Weekly Wrap-Up (FEB 05 – FEB 09, 2024)

Following a surge to new highs in the Budget week, the Nifty50 index experienced a period of consolidation amid heightened volatility in the week ending February 9. This trend was influenced by the hawkish commentary from both the US Federal Reserve and the Reserve Bank of India (RBI), which dampened expectations of imminent rate cuts.

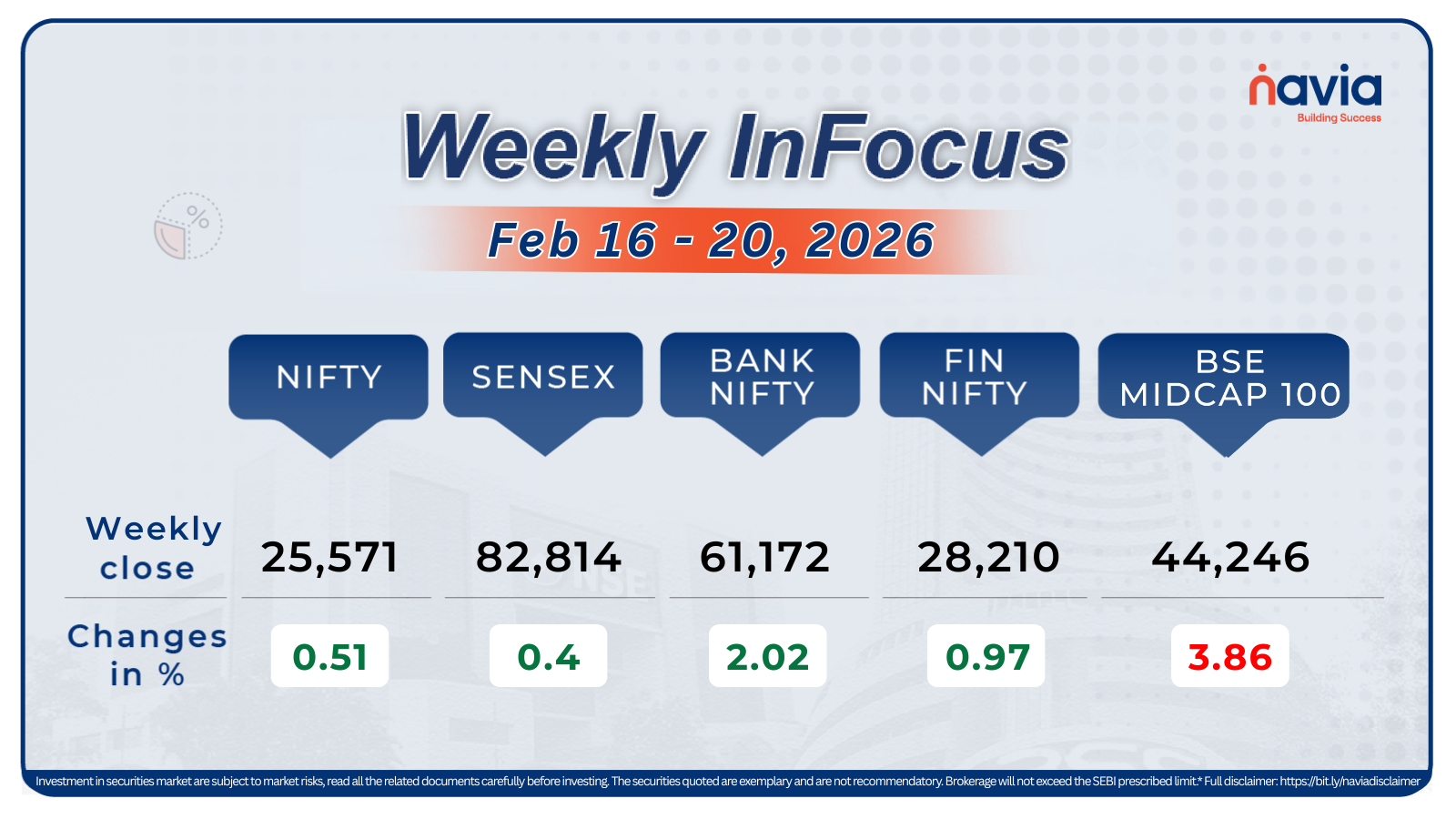

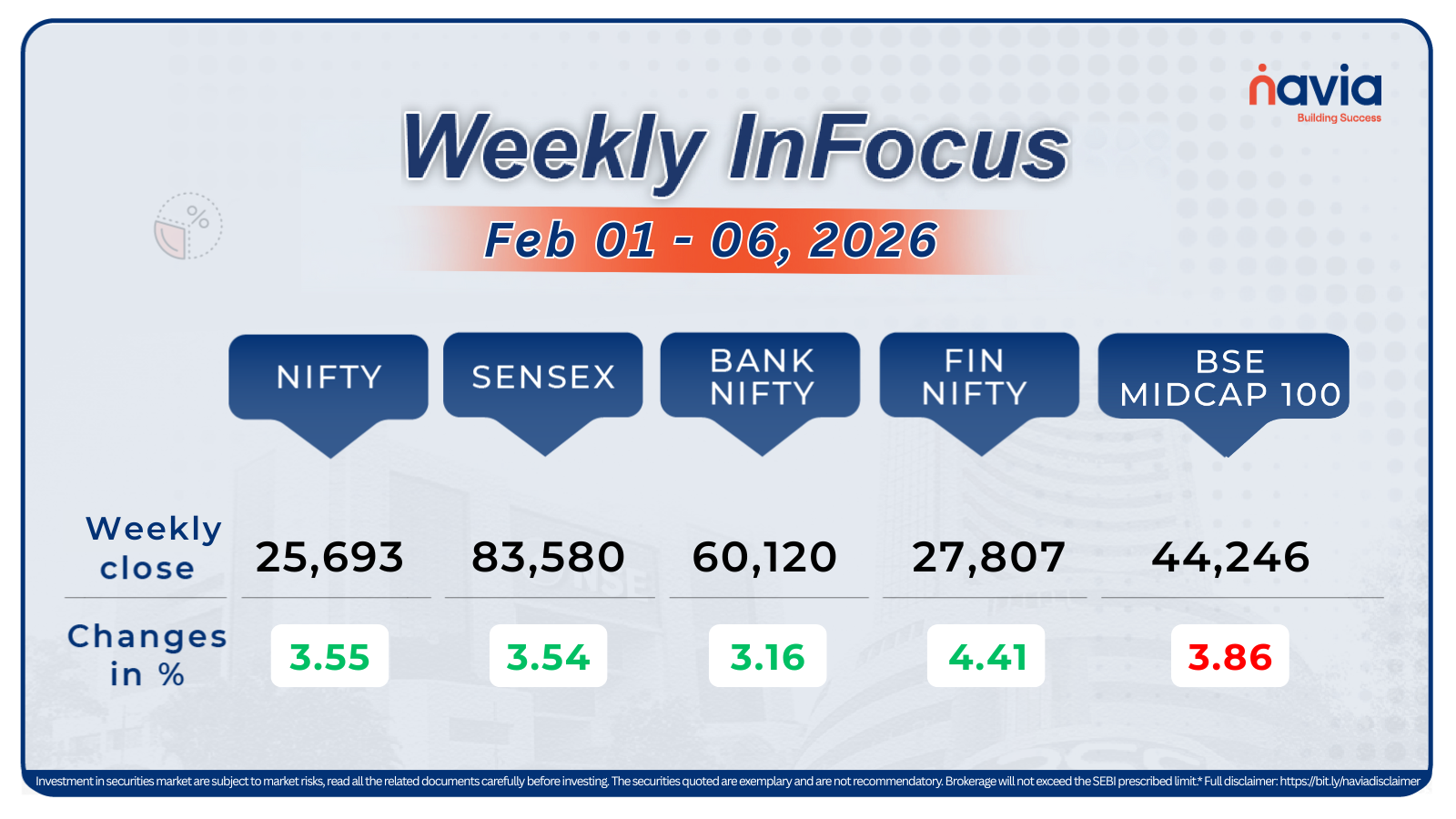

Indices Weekly Performance

This week, Nifty declined by 0.33 percent to conclude at 21,782, while BSE Sensex dropped by 0.68 percent to finish at 71,595.

For any further queries, you can now contact us on WhatsApp!

Indices Analysis

NIFTY 50

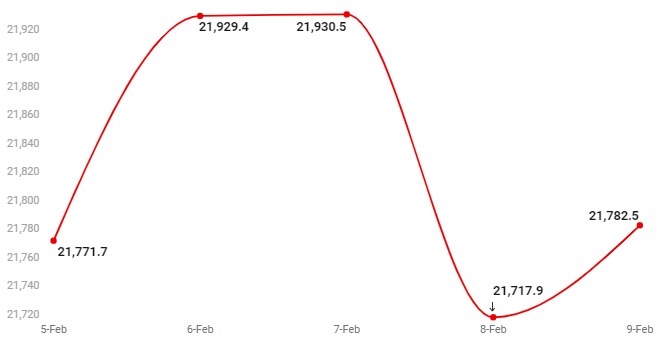

The Nifty 50 held on to the 21,700 level throughout the week ended February 9 and closed lower at 21,783, down 71 points or 0.33 percent during the week largely due to major corrections on RBI policy day. The implied volatility percentile (IVP) of Nifty stood at 89 percent. The implied volatility (IV) of Nifty is 14.5. The IVP of 89 percent indicates that 89 percent of the times in the last 1 year, the IV of Nifty traded below 14.5 and only 11 percent of the times in the last 1 year the IV of Nifty traded above 14.5. The current IV of Nifty, which is 14.5, is still trading at the higher range of the historical volatility and any rise further can lead to bulls exiting the markets.

BANK NIFTY

Bank Nifty cracked 1.76 percent on February 8 after the Reserve Bank of India (RBI) policy announcement. The RBI decided to keep the interest rates unchanged for the sixth consecutive time. This is also the longest pause in the rates since 2008

Nifty Chart

The derivative data indicators have turned slightly negative compared to the previous week. Nifty failed to break past the 22,000 level convincingly. On the other hand, the 21,700 level of the downside acted as strong support.

Despite the ups and downs this week, Nifty is fairly traded in a range and lacks clear direction at the moment. The maximum Call open interest is placed at 22,000 strikes, while the maximum Put open interest is placed at 21,500 strikes. These are the key levels to track in the upcoming week. If the Put writers exit from the 21,500 strikes, the Nifty may extend its fall further until the 21,150 level, where its next support is placed. A strong close below 21,135 can trigger a short-term correction in the Index. Nifty is likely to resume an uptrend upon Call writers exiting from the 22,000 strike.

Now with N Coins, Navia customers can actually #Trade4Free.

INDIA VIX

The India VIX, known as the fear indicator, rose from 14.69 on February 2 to a high of 16.33 on February 9 before settling at 15.10. The rise in India VIX gave serious discomfort to the bulls.

Refer your Friends and family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

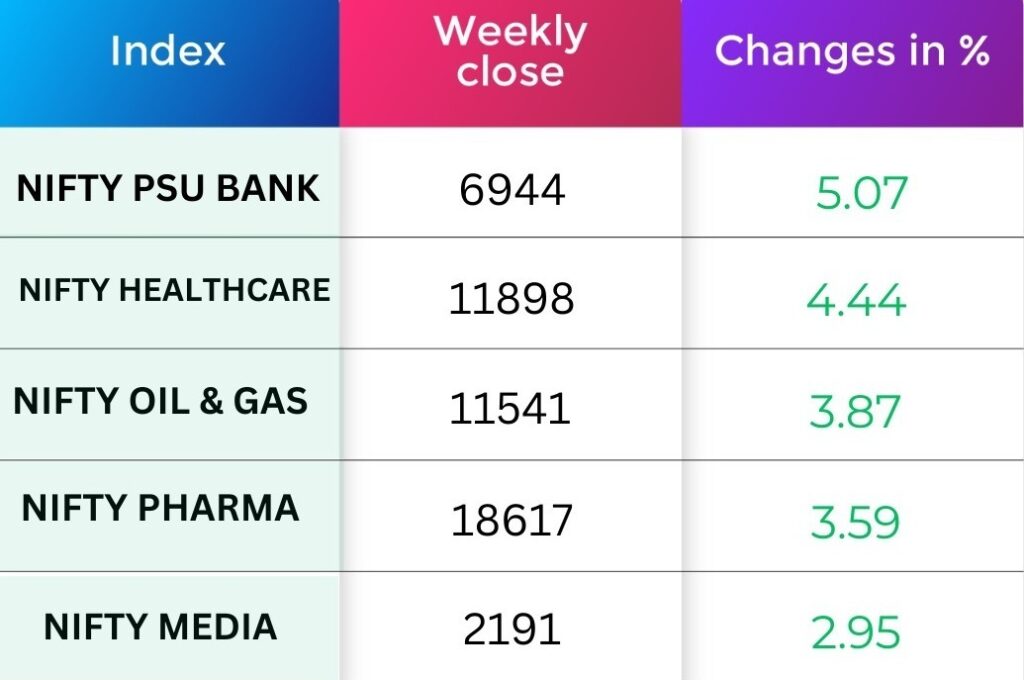

Sectoral Performance

On the sectoral front, Nifty PSU Bank index added 5.07 percent, Nifty Healthcare index gained 4.44 percent, Nifty Oil & Gas index rose 3.87 percent, Nifty Pharma index up 3.59 percent, and Nifty Media index up 2.95 percent.

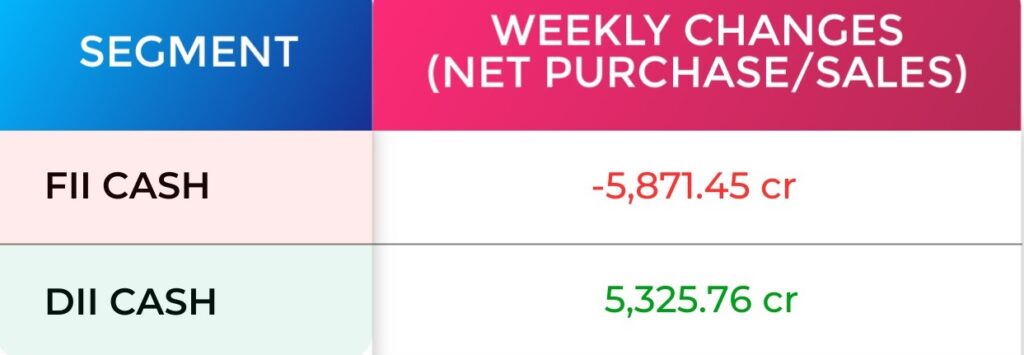

FII & DII Weekly Activity

Foreign institutional investors (FIIs) sold equities worth of Rs 5,871.45 crore, while Domestic institutional investors (DIIs) have provided support by compensating buying of equities worth Rs 5,325.76 crore during the week. However, in February, the FIIs sold equities worth Rs 7,680.34 crore, while DIIs bought equities worth Rs 8,661.41 crore.

Global Market

The S&P 500 Index finished above 5,000 for the first time ever Friday as investors continue to bet on the resilient US economy and the Federal Reserve’s plans to start cutting interest rates later this year.

The equities benchmark closed at 5,026.61 to notch five straight weeks of gains. It briefly breached the round-number threshold minutes before the close Thursday.

Currency Indices

In this week, the Indian rupee lost some ground against the US dollar, as domestic unit fell 11 paise to close at 83.03 in the week ended February 9 against the February 2 closing of 82.92.

Poll of the week

Last week’s poll:

Q) The Term Bullish Indicates:

a) Positive Price Action

b) Negative Price Action

c) Neutral Price Action

Last week’s poll answer: a) Positive Price Action

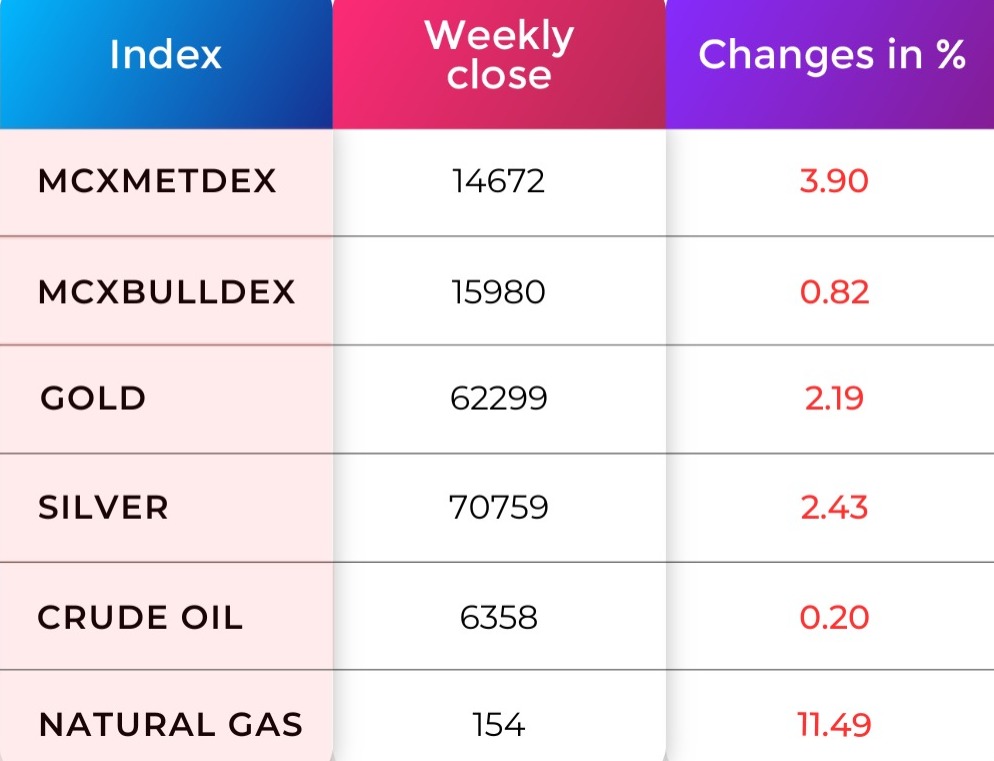

Commodity Market

Over the 2 trading sessions, gold formed a doji candle indicating strong indecision in the market. countering safe-haven demand fueled by lingering concerns in the Middle East. Current R1 is placed at 62710, and S1 is placed at 62137.

Natural gas is showing a strong downtrend over the past 3 trading sessions, Currently, an unusually mild winter has sapped heating demand for natural gas and kept U.S. inventories elevated. Because of this reason, natural gas is showing a downtrend. Current R1 is placed at 167.80, and S1 is placed at 153.60.

Blog Of The Week!

Did you Know?

“Flash Crash”

Did you know? On May 6, 2010, the financial world was shaken by an event known as the Flash Crash, During this incident, the Dow Jones Industrial Average suddenly dropped by nearly 1,000 points in just a few minutes before rebounding significantly. This unexpected occurrence left investors and experts perplexed, sparking widespread debate regarding its underlying causes. While the exact trigger remains uncertain, factors such as the proliferation of high-frequency trading (HFT) algorithms, which enable rapid automated trading, and the phenomenon of “quote stuffing,” involving the inundation of the market with excessive buy or sell orders, are believed to have played significant roles in the extreme market volatility experienced on that day.

The Flash Crash served as a stark reminder for regulators and market participants alike, highlighting the critical importance of enhanced oversight and improved risk management practices to mitigate the risk of future market disruptions. Despite extensive investigations, the precise sequence of events and underlying mechanisms behind the Flash Crash continue to be subjects of ongoing analysis and debate. Nevertheless, this event underscored the complex challenges inherent in the evolving landscape of financial markets and emphasized the paramount importance of ensuring their stability and resilience in the face of sudden and severe disturbances.

Happy Investing!

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?

Happy Learning,

Team Navia

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.