Which One to Choose for SIP: Mutual Fund or ETF

When it comes to investing through Systematic Investment Plans (SIPs), investors often find themselves debating between mutual funds and Exchange-Traded Funds (ETFs). Both options offer distinct advantages, and the choice depends on various factors such as investment goals, risk tolerance, and preferences. Let’s explore the differences between mutual funds and ETFs to help you make an informed decision for your SIP investments.

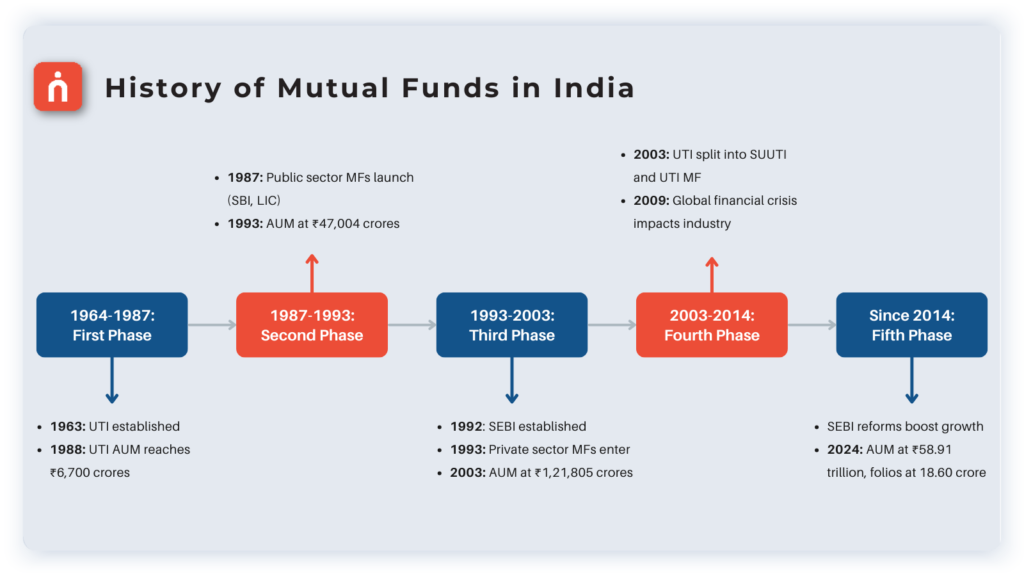

History of Mutual Funds in India

India’s mutual fund journey began in 1963 with the establishment of the Unit Trust of India (UTI) by the Government of India and the Reserve Bank of India to promote savings and investment. The industry’s evolution can be divided into five phases:

» First Phase (1964-1987): UTI was formed under RBI’s control, later transitioning to IDBI’s oversight in 1978. The first scheme, Unit Scheme 1964 (US ’64), helped UTI amass ₹6,700 crores in assets by 1988.

» Second Phase (1987-1993): Public sector mutual funds emerged, with SBI Mutual Fund being the first non-UTI fund in 1987. By 1993, the industry’s assets had grown to ₹47,004 crores.

» Third Phase (1993-2003): SEBI’s establishment in 1992 and subsequent regulations in 1993 allowed private sector mutual funds to enter the market. This phase saw significant growth, with assets reaching ₹1,21,805 crores by 2003.

» Fourth Phase (2003-2014): UTI was split into SUUTI and UTI Mutual Fund in 2003, bringing it under SEBI regulations. The global financial crisis in 2009 impacted the industry, but it began recovering by 2014.

» Fifth Phase (Since 2014): SEBI’s measures in 2012 boosted mutual fund penetration, especially in smaller cities. The industry’s assets grew from ₹10.11 trillion in May 2014 to ₹58.91 trillion in May 2024. Investor folios increased from 8.32 crores in 2019 to 18.60 crores in 2024, with a significant rise in SIP accounts.

Mutual Funds

Professional Management

Mutual funds are overseen by skilled fund managers who execute investment decisions on behalf of the investors. These managers conduct research, analyze market trends, and actively manage the fund’s portfolio to achieve the stated investment objectives.

Diversification

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets. This diversification helps spread risk and reduce the impact of volatility on investment returns.

SIP Flexibility

Mutual funds offer flexibility in SIP investments, allowing investors to automate regular contributions at predetermined intervals. SIPs enable disciplined investing and help investors benefit from rupee-cost averaging over time.

NAV-Based Pricing

Mutual fund transactions are executed at the Net Asset Value (NAV) at the end of the trading day. Investors receive units of the fund based on the NAV prevailing on the SIP date.

Types of Mutual Funds

🔸 Open-Ended Funds: Open-ended funds are the most prevalent type in the mutual fund market, both in terms of volume and assets under management. The purchase and sale of fund shares take place directly between investors and the fund company, with no limit to the number of shares issued.

🔸 Closed-End Funds: These funds issue a specific number of shares and do not issue new shares as investor demand grows. Prices are driven by investor demand and can be at a premium or discount to NAV.

History of ETFs in India and Key Growth Drivers

The advent of ETFs in India began with Benchmark Mutual Fund launching the country’s first ETF, the Nifty Benchmark Exchange-Traded Scheme (Nifty BeES), in 2001. This ETF, listed on the NSE, tracked the Nifty 50 Index and allowed investors to gain exposure to the entire index with a single transaction, providing a diversified portfolio without active management.

In 2004, Benchmark Mutual Fund introduced India’s first debt ETF, Liquid BeES, catering to conservative investors by providing access to the money market. This was followed by the launch of the first gold ETF, Gold BeEs, in 2007. Gold ETFs gained immense popularity between 2008 and 2013 as investors sought safer havens during the global credit crisis, with gold funds accounting for more than half of total ETF assets during this period.

A significant boost for ETFs occurred in 2013 when they were recognized as an eligible asset class for pension funds, and securities transaction taxes were reduced, creating a level playing field with mutual funds. The government’s decision to divest its share in public sector enterprises via ETFs led to the launch of the CPSE ETF in 2014, raising Rs 3000 crores in disinvestment proceeds.

The growth of ETFs has been further driven by increasing awareness, the underperformance of large-cap active funds compared to large-cap indices, and the low management fees associated with ETFs. Recent additions to the ETF landscape include the Bharat Bond ETFs launched in 2019 and 2020, along with various sector-specific ETFs such as the HDFC Banking ETF and ICICI Prudential IT ETF.

From just 78 ETFs in March 2019, the number grew to 99 ETFs by November 2020, with assets under management rising to Rs 2.47 lakh crores, demonstrating the growing acceptance and adoption of ETFs in India.

ETFs (Exchange-Traded Funds)

Passive Investing

ETFs typically track an underlying index or asset and aim to replicate its performance. Unlike mutual funds, ETFs are passively managed, meaning they aim to mirror the performance of an index rather than beat it.

Liquidity and Trading Flexibility

ETFs can be traded on stock exchanges just like individual stocks, providing the flexibility to buy and sell them throughout the trading day. Investors can buy and sell ETF units throughout the trading day at market prices, providing liquidity and transparency.

Lower Expense Ratios

ETFs typically come with lower expense ratios than actively managed mutual funds. This is because ETFs require less frequent portfolio turnover and incur fewer management fees.

Market Price-Based Trading

ETF transactions are executed at market prices throughout the trading day, allowing investors to buy or sell at the prevailing market rate. The price of an ETF may differ slightly from its NAV due to supply and demand dynamics.

Types of ETFs

🔸 Exchange-Traded Open-End Fund: The majority of ETFs are registered under the SEC’s Investment Company Act of 1940 as open-end management companies. These ETFs offer greater portfolio management flexibility compared to the Unit Investment Trust structure.

🔸 Exchange-Traded Unit Investment Trust (UIT): These ETFs, regulated by the Investment Company Act of 1940, aim to closely replicate their specific indexes to minimize tracking errors.

🔸 Exchange-Traded Grantor Trust: These ETFs, commonly used for investing in commodities, are structured as grantor trusts and are registered under the Securities Act of 1933. Investors own the underlying shares in the companies in which the ETF is invested.

Choosing Between Mutual Funds and ETFs for SIP

Consider Investment Objectives

Evaluate your investment objectives, time frame, and risk tolerance. Mutual funds may be suitable for investors seeking active management and diversified exposure, while ETFs may appeal to those looking for passive investing and intraday trading flexibility.

Evaluate Costs and Fees

Compare expense ratios, transaction costs, and other fees associated with mutual funds and ETFs. Lower costs can enhance long-term returns, so choose the option that aligns with your cost considerations.

Analyze Liquidity and Trading Needs

Determine your liquidity requirements and trading preferences. If you value intraday trading flexibility and market price-based transactions, ETFs may be more suitable. However, if you prioritize SIP automation and NAV-based pricing, mutual funds could be the preferred choice.

“For a broader understanding, explore our informative blog post for a thorough comparison of Mutual Funds and ETFs, where we delve into their differences in detail.”

Conclusion

Both mutual funds and ETFs offer unique advantages for SIP investors. Mutual funds provide active management, diversification, and SIP flexibility, while ETFs offer passive investing, liquidity, and lower expense ratios. Consider your investment objectives, costs, liquidity needs, and trading preferences to decide which option aligns best with your financial goals. Whether you choose mutual funds or ETFs for your SIP investments, remember to focus on consistency, discipline, and long-term wealth accumulation.

Ready to start your SIP journey? Explore a wide range of mutual funds and ETFs at Navia Markets Limited. Begin your systematic investing today for a brighter financial future!

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit