Why We Fear Losses More Than We Enjoy Gains?

- What is Prospect Theory?

- Why Does This Happen?

- How it Shows Up in Investing?

- How to Overcome the Loss Aversion Trap?

- Final Words

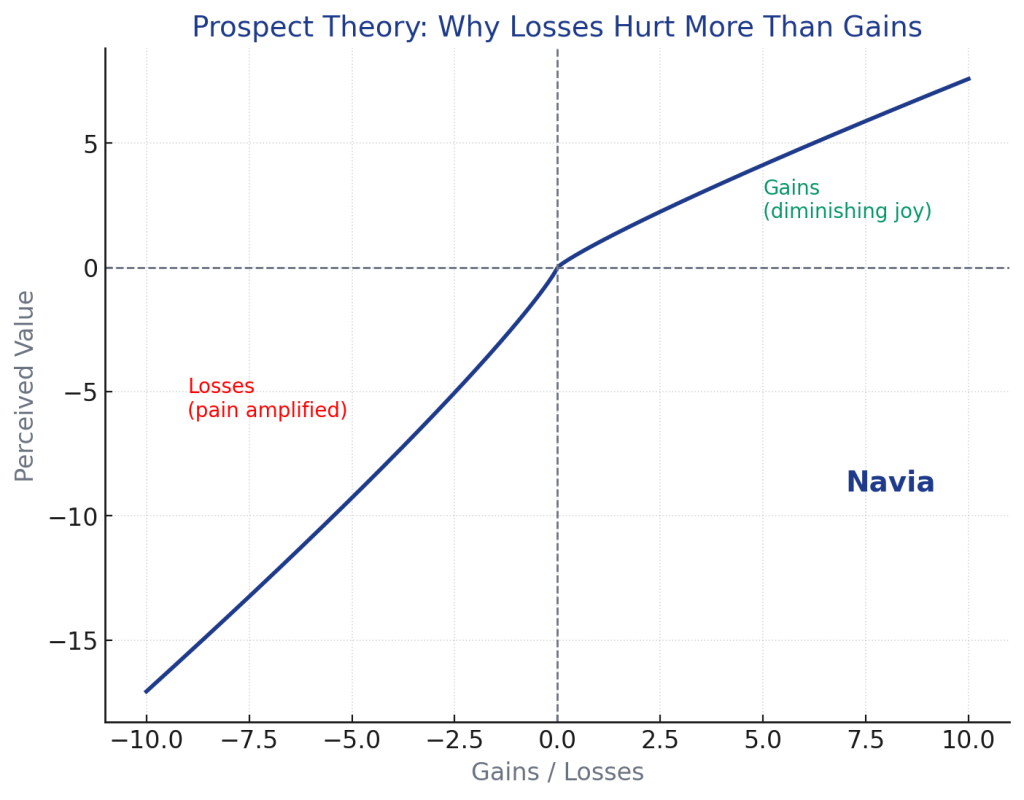

One of the most puzzling things in investing is this: people react much more strongly to losing ₹10,000 than to gaining the same amount. This isn’t just intuition—it’s a well-studied behavioral bias known as Prospect Theory, developed by Nobel laureates Daniel Kahneman and Amos Tversky.

What is Prospect Theory?

Prospect Theory explains how people actually make decisions under risk. It shows that:

➣ Losses hurt more than equivalent gains feel good.

➣ People are not always rational. They weigh potential outcomes differently, often leading to suboptimal financial decisions.

Simply put: losing ₹1,000 feels almost twice as painful as the joy of gaining ₹1,000.

Why Does This Happen?

🔸 Survival Instincts – From an evolutionary view, avoiding loss (danger) was critical for survival. This instinct carries over into money decisions.

🔸 Emotional Weight – Our brain’s emotional centers are more active when processing losses than gains.

🔸 Reference Points – We judge outcomes based on where we started rather than absolute wealth.

How it Shows Up in Investing?

Prospect Theory plays out every day in the stock markets:

➜ Holding on to Losers: Investors often refuse to sell a stock at a loss, waiting endlessly for it to “bounce back.”

➜ Booking Profits Too Early: Many sell winners too quickly, locking in small gains but missing long-term compounding.

➜ Overreacting to Market Corrections: A 10% market drop feels like a disaster, even if the long-term trend is intact.

➜ Avoiding Equity Investing: Some investors stick only to FDs or gold, fearing losses in equities, even though history shows equities generate higher returns over time.

How to Overcome the Loss Aversion Trap?

⦿ Reframe Losses as Part of the Game – Volatility is not permanent loss. It’s the price of long-term returns.

⦿ Set Clear Goals – Anchor your decisions on long-term goals (retirement, education fund) rather than daily price swings.

⦿ Automate Discipline – Use SIPs and systematic investing to reduce emotional decision-making.

⦿ Diversify – A balanced portfolio reduces the fear of individual losses.

⦿ Focus on Probabilities, Not Emotions – Look at data, not just feelings. Over time, equities have outperformed despite short-term losses.

Final Words

Prospect Theory reminds us that our brains are wired to fear losses more than we celebrate gains. But in investing, this bias can lead to poor decisions—holding losers, exiting too early, or avoiding equities altogether.

At Navia, we design platforms, tools, and advisory services to help clients rise above these behavioral traps. By combining discipline with the right technology—like SIP automation and AI-driven insights—you can stay invested with confidence.

Remember, wealth is built not by avoiding every loss, but by staying the course long enough for gains to compound.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.