Mastering the Art of Value Investing: Strategies for Successful Wealth Building

Value investing is a clever way to invest in stocks. Its essence lies in identifying stocks that are undervalued relative to their intrinsic worth. Instead of blindly following market trends, value investors seek opportunities where market perceptions diverge from a company’s true value. They believe that sometimes stock prices swing too much because of news, giving them a chance to buy good stocks at lower prices.

Benjamin Graham, an American economist and investor, pioneered the principles of value investing during the 1920s. He’s known as the “Father of Value Investing” and has followers like Warren Buffet. This strategic approach not only helps people make money but also reduces risks by carefully studying companies.

Understanding Value Investing

Value investing is an investment strategy where investors look for stocks of companies trading below their intrinsic value. This approach requires a deep understanding of the stock market. In essence, value investing revolves around undervaluation and overvaluation. An undervalued stock is priced lower than its intrinsic value, while an overvalued stock is priced higher.

Value investors believe that stock prices don’t always reflect a company’s long-term potential due to market fluctuations. They take a contrarian approach, often going against market trends.

How Value Investing Works

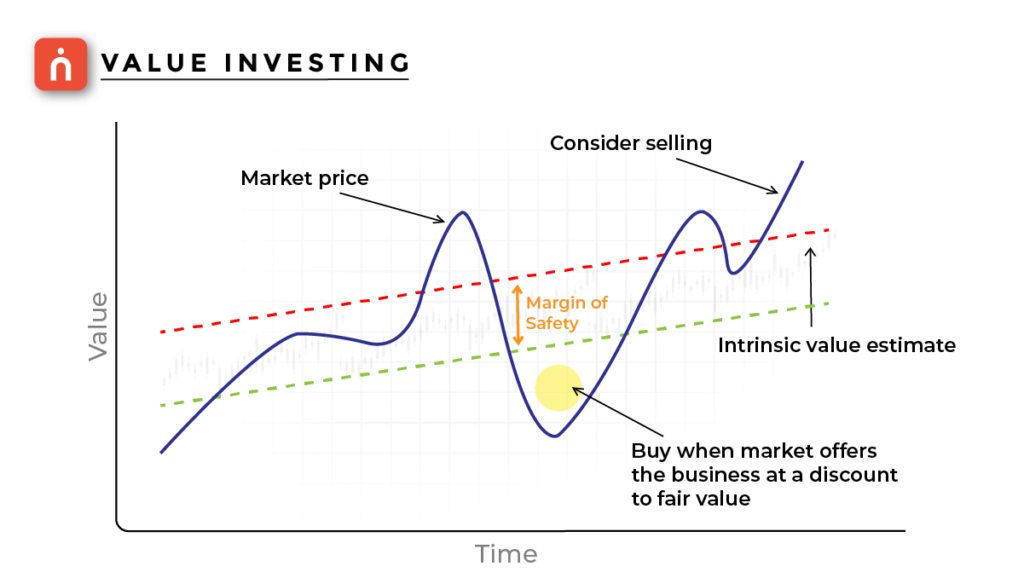

Value investing operates by recognizing stocks that are trading below their intrinsic value, which represents their genuine worth based on fundamental factors like earnings, assets, and growth prospects.

For instance, if Company A’s stock price surges from Rs. 100 to Rs. 120 and then to Rs. 180 due to popular belief, yet its actual value is only Rs. 80, it’s deemed overvalued by Rs. 100.

Value investors steer clear of such market hype and concentrate on companies with robust fundamentals trading below their intrinsic worth. They scrutinize various metrics to pinpoint undervalued stocks with enduring potential, notwithstanding transient market biases.

Example of value investing:

During the March 2020 pandemic, global financial markets experienced a significant downturn, leading to a sharp sell-off due to heightened concerns among investors.

Despite this volatility, value investors remained opportunistic, recognizing potential in undervalued stocks across various sectors. Their investment decisions were based on careful valuation analysis. They specifically targeted companies that were both undervalued and financially sound, which later proved to be highly profitable additions to their portfolios.

Value Investing Strategies

Now, let’s explore the key strategies that value investors employ to identify undervalued stocks and build resilient investment portfolios. From conducting comprehensive financial analysis to embracing contrarian viewpoints, these strategies form the cornerstone of successful value investing.

The key to finding undervalued stocks is thorough research and logical thinking. Value investor Christopher H. Browne advises considering if a company can grow its revenue by:

⮞

Increasing product prices

⮞

Boosting sales volumes

⮞

Cutting operating costs

⮞

Disposing of unprofitable divisions

Browne also recommends analyzing a company’s competitors to assess its potential for future growth. However, these evaluations often rely on speculation rather than concrete numerical data. This lack of quantitative tools makes value investing somewhat of a guessing game, according to Browne and Warren Buffett.

Warren Buffett further suggests investing in industries you are familiar with, such as automotive, fashion, appliances, or food. One strategy is to target companies offering highly demanded products or services. While predicting the success of new innovations can be challenging, assessing a company’s track record of adaptation and longevity can provide valuable insights for investment decisions.

Intrinsic Value and Value Investing

Those who engage in value investing seek out undervalued stocks with the belief that they can profit when the stock price eventually rises.

To determine if a stock is undervalued, investors assess various factors such as the company’s financial performance, profitability, and business model. They also consider intangible aspects like the company’s brand strength, target market, and competitive advantages.

Investors rely on different metrics to evaluate a stock’s value. For instance:

→ Price-to-book (P/B) ratio compares a company’s assets to its stock price.

→ Price-to-earnings (P/E) ratio examines a company’s earnings relative to its stock price.

→ Free cash flow indicates the amount of money a company has after covering its expenses.

By analyzing these factors, investors can determine if a stock is worth purchasing based on its current market price compared to its intrinsic value.

Calculating Intrinsic Value

Fundamentally, calculating a company’s intrinsic value involves assessing the present value of its future cash flows. This estimation requires forecasting future cash flows and determining the applicable interest rate to ascertain the present value of those flows. Given these assumptions, it’s understandable why intrinsic value is often depicted as a range rather than a precise figure.

Warren Buffett described intrinsic value as the “only logical approach” to evaluating investment attractiveness. He defined it simply as the discounted value of the cash that can be withdrawn from a business over its remaining life. Various metrics are used to gauge whether a company is trading below its intrinsic value, although none should be used blindly. They can, however, serve as valuable starting points.

Margin of Safety

Value investors like to have a safety net when they estimate a stock’s worth. They set a “margin of safety” based on how much risk they can handle. This principle is crucial in value investing because it means buying stocks at lower prices, which can lead to higher profits when you sell them later.

Let’s say you think a stock is worth $100 but buy it for $66. That $34 difference is your profit if the stock eventually reaches its true value. Plus, if the company grows, the stock could become even more valuable, giving you more profit. For instance, if the stock rises to $110, you’d make $44 because you bought it at a discount. If you had bought it at $100, your profit would only be $10.

Reasons Stocks Are Undervalued

Stocks can be undervalued for various reasons, from market sentiment and cyclical fluctuations to unnoticed opportunities and adverse events. By understanding these factors, investors can identify lucrative investment opportunities hidden beneath the surface. Here are a few such factors:

🔹 Market Movements and Herd Mentality

Investors sometimes make irrational decisions driven by psychological biases rather than market fundamentals. They may buy when a stock’s price or the overall market is rising, driven by fear of missing out. Conversely, they may sell when prices fall, driven by loss aversion.

🔹 Market Crashes

Bubbles, fueled by investor exuberance, often lead to unsustainable price increases, resulting in market crashes when the bubble bursts. This occurred during the dot-com bubble in the early 2000s and the housing bubble in the mid-2000s.

🔹 Overlooked and Unappealing Stocks

Opportunities may arise in undervalued stocks that fly under the radar, such as small caps or foreign stocks. Investors often flock to the next big thing rather than established companies, leading to overlooked opportunities.

🔹 Negative News

Even fundamentally sound companies may face setbacks, such as litigation or product recalls. While such events may dent profitability temporarily, they don’t necessarily reflect the company’s long-term value. Additionally, analysts’ forecasts may not accurately predict a company’s future performance, leading investors to panic and sell, thereby creating buying opportunities for value investors.

🔹 Cyclicality

Economic fluctuations can impact a company’s profitability and stock price, but they don’t necessarily affect its long-term value. Understanding these cycles can help investors identify undervalued opportunities amidst short-term market fluctuations.

Exploring Alternatives to Value Investing

Value investing isn’t the sole method for selecting stocks. Growth investing emerges as a significant alternative. While value investing seeks companies with discounted stocks, growth investing targets those experiencing rapid revenue and profit growth. Growth investors prioritize companies with high growth rates, often leading to elevated P/E and P/B ratios.

Both value and growth investing can outperform average market returns over time. Recent trends indicate growth investing’s dominance, exemplified by companies like Bajaj Finance, Britannia Industries, and Deepak Nitrite. However, historical data suggests periods where value investing outperformed.

In addition to value and growth investing, alternatives dismiss fundamental analysis entirely. Technical analysis relies on past market data to predict future prices, while day traders exploit short-term market fluctuations.

Exploring Value Investing through Mutual Funds

Mutual funds provide exposure to value investing. Major fund companies offer actively managed and passively managed (index funds) value funds. For instance, the Nippon India Nifty 50 Value 20 Index Fund invests in value companies. Comparing this fund with the Nippon India Growth Fund highlights the difference in investment approaches.

The value fund boasts a P/E ratio of 17.01, while the growth fund’s ratio is 18.42. Similarly, the value fund’s P/B ratio stands at 3.62, contrasting with the growth fund’s 2.76.

Recent performance favors growth funds, with returns of 8.90% compared to the value fund’s 7.60% over the past year. However, this data doesn’t imply a preference for growth investing over value investing. Both approaches have their merits. For investors seeking a blend of these styles, Nifty 50 index fund presents a suitable option.

Value investing offers a clever approach to investing in stocks. It’s about finding stocks that are priced lower than they should be based on how good the company is. This method, made famous by Benjamin Graham and Warren Buffett, helps reduce risks by carefully studying companies. By doing thorough research and buying stocks when they’re cheap, investors can make good profits in the long run. Even though there are other ways to invest, value investing remains a strong choice for those looking to grow their money steadily.

We’d Love to Hear from you –