Start your journey now

5 simple steps in 5 minutes

Aadhar Number + OTP

Enter PAN Number and Bank Account Details

Email Verification and Personal Details

*Document Upload & Selfie Photo

eSign + OTP

Free Nifty Options | Free Bank Nifty options | Free Midcap Nifty Options

Free FinNifty Options | Free Commodity Options | Free Intraday

No order limit | No Subscriptions

Zero Brokerage | Zero Charges*

| Segment | STT /CTT Description | STT/CTT | Transaction Charges* |

|---|---|---|---|

| Equity Options | Sale Of Options Premium | 0.05% | NSE Charge: 0.053% Clearing Charge: 0.025% |

| On Expiry - Exercise Trade On Intrinsic Value* | 0.125% |

| Segment | Other charges* |

|---|---|

| Call N Trade Charges | ₹50 + GST - (A - Each call connected on order placing queue of our dealing desk. B - Each Order executed by Admin for MIS square off, square off due to M-to-M losses, Shortfalls or for any other reason as required from time to time by our Risk Management Policy.) |

| Pay-in Charges | Payment Gateway - ₹ 9/- + GST per transaction Cheque Payments - ₹ 15/- + GST per instrument |

| Physical Contract Note postage charges | ₹ 50 +GST per day |

| Margin Trade funding (MTF) interest rate | 2% per month |

Tax by the government when transacting on the exchanges. Charged as above on both buy and sell sides when trading equity delivery. Charged only on selling side when trading intraday or on F&O. When trading at Navia STT/CTT can be a lot more than the brokerage we charge. Important to keep a tab.

Transaction charge includes Exchange transaction charges + Clearing corporation charges. Charged by exchanges (NSE,BSE,MCX) and clearing corporation (NSCCL) Clearing charge is the amount charged by Clearing member. Orbis is the clearing member in Equity and Commodity derivatives for Navia.

Additional charges of ₹50 + GST will be on

A)Each call connected on order placing queue of our dealing desk.

B)Each Order executed by Admin for MIS square off, square off due to M-to-M losses, Shortfalls or for any other reason as required from time to time by our Risk Management Policy.

Stamp charges as per the Indian Stamp Act of 1899 for transacting in instruments on the stock exchanges and depositories Click here.

Tax levied by the government on the services rendered. The current GST rate is 18% on Exchange Transaction Charges, Clearing Charges, SEBI charges and Brokerage, if any

Charged at ₹ 10 per crore by Securities and Exchange Board of India for regulating the markets.

Depository transaction charges are levied by the Depository (NSDL/CDSL) and depository participant (Navia Markets Ltd.) These charges are only levied when you sell your shares through us from your DP account with us. The charges are 0.03% of transaction value, subject to a minimum of 25 & maximum of 250 per transaction. NDU charges under Tariff : 0.05% of the value of securities upon creation of hold subject to a minimum of Rs. 50. There are so also other Depository related charges for one off activities like demating/ Pledging / Failed transactions etc. For list of complete charges Click here.

Brokerage will not exceed the rates specified by SEBI and the exchanges. All statutory and regulatory charges will be levied at actuals. Brokerage is also charged on expired, exercised, and assigned options contracts. Free investments are available only for our retail individual clients. These charges not applicable for Companies, Partnerships, Trusts, and HUFs.

You can complete your eKYC within 5 Min. Once your documents are successfully verified and e-Signed using Aadhar OTP, your A/c will be activated within 24 hours if you are KRA Compliant . You would receive a welcome email to your registered email id.

If you are non KRA Compliant, the Account opening process would take 48-72 hours after which you would receive a welcome email to your registered email id.

Any discrepancies or mismatch in the documents submitted would delay the account opening process.

For Individuals, documents required include:

Note: If bank verification fails, cheque copy of your bank account is mandatory to upload.

You get a totally FREE all in one account. Option Trading and Demat account opening is FREE. There is ZERO demat & AMC charges. You can use the demat account to invest in Mutual funds, Equity, IPO’s, Bonds etc.

You can trade in Liquid Index Options expiry contract on expiry date. However you cannot trade in Stock option expiry contracts on Expiry day due to liquidity concerns.

Illiquid Options are blocked as per Navia’s internal Risk management policy in order to protect traders from being stuck with a position in the absence of counter parties to cover the same.

When we allow to buy an illiquid contract, a client would be able to create a position in it by buying or selling the contract. A risk arises when the client is unable to square off the position due to non-availability of counter party which is highly common in illiquid contracts. As a result of this, the client would necessarily be required to bring in additional margins, failing which, would attract penalties.

The broker will be levied these penalties for not taking due diligence to prevent trading in illiquid contracts. To avoid these we block illiquid contracts. Click to the link to know more

The premium received on Selling Options can be used to buy other options in the same segment. Since the settlement cycle for Derivative Segment is T+1, you cannot use the premium received to trade in other segments during the day. If allowed, this would result in margin shortfalls which would attract regulatory penalties.

NO. As per SEBI Regulations, settlement cycle for derivative segment (F&O) is T+1 day. This implies that if you make profits trading in derivative segment (F&O), it will be eligible on the T+1 day only. Hence, if you take an F&O position & make profits, we will not consider the profits made on T Day while reporting margins to the exchanges, since the profits are realized only on T+1. These profits will not be clear balance on that day, and thus won't be considered as available margin for trading in F&O.

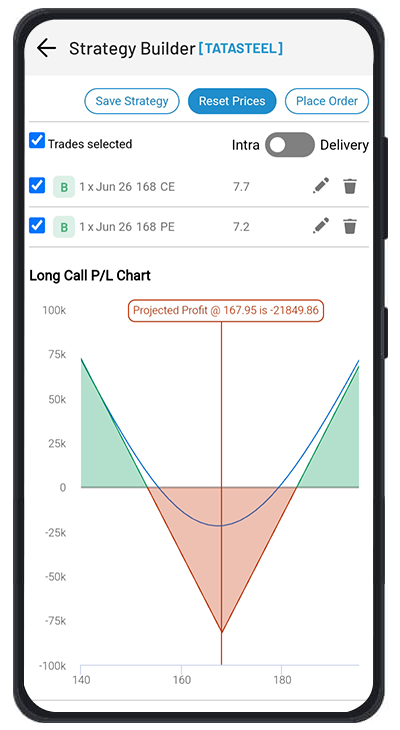

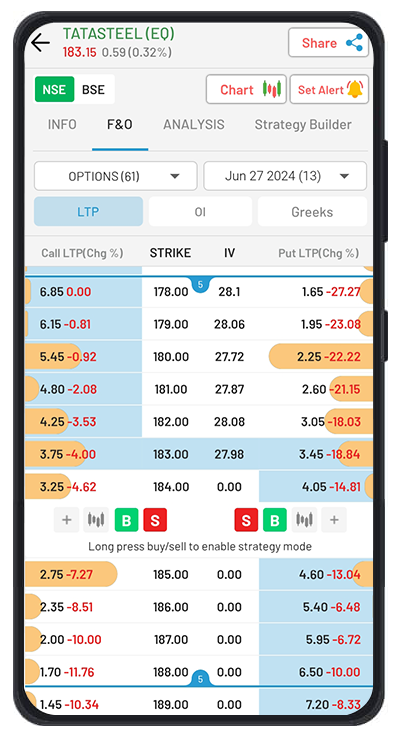

For Buying Options you require 100% value of contract as margins. For Selling Options the margin required would be SPAN + Additional Margin + Premium received which is prescribed by the Regulator for both Intra-day and Carry forward trades. You can view the margins Live in our Mobile APP and Web based terminal while placing orders.

An options contract is a financial contract between a buyer and a seller that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a specified date (expiration date). The underlying asset can be a commodity, a bond, a stock, or an index. There are two types of options: call options, which give the buyer the right to buy the underlying asset, and put options, which give the buyer the right to sell the underlying asset. Options can be used for a variety of purposes, such as hedging against a potential loss in an underlying asset, speculating on the price of an underlying asset, or generating income. Read More

Options cannot be bought in single shares but in minimum lots. An option buyer has limited risk and potential for unlimited profits. The option seller has limited returns and unlimited risk. There are 4 key option risks and how they impact option buyers and option sellers. Read More

When the Greek emperor asked the famous mathematician, Euclid, if Geometry could be made simpler, his answer was, “Your honour, there is no royal route to geometry”. Similarly, there is no royal route to picking the right stock for options trading. It has to be a combination of analysis, back testing and iterations. However, there are some basic rules that you can follow to make the task more purposeful. Read More

You must not only track the performance of the option but also the various factors that could have a bearing on the option value. In addition, even if the option position is closed, you need to track how it impacted your overall trading performance. The question you need to answer is whether the particular position added to your trading profits overall or depleted your average returns. Let us look at 13 such factors (or shall we call it a baker’s dozen) that you must track regarding your options position. Read More