertainty and potential volatility to the stock market, the key to successful investing lies in maintaining a focus on long-term growth and strong, fundamentally sound stocks. History shows that the market has the resilience to weather political changes. Stay calm, remain invested, and trust in the enduring strength of solid businesses.

We’d Love to Hear from you