Weekly Wrap-up (OCT 23 – OCT 27, 2023)

The benchmark Indian indices ended lower for the second consecutive week ended October 27 as investors remained concern over rising geopolitical risks, elevated interest rates and weak global markets.

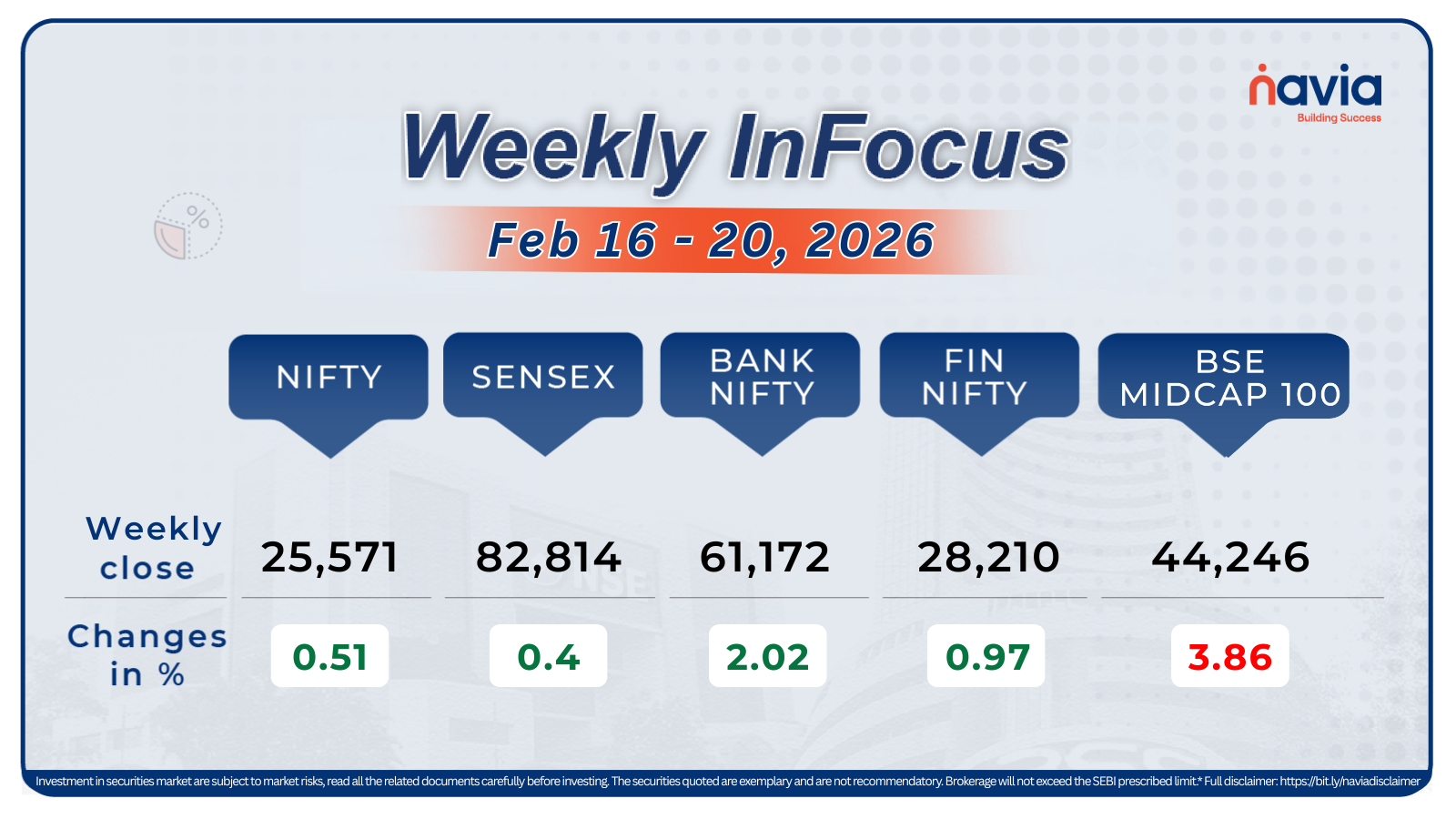

Indices Weekly Performance

In this week, the BSE Sensex fell 2.47 percent or 1,614.82 points to finish at 63,782, while the Nifty50 declined 495.35 points or 2.53 percent to close at 19,047.

For any further queries, you can now contact us on Whatsapp!

Indices Analysis

Nifty 50 :-

Overall this week has stayed and traded under selling pressure and now it is respecting 200 MA on Daily TF and 50 MA on weekly Time frame . This week markets behaviour was :-

As on Monday Nifty opened flat and after morning session it started trading negative as because of overall negative market sentiment . Closed with loss of 260 pts

Markets were closed on Tuesday on account of Dussehra.

As on Wednesday Nifty opened flat and continued the downside trend by closing-156 pts . On second half it tried to break 100 MA plot resistance on daily Tf but failed to breach.

On Thursday Nifty opened gap down and continued the downfall rally by sustaining above crucial level of 18,800 which was also the 200 MA plot .

Nifty as on Friday Opened gap up and showed a buying volume in market. Nifty overall has took supported from MA plots and now has expected to show a supportive behaviour.

Bank Nifty:-

BN INDICES have been observed forming lower lows and providing selling pressure

As on Daily Time Frames BN has been observed as :-

Monday BN opened flat and traded under selling volume by closing with -571 pts .

Markets were closed on Tuesday on account of Dussehra.

On Wednesday BN faced a rejection from 200 MA plot on daily time frame and closed with net loss of -319 pts

On Thursday BN opened gap down and traded under selling pressure by closing -551 pts .

Friday BN observed a buying volume and closed with 501 pts positive. Overall BN indices have shown the same structure as Nifty and now both indices are sustaining above 50 MA plots on weekly basis

Nifty Chart

Nifty reversed the downtrend on Oct 27 but low volumes on such a day remains a concern. In the process it filled the down-gap on daily charts formed on the previous day. Nifty could now head towards 19229-19298-19432 levels over the next few days while 18826-19047 band could provide support on down move.

Now with N Coins, Navia customers can actually #Trade4Free.

INDIA VIX

Market volatility saw a slight decrease, with India VIX by 0.81 percent.

Refer your Friends and family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

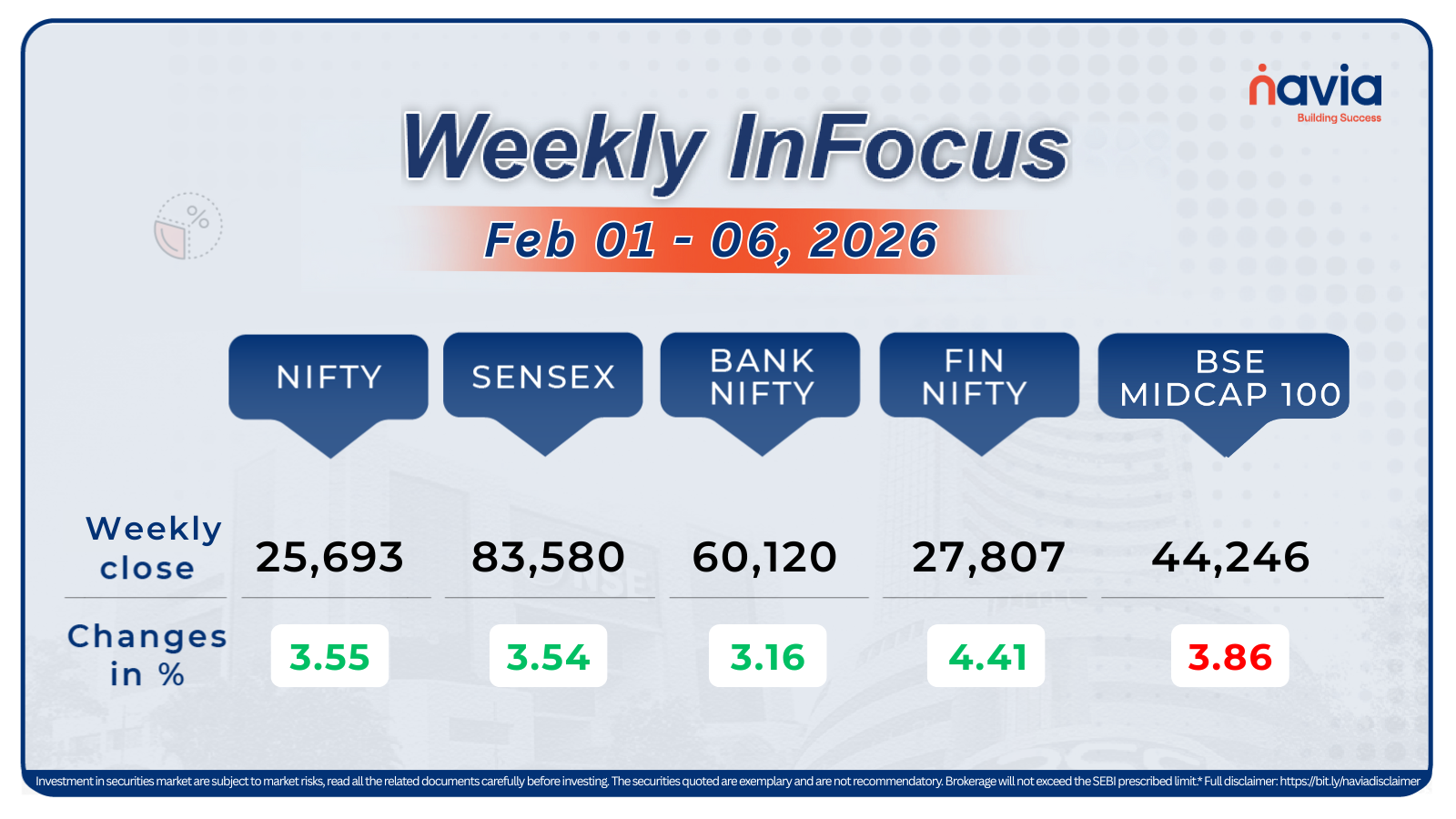

Sectoral Performance

On the sectoral front, all the indices ended in the red with the Nifty Metal index down 3.87 percent, Nifty IT down 2.76 percent, Nifty Auto down by 1.99 percent and Nifty Pharma indices trading lower by 2.44 percent.

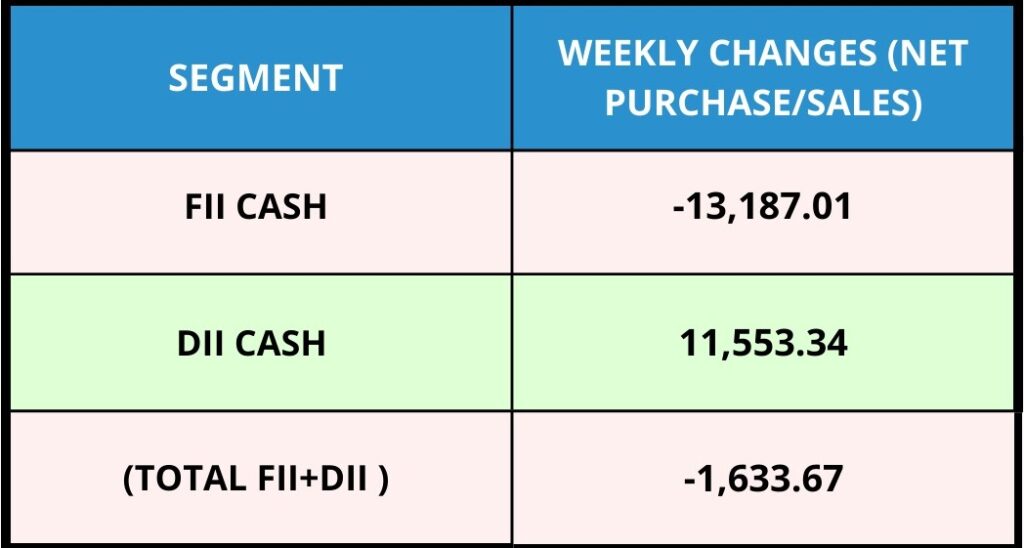

FII & DII Weekly Activity

Overall FII’s have been consistent net sellers in cash markets while DII’s are supporting the selling in markets by being net buyers

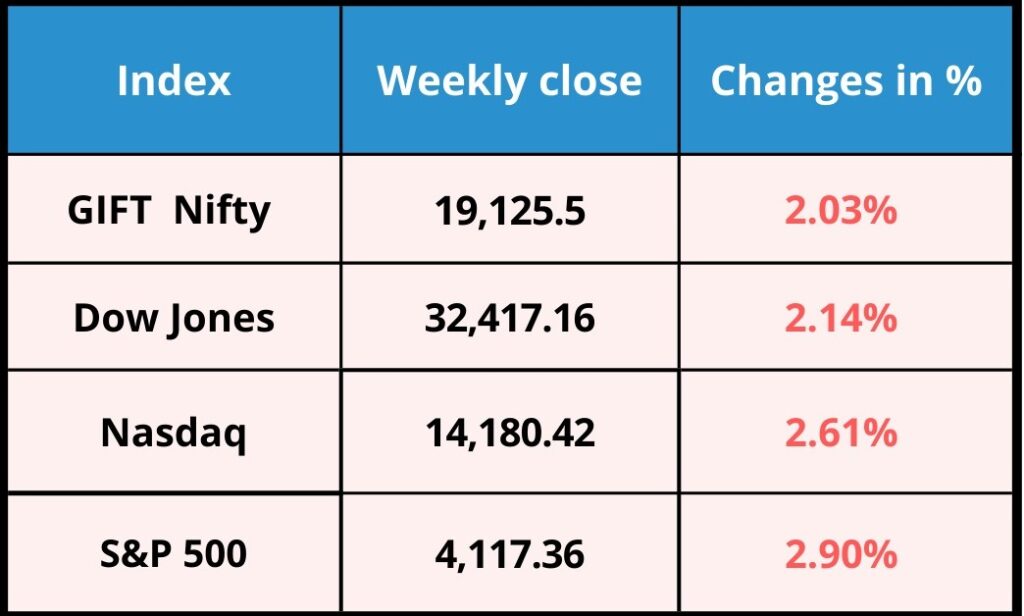

Global Market

GIFT Nifty :- Gift Nifty has closed with a loss -396.5 pts

Dow Jones :- DJI has closed with a loss -709.69 pts

Nasdaq :- Nasdaq has has closed with loss of- 380.46pts

S&P 500:- SPX has closed with a loss -106.79 pts

Currency Indices

The Indian rupee ended lower against the US dollar as it lost 14 paise in the week ended October 27 to close at 83.24 versus its October 20 closing of 83.10.

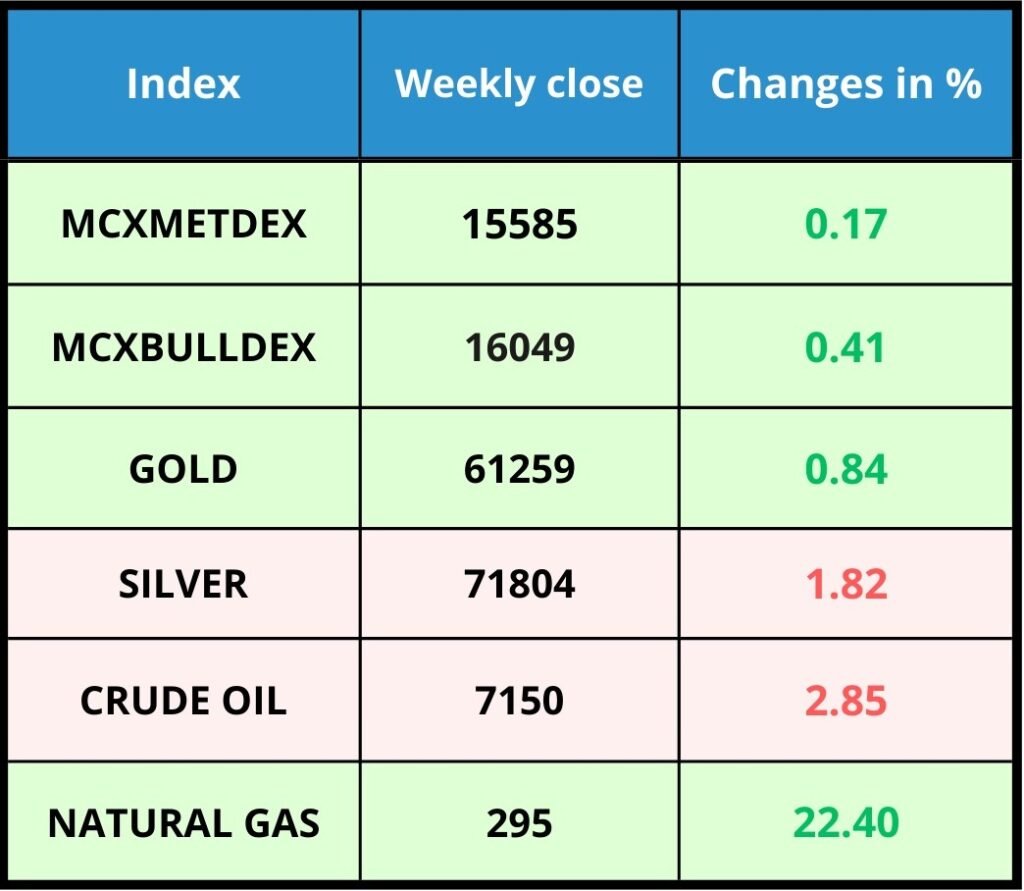

Commodity Market

Oil prices edged higher in early Asian trade after falling overnight amid easing concerns over the Israel-Hamas conflict. Worries about a wider conflict in the Middle East have subsided. Friday’s session saw crude oil forming a bearish candle and closing with a 0.29% negative change.

Over the past three weeks, gold has experienced an uptrend movement, and in Friday’s session, gold formed a bullish doji candle, closing with a 0.04% positive change.

Stay Updated with the Latest Stock Market News! Follow us on Twitter

Happy Learning,

Team Navia

We’d Love to Hear from you-