YOLO to “Oh No!”: A Ramen-Fueled Journey

Manish, a recent college graduate, was itching to make his mark on the world. Unfortunately, his mark so far consisted of a dwindling bank account and a mounting pile of ramen noodle packages. He craved financial freedom, the kind that allowed for fancy coffee and weekend getaways, not instant noodles and nights in.

One evening, while drowning his sorrows in an overpriced cup of gas station coffee, Manish overheard a conversation about “Options Trading” and how it could turn chump change into a king’s ransom. Visions of yachts and poolside cocktails danced in his head. With stars in his eyes and zero knowledge, Manish plunged headfirst into the world of options.

He downloaded a popular trading app, barely registering the disclaimers about risk and complexity. He picked a stock that “felt good” and blindly bought a call option, convinced it was a one-way ticket to easy street. A week later, his calls were worthless, and his bank account looked like it had been raided by a particularly enthusiastic looter.

Dejected and confused, Manish bumped into Shyam, a bright-as-a-button friend from school who now worked as a financial advisor. Shyam, sensing Manish’s woes, listened patiently to his tale of options-induced disaster.

“Options can be a powerful tool,” Shyam explained, “but they’re like a high-performance car – great in the right hands, dangerous in the wrong ones.”

Shyam then launched into a simplified explanation of options. He likened them to contracts that gave Manish the right, but not the obligation, to buy (call) or sell (put) a stock at a specific price (strike price) by a certain date (expiration). He highlighted the key areas Manish had ignored: time decay (the value of options erodes as expiry approaches), volatility (wild swings in the market can wreak havoc on option prices), and leverage (small movements in the stock price can lead to big losses in options).

Want to avoid the pitfalls Manish encountered? Discover effective strategies for options trading and make informed decisions.

“Options trading requires knowledge, Manish,” Shyam concluded. “It’s not a get-rich-quick scheme.”

Manish felt a surge of gratitude for his friend’s patience. The world of options wasn’t the El Dorado he’d imagined, but it held a strange allure now, a challenge to be mastered.

Fired up with newfound determination, Manish pulled out his phone. “So, where do I start?”

Shyam smiled. “There’s an app called Navia. They offer resources for new options traders, including pre-built strategies. You can check them out as a guest user before you dive in.”

Manish downloaded the app, a flicker of hope replacing the earlier despair. Maybe, just maybe, with some education and the right tools, options trading wouldn’t be his financial Waterloo, but the stepping stone to a brighter future. After all, even the most thrilling rides start with learning the ropes, not just grabbing the wheel and hoping for the best.

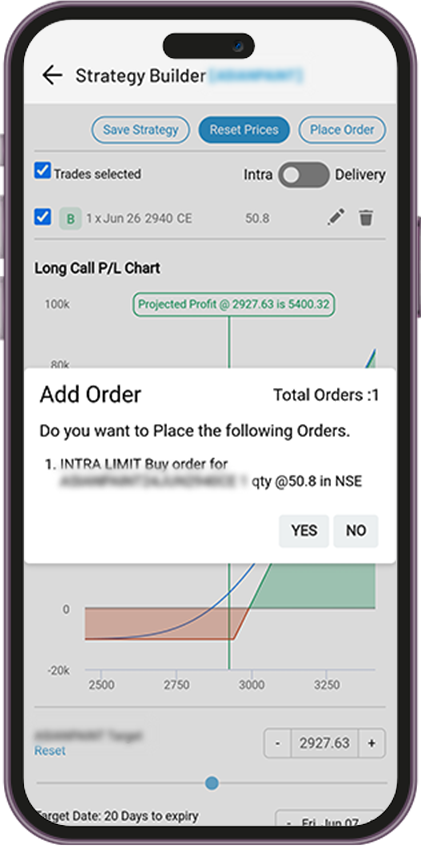

How to use Readymade Options strategy on the Navia App?

🔸 Open the Navia App: Launch the Navia app on your device.

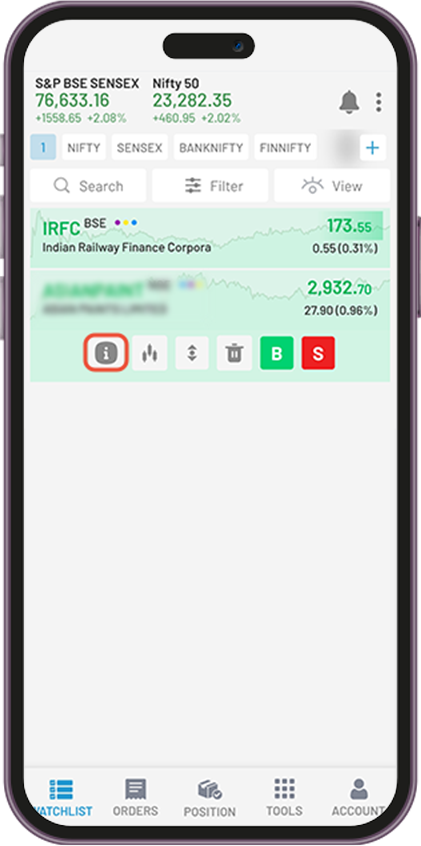

🔸 Select the Option Script: Navigate to the watchlist and choose the option script you’re interested in.

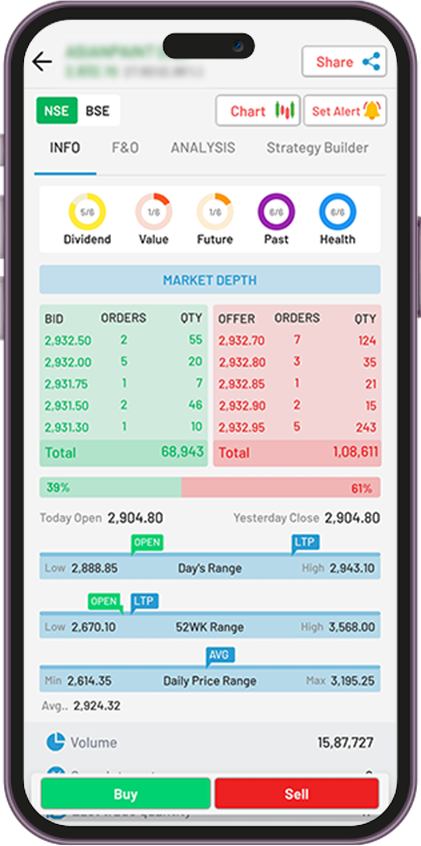

🔸 Access the Strategy Builder: Click on the ‘i’ button next to the selected option script and swipe right to find the ‘Strategy Builder’ option.

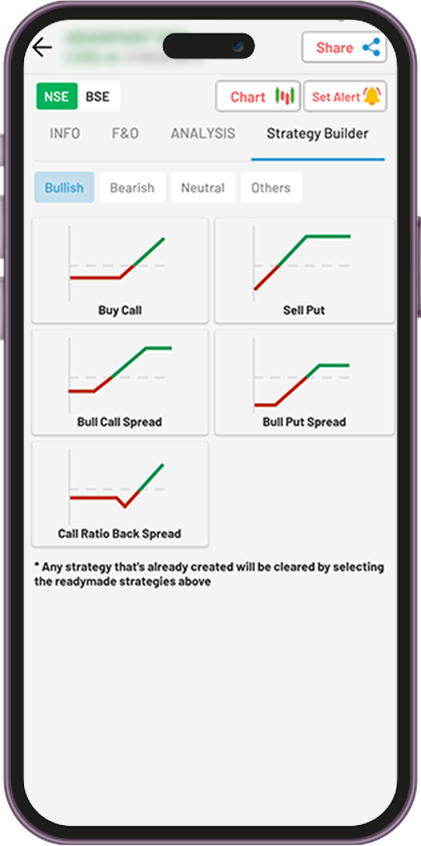

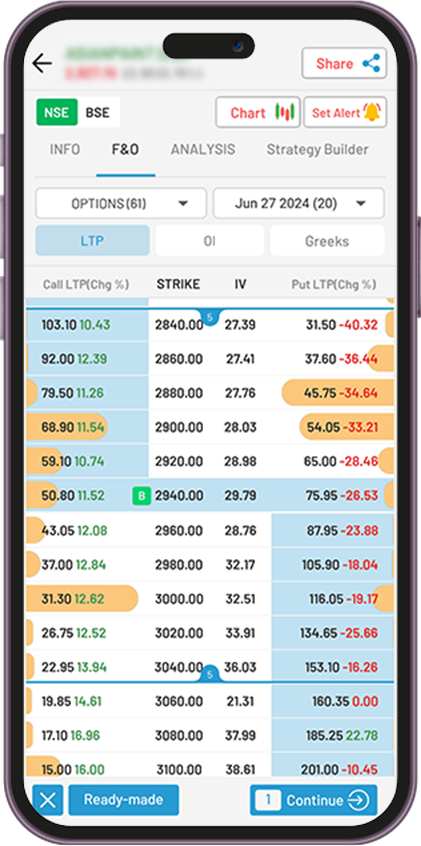

🔸 Explore Strategies: Browse a variety of readymade strategies tailored for different market conditions and choose one that suits your analysis.

🔸 Execute the Strategy: Tap on ‘Continue’ and place the order to execute your chosen strategy.

🔸 Click on “Yes” to Place the order successfully.

We’d Love to Hear from you